-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI ASIA OPEN: Fed Gov Waller Needs a Few Good Prints

- MNI INTERVIEW: Fed Likely To Wait And See On Scenarios - Bordo

- MNI FED: Waller Wants Several Good Inflation Prints Before Fed Cut

- MNI FED Survey: Household's Financial Security Still Strained

- MNI CANADA: April CPI Is Slowest In Three Years And Core Fades

- MNI FOMC Minutes Preview – May 2024

US

FED INTERVIEW (MNI): Fed Likely To Wait And See On Scenarios - Bordo: The Federal Reserve should regularly discuss alternate analyses of the economic outlook that allow for large changes to its baseline forecast, but it is likely that U.S. policymakers will wait to observe the experience of other central banks taking such an approach before deciding whether to follow suit, Rutgers University economist Michael Bordo told MNI.

- Former Fed Chair Ben Bernanke’s recommendation last month that the Bank of England expand its use of scenarios to quantify risks to its central forecast cited a 2020 paper by Bordo, Andrew Levin and Mickey Levy, members of the watchdog Shadow Open Market Committee, that urged the Fed to explaining its policy strategy at the height of the pandemic using different scenarios of vaccine success rather than focusing on a single benchmark projection.

- "We live in a stochastic world and there are always shocks, things you can’t predict. You can’t just assume what the world is going to be based on the models you follow. Scenario analysis, it seems to me, is a way of cross checking everything else you do," Bordo said in an interview.

FED (MNI): Waller Wants Several Good Inflation Prints Before Fed Cut: Recent U.S. economic data indicate high interest rates are helping to cool off demand and disinflation has likely resumed, but the Federal Reserve needs to see several more months of good inflation data before cutting rates, Governor Christopher Waller said Tuesday.

- That would be largely in line with market expectations for a first cut in either September or November, according to futures pricing. "The economy now seems to be evolving closer to what the committee expected," he said in remarks prepared for the Peterson Institute for International Economics in Washington.

FED SURVEY (MNI): Household's Financial Security Still Strained: Ongoing price increases continued to pressure U.S. households' sense of financial security at the end of 2023, the Federal Reserve reported Tuesday, with those doing at least okay financially still well below highs in 2021 and parents feelings particularly gloomy.

- In an annual survey showing the corrosive effects of inflation on Americans' economic confidence, the Fed said the percentage of respondents who said they were doing "at least okay financially" in 2023 were down a percentage point and still well below the recent high of 78% in 2021. Parents "at least doing okay financially" showed a sharp decline last year dropping 5 percentage points over the year to 64% and down 11 percentage points from 2021. That is the lowest in the data series going back to 2015.

