MNI ASIA OPEN: NY Fed Williams Rates Well Positioned

EXECUTIVE SUMMARY

MNI FED: Williams Says Fed Rates Are Well-Positioned

MNI US DATA: Initial Jobless Claims Tick Higher, Continuing Roughly In Line

US

FED (MNI): Williams Says Fed Rates Are Well-Positioned: New York Fed President John Williams on Thursday said he expects inflation to moderate in the second half of this year and repeated the FOMC's promise in May that officials would not cut interest rates until they have gained greater confidence that inflation is moving sustainably toward 2%.

- "I see the current stance of monetary policy as being well positioned to continue the progress we’ve made toward achieving our objectives," said Williams in prepared remarks. "It goes without saying that the outlook is uncertain. The risks are two-sided, with geopolitical events and China’s growth outlook prominent examples."

- The New York Fed chief said inflation in the United States remains too high. "Overall, I see some of the recent inflation readings as representing mostly a reversal of the unusually low readings of the second half of last year, rather than a break in the overall downward direction of inflation."

NEWS

US-EU (MNI): Dep Treasury Sec Adeyemo To Target China In Tightening Of Russia Sanctions: US Deputy Treasury Secretary Wally Adeyemo will deliver major remarks in Germany tomorrow, "on further steps needed to tighten our sanctions on Russia as it transitions to a war economy." Adeyemo is expected to urge EU partners to hold China accountable for its trade relationship with Moscow.

ISRAEL (MNI): Gantz Puts Forward Bill To Dissolve Knesset, But Not Sufficient Votes: Isralei media is reporting that the centrist National Unity party of security cabinet member Benny Gantz has put forward a bill seeking to dissolve the Knesset and bring about snap elections.

Stoltenberg (MNI): Time Has Come To Reconsider Restrictions On UKR Weapons: NATO Secretary General Jens Stoltenberg, speaking at a NATO conference in Prague, has escalated a call for Ukraine's backers to authorize Ukraine to use western-supplied weapons to strike targets within the Russian Federation.

US TSYS Off Midweek Lows, Higher Weekly Claims Sets Stage for Friday PCE

- Treasuries finish higher Thursday, near highs after higher than expected weekly jobless claims triggered rebound off midweek lows.

- Treasury futures extend gains after weekly claims comes out a little higher than expected at 218k vs. 217k est (prior revised to 216k from 215k), continuing claims lower than expected at 1.791M vs. 1.796M est (prior down-revised to 1.797M from 1.794M). GDP in-line at 1.3% while Personal Consumption slips to 2.0% from 2.5% prior (2.2% est).

- Treasury futures holding near early session highs after weaker than expected Pending Home Sales: MoM -7.7% vs. -1.0 est (3.4% prior revised to 3.6%), YoY -0.8% vs. -2.0% est (-4.5% revised to -4.4%).

- Fed-speak leaned dovish as Atlanta Fed President Bostic (unscheduled) expects the pace of economic growth to slow, while a rate hike isn't necessary to reach 2Y goal.

- Sep'24 10Y trades 108-17 last (+15) vs. 108-19 high -- initial technical resistance at 108-19 (High May 29). Curves remain flatter, inside session range: 2s10s -1.202 at -37.498.

- Look ahead to Friday's data calendar: focus on PCE, Personal Income/Spending and MNI's Chicago PMI.

OVERNIGHT DATA

US DATA (MNI): Initial Jobless Claims Tick Higher, Continuing Roughly In Line: Initial jobless claims were slightly higher than expected with a seasonally adjusted 219k (cons 217k) in the week to May 25. Last week’s data were revised 1k higher to 216k.

- The four-week average increased 3k to 223k, now +13k over the last four weeks.

- In non-seasonally adjusted terms, the 196k figure appears in line with recent years.

- •ontinuing claims, for which this week’s data is a payrolls reference week, were below consensus at 1791k (cons 1796k). Last week’s data were revised to 1787k (from 1794k), so while the level of continuing claims was lower than expected, there was indeed a modest uptick from prior.

- The NSA data saw a -19k fall to 1668k but remains above 2023 levels for the week to May 25.

- Overall, initial claims continue to drift higher from the tight range seen in March, but do not signal any sharp deterioration in labour market conditions.

US DATA (MNI): Consumption Drives Downward Q1 GDP Revision: The second estimate of Q1 GDP was 1.3% Q/Q SAAR, in line with consensus and below the advance estimate of 1.6%.

