-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Very Far Along Hiking Cycle

- MNI: Fed Holds Rates, Doesn't Close Door To More Hikes

- MNI ADP Misses But After Period Of Weak Correlation With Payrolls

- MNI September JOLTS Paints Very Similar Picture To August

- MNI US TSY Refunding Long-End Sizes/Guidance More Friendly Than Feared

- MNI ISM Mfg Sees Surprise Reversal Of Prior Recovery Off Early Summer Lows

US

FED: Federal Reserve officials left interest rates on hold at 22-year highs for a second meeting in a row Wednesday, but also did not rule the possibility to additional tightening later this year or next year if inflation proves more stubborn than expected.

- Fed policymakers have made clear the bar is increasingly high for more rate increases despite a raft of strong economic data, as they wait for the lagged effects of past hikes to create a greater drag on growth and inflation. Officials are also keenly watching tighter financial conditions resulting from sharply higher long-term bond yields, which some say reduce any need for further tightening.

- “Tighter financial and credit conditions for households and businesses are likely to weight on economic activity, hiring and inflation,” the FOMC said in its statement, which notably added the word “financial” as a nod to the recent spike in 10-year yields to their highest levels since 2007. For more see MNI Policy main wire at 1400ET.

US Tsy Yields Retreat After FOMC Leave Rates Steady

- Tsy futures near highs after the bell, Dec'23 10Y at 107-00.5 vs. 107-04 high(+30.5), 10Y yield -.1693 to 4.7614% after the FOMC left rates unchanged for the second consecutive time, stocks higher as well as market take away is the Fed is farther along the hiking path.

- While discussing whether every meeting is "live", Chairman Powell said "we are going meeting by meeting, asking ourselves whether we achieved a stance of policy sufficiently restrictive to bring inflation down 2% over time" - "we have come very far with this rate hiking cycle, very far."

- Projected rate hikes into early 2024 continue to step down: December cumulative of 4.8bp at 5.373%, January 2024 cumulative 7.3bp at 5.398%, while March 2024 starts pricing in a cut (20.3%) with cumulative at 2.6bp at 5.350%. Fed terminal has slipped to 5.385% in Feb'24.

- Projected rate hikes into early 2024 continue to step down: December cumulative of 4.8bp at 5.373%, January 2024 cumulative 7.3bp at 5.398%, while March 2024 starts pricing in a cut (20.3%) with cumulative at 2.6bp at 5.350%. Fed terminal has slipped to 5.385% in Feb'24.

- Busy first half saw Treasury futures turn higher after lower than expected ADP private jobs data (113k vs. 150k est, 89k prior). Futures bounced again after nominal Tsy refunding hikes ($112B vs. $114B estimate).

- Tsy futures surged higher yet again after weaker than expected ISM data: Mfg (46.7 vs. 49.0 est), Employ (46.8 vs. 50.6 est), New Orders (45.5 vs. 49.8 est) and Prices Paid (45.1 vs 45.0 est).

- Meanwhile, Construction Spending MoM (0.4% vs. 0.4% est, prior up-revised to 1.0 from 0.5%) while JOLTS Job Openings firmed (9.553M vs. 9.400M est, prior down-revised to 9.497M from 9.610M).

OVERNIGHT DATA

US DATA: The ISM mfg index came in notably weaker than expected in October at 46.7 (cons 49.0) after 49.0.

- It contradicts the near unchanged print in the S&P Global US PMI finalized just fifteen minutes prior, as well as implications of little change across both the average of the regional Fed indicators and the MNI Chicago PMI.

- New orders lead the way, falling to 45.5 (cons 49.8) after 49.2 for the lowest since May.

- Employment is also sharply lower than expected at 46.8 (cons 50.6) after 51.2 for its lowest since July. The latest level corroborates the S&P Global PMI equivalent seeing its first decline in manufacturing employment since May’20, although the ISM component has seen regular sub-50 readings since mid-2022.

- The only measure that is closer to expectations is priced paid, pushing up to 45.1 (cons 45.0) after 43.8.

- ISM manufacturing has underperformed services for some time now, with no sign of spillover into broader economic growth yet, although the surprise here is that it marks a renewed downturn in manufacturing after looking to have bottomed at 46.0 in June before three monthly increases to 49.0 in September.

US DATA: ADP employment was softer than expected in October as it increased 113k (cons 150k)

It’s not a large miss considering the weak correlation the data have with private payrolls (also expected at 148k for Friday’s release).

- Whilst it’s admittedly comparing the latest vintages of data (i.e. after the usual monthly revisions) with prior three releases haven’t provided a consistent estimate of private payrolls growth: ADP overshot by 167k in Jul, was exactly in line in Aug and then undershot by 171k in Sep.

- The press release notes “no single industry dominated hiring this month” with October’s numbers overall painting a “well-rounded jobs picture”.

