-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA OPEN: Curves Flatter Ahead FOMC, Tsy Refunding Annc

- MNI INTERVIEW: Fed Overtightened But Will Wait 'Til May-Harvey

- MNI: Canadians Doubt BOC Wins Inflation Fight-Internal Polls

- MNI BOE WATCH: Wary BOE Seen Holding Policy, Eyes On Guidance

- MNI US DATA: Perception Of Jobs Being Hard To Get One Of Lowest On Record

- MNI US DATA: Higher Openings, But Quits Rounding Masks Further Downward Progress

US

INTERVIEW (MNI): Fed Overtightened But Will Wait 'Til May-Harvey

- The Federal Reserve has overtightened monetary policy and needs to start cutting interest rates soon in order to avoid a recession, but policymakers are likely to wait until May before they start reducing borrowing costs, Campbell Harvey, a former visiting scholar at the Fed's Board of Governors told MNI.

- "The Fed pushed rates unnecessarily too high and to mitigate the risk of much slower growth or recession they need to reverse some of that," said Harvey, who pioneered research showing movements in the yield curve could predict economic turning points. Harvey expects the Fed to begin its easing cycle with a 25 basis point cut in May.

NEWS

BOC (MNI): Canadians Doubt BOC Wins Inflation Fight-Internal Polls

Just one in five Canadians trust the Bank of Canada will return inflation to target within two years according to internal surveys obtained by MNI, results a spokesman said remain consistent with other evidence that longer-term expectations remain well anchored.

BOE WATCH (MNI): Wary BOE Seen Holding Policy, Eyes On Guidance

The Bank of England is set to hold Bank Rate at 5.25% this week, and while analysts are divided over whether it will soften December’s guidance by removing a reference to possible further tightening, the Monetary Policy Committee is likely to take a cautious approach in adjusting its communications as it edges closer to an easing cycle.

GLOBAL POLTICAL RISK (MNI): BRICS Foreign Ministers To Meet In Russia In June

Russian news services have confirmed that foreign ministers from the BRICS grouping will meet in Nizhniy Novgorod, Russia in June - one of roughly two-hundred events Russia will host as president of the bloc - leading up to the 16th BRICS Summit in Kazan in October.

US-CHINA (MNI): Counter-Narcotics Working Group Meets In Beijing

Reuters carrying comments from US and Chinese officials following a key working group meeting on counter-narcotics Beijing, another marker in the ongoing 'thaw' between Beijing and Washington initiated when President Biden met Chinese President Xi Jinping in San Francisco in November.

SECURITY (MNI): Hamas Studying Paris Ceasefire Proposal

Bloomberg reporting that Hamas is studying the ceasefire and hostage exchange proposal devised in meetings between security officials in Paris, France over the weekend.

SECURITY (MNI): Biden: We Don't Need Wider War In Middle East

US President Joe Biden has told reporters that he has, "decided how to respond," to a drone attack that killed US service members in Jordan on Sunday, but declined to elaborate, according to Reuters.

SECURITY (MNI): Houthis Ready For "Long-Term Confrontation" With U.S. And U.K.

Wires carrying comments from Houthi commander Mohamed al-Atifi stating that the Iran-backed group, which maintains de facto control over much of Yemen, is prepared for a "long-term confrontation" with the United States and the United Kingdom.

US TSYS Implications of Curve Flattening Ahead FOMC, Tsy Refunding

- Treasury futures running mixed after the bell, curves broadly flatter (2s10s -5.251 at -30.065) as bonds continue to outperform following US Tsy cut Q1 borrow est's from $816B to $760B late Monday with fcus on tomorrow's TBAC refunding annc at 0830ET.

- Tsys support evaporated, particularly in the short end, after higher than expected JOLTS job openings at 9.026m (cons 8.75m) in Dec after an upward revised 8.93m (initial 8.79m) in Nov. Meanwhile, the Conference Board consumer confidence figure may have been in line with expectations in January but the labor market differential increased strongly. It increased from 27.3 to 35.7 for its highest level since April, whilst the 8.4pt increase was the strongest monthly increase since May’21.