NEWS

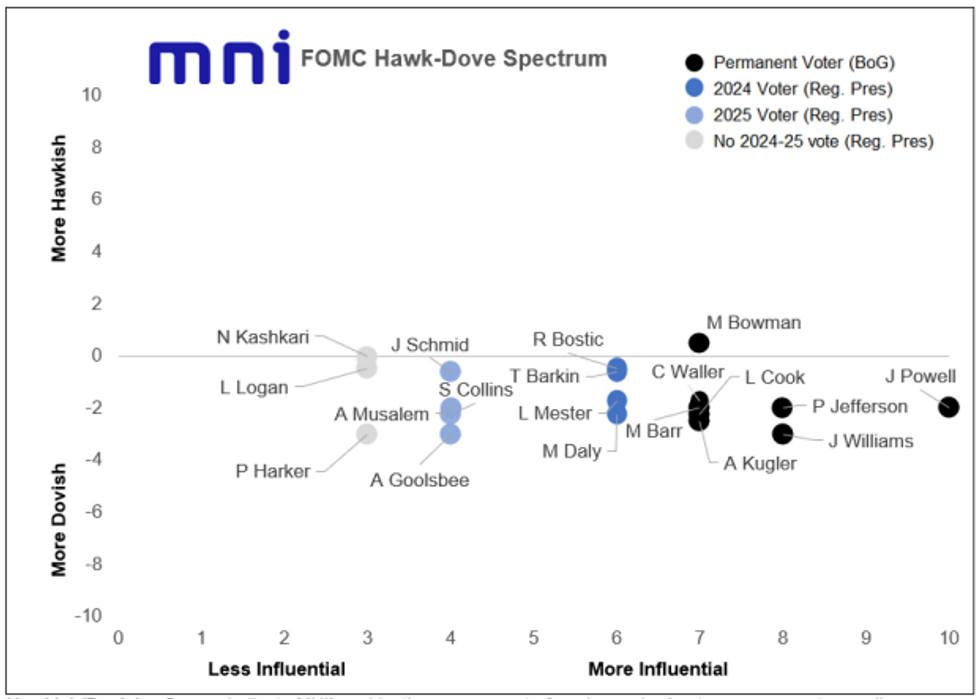

FOMC Minutes Preview – May 2024 (MNI): The minutes to the May FOMC meeting (Wednesday 1400ET/1900BST) could provide a bit more insight into how the Committee's view of the likely rate path has changed as participants sharpen their pencils for June's Dot Plot update. MNI's preview of the Minutes includes what to watch for upon release; our "Instant Answers" questions; MNI's FOMC Hawk-Dove Spectrum; and key highlights of FOMC participant commentary since the May meeting.

FED (MNI): Waller Probably Sees 2024 Cuts, But Needs "Several More...Good" CPI Prints: Today's speech by Fed Governor Waller - typically one of the best bellwethers of the current thinking of FOMC leadership - seem quite hawkish at first glance, with most attention on the headline of needing "several more" months of inflationary progress before making the first cut. But the speech is entitled "Little by Little, Progress Seems to be Resuming" which captures his thinking that inflation is still on-track to reach 2%, just a little later than previously thought.

ISRAEL (MNI): Qatari Spox Says Ceasefire-For-Hostage Deal Talks "Close To Stalemate": A spox for the Qatari Foreign Ministry has said that indirect talks between Israel and Hamas on a ceasefire-for-hostages deal remain "close to a stalemate".

IRAN (MNI): Presidential Election Confirmed For 28 June: The snap presidential election, which follows the death of incumbent Ebrahim Raisi in a helicopter crash, will take place on 28 June according to semi-official domestic news outlet Tasnim.

SECURITY (MNI): Lavrov Expects Continuity In Russia-Iran Relations: Wires carrying comments from Russian Foreign Minister Sergei Lavrov stating that he expects "continuity" in Russia-Iran relations following the death of Iranian President Ibrahim Raisi and Iranian Foreign Minister Hossein Amirabdollahian in a helicopter crash on Sunday.

Germany Warms to US Plan to Tap Russian Assets for Ukraine (BBG): In an about face, German officials are ready

to support a US plan to leverage the future revenue generated from frozen Russian assets — mostly stranded in Europe — to back $50 billion in aid to Ukraine, according to people familiar with the discussions.

US TSYS Focus Turns to May 1 FOMC Minutes

- Treasuries rebounded from Monday's losses Tuesday, taking the dovish side of two-way comments from Fed Gov Waller. Decent corporate debt issuance climbed over $12B, rate lock hedging helped constrain short cover/position squaring support.

- Recent U.S. economic data indicate high interest rates are helping to cool off demand and disinflation has likely resumed, but the Federal Reserve needs to see several more months of good inflation data before cutting rates, Governor Christopher Waller said Tuesday.

- Rate cut projections hold steady vs. late Monday: June 2024 at -5% w/ cumulative rate cut -1.2bp at 5.318%, July'24 at -20% w/ cumulative at -6.3bp at 5.267%, Sep'24 cumulative -19.9bp, Nov'24 cumulative -27.6bp, Dec'24 -43.7bp.