US DATA: JOLTS job openings surprisingly pushed higher to 9.553m (cons 9.4m) in September after last month’s surprise jump to 9.61M was trimmed slightly to 9.497m.

- It meant the ratio of openings to unemployed increased fractionally to 1.50 from 1.49, having stalled at the 1.5 since June having been 1.8 as recently as April. Recall Chair Powell has seen something closer to 1:1 as indicative of labor market balance.

- No change in quits rates, still back at their 2019 averages as has been the case since July. Overall quits at 2.33 after 2.34% (2019av 2.33) and private quits at 2.59 after 2.58 (2019av 2.59).

US DATA: Manufacturing PMI Firms Cut Employment For First Time Since July 2020 The S&P Global US manufacturing PMI was unchanged from its preliminary estimate for October, at 50.0 for a minor increase from 49.8.

- The press release notes “A back-to-back expansion in output and a renewed rise in new orders supported the move away from declining sectoral health.”

- However, whilst it’s just for the manufacturing sector and not the much larger services sector, the press release points to a softening labor market. “That said, demand conditions were historically muted overall, with firms downwardly adjusting their output expectations for the year ahead and cutting employment for the first time since July 2020. The drop in staffing numbers also reflected dwindling backlogs of work and excess capacity.”

- The ISM equivalent at the top of the hour will likely carry more weight.

US DATA: Mortgage Applications Continue Decline With 30Y Marginally Off Latest Cycle Highs

MBA mortgage applications fell -2.1% last week after -1% the week prior, led by refis (-4%) with a lighter decline in purchase applications (-1%).

- The 30Y conforming mortgage rate inched 4bps lower but only to 7.86% after the prior week jumping 20bps to 7.90% for a fresh high since Sep 2000. The level of purchase applications continues to plumb new cycle lows, extending lows since early 1995.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 224.08 points (0.68%) at 33285.9

- S&P E-Mini Future up 46.25 points (1.1%) at 4260

- Nasdaq up 218.3 points (1.7%) at 13064.06

- US 10-Yr yield is down 17.1 bps at 4.7593%

- US Dec 10-Yr futures are up 27.5/32 at 107-1

- EURUSD down 0.0008 (-0.08%) at 1.0565

- USDJPY down 0.85 (-0.56%) at 150.83

- WTI Crude Oil (front-month) down $0.13 (-0.16%) at $80.95

- Gold is down $5.54 (-0.28%) at $1978.91

- European bourses closing levels:

- EuroStoxx 50 up 30.59 points (0.75%) at 4091.71

- FTSE 100 up 20.71 points (0.28%) at 7342.43

- German DAX up 112.93 points (0.76%) at 14923.27

- French CAC 40 up 46.98 points (0.68%) at 6932.63

US TSY Refunding Long-End Sizes/Guidance More Friendly Than Feared(1/2)

Today's quarterly refunding brought a more market-friendly announcement than expected/feared, both on long-end auction sizes and on Treasury's guidance that "Treasury anticipates that one additional quarter of increases to coupon auction sizes will likely be needed beyond the increases announced today" (some had expected increases through not just Feb but potentially the May refunding).

- The table below shows the actual announced coupon sizes vs MNI expectations (which were close to consensus), and TBAC recommendations. Overall it's about $9B in total nominal coupon size less than expected across the three months, offset somewhat by FRN and TIPS increase (not shown here, though those were broadly in line).

- Treasury's new issue sizes are close to TBAC's recommendations for this quarter - differences are: Treasury went $1B smaller on 10Y and 30Y for this quarter than TBAC's recommendations. See PDF.

- Tsy also boosted FRN reopenings $2B in each of for Nov and Dec whereas TBAC saw no change to those months; TIPS were upsized in line with TBAC's recommendations and weren't surprising (maintain November 10-year TIPS reopening auction size at $15B, increase December 5-year TIPS reopening auction size by $1B to $20B, and increase January 10-year TIPS new issue auction size by $1B to $18B).

- For the following quarter (Feb-Apr 24) TBAC recommends similar increases to those they recommended in this quarter (incl unch 20Y once again)

Bill Issuance Set To Slow; Buyback Announce Eyed For Next Qtr (2/2)

Bills and buybacks were also an area of focus for this announcement:

- On bill issuance: TBAC recommended net bill issuance for Q4 (Oct-Dec) of $437.45B (this is basically an imputed figure: $776B, the figure in Monday's borrowing requirement doc for Q4, minus $338.55B in net bond issuance). TBAC bills recommended for Q1 (Jan-Mar) is $467.60B, which added to $348.40B in net bond issuance = $816B marketable borrowing requirement.

