-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA MARKETS ANALYSIS: Fed Eye Tighter Conditions Closely

- MNI: FINANCIAL CONDITIONS HAVE TIGHTENED SIGNIFICANTLY

- MNI: FED NEEDS MORE EVIDENCE INFLATION CLEARLY ON PATH 2%

- MNI SECURITY: US State Dept: "Very Close" To Hostage Exchange Agreement

- MNI GERMANY: Government Blocks Spending From Both Climate And Stabilization Funds

- MNI SECURITY: Xi Calls For Ceasefire At BRICS Summit

- ECB LAGARDE: NOT THE TIME TO START DECLARING VICTORY ON INFLATION, Bbg

- ECB LAGARDE: CAN ACT IF WE SEE RISING RISKS OF MISSING TARGET, Bbg

Key Links: MNI: Tighter Fin. Conditions Could Affect Policy Path -Minutes / US Treasury Auction Calendar

US TSYS Little React To Nov FOMC Minutes, Watching Financial Conditions Closely

- Treasury futures are firmer for the most part, 30Y Bond still mildly weaker vs. the balance of the strip. Still inside a narrow session range, markets showed little reaction to the November FOMC minutes.

- Fed officials believed tighter financial conditions could lessen the need for additional monetary tightening as they decided to hold interest rates steady for the second straight meeting earlier this month. “Financial conditions had tightened significantly in recent months,” the minutes said. “Persistent changes in financial conditions could have implications for the path of monetary policy and it would therefore be important to continue to monitor market developments closely.”

- Tsy futures had extended highs after this morning's lower than expected Existing Home Sales data (3.79M vs. 3.9M est, 3.95M prior/rev), MoM (-4.1% vs. -1.5M est, -2.2% prior/rev).

- Dec'23 10Y futures had tapped 109-03.5 high (+8.5), pared gains after the 10Y TIPS auction drew 2.180% yield vs. 2.94% prior. TYZ3 trades 108-30.5 last, still well above initial technical support below at 108-04 (50-day EMA). Initial technical resistance at 109-08+ (High Nov 17).

- Heavy volumes (TYZ3 >2.7M) is due to a surge in quarterly futures rolling ahead First Notice on Nov 30.

- Reminder: shortened Thanksgiving holiday week: full session Wednesday sees weekly claims, durables/cap-goods and UofM conditions/inflation expectations., Thursday close, Friday early close.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00596 to 5.34079 (+0.00826/wk)

- 3M +0.00651 to 5.37802 (+0.01109/wk)

- 6M +0.00734 to 5.38015 (+0.01668/wk)

- 12M +0.01516 to 5.24150 (+0.04077/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $101B

- Daily Overnight Bank Funding Rate: 5.32% volume: $257B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.621T

- Broad General Collateral Rate (BGCR): 5.30%, $588B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $574B

- (rate, volume levels reflect prior session)

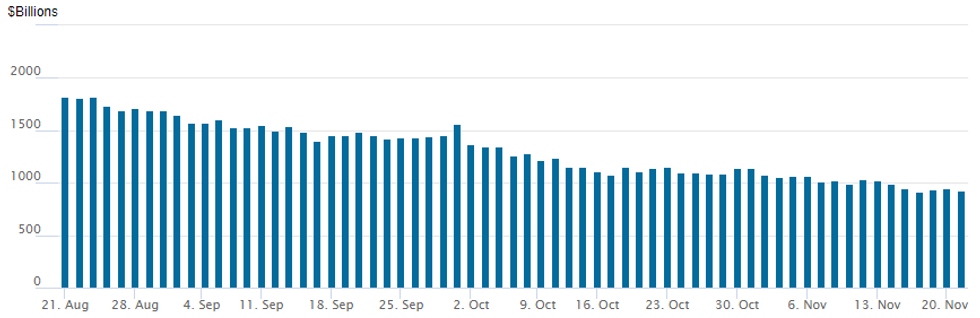

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage slipped to $931.155B w/95 counterparties today vs. $953,088B Monday. Usage fell below $1T for the first time since August 2021 last on November 9 ($993.314B) declining to $912.010B on November 16 - the lowest level since early August 2021.

