-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA MARKETS ANALYSIS: Yields Fall To Dec Lows Ahead NFP

- MNI SECURITY: US Def Sec-'Multi-Tiered Response' To Be Delivered After Jordan Attack

- MNI NATO: Hungarian Parl't To Reconvene Early; No Guarantee Of Sweden Ratification

- MNI US: Biden Targets Union Vote In Detroit Amid Criticism Of Gaza Strategy

- FRENCH FARMERS' UNIONS ANNOUNCE SUSPENSION OF BLOCKADES, Bbg

US TSYS 10Y Yield Sinks to 3.8% Ahead Jan Employment Report

- Tsys finished strong but off late morning highs Thursday, concerns over regional bank weakness helped push Treasury futures to the highest levels since late December '23 with TYH4 tapping 113-06.5 high (+28), well through initial resistance of 112-26.5 (Jan 12 high) focus on 113-12 (Dec 27 high and bull trigger). 10Y yield falls to 3.8147% low.

- Late morning rally appeared to be related to wider concerns over NY regional banks after New York Community Bancorp (purchaser of collapsed Signature Bank shares) fell over 40% yesterday and as much as 14% again today before paring losses to -11%. Meanwhile KBW Regional Banking Index is down -2.29% from -5.13% at midday.

- Knock-on effect saw projected rate cut chances above post-FOMC highs briefly Thursday, before moderating in the second half.

- Early support: Tsy futures extended highs after higher than expected Initial Jobless Claims (242k vs. 212k est) and Continuing Claims (1.898M vs. 1.839M est, prior down-revised slightly to 1.828M from 1.833M).

- Meanwhile Nonfarm Productivity higher than expected at 3.2% vs 2.5% est (prior down-revised to 4.9% from 5.2%) while Unit Labor Costs came in at 0.5% vs. 1.2% est (prior revised to -1.1% from -1.2%).

- Look ahead Friday Data Calendar: Jan Employ Report, UofM Inflation Expectations

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00643 to 5.32352 (-0.01295/wk)

- 3M -0.04275 to 5.27258 (-0.04485/wk)

- 6M -0.08118 to 5.08383 (-0.07357/wk)

- 12M -0.12439 to 4.70254 (-0.09644/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.874T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $691B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $679B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $75B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $221B

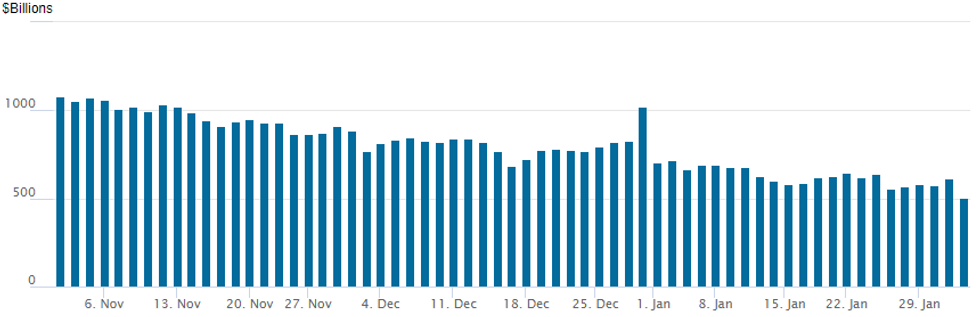

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage falls to the lowest level since mid-2021 today: $503.548B vs. $615.379B yesterday. Compares to prior low of $557.687B on Thursday, January 25.

- Meanwhile, the number of counterparties falls to 74 from 82 Wednesday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

Heavy SOFR option volume reported Thursday, particularly in March as accounts adjust positions following yesterday's steady FOMC rate annc as projections continue to see-saw. Dealer calls: Barclays and GS both push first rate cut to May from Mar, GS still est's 5 cuts in 2024.

