-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Rates Extend Highs on Strong 10Y Sale

EXECUTIVE SUMMARY

- MNI: Fed Must Do More, Tighten Financial Conditions-Waller

- MNI: Cook Says Soft Landing Is Possible, Fed Not Done Hiking

- MNI INTERVIEW: US Recession To Be Shallow, Can Be Avoided -S&P

- MNI INTERVIEW: BOC Has Strong Case to Cut This Year-Ex Adviser

- MNI: EU Officials Doubt Gentiloni's Fiscal Rules "Consensus"

US

FED: Federal Reserve Governor Chris Waller said Wednesday the central bank has "farther to go" and he is preparing for a longer fight to bring inflation down to its 2%, and part of that process will be to tighten financial conditions.

- "Our intention is to tighten financial conditions, including raising the cost of credit, to dampen demand and spending to further reduce inflation," he said. "Some believe that inflation will come down quite quickly this year. That would be a welcome outcome. But I’m not seeing signals of this quick decline in the economic data, and I am prepared for a longer fight to get inflation down to our target."

- The big picture, he said, is that the U.S. economy is adjusting well so far to the higher interest rates that are necessary to rein in inflation. "But inflation remains quite elevated, and so more needs to be done." For more see MNI Policy main wire at 1345ET.

FED: Federal Reserve Governor Lisa Cook said Wednesday a soft landing in which inflation comes down and unemployment stays low remains possible, but the central bank is not done raising rates.

- "I believe this can be accomplished, both sides of the dual mandate, without a large increase in unemployment," she said. The "labor market is historically strong by many measures, such as job openings, claims for unemployment insurance and what we call job quits."

- But "inflation is still elevated. Yes, it has moderated and we consider that a very positive development but still it is running too high."

- "Going forward, as we further tighten monetary policy, it is appropriate to move in smaller steps while we assess the effects of our cumulative tightening in the economy and inflation," she said. "We are not done yet with raising interest rates, and we will need to keep interest rates sufficiently restrictive to bring inflation back to our target over time." For more see MNI Policy main wire at 1035ET.

- “We still have a shallow recession in our forecast, although it looks like it could be shallower than what we had earlier thought and it was a pretty shallow recession to begin with,” she said in an interview. “There is the chance, the upside would be that there could be a very low growth environment for this year, still painful, but nowhere near the last two recessions the United States went through.”

- U.S. recession worries have receded as the job market continues to show unexpected strength because of the unusually tight conditions of post-Covid employment. Federal Reserve officials’ hopes for a soft landing have hinged in part on the idea that Fed tightening could reduce the number of job openings without delivering a major hit to employment. For more see MNI Policy main wire at 1109ET.

CANADA

BOC: The Bank of Canada will have a strong case to reverse course and cut interest rates later this year as inflation slows and indebted consumers feel the growing weight of the fastest tightening cycle in decades, former special adviser Andrew Spence told MNI.

- While Governor Tiff Macklem signaled a pause after the quarter-point increase on Jan. 25 and said he could hike again if needed, Spence said downside inflation risk is more relevant. Monetary policy looks tight following 425bps of hikes and the Bank's view inflation will slow to 3% this year and 2% in 2024 is more certain with the worst shocks from Covid and the Ukraine war fading, Spence said.

- “If they hold interest rates where they are that means real interest rates, inflation-adjusted interest rates, are going up while the lagged effect of their tightening is coming through. That is a pretty compelling for an ease later this year,” Spence said by phone Monday. For more see MNI Policy main wire at 0742ET.

EUROPE

EU: European Union officials are doubtful that the “broad consensus” over reform of the bloc’s fiscal rules will be reached by March in line with a call by Economy Commissioner Paolo Gentiloni, several told MNI.

- While the Swedish presidency is putting a high priority on talks over the Stability and Growth Pact debt rules, more political impetus will be required to shift opposition, officials said, with progress needed at the Feb 9-10 leaders summit. While the European Central Bank has tried to encourage reform, it also remains an open question as to how much sway it now has over finance ministers compared with the 2010-11 debt crisis.

- “There are still clear and major differences between countries,” one source said following a recent round of talks.

- In recent days, ECB President Christine Lagarde and Bank of France President Francois Villeroy have called for rapid agreement on the long-delayed dossier of EU economic governance reform in order to pre-empt concerns over financial market stability as interest rates continue to rise and the central bank starts the potentially fraught process of winding down its near EUR8-trillion balance sheet.