SOFR/TREASURY OPTION SUMMARY

Reported SOFR and Treasury option flow was mixed on net Tuesday, low delta calls emerged during midday trade after better put trade carried over from London hours. Projected rate cut in early 2024 largely static: December at 1.2bp at 5.343%, January 2024 cumulative 1.2bp at 5.343%, March 2024 pricing in -29.1% chance of a rate cut with cumulative at -6.1bp at 5.270%, May 2024 pricing -45.6% chances with cumulative at -18.2bp at 5.149%. Fed terminal at 5.345% in Jan'24-Feb'24.- SOFR Options:

- Block, 8,000 SFRU4 95.25/95.87 call spds, 19.5 vs. 95.295/0.19%

- +20,000 SFRU4 97.00/98.00 call spds, 6.0

- +10,000 SFRM4 96.00/97.00 call spds, 6.0

- +5,000 2QH4 96.25 calls, 30.5 vs. 96.245/0.50%

- 2,100 2QH4/2QU4 97.50/98.50 call spd spd

- Block, 5,000 SFRH4 94.75/94.87/95.00/95.12 call condors, 2.0 ref 94.755

- Block, 2,500 2QZ4 96.50/97.25 2x3 call spds vs. 2,500x2 2QZ4 94.75/95.00 put spds, 18.5

- -45,000 SFRH4 94.50 puts 1.5 over SFRH4 95.00/95.25 call spds ref 94.755 to -.745

- 10,000 0QZ3 94.87/95.25/95.50 broken put flys ref 95.585

- 2,000 3QZ3 95.50/95.75 put spds ref 96.255

- 2,100 2QH4/2QU4 97.50/98.50 call spd spds

- 4,000 SFRG4 94.00/94.12 put spds ref 94.75

- Treasury Options:

- 6,000 TYF4 115.5 calls, 2 ref 109-19

- 6,000 TYG4 107 puts, 30 ref 109-11.5

- 2,000 USH4 122 calls, 112 ref 115-30

- 1,000 TUZ3 101.75/101.87 call spds

- 8,800 TYZ3 108.5/109.5 call spds, 29 ref 108-29

- 2,000 TYF4 106.5/107/108.5 2x3x1 broken put flys ref 109-09

EGBs-GILTS CASH CLOSE: Gilts Underperform Ahead Of UK Autumn Statement

Bunds outperformed Gilts and reversed most of Monday's losses in a constructive session Tuesday, with the German curve bull flattening and the UK's twist flattening.

- ECB and BoE speakers largely reiterated the higher-for-longer narrative, though some of BoE Gov Bailey's commentary today re market pricing were explicit than in the past, in line with those that we have seen recently from hawks Mann and Greene.

- BTPs underperformed with spreads widening marginally on the day. The European Commission warned that the draft 2024 budgets of multiple countries were either not fully in line or risk not being in line with EU guidance, including Germany, Italy, and France.

- Gilts started strong but traded with little direction, with futures trade beginning to reflect the quarterly roll period (MNI Europe Pi sees the contract as marginally short going into the roll).

- The UK autumn statement looms large Wednesday - MNI's preview was out today, including potential impact on Gilt issuance.

- The European data slate remains relatively thin Wednesday, with Eurozone consumer confidence the highlight. We also hear from ECB's Nagel and Centeno. Additionally, the Netherlands holds elections - MNI's preview is here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.3bps at 2.994%, 5-Yr is down 5bps at 2.521%, 10-Yr is down 4.5bps at 2.566%, and 30-Yr is down 3.3bps at 2.77%.

- UK: The 2-Yr yield is up 1.4bps at 4.545%, 5-Yr is up 2.6bps at 4.138%, 10-Yr is down 2bps at 4.105%, and 30-Yr is down 1.5bps at 4.537%.