- Projected rate cut chances moderated after surging higher at midday: March 2024 chance of 25bp rate cut currently -39.7% vs. -45.5% w/ cumulative of -9.9bp at 5.220%, May 2024 at -97% vs. -98.2% w/ cumulative -34.2bp at 4.977%, while June 2024 slips to 113% vs. 116.6% w/ cumulative -62.2bp at 4.697%. Fed terminal at 5.3125% in Feb'24. Highlight trades:

SOFR Options:

7,700 SFRU4 96.75 puts vs. 96.87/98.00 2x1 call spds

over 10,000 SFRH4 94.68/94.75/94.81 put flys, 2.25 ref 94.89

Blocks, -17,500 SFRH4 94.75 puts vs. 95.00/95.12 call spds, .25 Blocked earlier at 0.0 vs. 94.87/0.30%

Blocks, total 18,000 SFRG4/SFRH4 94.93/95.06 1x2 call spd strip, 3.5 total

Block, -10,000 SFRH4 95.50/96.00 call spds .25 ref 94.88 to -.885

Block, 7,500 SFRH4 94.75 puts vs. 95.00/95.12 call spds, 0.0 vs. 94.87/0.30% (more on screen)

Block, -6,000 SFRJ4 95.37/95.68/96.00 call flys, 4.5

2,500 SFRK4 94.75/95.00 put spds 95.35

5,500 SFRH4 94.93/95.18/95.43 call flys ref 94.87

8,000 SFRH4 95.12/95.37 call spds, 0.75 ref 94.87

Block, 3,000 0QH4 96.00/96.25 put spds, 7.5

Block, 5,000 SFRH4 95.06/95.12 call spds 0.5 ref 94.87

Block, 5,000 SFRH4 94.75/94.81/94.87/94.93 put condors, 2.25 ref 94.87

5,500 0QG4 96.00/96.25/96.37/96.50 broken put condors ref 96.445

2,500 SFRH4 94.75/94.81 2x1 put spds ref 94.87

4,000 SFRM4 94.75/95.00/95.50/95.75 1x2x2x1 call condor

Block, 2,500 SFRH4 94.87/94.93/95.00/95.06 call condors, 1.25 ref 94.88 (more on screen)

4,300 0QH4 97.12/97.37 call spds ref 96.46

1,000 SFRK4 95.56/95.62/95.68/95.75 call condors ref 95.36

Block, 2,750 0QG 96.12/96.25 put spds, 2.5 ref 96.46

Block, 4,500 SFRM4 95.43/0QM4 97.12 call spds, 1.0 net/midcurve over

3,000 SFRJ4 95.00 puts ref 95.33

over 20,000 SFRH4 94.87/94.93/95.00 call flys

Treasury Options:

Block, 10,000 Wednesday weekly 30Y 121.5/123 put spds, 20 vs. 124-06/0.18% expire Feb 7)

Block, 10,000 TYH4 114.5 calls, 17 ref 112-2.5

25,000 TYH4 111.5/112.5 2x1 put spds 2 ref 112-30

Block, 8,000 TYM4 111 puts, 47 vs. 112-24.5/0.28%

10,000 TYH4 112.5/113.75 call spds 32 ref 112-23.5

5,000 FVH4 107.25/107.5 2x1 put spds

over 7,000 TYH4 109.5/111/112.5 put flys ref 112-14

3,800 TYH4 115/116 call spds ref 112-12

1,500 TYH4 112.5/113.5 1x2 call spds, 2 ref 112-14.5

EGBs-GILTS CASH CLOSE: Gilts Outperform After Initial BoE Selloff

European core yields finished mostly lower and well off session highs Thursday, with Gilts closing as an outperformer on BoE decision day.

- Yields opened higher after the Fed's Powell came out on the hawkish side overnight, with European morning headlines centered around data: Eurozone flash inflation came in above the consensus coming into the week on both headline and core, but was largely in line with the national prints so had limited impact.

- The BoE skewed more hawkish than most market participants had expected though was broadly in line with MNI's view, with a vote split including 2 members favouring a hike (vs consensus for a unanimous vote to hold), and the tightening bias being ended (though this was expected).