- Concerted tone change in the curve ahead of the Tsy refunding as well as tomorrow's FOMC policy annc. Steepener unwinds a contributing factor over the last 24 hours:

- Flattener post at 1152:47ET Tuesday: -24,007 TUH4 102-17.88, sell through 102-18.62 post time bid, DV01 $917,000 vs. +9,846 UXYH4 115-29, post time bid, DV01 $901,800.

- Large flattener posted at 1612:49ET late Monday: -21,742 FVH4 107-30, sell through 107-31.25 post time bid, DV01 $921,800 vs. +4,432 WNH4 126-30, post time offer, DV01 $909,800.

- As noted in the option summary, projected rate cuts have receded: January 2024 cumulative -.5bp at 5.324%, March 2024 chance of 25bp rate cut -40.7% vs. -46.5% this morning w/ cumulative of -10.7bp at 5.222%, May 2024 at -78.4% vs. -82.7% earlier w/ cumulative -30.3bp at 5.026%, June 2024 -94.6% vs. -98.1% earlier w/ cumulative -53.9bp at 4.790%. Fed terminal at 5.325% in Feb'24.

OVERNIGHT DATA

US DATA (MNI): Higher Openings, But Quits Rounding Masks Further Downward Progress

- Higher than expected JOLTS job openings at 9.026m (cons 8.75m) in Dec after an upward revised 8.93m (initial 8.79m) in Nov.

- It meant the ratio to unemployed inched up to 1.44 from an upward revised 1.43 (initial 1.40), a second monthly lift off the 1.37 in Oct. . It ended 2022 at 1.97, but remains above the 1.2 averaged in 2019 or 1.0 in 2017-18.

- Quits rate: 2.16% from 2.24 (initial 2.21). It averaged 2.33 in 2019, 2.20 in 2017-18.

- Private quits: 2.38% after 2.48 (initial 2.45). It averaged 2.59 in 2019, 2.45 in 2017-18.

US DATA (MNI): Perception Of Jobs Being Hard To Get One Of Lowest On Record

- The Conference Board consumer confidence figure may have been in line with expectations in January but the labor market differential increased strongly.

- It increased from 27.3 to 35.7 for its highest level since April, whilst the 8.4pt increase was the strongest monthly increase since May’21.

- Jobs plentiful increased from 40.4 to 45.5 (highest since April) whilst jobs hard to get fell from 13.1 to 9.8. It has only been lower in two months of the data since at least 1985 (9.6% in Mar’22 and Jul’00).

US DATA (MNI): FHFA house prices were in line in November, increasing a seasonally adjusted 0.31% M/M (cons 0.3) after a downward revised 0.27% (initial 0.34) in Oct.

- It’s the second month with a rounded 0.3, the slowest monthly pace since Jan’23 having increased an average 0.7% M/M in the eight months through Feb-Sep.

- S&P CoreLogic 20-city prices missed meanwhile, rising a seasonally adjusted 0.15% M/M seasonally (cons 0.50) after an almost unrevised 0.63% M/M in Oct.

- In a similar pattern to the FHFA data, it marks the softest print since Feb’23.

The softer pace of seasonally adjusted house price growth has come as existing home sale relative supply has closed the gap with pre-pandemic years for the early winter months.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 135.54 points (0.35%) at 38474.95

- S&P E-Mini Future down 0.25 points (-0.01%) at 4955.25

- Nasdaq down 103.8 points (-0.7%) at 15525.59

- US 10-Yr yield is down 1.9 bps at 4.0547%

- US Mar 10-Yr futures are up 3.5/32 at 111-20

- EURUSD up 0.0014 (0.13%) at 1.0849

- USDJPY up 0.11 (0.07%) at 147.6

- WTI Crude Oil (front-month) up $0.96 (1.25%) at $77.72

- Gold is up $3.05 (0.15%) at $2036.25

- European bourses closing levels:

- EuroStoxx 50 up 23.34 points (0.5%) at 4662.7

- FTSE 100 up 33.57 points (0.44%) at 7666.31

- German DAX up 30.63 points (0.18%) at 16972.34

- French CAC 40 up 36.66 points (0.48%) at 7677.47

US TREASURY FUTURES CLOSE

- 3M10Y -1.87, -130.834 (L: -136.879 / H: -126.764)