- These bill estimates will be roughly line with Treasury's which as noted have announced slightly smaller 10s / 30s auctions than TBAC recommended for the upcoming quarters but larger FRNs (TIPS upsizing was in line).

- This is a of course a slowdown by comparison to the post-debt limit cash buildup which will have seen a staggering $1.5T in net bill issuance since early June.

- Treasury notes "By early-December, Treasury anticipates implementing modest reductions to short-dated bill auction sizes that will likely then be maintained through mid- to late-January." That's largely as expected.

- This still will mean bills as a % of marketable debt will remain well above the 20% upper TBAC-recommended threshold, though TBAC reiterated "continued comfort with the bill share of total marketable debt outstanding remaining temporarily above its recommended range given continued robust demand for bills and Treasury’s regular and predictable approach."

- In a minor surprise, 6-week bills weren't made a benchmark (Treasury is "actively evaluating" this), despite TBAC noting primary dealers' "near unanimous support for converting the 6-week cash management bill to a benchmark tenor." Treasury will continue to issue 6-week bills at least through March 2024.

- On buybacks: "Treasury intends to provide an update on the timing for implementing the regular buyback program in the next quarterly refunding announcement." We interpret this as a signal that it's likely on Jan 31 they'll be announcing the start of the program - as expected.

US TREASURY FUTURES CLOSE

- 3M10Y -16.698, -71.165 (L: -72.107 / H: -56.344)

- 2Y10Y -4.022, -20.102 (L: -24.836 / H: -14.88)

- 2Y30Y -1.812, -1.649 (L: -7.866 / H: 2.592)

- 5Y30Y +2.641, 26.415 (L: 19.362 / H: 29.17)

- Current futures levels:

- Dec 2-Yr futures up 6.75/32 at 101-13.5 (L: 101-05.75 / H: 101-15.25)

- Dec 5-Yr futures up 18.25/32 at 105-1.5 (L: 104-11 / H: 105-04.5)

- Dec 10-Yr futures up 27.5/32 at 107-1 (L: 105-27.5 / H: 107-04)

- Dec 30-Yr futures up 1-12/32 at 110-26 (L: 108-19 / H: 110-29)

- Dec Ultra futures up 1-12/32 at 113-30 (L: 111-06 / H: 114-01)

US 10Y FUTURE TECHS: (Z3) 20-day EMA Tested Ahead of the Fed

- RES 4: 109-20 High Sep 19

- RES 3: 108-03+/16 50-day EMA / High Oct 12 and key resistance

- RES 2: 107-22+ High Oct 16

- RES 1: 106-23+/27+ 20-day EMA / High Nov 1

- PRICE: 106-21+ @ 16:21 GMT Nov 1

- SUP 1: 105-10+ Low Oct 19 and the bear trigger

- SUP 2: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 103-31 2.0% 10-dma envelope

- SUP 4: 103-20+ Low Jun’07

Treasuries rallied through the London close, briefly showing above the 20-day EMA just ahead of the Fed decision. Nonetheless, the trend condition is unchanged and remains bearish. The recent breach of 106-03+, the Oct 4 low, confirmed a resumption of the downtrend and maintains the price sequence of lower lows and lower highs. This has opened 104-26, a Fibonacci projection. Key short-term trend resistance is at 108-16, the Oct 12 high.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 +0.030 at 94.590

- Mar 24 +0.070 at 94.695

- Jun 24 +0.115 at 94.940

- Sep 24 +0.145 at 95.230

- Red Pack (Dec 24-Sep 25) +0.150 to +0.160

- Green Pack (Dec 25-Sep 26) +0.135 to +0.140

- Blue Pack (Dec 26-Sep 27) +0.135 to +0.140

- Gold Pack (Dec 27-Sep 28) +0.135 to +0.140

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00312 to 5.32271 (-0.00141/wk)

- 3M +0.00915 to 5.39190 (+0.00869/wk)

- 6M +0.01094 to 5.45367 (+0.01304/wk)

- 12M +0.02628 to 5.39369 (+0.02074/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $86B

- Daily Overnight Bank Funding Rate: 5.32% volume: $201B

- Secured Overnight Financing Rate (SOFR): 5.35%, $1.582T

- Broad General Collateral Rate (BGCR): 5.30%, $585B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $567B

- (rate, volume levels reflect prior session)

