-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA MARKETS ANALYSIS: Risk-On Gains Momentum Ahead NFP

- MNI JAPAN: PM Kishida-90mn People Will Be Eligible For Tax Rebates

- MNI US-CHINA: Yellen: US-China Separation Would Have Disastrous Effects

- MNI SECURITY: Kirby: US Hasn't Seen Signs Of Hezbollah Entering Conflict

- MNI SECUIRTY: WSJ: Wagner Group May Transfer Air Defense System To Hezbollah

- MNI US: Schumer-Senate Will Not Take Up House Funding Bill On Israel Aid

- MNI US: Bipartisan Border Security Bill Could Unlock Biden's USD$106B Supplemental

cropfilter_vintageloyaltyshopping_cartdelete

Tsys Off Highs Ahead October Employment Data

- Risk sentiment continued to improve following yesterday's dovish hold announcement from the Fed and this morning's data: Treasury futures extended gains after lower than expected Unit Labor Costs (-0.8% vs. 0.3% est, 2.2% prior), Nonfarm Productivity (4.7% vs. 4.3% est, 3.5% prior), while Initial Jobless Claims gained (217k vs. 210k est, 210k prior), Continuing Claims (1.818M vs. 1.800M est, 1.790M prior) while

- Treasury futures are paring back from this morning's highs after Factory Orders (2.8% vs. 2.3% est, 1.0% prior rev), Ex Trans (0.8% vs. 0.8% est, 1.5% prior rev), Durable Goods near in-line (4.6% vs 4.7% est), Ex Trans (0.4% vs. 0.5% est). Cap Goods Orders/ship slightly lower than expected at 0.4% and 0.5% respectively.

- How far yields have come: 10Y yield slipped to a session low of 4.6237% after ULC and weekly claims, are drifting near 4.6700% after the close, this compares to last week Monday's 16Y high of 5.0187%.

- Dec'23 10Y futures are currently trading 107-13 (+17.5) vs. 107-28 high (breach of initial technical resistance of 107-22+ (High Oct 16), next level at 108-02 (50-day EMA). Curves broadly flatter - but off lows: 3M10Y -3.250 at -76.775 (-83.440 low), 2Y10Y -10.823 at -31.987 (-34.071 low). Bull flattening over the last 24 hours partially due to the Tsys lower than expected Q4 refunding needs.

- Focus now turns to Friday's headline Oct Employ Report and ISMs while the Fed exits policy Blackout.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00700 to 5.32971 (+0.00559/wk)

- 3M +0.00080 to 5.39270 (+0.00949/wk)

- 6M -0.00876 to 5.44491 (+0.00158/wk)

- 12M -0.03028 to 5.36341 (-0.00954/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $92B

- Daily Overnight Bank Funding Rate: 5.32% volume: $227B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.621T

- Broad General Collateral Rate (BGCR): 5.30%, $576B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $565B

- (rate, volume levels reflect prior session)

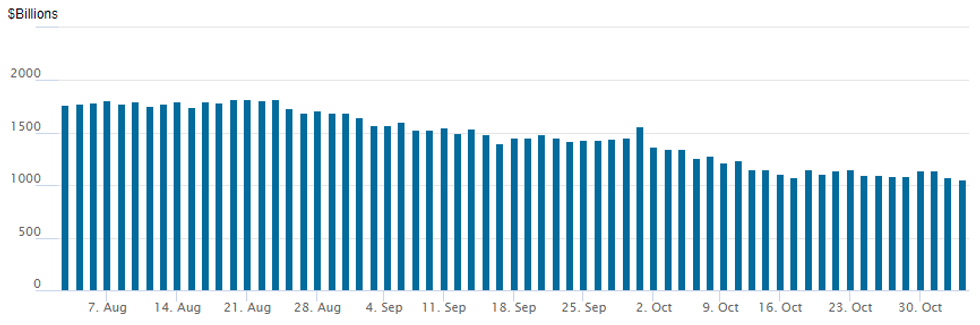

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage falls to new lowest level since mid-September 2021: $1,054.986B w/98 counterparties vs. $1,079.462B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury options generated robust volumes Thursday, mixed trade generally bullish with upside call buying and put unwinds as underlying futures added to Wednesday's post-FOMC rally as projected rate hikes into early 2024 continue to recede: December cumulative of 4.8bp at 5.373%, January 2024 cumulative 7.3bp at 5.398%, while March 2024 starts pricing in a cut (18.9%) with cumulative at 2.6bp at 5.350%. Fed terminal at 5.40% in Feb'24.