- Gilt yields hit session highs after the decision but slightly dovish wording surrounding inflation projections helped limit weakness.

- Yields had already started leaning lower as the BoE wrapped up, but the fall gathered steam amid yet another set of dovish US labour market data and accelerated an hour before the European cash close as US bank stocks fell sharply for a 2nd day, triggering a safe haven rally.

- The German curve twist flattened, with the UK's bull flattening. Periphery spreads widened again on the risk-off move (as did swap spreads), led by Greece.

- Capping a busy week will be the US nonfarm payrolls report Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.9bps at 2.457%, 5-Yr is up 0.2bps at 2.053%, 10-Yr is down 1.7bps at 2.149%, and 30-Yr is down 3.4bps at 2.371%.

- UK: The 2-Yr yield is down 2.4bps at 4.234%, 5-Yr is down 4.7bps at 3.698%, 10-Yr is down 4.8bps at 3.746%, and 30-Yr is down 4.2bps at 4.414%.

- Italian BTP spread up 1.4bps at 157.6bps / Greek up 3.3bps at 108.2bps

EGB Options: Limited BoE Day Trade Includes Euro Rate Upside Unwind

Thursday's Europe rates/bond options flow included:

- ERH4 96.37/96.50/96.62c fly sold at 1.25 and 1 in 21.5k (suggest an unwind)

- ERJ4 96.50/96.37ps vs ERM4 96.37/96.25ps, bought the J4 for 1.25 in 8.88k

FOREX Greenback Reverses South Amid Lower Yields and Higher Equities

- A mid-session decline for US yields amid a confluence of headlines on US regional bank concerns and geopolitical developments, prompted a notable turn lower for the greenback on Thursday. Despite the earlier extension of post-FOMC dollar strength, the USD index eventually slipped all the way into negative territory on the session and currently resides 0.25% lower ahead of the APAC crossover.

- Sensitivity to core rates continues to feed through to USDJPY volatility, with the pair briefly making a new post-Fed low at 145.90 on Thursday. A subsequent bid for equities and stabilisation in rates has seen the pair consolidate back around 146.30.

- Moving average studies have recently crossed and are in a bull-mode set-up for USDJPY, reinforcing the current bullish trend condition. Key short-term support remains much lower at 144.36, the Jan 12 low. A break would be required to signal a top.

- Elsewhere, EURUSD has risen 0.52% to 1.0875, with the late equity strength further boosting the pair to session highs. However, the Australian dollar has underperformed compared to G10 counterparts, rising only 0.10% against the dollar despite the broader greenback selloff.

- From a trend perspective, a bearish theme in AUDUSD continues to dominate and the latest pause appears to be a flag formation - a bearish continuation pattern. A resumption of weakness would open 0.6500, a Fibonacci retracement and the next objective.

- Currency markets appear to be consolidating ahead of another busy data docket on Friday, headlined by the release of US employment data for January. Bloomberg consensus sees nonfarm payrolls rising 185k in January, primary dealers see a median 205k. University of Michigan consumer sentiment and inflation expectations will round off the week’s data calendar.

FX OPTION EXPIRY

Of note:

EURUSD 1.1bn at 1.0800 (Mon).

AUDUSD 3.91bn at 0.6570/0.6610 (Tue).

EURUSD 1.02bn at 1.0800 (Tue).

USDJPY 1.4bn at 147.00 (Wed).

- EURUSD: 1.0775 (445mln), 1.0800 (783mln), 1.0845 (298mln), 1.0850 (336mln), 1.0860 (830mln).

- GBPUSD: 1.2630 (307mln), 1.2670 (224mln).

- USDJPY: 146.00 (431mln), 146.50 (333mln), 147.00 (200mln). 147.50 (449mln).

- AUDUSD; 0.6590 (659mln), 0.6605 (302mln), 0.6640 (724mln), 0.6650 (583mln).

- USDCNY: 7.1500 (479mln), 7.1510 (615mln).