- Final sales of domestic purchases contributed 2.59pp to the overall GDP print (vs 2.80pp in the advance reading). Fed officials regard this as a key indicator of underlying growth, so the softer print (alongside a slightly softer PCE deflator) represents a marginally dovish development.

- This reflected a -0.34pp downward revision to personal consumption (which rose 2.0% Q/Q SAAR vs 2.0% cons, 2.5% advance), offset slightly by a 0.11pp upward revision to fixed investment.

- The revisions to consumption are unsurprising following downward revisions to February and March retail sales.

- Inventories were revised 0.1pp lower, contributing -0.45pp to real GDP, while net exports saw a -0.03pp revision to contribute -0.89pp overall.

- Notably, Q4 GDI saw a -1.2pp downward revision to 3.6% Q/Q. Q1 GDI rose 1.5% Q/Q.

- The Q1 core PCE index registered an 8bp downward revision to 3.65% Q/Q, which may impact the monthly profile in tomorrow’s PCE release.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 315.75 points (-0.82%) at 38125.71

- S&P E-Mini Future down 23 points (-0.44%) at 5260.75

- Nasdaq down 132.1 points (-0.8%) at 16790.3

- US 10-Yr yield is down 5.8 bps at 4.554%

- US Jun 10-Yr futures are up 14.5/32 at 108-7

- EURUSD up 0.0034 (0.31%) at 1.0835

- USDJPY down 0.8 (-0.51%) at 156.84

- WTI Crude Oil (front-month) down $1.2 (-1.51%) at $78.04

- Gold is up $3.31 (0.14%) at $2341.41

- European bourses closing levels:

- EuroStoxx 50 up 18.98 points (0.38%) at 4982.18

- FTSE 100 up 47.98 points (0.59%) at 8231.05

- German DAX up 23.5 points (0.13%) at 18496.79

- French CAC 40 up 43.48 points (0.55%) at 7978.51

US TREASURY FUTURES CLOSE

- 3M10Y -5.431, -86.235 (L: -88.407 / H: -79.364)

- 2Y10Y -1.202, -37.498 (L: -38.5 / H: -35.521)

- 2Y30Y -0.172, -24.358 (L: -25.971 / H: -23.11)

- 5Y30Y +1.282, 11.121 (L: 9.285 / H: 11.907)

- Current futures levels:

- Jun 2-Yr futures up 2.375/32 at 101-14.125 (L: 101-11.5 / H: 101-14.62)

- Jun 5-Yr futures up 8.5/32 at 105-8 (L: 104-31 / H: 105-09.75)

- Jun 10-Yr futures up 14.5/32 at 108-7 (L: 107-23 / H: 108-09.5)

- Jun 30-Yr futures up 27/32 at 115-13 (L: 114-15 / H: 115-19)

- Jun Ultra futures up 1-05/32 at 121-17 (L: 120-09 / H: 121-25)

US 10Y FUTURE TECHS: (U4) Bear Cycle Extends

- RES 4: 109-28 High May 17

- RES 3: 109-14 50-day EMA

- RES 2: 109-00+ 20-day EMA

- RES 1: 108-19 High May 29/30

- PRICE: 108-17+ @ 1447 ET May 30

- SUP 1: 107-31 Low May 29

- SUP 2: 107-20+ Low May 29

- SUP 3: 107-12+ Low Apr 25 and the bear trigger

- SUP 4: 107-00 Round number support

Treasuries remain vulnerable and yesterday’s extension lower reinforces a bearish theme and marks an extension of the reversal from the May 16 high. The contract has pierced 108-02+, the 76.4% retracement of the Apr 25 - May 16 climb. A clear breach of this price point would open the key support at 107-12+, the Apr 25 low. Initial firm resistance is seen at 109-00+, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 +0.008 at 94.665

- Sep 24 +0.025 at 94.815

- Dec 24 +0.040 at 95.010

- Mar 25 +0.055 at 95.210

- Red Pack (Jun 25-Mar 26) +0.065 to +0.070

- Green Pack (Jun 26-Mar 27) +0.075 to +0.080

- Blue Pack (Jun 27-Mar 28) +0.070 to +0.075

- Gold Pack (Jun 28-Mar 29) +0.060 to +0.070

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00002 to 5.32918 (+0.00140/wk)

- 3M -0.00126 to 5.34608 (+0.00320/wk)

- 6M -0.00029 to 5.32565 (+0.00931/wk)

- 12M +0.01475 to 5.22801 (+0.02772/Wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.01), volume: $1.807T

- Broad General Collateral Rate (BGCR): 5.32% (+0.01), volume: $736B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.01), volume: $719B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $271B