- SOFR Options

- over 18,500 SFRZ3 94.75 calls, 2.5 ref 94.585

- over 14,000 0QZ3 94.87/95.25/95.50 put flys ref 95.555

- 8,000 SFRH4 94.31/94.43 put spds vs. SFRH4 94.62/94.75 call spds

- over 20,000 SFRH4 94.37/94.50 put spds vs. SFRH4 94.75/94.87 call spds

- 6,000 0QH4 96.25/96.50 call spds vs. 0QH4 95.00/95.25 put spds

- 3,000 0QZ3 95.12/95.37 3x2 put spds

- Block, +11,000 SFRM4 94.75/94.87 call spds vs. SFRM4 94.37/94.50 put spds, 1.5 net/call spd over ref 94.94

- Another 7,000 of the above block on the screen ref 94.91

- 16,000 SFRM4 94.75/94.50 call spds vs. 94.31 puts ref 94.92

- 2,000 SFRM4 94.50/94.62/94.75 call flys, ref 94.91

- Treasury Options

- over 8,000 USZ3 105/109 put spds, 35-30 ref 112-12 to -06

- 3,500 FVZ3 105.5/106.5 1x2 call spds ref 105-06.5

- 1,600 TYZ3 105/105.5/106.5 broken put flys, 13 ref 107-17

- over 12,600 TYZ3 111 calls, ref 107-23 to -24.5

- 7,500 FVZ3 103.75/104.25 put spds, 5.5 ref 105-08

- over 7,700 TYZ3 107.75 calls, 49 ref 107-19

- over 8,400 TYZ3 106.5 puts, 25-24 ref 107-19 to -21

- 4,700 TUZ3 102.12 calls, 4 ref 101-15.38

- 5,000 TYZ3 105.5 puts, 11 ref 107-21.5

- 14,000 weekly 10Y 17/108.5 strangles, 21

- over 5,000 FVZ3 106 calls, 19.5 last

- over 10,000 TYZ3 110 calls, 9 ref 107-25

- 1,500 USZ3 112/114 call spds, 58

- 2,500 TYZ3 105/105.5 put spds

- 2,000 FVZ3 104.75 puts, 21.5 ref 105-06.5

- over 41,500 TYZ3 104 puts, 4 ref 107-10.5 to -15

- 6,500 wk2 10Y 108.25/108.75 call spds, 7 ref 107-12.5

- +10,000 TYZ3 103/104/105 put flys, 3

- 4,500 TYZ3 108/109.5 1x3 call spds vs. 103/104.5 3x2 put spds, o

- over 9,000 TYZ3 105 puts, 10

- 4,000 TYZ3 103 puts, 2 ref 107-08

- over 10,000 TYZ3 106/107 put spds vs. TYZ3 108.5 calls

- 1,800 TYZ3 105.75/107 put spds, ref 107-10.5

EGBs-GILTS CASH CLOSE: UK Curve Bull Flattens As BoE Holds

Gilts easily outperformed Bunds Thursday, with the bullish implications of Wednesday's US Treasury refunding and dovish-leaning Fed meeting still reverberating through European rates.

- The BoE decision and communications were largely as expected (rate hold on a 6-3 vote split), but market pricing of future cuts increased, with UK rates rallying across the curve.

- Bund futures rose to session highs in early afternoon as the BoE decision was digested. 10Y German yields hit their lowest levels since mid-September, but finished off the lows.

- The UK curve bull flattened sharply, with Germany's twist flattening.

- Periphery EGBs rallied, with 10Y BTP spreads to Bunds nearing the tightest levels (sub 190bp) since early Oct.