Late Equities Roundup: Extending Highs

- Stocks extended highs in late Thursday trade, Consumer Discretionary and Consumer Staples outperforming. Currently, the DJIA is up 321.76 points (0.84%) at 38472.78, S&P E-Minis up 51.75 points (1.06%) at 4922, Nasdaq up 190.1 points (1.3%) at 15354.52.

- Consumer Discretionary and Consumer Staples sector shares led gainers, broadline retailers buoyed the former: Etsy +8.01%, Lowe's +3.38%, Tractor Supply +3.14%. Food & beverage and retail distributors supported the former: Brown Forman +3.33%, Altria Group +3.12% Constellation Brands +2.48% while Target gained +3.61%, Dollar Tree +3.36%.

- Notable dynamic: carry-over weakness in regional bank shares helped Treasury futures rally back to late December highs which simultaneously pushed projected rate cut chances higher and underpinned stocks.

- After NY Community Bancorp fell over 40% Wednesday, -8.6% again today after they cut it's dividend and posted a loss on purchase of collapsed Signature Bank shares. Meanwhile KBW Regional Banking Index is down -1.91% -- off lows.

- Off midday lows, large banks still weighed on the Financial sector amid some concern over spreading risks: Zion Bancorp -5.42%, M&T Bank -3.98%, PNC -3.29%.

- Looking ahead: corporate earnings docket after the close: Meta, US Steel, Amazon, Apple, Clorox and Eastman Chemicals.

E-MINI S&P TECHS: (H4) Corrective Sell-Off

- RES 4: 5012.80 1.618 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5000.00 Psychological round number

- RES 2: 4982.62 1.50 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4957.25 High Jan 30 and the bull trigger

- PRICE: 4922.00 @ 1500 ET Feb 1

- SUP 1: 4855.89/4757.66 20- and 50-day EMA values

- SUP 2: 4702.00 Low Jan 5

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

A broader uptrend in S&P E-Minis remains intact and the latest pullback is considered corrective. This week’s fresh cycle highs, reinforce current trend conditions. Note too that moving average studies remain in a bull-mode condition, highlighting positive market sentiment. A resumption of gains would open 4982.62 next, a Fibonacci projection. Initial support to watch lies at 4855.89, the 20-day EMA. Key support is 4757.66, the 50-day EMA.

COMMODITIES Crude Slides On Ceasefire Headlines Despite Correction, Gold Surges On Soft USD

- Crude markets have been volatile during US hours amid earlier headlines which sparked optimism for a ceasefire between Israel and Hamas. While earlier tweets from Al Jazeera suggesting as such were deleted, crude has continued to soften.

- CBS News reports the US has a series of strikes planned in the coming days in response to the drone attack on a Jordanian outpost that killed three US service personnel and injured dozens more over the weekend.

- OPEC+ has not made any recommendations to change the group’s output policy in the today’s JMMC meeting but noted high conformity with production quotas, the group said in a release.

- WTI is -2.6% at $73.89, punching through suport at the 50-day EMA of $74.80 to open $70.62 (Jan 17 low).

- Brent is -2.2% at $78.74, punching through support at the 50-day EMA of $79.45 to open $76.13 (Jan 17 low).

- Gold is +0.8% at $2056.10, buoyed by the day’s slide in the USD after softer US data. Touching an earlier high of $2065.35 before pulling back on ceasefire confusion, it briefly cleared resistance at 2062.0 (Jan 12 high) to open $2088.5 (Dec 28 high).

- TD Securities noted that macro traders in gold are historically underinvested for a cutting cycle. “In fact, our estimates of discretionary trader positioning points to notable short acquisitions over the last weeks, which could suggest that macro traders have been caught in a bear trap following the slew of hot data releases. This sets the stage for substantial outperformance in the yellow metal on the horizon, and our simulations of future price action suggest that imminent CTA buying activity could potentially kick off the start of a pain trade for macro traders.”

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2024 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 02/02/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 02/02/2024 | 1215/1215 |  | UK | BOE's Pill- MPR National Agency briefing | |

| 02/02/2024 | 1330/0830 | *** |  | US | Employment Report |

| 02/02/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 02/02/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.