Tsys Hold Range After Strong 10Y Sale

Tsys trading firmer -- near middle session range by the bell. Tsys scaled off highs after strong $35B 10Y Tsy note auction stopped 2.9bp through w/ 3.613% high yield (3.642%WI going into the auction cutoff). Yield curves flatter, but still off Mon's 40 year inverted lows (2s10s currently -1.022 at -80.528 vs. -84.734 late Monday).

- Tsys and EGBs traded weaker in the first half amid ongoing central bank telegraphing further (and larger if necessary) rate hikes needed to tamp down inflation.

- NY Fed Pres Williams economic outlook at WSJ live event cited a "lot of uncertainty around inflation" specifically services sector prices that may necessitate more hikes, adding "peak rate of 5-5.25% .. still a reasonable view."

- Earlier ECB commentary highlighted by MNI's event with Klaas Knot who said a 50bp hike was possible in May (as well as March) pending inflation developments. Kazaks called for "significantly" restrictive rates while de Guindos wouldn't rule out further hikes past March.

- Fed funds implied hike for Mar'23 at 26.1bp (+.7), May'23 cumulative 44.9bp to 5.031%, Jun'23 55.5bp (+1.2) to 5.137%, terminal at 5.145% in Aug'23.

- Tsy futures rally after strong $35B 10Y note auction (91282CGM7) stops through w/ 3.613% high yield vs. 3.642% WI; 2.66x bid-to-cover vs. 2.53x prior. Indirect take-up surges to new high of 79.45% vs. 67.02% prior; direct bidder take-up 15.19% from 17.92% prior; new low primary dealer take-up 5.36% vs. 15.06%.

OVERNIGHT DATA

US DEC WHOLESALE INV 0.1%; SALES 0%

MARKETS SNAPSHOT

Key late session market levels:

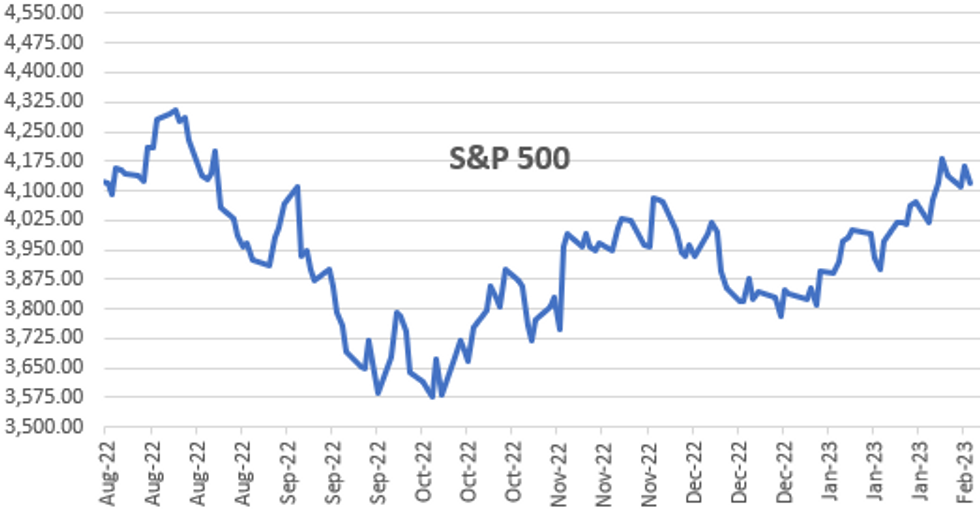

- DJIA down 200.7 points (-0.59%) at 33955.37

- S&P E-Mini Future down 46.75 points (-1.12%) at 4128.5

- Nasdaq down 205.3 points (-1.7%) at 11908.88

- US 10-Yr yield is down 2.8 bps at 3.6453%

- US Mar 10-Yr futures are up 6.5/32 at 113-14

- EURUSD down 0.0012 (-0.11%) at 1.0714

- USDJPY up 0.35 (0.27%) at 131.42

- WTI Crude Oil (front-month) up $1.26 (1.63%) at $78.39

- Gold is up $1.97 (0.11%) at $1875.09

- EuroStoxx 50 down 0.16 points (0%) at 4209.15

- FTSE 100 up 20.46 points (0.26%) at 7885.17

- German DAX up 91.17 points (0.6%) at 15412.05

- French CAC 40 down 12.52 points (-0.18%) at 7119.83

US TSY FUTURES CLOSE

- 3M10Y -5.877, -108.125 (L: -110.172 / H: -102.841)