- ECB's Schnabel speaks after market close Thursday. Friday's calendar includes French industrial data and Spanish/Italian/Eurozone labour market reports, as well as multiple speakers including BOE's Pill.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is up 1.8bps at 3.009%, 5-Yr is down 1.6bps at 2.6%, 10-Yr is down 4.7bps at 2.717%, and 30-Yr is down 7bps at 3.004%.

- UK: The 2-Yr yield is down 5.8bps at 4.739%, 5-Yr is down 11.7bps at 4.341%, 10-Yr is down 11.7bps at 4.382%, and 30-Yr is down 9.3bps at 4.868%.

- Italian BTP spread down 4.9bps at 191.4bps / Spanish down 2.2bps at 105.2bps

EGB Options: Large Euribor Call Fly Buying Continues

Thursday's Europe rates / bond options flow included:

- OEZ3 115.50/115.00ps, sold at 5.5 in 1.5k

- ERZ3 95.87p, sold at half in 6.5k.

- ERM4 96.62/96.87/97.12c fly, has been bought for 3 up to 3.25 in 40k total all day. This was also bought Wednesday for 2.25 and 2.5 in some 20k

FOREX Greenback Reversal Lower Extends Amid Surging Equities

- The significant rally for major equity benchmarks has continued to weigh on the greenback on Thursday, with the USD index briefly extending its post-FOMC decline to over 1%. The move higher for yields during the US session prompted only a moderate USD recovery, with the DXY consolidating the majority of session losses ahead of the US employment data tomorrow.

- G10 gains versus the dollar were broad based with the outperformance unsurprisingly being seen in higher beta currencies such as the New Zealand and Canadian dollars, which have both risen around 0.80%.

- The move lower for USDCAD more notably pushed below support at 1.3790 (Oct 26 low) narrowing the gap significantly with 1.3739, the 20-day EMA. Upward pressure for crude futures amid headlines implying further escalation in the Israel-Hamas conflict have also provided an additional CAD tailwind.

- EURUSD steadily climbed over the first half of the day, regaining the 1.0600 handle and peaking at 1.0668, just shy of the week’s highs at 1.0675. Interestingly ahead of tomorrow’s US data, the overall technical outlook is bearish and short-term gains have been considered corrective so far. The move lower last week has reinforced a bearish theme - the Oct 24 price pattern is a bearish engulfing candle, a strong reversal signal.

- The Japanese Yen also heavily benefitted from the substantial shift lower for US yields late Wednesday and across the first half of Thursday trade. This prompted the pair to briefly slide back below the 150.00 mark to print 149.85, roughly 190 pips below Tuesday’s peak.

- Some emerging market currencies have understandably been the biggest beneficiaries from the more optimistic market backdrop. LatAm FX standouts with the Mexican peso rallying another 1.25%, and the likes of HUF & PLN also rising over 1%.

- All eyes turn to the US employment data on Friday where Bloomberg consensus sees nonfarm payrolls growth of 180k in October after almost doubling estimates with 336k in September along with strong two-month revisions.

FX Expiries for Nov03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.6bln), $1.0520-30(E919mln), $1.0575-85(E1.0bln), $1.0600(E1.8bln), $1.0700(E683mln)

- USD/JPY: Y149.50($1.1bln), Y150.00($1.3bln), Y150.50($884mln), Y151.00($940mln)

- GBP/USD: $1.2100(Gbp981mln), $1.2130-50(Gbp1.3bln)

- EUR/GBP: Gbp0.8635-45(E519mln)

- USD/CAD: C$1.3700-05($2.5bln), C$1.3750-65($1.3bln), C$1.3900($1.7bln)

Late Equity Roundup: Real Estate, Energy Leads, Apple Reports Late

- Stocks have climbed steadily throughout the session, holding near late session highs. Risk-on persists after yesterday's dovish hold announcement from the Fed and this morning's data. Currently, DJIA is up 373.3 points (1.12%) at 33647.96, S&P E-Mini future up 60.5 points (1.42%) at 4316, Nasdaq up 176.1 points (1.3%) at 13237.06.

- Leaders: Real Estate, Energy and Consumer Discretionary sectors outperformed in late trade, hotel/resort and office real estate investment trusts buoyed the former: Alexandria Real Estate +4.93%, Boston Properties +4.15%, Host Hotels +3.78%.

