-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI ASIA MARKETS ANALYSIS - Yields Slide In Potential Pivot Play

- Treasury yields slump, the USD softens and equities surge

- Crude oil jumps on combination of more supportive backdrop and OPEC+ large cut speculation

US TSYS: Treasuries Unwind ISM Hit But Still See Substantial Rally

- Cash Tsys have pulled back off session highs to unwind the additional rally on the ISM mfg miss.

- They still see a significant rally on the day though, with yields 17.5-21bps lower across 2-10Y tenors, led by the belly on what started as a fading of Friday’s quarter-end cheapening that accelerated with the US coming in and looking to large rallies in EU FI (European bank concerns, UK fiscal u-turns).

- Even larger declines in real yields (5YY -33bps) drive a large 3% gain in S&P whilst also seeing the breakeven pop higher (5Y +12bps). However, having fallen sharply since the Sep FOMC, the latter is still only at 2.29% and at levels last seen in Feb’21.

- TYZ2 at 113-07 holds onto its clearance of 113-00 from a high of 113-27+ that came close to testing the 20-day EMA of 113-30 in second resistance of the day before volumes petered away.

STIR FUTURES: Near-Term Fed Hikes Resilient But 2023 Rates Slide

- Fed Funds implied hikes hold firm for Nov 2 at 68bp, unchanged since Fri close but firming in the US session after weakness overnight despite the ISM miss, with the 113bps of hikes to 4.22% relatively little changed.

- Much larger moves for 2023 meetings though, with a terminal now seen at 4.45% for Mar’23 (-8bp) before 4.15% for Dec’23 (-17bp), despite further increases after a speech from NY Fed's Williams entitled a Bedrock Commitment to Price Stability. The latter is back near pre-Sep FOMC levels and was at one point 4.07% post-ISM, helping drive today's strength in equities with S&P up 3%.

- Five Fed speakers tomorrow including the first from Governor Jefferson since his confirmation to the Board.

US DATA: ISM Manufacturing Misses With Weak Details

- ISM mfg was softer than expected, falling from 52.8 to 50.9 (cons 52.1) with Friday’s drop in the Chicago PMI better reflecting the softening in activity vs the nudge higher in the S&P Global PMI.

- Fresh low since May’20 and with weak internals: new orders 47.1 (low since May’20), new orders less inventories continuing to point to further weakness ahead for the overall index and employment unwinding the large jump in August back into contraction territory.

- Prices of 51.7 confirmed the sizeable decline over the summer from 78.5 in June, close to the 2019 average of 49.1 and below the long-term (2000-19) average of 59.5.

- The Tsy rally extends even further on the release, led by 5YY down -24bps at typing.