- Look ahead to Wednesday: May 1 FOMC Minutes, Existing Home Sales and US Tsy 20Y Bond Sale.

- The message from Chair Powell and other members since the May meeting has been a fairly emphatic "high for longer", with policy currently seen as restrictive but needing further time to work to bring inflation down.

OVERNIGHT DATA

MNI: US MAY PHILADELPHIA FED NONMFG INDEX -0.6

US REDBOOK: MAY STORE SALES +5.9% V YR AGO MO

US REDBOOK: STORE SALES +5.5% WK ENDED MAY 18 V YR AGO WK

CANADA DATA (MNI): Canada April CPI Is Slowest In Three Years And Core Fades: Canada's inflation rate was the slowest in three years in April and core measures moved back within the central bank's target band for the first time since the pandemic rebound, the kind of progress Governor Tiff Macklem has said may allow him to cut borrowing costs at the next meeting on June 5.

- Consumer price growth slowed to 2.7% in April from a year ago versus the March pace of 2.9%, in line with economist forecasts. The "trim" core index slowed to 2.9% from 3.2% and the "median" faded to 2.6% from 2.9%, and both measures were the lowest since June 2021. Statistics Canada said Tuesday from Ottawa that the "broad-based deceleration in the headline CPI was led by food prices, services and durable goods."

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 48.32 points (0.12%) at 39856.35

- S&P E-Mini Future up 7.25 points (0.14%) at 5339.5

- Nasdaq up 17.3 points (0.1%) at 16812.17

- US 10-Yr yield is down 3.1 bps at 4.412%

- US Jun 10-Yr futures are up 4.5/32 at 109-7.5

- EURUSD down 0.0002 (-0.02%) at 1.0855

- USDJPY down 0.1 (-0.06%) at 156.16

- WTI Crude Oil (front-month) down $0.54 (-0.68%) at $79.26

- Gold is down $1.5 (-0.06%) at $2423.96

- European bourses closing levels:

- EuroStoxx 50 down 27.35 points (-0.54%) at 5046.99

- FTSE 100 down 7.75 points (-0.09%) at 8416.45

- German DAX down 42.2 points (-0.22%) at 18726.76

- French CAC 40 down 54.51 points (-0.67%) at 8141.46

US TREASURY FUTURES CLOSE

- 3M10Y -2.568, -98.765 (L: -100.59 / H: -96.651)

- 2Y10Y -0.992, -41.868 (L: -42.615 / H: -39.374)

- 2Y30Y -1.204, -27.966 (L: -28.814 / H: -25.165)

- 5Y30Y +0.029, 11.512 (L: 10.422 / H: 12.474)

- Current futures levels:

- Jun 2-Yr futures up 0.625/32 at 101-22 (L: 101-20.625 / H: 101-22.75)

- Jun 5-Yr futures up 2.5/32 at 105-28.5 (L: 105-24.25 / H: 105-30.5)

- Jun 10-Yr futures up 4/32 at 109-7 (L: 108-31.5 / H: 109-10.5)

- Jun 30-Yr futures up 9/32 at 117-11 (L: 116-27 / H: 117-19)

- Jun Ultra futures up 14/32 at 124-10 (L: 123-17 / H: 124-20)

US 10Y FUTURE TECHS: (M4) Corrective Pullback

- RES 4: 110-16 50.0% retracement of the Feb 1 - Apr 25 bear leg

- RES 3: 110-06 High Apr 4

- RES 2: 110-00 Round number resistance

- RES 1: 109-31+ High May 16 and the bull trigger

- PRICE: 109-05+ @ 11:15 BST May 21

- SUP 1: 108-28/108-15 20-day EMA / Low May 14 and key support

- SUP 2: 108-06 Low May 3

- SUP 3: 107-25 Low May 2

- SUP 4: 107-04 Low Apr 25 and the bear trigger

Despite the latest pullback in Treasuries, the short-term trend condition remains bullish. The contract last week moved through resistance at the top of a bear channel, drawn from the Feb 1 high. Note that resistance at 109-09+, the May 3 high, has also been cleared. This reinforces the bullish importance of the channel break and signals scope for an extension higher. Sights are on 110-00 next. Initial key support is at 108-15, May 14 low.