- Energy sector shares were supported by oil and gas stocks: Targa Resources +6.8, Conoco Philips +5.15%, Hess +3.42%. Meanwhile, auto makers lead the Discretionary sector: Tesla +5.84%, GM +1.93% and Ford +1.87%.

- Laggers: Communication Services and Consumer Staples sectors lagged the broader based rebound. Telecom and interactive media shares underperformed: Meta -0.95%, Match -0.39%. Meanwhile, distribution and retail shares weighed on Consumer Staples: Sysco -0.50%, Kroger -0.15%, Costco flat.

- Reminder that a slew of corporate earnings annc's are expected after the close: Apple, Booking Holdings, Insulet, Stryker, Microchip Technology, DraftKings, Carvana, SBA Communications, Five9, Floor & Decor Holdings, Expedia Group, Paramount Global, Live Nation Entertainment, Redfin

E-MINI S&P TECHS: (Z3) Correction Extends

- RES 4: 4455.75 Trendline resistance drawn from the Jul 27 high

- RES 3: 4430.50 High Oct 12

- RES 2: 4355.36 50-day EMA

- RES 1: 4334.75 Intraday high

- PRICE: 4332.00 @ 1445 ET Nov 2

- SUP 1: 4191.25/4122.25 Low NOv 1 / Low Oct 27 and the bear trigger

- SUP 2: 4100.00 Round number support 4124.19

- SUP 3: 4090.35 1.764 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4049.00 Low Mar 28

S&P e-minis are trading higher today as the contract extends the recovery from the Oct 27 low. The latest climb still appears to be a correction, however, price is through the 20-day EMA, at 4276.29. The clear break of this average suggests scope for a stronger short-term recovery, perhaps towards the 50-day EMA at 4355.36. Key support and the bear trigger has been defined at 4122.25, the Oct 27 low.

COMMODITIES Crude Gains On Middle East Tensions, Less So Gold

- Crude is holding onto strong gains amid headlines implying further escalation in the Israel-Hamas conflict, although both WTI and Brent remain below yesterday’s intraday peak.

- Israel says it is fighting ‘face-to-face battles’ with Hamas as its troops move deeper into Gaza according to NYT. Meanwhile, The Wall Street Journal has reported that the Russian paramilitary Wagner Group may provide an air defence system to the Iranian-backed Lebanon-based Hezbollah.

- The New York Times also reported that US Secretary of State Anthony Blinken is to press Israel for pauses in war against Hamas.

- WTI is +2.65% at $82.58, moving back closer to resistance at $85.90 (Oct 27 high).

- Brent is +2.65% at $86.89, moving back closer to resistance at $89.49 (Oct 24 high).

- Gold is +0.2% at $1985.75, again not troubling support at $1950.4 (20-day EMA) or resistance at $2009.4 (Oct 27 high) whilst the trend outlook appears bullish.

- MNI COMMODITY ANALYSIS: Chinese Refiners Depend on Sanctioned Barrels as Margins Tighten - Full piece here: https://enews.marketnews.com/ct/x/pjJscQOPkeoI6agzdR1zHg~k1zZ8KXr-kA8x6nEXZCiptIPjO1OcQ

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/11/2023 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 03/11/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/11/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 03/11/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/11/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/11/2023 | 0900/0900 |  | UK | BoE's Hauser speech at Watchers' conference | |

| 03/11/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/11/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 03/11/2023 | - |  | UK | BoE APF Q3 Report | |

| 03/11/2023 | 1200/0800 |  | US | Fed's Michael Barr | |

| 03/11/2023 | 1215/1215 |  | UK | BoE's Pill MPR National Agency Briefing | |

| 03/11/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 03/11/2023 | 1230/0830 | *** |  | US | Employment Report |

| 03/11/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/11/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/11/2023 | 1600/1600 |  | UK | BoE's Haskel panellist at Watchers' Conference | |

| 03/11/2023 | 1645/1245 |  | US | Minneapolis Fed's Neel Kashkari | |

| 03/11/2023 | 1930/1530 |  | US | Fed's Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.