- Italian BTP spread up 1.7bps at 175.1bps / Greek down 1.5bps at 120.2bps

EGB Options: Rolling Euribor Calls And Large UK Rate Call Condor Feature Tuesday

Tuesday's Europe rates/bond options flow included:

- RXF4 127.00/126.5 ps, bought for 3 in 12k.

- OEZ3 116.50/118.00cs 1x2, sold at 30 in 4k.

- ERJ4 96.50c, vs ERH4 96.12c, bought J4 for 3.5 in another 4k, 14k total.

- SFIG4 94.80/94.90/95.00/95.10 call condor bought for 2.5 in 20k

- SFIH4 94.10/94.00ps, bought for 0.25 in 6k

FOREX USD Index Recovers Into Positive Territory As Thanksgiving Approaches

- The greenback has traded on a firmer note across US hours, with the USD index erasing its earlier declines and extending into positive territory ahead of the FOMC minutes. While no surprises within the minutes, similarly positive price action for the greenback prevailed in the direct aftermath. This was mainly reflective of the grinding downward pressure on major equity indices throughout the session amid potential profit taking dynamics in play, especially as we approach the Thanksgiving Holiday in the US.

- The most notable uptick has been for USDJPY, which makes sense given its more volatile nature in recent sessions and its impressive extension lower below 150.00 from last week. After reaching a low of 147.15, the pair now trades around 148.35 as we approach the APAC crossover, having traded as high as 148.60 after the minutes release.

- Overall, support at 149.16 (50-day EMA), has been cleared. This strengthens a short-term bearish theme and signals scope for a deeper correction, towards 146.00, a trendline support drawn from the Mar 24 low.

- EURUSD has echoed this sentiment, however the moves have been much more measured with 1.0900 limiting the downside and the pair consolidating around 1.0915 at typing.

- RBA Governor Bullock is due to speak overnight about the economic outlook and monetary policy at the Australian Business Economists Annual Dinner. AUDUSD has kept a fairly narrow range on Tuesday and trades close to unchanged at 0.6555. Importantly, the latest rally has resulted in a clear break of former resistance at 0.6522, the Aug 30 and Sep 1 high. The breach is an important short-term bullish development and signals scope for a continuation higher near-term towards 0.6616 next, the Oct 8 high.

- Elsewhere on Wednesday, markets will await the UK’s Autumn Forecast Statement, and in the US, initial jobless claims, durable goods and revised UMich sentiment data are all scheduled.

FX Expiries for Nov22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0730-50(E1.7bln), $1.0840-60(E1.4bln), $1.0905-25(E2.7bln), $1.0930(E591mln), $1.0940-45(E1.9bln), $1.0960-61(E632mln)

- EUR/GBP: Gbp0.8705-15(E867mln), Gbp0.8735-50(E519mln)

- USD/JPY: Y147.75($1.2bln), Y149.10($671mln)

- AUD/USD: $0.6320(A$1.1bln) $0.6435-40(A$1.7bln)

- USD/CNY: Cny7.2400-20($1.2bln), Cny7.2500-10($1.1bln)

Late Equities Roundup: Off Lows, IT, REITS Lagging

- Stocks are still weaker in late trade, but see-sawing off session lows little reaction to the November FOMC minutes where officials expressed continued caution regarding sticky inflation after deciding to hold interest rates steady for the second straight meeting. Currently, DJIA is down 89.16 points (-0.25%) at 35061.9, S&P E-Mini futures down 14 points (-0.31%) at 4548, Nasdaq down 90.8 points (-0.6%) at 14193.75.

- Laggers: Information Technology, Real Estate and Consumer Discretionary sector shares underperformed in late trade, semiconductor shares weighing on the former: On Semiconductors -3.35%, Solar Edge -3.06%, Intel -3.04%, Applied Materials -2.8%. Real Estate Investment Trusts, particularly hotel and office REITS weighed on RE: Boston Properties -2.63%, Host Hotels -1.25%. Broadline retailers weighed on the Consumer Discretionary sector with Etsy -1.76% and Amazon -1.84% (headlines reporting Bezos intent to be an ongoing aggressive seller Tuesday).