- 2Y10Y -5.84, -30.654 (L: -31.128 / H: -24.779)

- 2Y30Y -7.734, -8.627 (L: -9.453 / H: -1.216)

- 5Y30Y -5.032, 27.849 (L: 26.902 / H: 32.623)

- Current futures levels:

- Mar 2-Yr futures down 2.375/32 at 102-18.75 (L: 102-16.875 / H: 102-23)

- Mar 5-Yr futures down 1.75/32 at 107-28.25 (L: 107-23.5 / H: 108-03.5)

- Mar 10-Yr futures up 3.5/32 at 111-20 (L: 111-11 / H: 111-27.5)

- Mar 30-Yr futures up 24/32 at 121-9 (L: 120-19 / H: 121-14)

- Mar Ultra futures up 1-08/32 at 127-30 (L: 126-29 / H: 128-03)

US 10Y FUTURE TECHS: (H4) Corrective Cycle

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-01+/112-26+ High Jan 17 / 12

- PRICE: 111-20 @ 1420 ET Jan 30

- SUP 1: 110-26 Low Jan 19

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

The trend needle in Treasuries continues to point south and short-term gains are considered corrective for now. Sights are on 110-26, the Jan 19 low. A break of this level would confirm a resumption of the current bear cycle and highlight a clear break of the 50-day EMA, at 111-04. This would set the scene for a move towards 110-16, the Dec 13 low. Firm resistance is 112-26+, the Jan 12 high. Initial resistance is at 112-01+, the Jan 17 high.

SOFR FUTURES CLOSE

- Mar 24 -0.020 at 94.855

- Jun 24 -0.040 at 95.255

- Sep 24 -0.055 at 95.655

- Dec 24 -0.070 at 960

- Red Pack (Mar 25-Dec 25) -0.075 to -0.04

- Green Pack (Mar 26-Dec 26) -0.03 to +0.005

- Blue Pack (Mar 27-Dec 27) +0.020 to +0.035

- Gold Pack (Mar 28-Dec 28) +0.045 to +0.065

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00426 to 5.32834 (-0.00813/wk)

- 3M -0.00623 to 5.30643 (-0.01100/wk)

- 6M -0.00656 to 5.14613 (-0.01127/wk)

- 12M -0.00963 to 4.78940 (-0.00958/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.598T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $671B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $657B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $92B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $269B

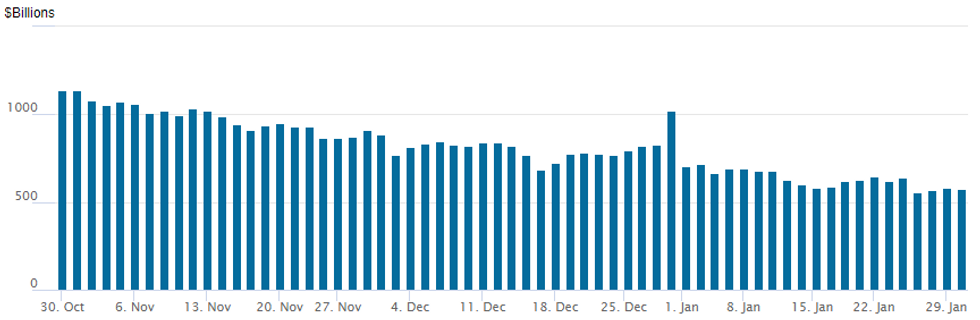

US FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage recedes to $577,755B vs. $581.410B yesterday. Compares to cycle low of $557.687B on Thursday, January 25 -- the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties slips to 78 from 81 Monday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $2.5B UKG Inc. 7NC3 Priced

$5.75B to Price Tuesday- Date $MM Issuer (Priced *, Launch #

- 1/30 $2.5B *UKG Inc. 7NC3 6.875%

- 1/30 $750M #Kodiak Gas 5NC2 7.25%

- 1/30 $750M *AfDB PerpNC10.5 5.75%

- 1/30 $750M #KLA Corp $500M 10Y +72, $250M 2052 Tap +80

- 1/30 $500M #Turk Eximbank 4Y 7.75%

- 1/30 $500M *OPEC Fund WNG 3Y SOFR+78

EGBs-GILTS CASH CLOSE: Bear Flattening Ahead Of French/German Inflation

The UK and German curves bear flattened Tuesday with Gilts underperforming, ahead of multiple

- After a positive overnight session for global core FI, in part following Monday's late announcement of a lower-than-expected US Treasury borrowing requirement, EGBs reversed lower after Spanish flash Jan inflation came in firmer than expected. (Eurozone Q4 GDP wasn't as bad as feared.)

