-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: January CPI Inflation Data Next Up

- MNI US: New York Special Election To Provide First Hard Voting Data Of 2024

- MNI US: Speaker Johnson Faces Bind Over USD$95b National Security Supplemental Bill

- MNI SECURITY: Tusk: Increasing Defense Production Is An Absolute Priority

- Fed Officials Eye ‘Broadening’ Disinflation as New Rate-Cut Test, Bbg

- BOE'S BAILEY: BANK RESERVES WILL SETTLE HIGHER THAN IN THE PAST, Bbg

- EU PROPOSES FIRST TRADE CURBS ON CHINESE FIRMS OVER RUSSIA WAR, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

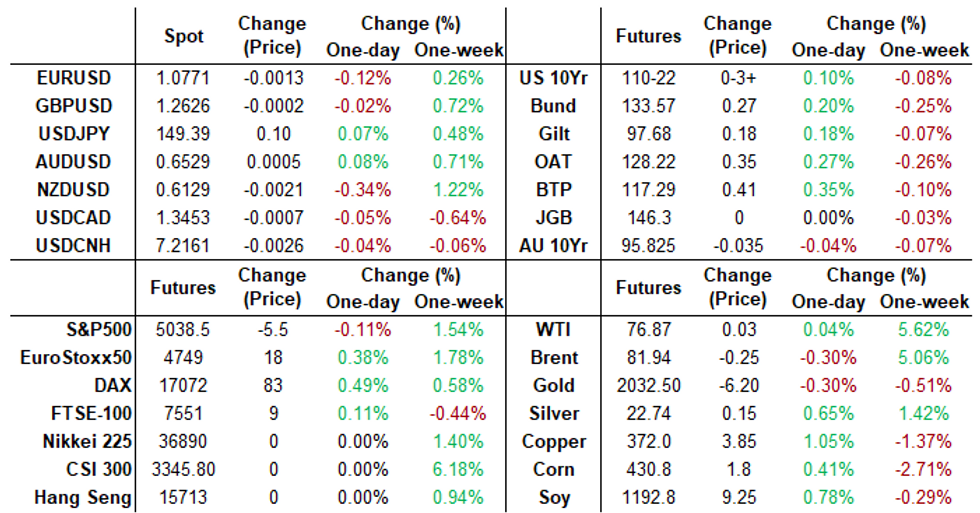

US TSYS Week Opener Focus on January CPI

- Treasury futures see-sawed higher in a narrow range Monday, modest volumes (TYH4 appr 920k by the close) with much of Asia/Pac closed for Lunar New Year holidays. Main focus for the week is tomorrow morning's January CPI and Retail Sales on Thursday.

- Inflation expectations in January remained unchanged at the short- and longer-term horizons and declined slightly at the medium-term horizon , according to a New York Fed's survey of consumers, while consumers were more optimistic about their financial situation.

- Median year-ahead inflation expectations were unchanged at 3.00%, while the five-year-ahead measure was unchanged at 2.54%. The three-year-ahead measure decreased 0.2ppt to 2.35%, the lowest since the New York Fed’s Survey of Consumer Expectations started in 2013.

- Decent corporate bond issuance resumed, just over $17B generated decent two way hedging/unwind flows.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00032 to 5.32040 (-0.00139 total last wk)

- 3M -0.00252 to 5.30653 (+0.01859 total last wk)

- 6M +0.00233 to 5.19099 (+0.09256 total last wk)

- 12M +0.01837 to 4.89862 (+0.18745 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.581T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $671B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $661B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