- Leading gainers: Health Care, Materials and Consumer Staples sectors outperformed, equipment and services supported the Health Care sector: Medtronic +4.37%, Dentsply Sirona +4.04%. Metals and mining stocks support the Materials sector: Newmont +2.65%, Freeport McMoRan +1.02%, Steel Dynamics +0.98%. Consumer Staples, meanwhile, were buoyed by retail distributors: Walmart +0.95%, Dollar General +0.79%, Target +0.55%.

- Corporate earnings still expected this week: HP, Autodesk, Nvidia and Nordstrom after Tuesday's close.

E-MINI S&P TECHS: (Z3) Northbound

- RES 4: 4685.25 High Jul 27 and a bull trigger

- RES 3: 4644.75 High Aug 2

- RES 2: 4597.50 High Sep and a key resistance

- RES 1: 4571.00 High Nov 20

- PRICE: 4550.00 @ 14:33 GMT Nov 21

- SUP 1: 4501.75/4415.80 Low Nov 16 / 20-day EMA

- SUP 2: 4354.25 Low Nov 10

- SUP 3: 4257.75 Low Nov 3

- SUP 4: 4122.25 Low Oct 27 and the bear trigger

S&P e-minis traded higher Monday, starting the week on a bullish note and confirming an extension of the recovery that started Oct 27. The trend direction remains up. Recent gains have resulted in the break of a trendline drawn from the Jul 27 high. This reinforces bullish conditions and signals scope for a climb towards 4597.50, the Sep 1 high. On the downside, initial firm support is seen at 4415.80, the 20-day EMA.

COMMODITIES Crude Consolidates Yesterday’s Rally With Weekend OPEC+ In Mind

- Crude front month futures have traded in a relatively narrow range today, broadly consolidating yesterday’s strong gains with an eye on this weekend’s OPEC+ meeting with the market torn between voluntary cut extensions or the possibility for them to deepen.

- The OPEC+ meeting is clouded by an unexpected crude supply side coming from Iran. It’s oil minister said Tuesday that oil output from the country is expected to rise to 3.6mbpd in March next year – up from 3.4mbpd currently. Most of its flows area heading to China.

- Saudi Arabia is likely to extend its 1mbpd oil output cut through 1Q 2024, and Russia is expected to do the same to its current 300kbpd cut of crude and oil products exports, while a deepening of cuts is not included in the base case, Citigroup said in a client note.

- WTI is -0.2% at $77.69, haven’t not troubled resistance at $78.81 (20-day EMA) or support at $72.37 (Nov 16 low).

- Brent is flat at $82.31, off resistance at $83.97 (Nov 14 high) and support at $76.60 (Nov 8 low).

- Gold is +1.1% at $2000.23, pulling back off highs of $2007.61 with some intraday strengthening in the USD index. It has cleared $2,000/oz in spot trade, for the first time since late October. Technically, well-defined parameters remain in play and bulls remain in control at present. A stronger resumption of gains would open $2,022.20/oz (the May 15 high). The bull trigger at $2,009.4/oz (the Oct 27 high) provides initial resistance ahead of there.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/11/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/11/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/11/2023 | 1230/1230 |  | UK | UK Autumn Statement | |

| 22/11/2023 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 22/11/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 22/11/2023 | 1410/1510 |  | EU | ECB's Elderson keynote speech on stability in the Green Transition | |

| 22/11/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/11/2023 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 22/11/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/11/2023 | 1530/1530 |  | UK | DMO publish agenda for quarterly meetings | |

| 22/11/2023 | 1630/1130 |  | CA | BOC Governor Tiff Macklem speech/press conference | |

| 22/11/2023 | 1700/1200 | ** |  | US | Natural Gas Stocks |

| 23/11/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.