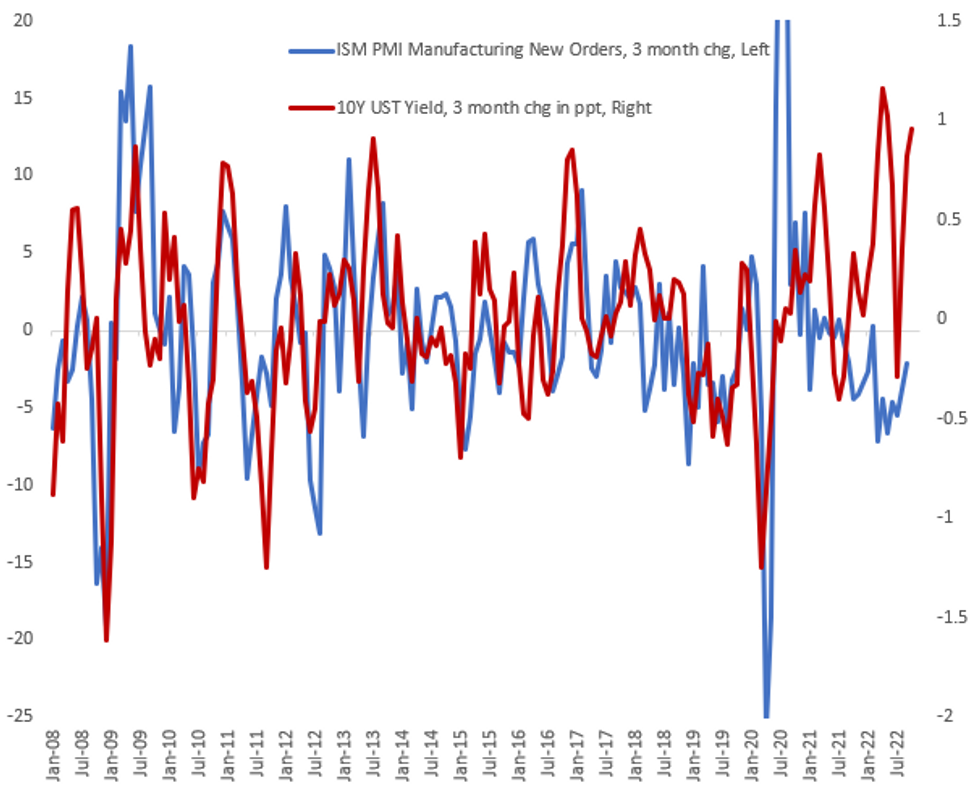

ISM Vs Tsy Disconnect Continues

Today's September ISM PMI Manufacturing disappointment included a very weak New Orders component (47.1, vs 51.3 prior and 50.5 expected).

- While September's reading means that the slowdown in new orders has actually decelerated on a 3-month basis (see chart), there is still a very wide disconnect between that ISM subcomponent and changes in Treasury yields. That's even when taking today's rally into account.

- The Treasury rally could continue if - as in July - the disconnect resolves in the ISM's favor, even if only briefly.

Source: ISM, MNI

Source: ISM, MNI

US DATA: PMI Nudges Higher, Dollar Strength Impacts Noted

- The S&P Global US manufacturing PMI was modestly revised up 0.2pts to 52.0 in the final September print, leaving a 0.5pt increase from August’s 51.5 but still close to lows for the post-pandemic recovery.

- It introduces some evidence against the slide in the MNI Chicago PMI and helps Tsy yields pull off session lows but impact limited ahead of the ISM counterpart following closely at 1000ET.

- Dollar strength sees focus in press release: “Manufacturers across the board are, however, reporting further export losses, linked to weaker economic growth abroad and the dollar’s strength. “While the strong dollar is curbing exports, a beneficial effect from the greenback’s strength is being seen via lower import costs. With supply chain delays also easing substantially again in September and shipping costs falling, upwards pressure on firms’ costs has moderated sharply, which will feed through to lower goods prices to consumers.””

MNI RBA Preview - October 2022: 50bp But A Very Close Call

EXECUTIVE SUMMARY

- We think that the data and RBA communique point to a final 50bp hike at the Bank’s October meeting, which would leave the cash rate target at 2.85%.

- Market pricing surrounding the terminal rate has shifted higher again in recent weeks’ although the June peak of ~4.50% has not been breached.

- The RBA has made it very clear that its decisions will be data dependent and this month’s data show that the economy continues to operate in a resilient manner.

- Full MNI preview here

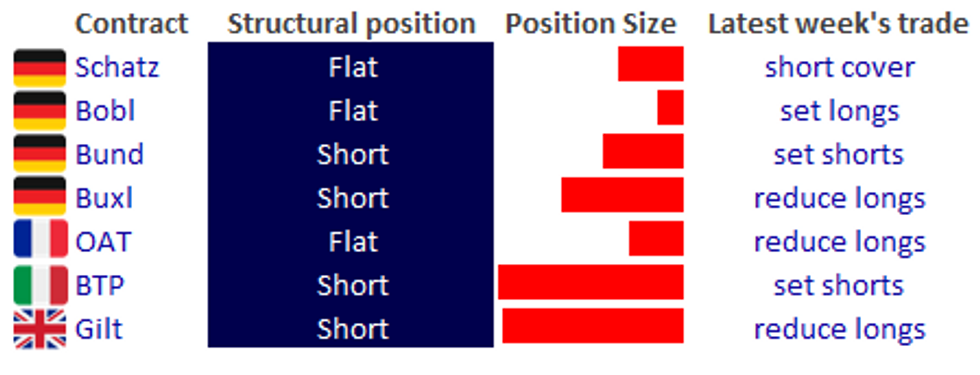

MNI Europe Pi (Positioning Indicator): Flat-To-Short

Structural positioning in European bond futures contracts has stayed flat/short since our last biweekly MNI Pi update, with some notable volatility in Gilt positioning in the interim.