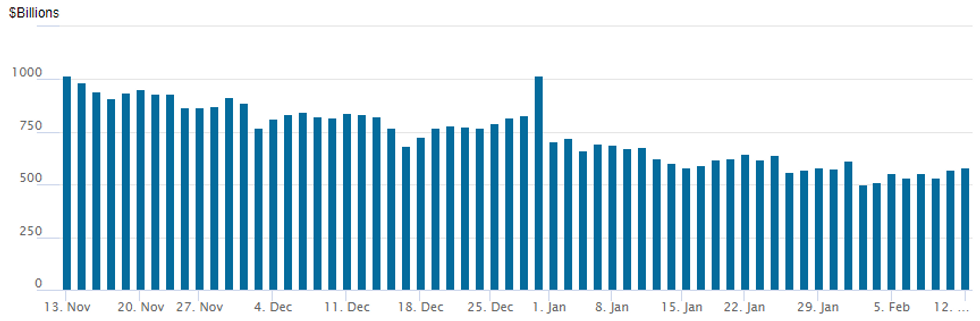

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $581.568B vs. $569.175B Friday - remains well above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 78 from 80 Friday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option flows remained mixed Monday, moderate volumes as accounts try to hedge data risk ahead tomorrow's January CPI release. Similarly, underlying futures see-sawed higher in a narrow range by the close.Projected rate cut pricing consolidated slightly on the day: March 2024 chance of 25bp rate cut currently -18.3% vs. -19.3% this morning w/ cumulative of -4.6bp at 5.28%, May 2024 at -53.0% vs. -56.0% earlier w/ cumulative -17.8bp at 5.148%, while June 2024 -80.3% vs. -83.8% earlier w/ cumulative -37.9bp at 4.947%. Fed terminal at 5.325% in Feb'24.

- SOFR Options:

- 6,000 0QG4 96.00/96.25 put over risk reversals

- +5,000 SFRH5 95.75/96.37/97.00 call flys, 11.0

- 5,000 SFRM4 95.00/95.12/95.25 put flys ref 95.105 to -.11

- +5,000 SFRH5 95.75/96.37/97.00 call flys, 11.0 ref 96.10

- +7,500 0QH4 95.87 puts, 8.0 vs. 96.105/0.25%

- +5,000 SFRJ4 94.87/95.12 1x2 call spds, 1.75

- +5,000 SFRJ4 94.87 puts, 3.0

- +2,000 SFRG4 94.75 puts, 1.25

- +2,500 0QU4/0QZ4 96.00/97.00 strangle spd, 14.5

- Block/pit, +15,000 0FU4/0FZ4 96.50 straddle spd, 14.5 net/Dec over

- +5,000 SFRZ4 95.50/96.12/96.37/97.00 call condors, 13.5 ref 95.83

- +7,000 SFRZ4 95.62/96.12/96.37/96.87 call condors, 9.5

- +5,000 SFRU4 95.25 puts, 19.5 vs. 95.49/0..36%

- 5,750 SFRM4 95.12/95.37/95.50/96.00 call condors ref 95.12 to -.125

- 2,500 SFRH5 96.00/96.50/97.00 call flys ref 96.125

- 1,250 SFRM4 95.50/96.50 4x5 call spds ref 95.125

- 1,750 SFRJ4 95.12/95.25/95.37 call spds

- 2,000 SFRU4 94.87/95.12 put spds vs. 95.68/96.00 call spds ref 95.49

- 2,000 SFRM4 94.75 puts, 3.5 last

- 6,000 SFRM4 95.12/95.37 call spds 3.75 over 94.75 put spds

- 1,200 0QG4 96.18/96.31 put spds ref 96.115

- Treasury Options:

- +25,000 wk3 FV 107.5 calls, 8 ref 107-08.5 (expire Friday)

- +20,000 wk3 FV 107.5 calls 12.5 ref 107-08.25 (expire Friday)

- +5,000 TYH4 110.75 puts, 33

- +5,000 TYJ4 107/107.5/108 put strip, 18

- 5,400 FVM4 109/110 call spds, ref 107-21.5

- over 12,000 TYH4 110 puts 14 last

- 2,000 TYH4 110.5 puts, 27 ref 110-20

- 3,300 TYJ4 112 calls, 42 last

- 1,200 TYJ4 104.5 puts ref 111-12

- 2,300 TYJ4 108 puts, ref 111-08

EGBs-GILTS CASH CLOSE: Yields End Lower Ahead Of UK Data

Core European yields fell modestly Monday, with curves leaning bull steeper and periphery EGBs outperforming.