- Gilts would hit higher levels in the session but Bunds didn't recover, with both dragged down by Treasuries in early afternoon after data showed a surprising rise in US job vacancies - a key metric eyed by the Fed, ahead their decision tomorrow. Higher oil prices kept the pressure on.

- Periphery EGB spreads finished wider, with BTPs cheapening after the announcement of a 15Y syndication. (Today also saw BTP auctions, plus German/Greek bond syndications.)

- The highlight early Wednesday will be French and German state-level inflation data - our Eurozone inflation preview was published today and is available here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.1bps at 2.5154%, 5-Yr is up 3.8bps at 2.164%, 10-Yr is up 3.3bps at 2.268%, and 30-Yr is up 2.6bps at 2.496%.

- UK: The 2-Yr yield is up 7.1bps at 4.339%, 5-Yr is up 5bps at 3.857%, 10-Yr is up 2.5bps at 3.901%, and 30-Yr is up 2.4bps at 4.53%.

- Italian BTP spread up 3bps at 152.9bps / Spanish up 1bps at 90.3bps

FOREX G10 Ranges Contained As Key Event Risk Approaches

- Moderate greenback weakness reversed following an above estimate reading for US JOLTS Job Openings on Tuesday. However intra-day currency ranges remain narrow and the USD index remains little changed on the week as we approach tomorrow's FOMC decision/press conference.

- The greenback bounce was once again best reflected by the rally for USDJPY, which rose to a session high of 147.93 after printing as low as 147.10 overnight. However, the USD index failed to escape out of its 30 pip range, with G10 currency adjustments on the day kept to minimal sizes.

- The Australian dollar has moderately weakened on Tuesday, giving back some of the prior day’s advance ahead of both the key domestic inflation data and the FOMC meeting. EURAUD stands around 0.20% higher, giving up a portion of the move lower at the start of the week. Q4 CPI figures will be a crucial input into deliberations at next week's RBA meeting.

- In emerging markets, the Hungarian Forint outperformed following a below consensus rate cut of just 75bps from the NBH, who cited deteriorating risk sentiment as the primary reason behind the smaller than expected move. USDHUF is 0.90% lower on the session.

- As mentioned, Australia CPI kicks off Wednesday’s calendar before China PMI data is released. Eurozone inflation data is scheduled across the European morning. US ADP and ECI will cross alongside Canadian GDP before the MNI Chicago PMI rounds off the data docket. Focus then swiftly turns to the Jan FOMC decision. While no change is expected on rates, there is a good chance that the forward guidance will be amended to remove the tightening bias in favour of a more neutral stance, in light of recent disinflationary progress.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/01/2024 | 0030/1130 | *** |  | AU | CPI inflation |

| 31/01/2024 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 31/01/2024 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/01/2024 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/01/2024 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 31/01/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/01/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 31/01/2024 | 0730/0830 | ** |  | CH | Retail Sales |

| 31/01/2024 | 0745/0845 | *** |  | FR | HICP (p) |

| 31/01/2024 | 0745/0845 | ** |  | FR | PPI |

| 31/01/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 31/01/2024 | 0900/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 31/01/2024 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 31/01/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/01/2024 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2024 | 1315/0815 | *** |  | US | ADP Employment Report |

| 31/01/2024 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/01/2024 | 1330/0830 | ** |  | US | Employment Cost Index |

| 31/01/2024 | 1330/0830 | ** |  | US | Treasury Quarterly Refunding |

| 31/01/2024 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 31/01/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 31/01/2024 | 1900/1400 | *** |  | US | FOMC Statement |

| 01/02/2024 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.