- Last week saw a mixture of trade, with both shorts and longs set and reduced.

- Full PDF analysis is available on our website, and has been emailed to clients.

GILTS: Why was there such a low take-up at today's long-dated purchase op?

- There is no detail on the prices of the offers that were rejected - only for those accepted.

- Only one gilt was purchased - the 3.25% Jan-44 gilt for GBP22.1mln with an WAAP of 91.35 and a high accepted price of 91.400.

- We recorded the midprice at 91.700 - and there were GBP609.4mln bids rejected for this bond in particular.

- We noted last week that the BOE was buying with a reasonable bid-ask spread over the mid-price.

- The question now is are the BOE only accepting offers below the mid-price, or were the other offers submitted today too far below mids?

FOREX: Greenback Undermined by Weakness in ISM Employment

- GBP/USD held on to early gains and gained further through the London close as markets extended their response to the UK government U-turning on the unfunded abolition of the top rate of tax. While the move itself is a relatively small measure, the move has settled prices as it may show the government will heed market warnings in the future. GBP/USD headed through the London close just shy of the $1.13 level.

- Meanwhile, the USD was among the poorest performers in G10 following a sharp miss for ISM Manufacturing PMI, which dropped to 50.9 vs. Exp. 52.0. The employment sub-component was a particular source of weakness, slipping to 48.7 ahead of Friday's nonfarm payrolls.

- The downtick in the greenback helped alleviate pressure on USD/JPY, which had approached levels last seen just prior to formal intervention from the Japanese ministry of finance. USD weakness marked the pair lower, putting Friday's lows at 144.21 within range.

- The RBA rate decision takes focus going forward, with median consensus looking for a 50bps rate rise to 2.85% this month. Later in the Tuesday session, Fed's Logan, Williams, Mester, Jefferson & Daly are on the docket, with ECB's Lagarde also set to speak.

COMMODITIES: Oil Surges On OPEC+ Cuts Speculation and US Yields Sliding

- Commodities broadly see strong gains as Treasury yields slide and the USD loses some of its shine, with an additional boost for crude oil coming on speculation that OPEC+ could cut production by more than 1mbpd in what would be the largest reduction since the pandemic. A final decision is to be made on Wednesday.

- WTI is +4.8% at $83.29 with a session high of $84.56. It cleared the 20-day EMA of $87.26, opening the 50-day EMA of $87.26. Most active strikes in CLX2 today have been $90/bbl and then $100/bbl calls.

- Brent is +4.2% at $88.72 with a session high of $89.82. It cleared the 20-day EMA of $88.93 and moved closer to the 50-day EMA of $92.24.

- Gold is +2.2% at $1696.7 having cleared two resistance levels, the higher being $1688.0 (Sep 21 high) to leave $1707.1 (Sep 14 high) open, and in turn testing what was deemed only a short-term corrective bounce.

BRAZIL: 1st Round of Presidential Elections Proves Market Friendly

- A solid session for Brazilian assets, with BRL and local equities outperforming all others in the region, while local swap rates are under pressure.

- Moves follow the 1st round of the Presidential election being much closer than expected, with Lula on 48% vs. Bolsonaro's 43%, with both candidates likely coming under pressure to appeal to the centrist vote in the run-off due at the end of October.

- Markets are on watch for the resumption of the campaign and in particular any endorsement from those eliminated in the first round (center-left Gomes and center-right Tebet). Expectations area for the Gomes supporters to naturally tend toward Lula, while Tebet's support could be more evenly split the two remaining candidates.

- USD/BRL gapped lower, touching the lowest level since Sep23 to narrow the gap with the 50-dma at 5.1963.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/10/2022 | 0130/1230 | ** |  | AU | Lending Finance Details |

| 04/10/2022 | 0130/1230 | * |  | AU | Building Approvals |

| 04/10/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 04/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/10/2022 | 0900/1100 | ** |  | EU | PPI |

| 04/10/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 04/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/10/2022 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 04/10/2022 | 1315/0915 |  | US | Cleveland Fed's Loretta Mester | |

| 04/10/2022 | 1400/1000 | ** |  | US | factory new orders |

| 04/10/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 04/10/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 04/10/2022 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students Event | |

| 04/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 04/10/2022 | 1545/1145 |  | US | Fed Governor Philip Jefferson | |

| 04/10/2022 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 05/10/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.