- Bunds and Gilts began the week constructively, with yields heading to session lows by midday.

- But befitting a day with little news/macro data flow, yields remained bounded by last week's ranges and reversed higher in the afternoon, with risk looming in the form of US CPI (Tuesday) and UK labour market/CPI data (Tues/Weds).

- Strengthening equities in the afternoon also weighed on core EGBs/Gilts, and helped periphery EGB spreads tighten further, led by BTPs.

- Of note, BoE's Bailey speaks after Monday's cash close.

- UK labour market data (MNI preview here) features early Tuesday, with wages in focus - German ZEW and US CPI arrive later in the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at 2.693%, 5-Yr is down 3bps at 2.306%, 10-Yr is down 2bps at 2.362%, and 30-Yr is down 1bps at 2.559%.

- UK: The 2-Yr yield is down 5.1bps at 4.551%, 5-Yr is down 4.8bps at 4.052%, 10-Yr is down 2.9bps at 4.057%, and 30-Yr is down 2.8bps at 4.585%.

- Italian BTP spread down 3.7bps at 154.7bps / Spanish down 2.5bps at 96.2bps

Rate Upside Features Monday

Monday's Europe rates/bond options flow included:

- SFIZ4 96.00/96.50cs vs 95.50/95.25ps, bought the cs for 1.5 and 1.75 in 5k

- ERK4 96.50/96.625/96.75/96.875c condor, bought for 3 in 20k

- ERM4 96.50/96.62/96.75/96.87c condor vs 96.00p, bought the condor for 1 in 26.5k

- DUH4 106.00/106.20cs, bought for 1.5 in 2k

FOREX Narrow Ranges As US Inflation Data Awaited, NZD Underperforms

- Intraday ranges in currency markets remained narrow amid Chinese New Year holidays and the close proximity to Tuesday’s US CPI release. Despite session fluctuations, the overall continued strength for major US equity benchmarks saw some early greenback strength reverse, tilting the USD index into very moderate negative territory as we approach the APAC crossover on Monday.

- NOK and SEK remain the best performers so far Monday, rising around 0.5% against the greenback. NZD is among the weakest majors as markets trim the solid gains posted last week on the back of renewed hiking expectations from the RBNZ.

- EUR sits marginally weaker Monday, slipping against most others in G10 as EUR/USD slippage extended off the 1.0806 highs into NY hours. EUR/USD made a brief attempt below Friday’s worst levels and initial intraday weak support at 1.0762, however, 1.0742 below has remained intact.

- Despite the slightly lower US yields, USDJPY remains well supported on dips. 148.93 marked the intra-day low as NY sat down, before price action steadily grinded higher back towards the 2024 highs, located just above the 149.50 mark. Given the constructive technical tone, eyes will be on a move to 149.75, the Nov 22 high and then 150.78, the Nov 17 high.

- While China remains out, New Zealand inflation expectations, UK labour and Swiss CPI highlight the early docket on Tuesday. All focus then turns to the release of US CPI where consensus puts core CPI inflation at 0.3% M/M in January with mild risk seen to the downside, for a very similar reading to December after Friday’s annual revisions.

FX Expiries for Feb13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E855mln), $1.0700(E1.5bln), $1.0740-50(E1.1bln), $1.0775(E502mln), $1.0800(E1.0bln), $1.0825-30(E1.6bln), $1.0850(E650mln)

- USD/JPY: Y148.80-90($1.0bln), Y149.35-45($828mln), Y149.90-00($1.9bln)

- AUD/USD: $0.6600(A$717mln)

- USD/CAD: C$1.3380($550mln), C$1.3500($734mln)

Late Equities Roundup: Paring Gains Ahead CPI

- Stocks have been paring gains over the last hour, DJIA outperforming mildly weaker SPX Eminis and Nasdaq stocks, squaring ahead tomorrow's January CPI tomorrow data risk. Currently, the DJIA is up 102.41 points (0.26%) at 38767.3, S&P E-Minis down 7.5 points (-0.15%) at 5036.5, Nasdaq down 65.7 points (-0.4%) at 15923.95.