SOFR FUTURES CLOSE

- Jun 24 -0.003 at 94.683

- Sep 24 +0.010 at 94.870

- Dec 24 +0.015 at 95.10

- Mar 25 +0.020 at 95.350

- Red Pack (Jun 25-Mar 26) +0.015 to +0.015

- Green Pack (Jun 26-Mar 27) +0.020 to +0.025

- Blue Pack (Jun 27-Mar 28) +0.025 to +0.030

- Gold Pack (Jun 28-Mar 29) +0.025 to +0.035

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00166 to 5.32225 (+0.00249/wk)

- 3M +0.00274 to 5.32946 (+0.00366/wk)

- 6M +0.00687 to 5.29466 (+0.01145/wk)

- 12M +0.01865 to 5.15806 (+0.03554/Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.866T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $717B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $707B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $75B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

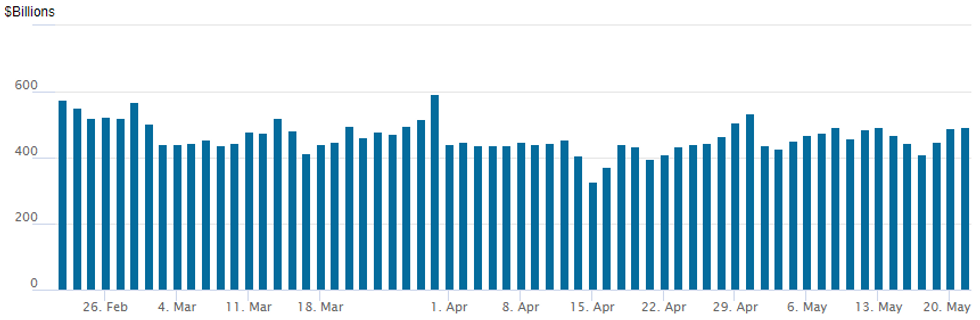

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches up to $491.720B from $489.728B prior; number of counterparties 81. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE Corporate Issuance Update, Over $12B Launched

$12.325B has launched so far today, still waiting on guidance for Tokyo Metropolitan, Korea Credit and Emirates Islamic Bank single tranches.

- Date $MM Issuer (Priced *, Launch #)

- 5/21 $2.5B Qatar 5Y +30, 10Y +40

- 5/21 $2.05B #BPCE $650M 5Y +85, %1.4B 11NC10 +153

- 5/21 $1.75B #Citigroup PerpNC5 7.125%

- 5/21 $1.5B #Schlumberger $500M each: 3Y +65, +5Y +80, 10Y +80

- 5/21 $1.2B #Coca-Cola $700M 5Y +85, $500M 10Y +105

- 5/21 $1.125B Community Health Sys 2023 Tap 10.875%

- 5/21 $600M #Uzbekistan 7Y 7.125% (plus E600M, UZS3000B)

- 5/21 $500M #Blackstone Private Credit 5Y +175

- 5/21 $600M #Verisk 10Y +105

- 5/21 $500M #Amcor Grp WNG 5Y +105

- 5/21 $500M Tokyo Metropolitan 5Y +64a

- 5/21 $Benchmark Korea Credit 3Y +110a

- 5/21 $Benchmark Emirates Islamic Bank 5Y Sukuk +130a

- Expected Wednesday

- 5/22 $1B EIB 5Y SOFR+32

EGBs-GILTS CASH CLOSE: Gilts Strengthen On Eve Of Key CPI Release

Gilts outperformed Bunds Tuesday, ahead of key UK data releases Wednesday.

- Morning developments were limited, focused mainly on corporate/sovereign supply (including a solid 20Y Gilt auction), with German PPI on the soft side and a pickup in Q1 Eurozone labour costs garnering some interest ahead of Thursday's negotiated wage print.