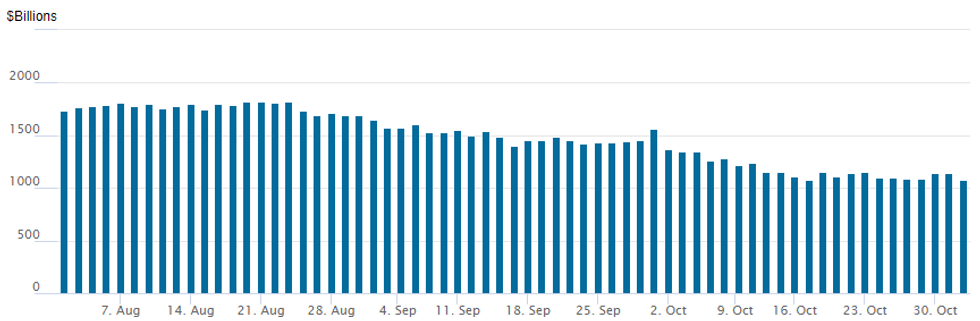

FED REVERSER REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage falls to the lowest level since mid-September 2021: $1,079.462B w/97 counterparties vs. $1,137.697B in the prior session. Latest usage compares to prior low of $1,082.399B on October 17. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE

No new corporate bond issuance Wednesday, issuers sidelined ahead of the FOMC policy announcement.

EGBs-GILTS CASH CLOSE: Afternoon Rally Ahead Of Fed, BoE

Bunds outperformed Gilts Wednesday as US developments set a bullish tone, helping reverse early weakness.

- In a quiet session for European data/speakers (a holiday was observed across much of the region), a combination of smaller-than-expected announced US supply at the Treasury's quarterly refunding and a weak ISM Manufacturing PMI print spurred afternoon gains in risk assets and core FI alike, led by a strong long-end UST rally.

- The UK curve twist flattened with 2Y yields higher ahead of Thursday's BoE decision (our preview went out this morning). Bunds outperformed in a German curve bull flattening move out to the 10Y segment.

- Periphery EGB spreads clawed back earlier losses in the afternoon, with 10Y BTP/Bund spreads tightening from wides above 200bp.

- The Federal Reserve decision and communications will be the focus this evening, and Thursday's European schedule is busy.

- The morning sees the Norges Bank decision, German labour market data, final Oct PMIs, and an appearance by ECB's Lane. We also get Spanish and French supply.

- Later, the BoE decision is set to be the main event: with a rate hold almost assured, MNI thinks the main driving factor is likely to be the vote breakdown, with <3 hawkish dissenters potentially seeing a small dovish reaction in markets.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.5bps at 2.991%, 5-Yr is down 3.9bps at 2.616%, 10-Yr is down 4.2bps at 2.764%, and 30-Yr is down 2bps at 3.074%.

- UK: The 2-Yr yield is up 1.7bps at 4.797%, 5-Yr is down 0.8bps at 4.458%, 10-Yr is down 1.3bps at 4.499%, and 30-Yr is down 1.5bps at 4.961%.

- Italian BTP spread up 4.3bps at 196.3bps / Spanish down 0.3bps at 107.4bps

FOREX Mixed Performance in G10 Amid Significantly Lower US Yields

- Despite the significantly lower yields in the US, the USD index trades close to unchanged as we approach the APAC crossover, with G10 currencies exhibiting mixed performance across Wednesday’s session.

- The key outperformer has been the Australian dollar with a number of factors working in favour of the AUD on Wednesday. Primarily, the outperformance of major equity indices has underpinned the Aussie’s resilience. Additionally, the break lower in EURAUD is also adding to the theme, there a multi-year uptrendline drawn off the 2022 low that is being tested in AUD’s favour today.

- While this could also be weighing on the broad single currency, it is worth noting that there were muted volumes across EUR given the European holidays, leaving EURJPY (-0.70%) pullback of the sharp Tuesday rally to lead the Euro’s decline.

- A brief EURUSD rally on treasury refunding headlines faded ahead of the Fed and with the FOMC changing very little and appearing to maintain its tightening bias, EURUSD made fresh lows for the week at 1.0517 in the aftermath of the Fed decision. However, the extension lower for US yields eventually filtered through into the greenback weakening which saw EURUSD rise back to 1.0565, but remains moderately lower on the day.

- The lower yields and higher equities benefitted some major EM currencies substantially, with the likes of USDMXN and USDBRL falling an impressive 1.35%.

- The action continues on Thursday with the Bank of England rate decision before focus turns to the US employment report on Friday.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/11/2023 | 0030/1130 | ** |  | AU | Trade Balance |

| 02/11/2023 | 0730/0830 | *** |  | CH | CPI |

| 02/11/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/11/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/11/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/11/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 02/11/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/11/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 02/11/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/11/2023 | 1100/1200 |  | EU | ECB's Lane lectures on EZ monetary policy | |

| 02/11/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/11/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/11/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 02/11/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/11/2023 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 02/11/2023 | 1230/1230 |  | UK | MPR Press Conference | |

| 02/11/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/11/2023 | 1400/1400 |  | UK | BOE DMP Survey | |

| 02/11/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 02/11/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/11/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/11/2023 | 1730/1830 |  | EU | ECB's Schnabel presentation at Fed St Louis | |

| 03/11/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.