- Leading gainers: Energy and Materials sectors continued to outperform in the second half, equipment and services shares supporting the former Schlumberger +2.87%, Baker Hughes +1.89%, Halliburton +1.1%. Notable mention: Diamondback Energy (FANG) surged +9.27% after announcing $26B merger with Endeavor. Meanwhile, construction material shares buoyed the latter: Martin Marietta Materials +2.69%, Vulcan Materials +1.32%.

- Laggers: Information Technology and Real Estate names displaced earlier laggers: Health Care and Consumer Staples. Software and services shares weighed on the former: Gartner -2.83%, ServiceNow -2.51%, PTC Inc -2.38%. Chip stocks remained strong, however, with Enphase +6.23%, First Solar +4.26, Intel +2.62%. Specialized and retail Investment trust shares weighed on the Real Estate sector: Digital Realty -1.36%, American Tower and Kimco both -0.75%.

- Looking ahead: corporate earnings expected next Monday (after the close): Arista Networks, Avis Budget Group, Cadence Design, Waste Management, Goodyear Tire and Vornado Realty Trust. Expected tomorrow before the open: Ecolab, Biogen, Coca-Cola, Hasbro, Moody's Corp, Watsco, Marriott Int.

E-MINI S&P TECHS: (H4) Bull Cycle Extends

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5110.50 2.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5100.00 Round number resistance

- RES 1: 5050.14 1.764 proj of Nov 10 - Dec 1 - 7 price swing

- PRICE: 5042.50 @ 1435 ET Feb 12

- SUP 1: 4926.31 20-day EMA

- SUP 2: 4866.000/4814.84 Low Jan 31 / 50-day EMA values

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis is unchanged and remains bullish - last week’s gains reinforce current conditions. The contract traded to a fresh cycle high again on Friday, confirming a resumption of the uptrend. Recent corrections have been shallow - this highlights a strong uptrend. The focus is on 5050.14, a Fibonacci projection. On the downside, initial key short-term support has been defined at 4866.00, the Jan 31 low.

COMMODITIES Crude Gains Stall For Second Day, Gold Possibly Weighed By CTA Selling

- WTI front month is headed for US close trading lower, although it has recouped most of the earlier losses. Initial downside came from comments that Saudi Aramco is not abandoning capacity expansion plans.

- In contrast, Saudi Aramco’s intensions to halt the expansion of its output capacity are being driven by the energy transition according to Saudi Energy Minister Prince Abdulaziz bin Salman.

- UKMTO reported an incident 40 nm south of Yemen’s Al Mukha, directed at the bulker Star Iris headed for Iran according to Kpler.

- US oil production is set to rise in March to 9.716m b/d across the major shale plays, according to the EIA Drilling Productivity Report.

- Observed crude oil shipments from the US Gulf to Europe are on track to reach 2.2mbpd in February, the highest level since 2016: Bloomberg.

- WTI is -0.2% at $76.72, still watching resistance with $78.14 (Jan 30 high) next up after which lies a key $79.29 (Jan 29 high).

- Brent is -0.4% at $81.85, with resistance at $82.86 (Jan 30 high) after which lies $84.17 (Jan 29 high).

- Gold is -0.2% at $2019.59, off a low of $2012.01 for a quick breach of $2015.0 (Feb 5 low) but stopping short of $2001.9 (Jan 17 low). The yellow metal sees losses despite the USD index on net moving sideways, with TD Securities noting it is “being weighed down by CTA selling activity”.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/02/2024 | 0600/1500 | * |  | JP | Machinery orders |

| 13/02/2024 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 13/02/2024 | 0730/0830 | *** |  | CH | CPI |

| 13/02/2024 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/02/2024 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/02/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 13/02/2024 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/02/2024 | 1330/0830 | *** |  | US | CPI |

| 13/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.