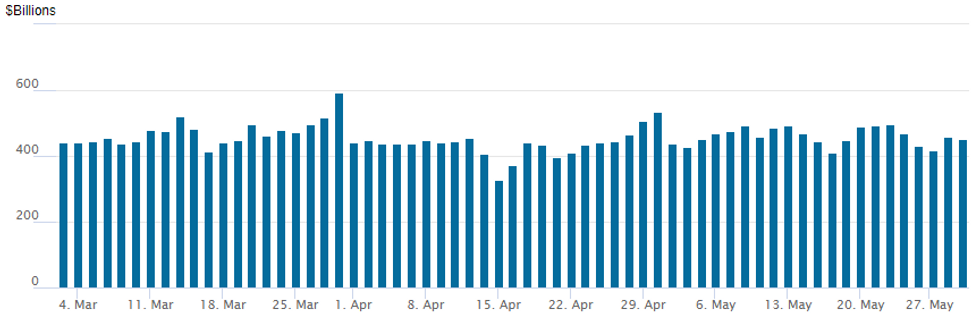

FED Reverse Repo Operation

- RRP usage recedes to $452.034B from $459.314B prior; number of counterparties 77. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $2B Bank of Montreal 3Pt US$ Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 5/30 $2B #Bank of Montreal $750M 3Y +63, $450M 3Y SOFR+76, $ 800M 7Y +95

- 5/30 $1.2B #Solvay Finance $600M 5Y +107, $600M 10Y +132

- 5/30 $750M #CNO Global Funding 3Y +115 (3Y SOFR dropped)

- 5/30 $600M #FS KKR Capital 5Y +255

- 5/30 $500M *Bank of Bahrain & Kuwait 5Y 6.875%

- 5/30 $500M *National Bank of Kuwait 6NC5 +130

FOREX Yield Reversal Prompts Greenback Weakness, CHF Maintains Outperformance

- Lower revisions to US core PCE price index data and softer personal consumption reinforced the partial retracement lower for US yields on Thursday, weighing on the USD index as we approach the key PCE deflator data tomorrow.

- Overnight comments from SNB Chair Jordan leave CHF as the G10 FX outperformer. Jordan identified a “small” upward risk to the SNB’s inflation forecast, while noting that there are reasons to believe that the natural rate of interest has increased somewhat or might rise over the coming years. As such USDCHF sits over 1% lower on the session, although the Swiss franc strength appears corrective at this juncture.

- EUR/CHF has broken below the 20-day EMA. The next support to watch lies at the 50-day EMA (0.9772). A clear break of this average would signal potential for a deeper retracement and expose the May 3 low (0.9730).

- USD/CHF is approaching support at the 50-day EMA (0.9055). A break here would expose short-term pivot support at the May 16 low (0.8988).

- With historical safe havens receiving support on Thursday, USDJPY has also tilted lower and has consolidated back below the 157.00 mark. Moves have concurred with rates markets fading somewhat after the sharp run higher in US yields since the beginning of the week.

- With that said, USDJPY remains just 0.65% off the Wednesday highs and the moves are deemed to be very much corrective at this juncture. As a reminder, Credit Agricole see equity market moves as suggesting month-end portfolio-rebalancing flows are likely to be moderate USD selling across the board, with the strongest sell signal in the case of USD/JPY.

- In emerging markets, heightened uncertainty around post-election coalition scenarios put pressure on the South African rand, comfortably the worst performer globally, down 1.35% against the dollar.

- Chinese PMIs highlight the APAC docket on Friday, alongside Tokyo CPI figures. Eurozone CPI figures will be the focus of the European session before US April PCE deflator and Canadian GDP round off the week’s calendar.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 31/05/2024 | 2330/0830 | * |  | JP | Labor Force Survey |

| 31/05/2024 | 2350/0850 | * |  | JP | Retail Sales (p) |

| 31/05/2024 | 2350/0850 | ** |  | JP | Industrial Production |

| 31/05/2024 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/05/2024 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/05/2024 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/05/2024 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 31/05/2024 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 31/05/2024 | 0630/0730 |  | UK | DMO to release FQ2 (Jul-Sep) gilt operations calendar | |

| 31/05/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2024 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2024 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2024 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2024 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2024 | 0800/1000 | *** |  | IT | GDP (f) |

| 31/05/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/05/2024 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/05/2024 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2024 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/05/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 31/05/2024 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/05/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 31/05/2024 | 2215/1815 |  | US | Atlanta Fed's Raphael Bostic |