- Global core FI was buffeted by North American developments in the afternoon, strengthening on soft Canadian CPI, but pulling back as Fed Governor Waller said it would take "several more" constructive inflation prints before he would consider rate cuts.

- In the end, gains resumed with Bund and Gilt futures hitting fresh session highs into the cash close.

- The 5Y-10Y segment outperformed on both the German and UK curves, while EGB periphery spreads widened modestly on the day.

- Attention swiftly turns to UK CPI/PPI/fiscal data early Wednesday.

- Our CPI preview is here (PDF): the MNI Markets team sees two-way risks to the MNI-compiled sell-side median for services CPI (5.47%), with slightly more upside risks to the Bloomberg consensus (5.4%).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at 2.97%, 5-Yr is down 2.9bps at 2.544%, 10-Yr is down 3bps at 2.499%, and 30-Yr is down 2.4bps at 2.642%.

- UK: The 2-Yr yield is down 3.6bps at 4.31%, 5-Yr is down 3.6bps at 4.011%, 10-Yr is down 3.9bps at 4.13%, and 30-Yr is down 3.8bps at 4.611%.

- Italian BTP spread up 1.4bps at 129.8bps / Spanish up 1.2bps at 76.7bps

FOREX CAD Pressured Following Soft CPI, G10 FX Markets Subdued Overall

- A very brief hawkish reaction to Fed Governor Waller stating that several more positive CPI readings will be required to cut rates. However, with other elements of his speech in line and a more balanced Q&A, the greenback swiftly pared this initial advance, leaving the USD index close to unchanged in an overall subdued session for G10 currencies.

- The one bit of excitement was in Canada, where a softer CPI report has prompted rate cut speculation for June to build. USDCAD is 0.20% higher on the session at 1.3650 with an overall bullish trend condition remaining intact here despite the most recent pullback.

- We also noted that EURCAD has recently broken above a cluster of highs from the past six months around 1.4780 and hovers close to the most recent highs of 1.4822. Exponential moving averages are also in a bull mode position.

- Elsewhere, NZD also underperforms ahead of tomorrow’s RBNZ decision, where the central bank will also release updated staff forecasts and hold a press conference. It is unanimously expected to leave rates at 5.5% as it is yet to be confident that inflation will sustainably return to target.

- NZDUSD did also weaken on Monday following a Q2 RBNZ survey of inflation expectations showed households saw a slightly lower median expected inflation rate for the next two years. This may have prompted some profit taking, given the solid run of form for NZD which has been supported by the optimistic risk backdrop.

- The Norwegian Krone crept higher in early trade amid the quieter markets on Tuesday. USD/NOK has so far respected support at 10.6478/10.6537, and a recovery in Brent crude prices could pose downside risks for the pair.

- As well as the RBNZ, Wednesday’s calendar is highlighted by UK inflation data and the FOMC minutes of the May meeting.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/05/2024 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/05/2024 | 2300/1900 |  | US | Cleveland Fed President Loretta Mester | |

| 22/05/2024 | 2301/0001 | * |  | UK | Brightmine pay deals for whole economy |

| 22/05/2024 | 2350/0850 | ** |  | JP | Trade |

| 22/05/2024 | 2350/0850 | * |  | JP | Machinery orders |

| 22/05/2024 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 22/05/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 22/05/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 22/05/2024 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 22/05/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 22/05/2024 | 0805/1005 |  | EU | ECB's Lagarde at ESMA event on effectiveness of capital markets | |

| 22/05/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 22/05/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/05/2024 | 1245/1345 |  | UK | BOE's Breeden Panellist on macroprudential policies | |

| 22/05/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/05/2024 | 1400/1000 | * |  | US | Services Revenues |

| 22/05/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/05/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/05/2024 | 1800/1400 | *** |  | US | FOMC Minutes |

| 23/05/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.