- 2Y10Y -1.397, -80.903 (L: -82.401 / H: -77.34)

- 2Y30Y +0.164, -75.402 (L: -76.618 / H: -71.901)

- 5Y30Y +0.651, -11.778 (L: -12.584 / H: -8.678)

- Current futures levels:

- Mar 2-Yr futures up 0.75/32 at 102-11.375 (L: 102-09.625 / H: 102-13.875)

- Mar 5-Yr futures up 3.5/32 at 108-12 (L: 108-08 / H: 108-17.25)

- Mar 10-Yr futures up 6.5/32 at 113-14 (L: 113-06 / H: 113-20)

- Mar 30-Yr futures up 2/32 at 128-15 (L: 127-28 / H: 128-26)

- Mar Ultra futures down 5/32 at 140-19 (L: 139-18 / H: 141-05)

US 10YR FUTURE TECHS: (H3) Bear Cycle Still In Play

- RES 4: 116-00 High Feb 2

- RES 3: 115-22+ High Feb 3

- RES 2: 114-14 20-day EMA

- RES 1: 114-03 50-day EMA

- PRICE: 113-10 @ 16:20 GMT Feb 8

- SUP 1: 113-05+ Feb 7 Low

- SUP 2: 112-29 76.4% retracement of the Dec 30 - Jan 19 bull run

- SUP 3: 112-18+ Low Jan 5

- SUP 4: 112-11+ Trendline support drawn from the Oct 21 low

A sharp pullback in Treasury futures last Friday and the continuation lower this week, highlights a bearish cycle and signals scope for an extension of the move down. The contract has breached 114-05+, the Jan 30 low and a short-term bear trigger. Note that price has also breached the 50-day EMA. This opens 112-29 next - a Fibonacci retracement. Initial firm resistance is seen at 114-14, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.005 at 94.945

- Jun 23 +0.010 at 94.680

- Sep 23 +0.010 at 94.685

- Dec 23 +0.010 at 94.990

- Red Pack (Mar 24-Dec 24) +0.010 to +0.035

- Green Pack (Mar 25-Dec 25) +0.025 to +0.030

- Blue Pack (Mar 26-Dec 26) +0.025 to +0.030

- Gold Pack (Mar 27-Dec 27) +0.020 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00185 to 4.55514% (+0.00243/wk)

- 1M -0.00571 to 4.57500% (+0.00314/wk)

- 3M +0.01429 to 4.85929% (+0.02515/wk)*/**

- 6M +0.01600 to 5.15100% (+0.09357/wk)

- 12M +0.02829 to 5.46829% (+0.21715/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.85929% on 2/8/23

- Daily Effective Fed Funds Rate: 4.58% volume: $103B

- Daily Overnight Bank Funding Rate: 4.57% volume: $271B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.208T

- Broad General Collateral Rate (BGCR): 4.52%, $474B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $461B

- (rate, volume levels reflect prior session)

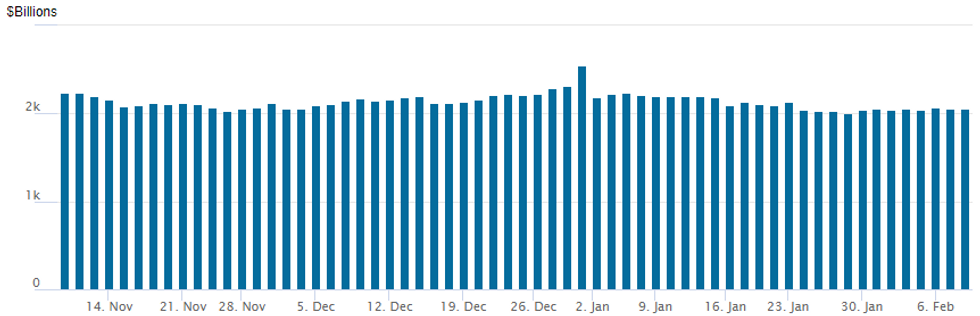

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,059.604B w/ 103 counterparties vs. prior session's $2,057.958B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: American Airlines 5NC2 After the Close

- Date $MM Issuer (Priced *, Launch #)

- 02/08 $2B *Korea Development Bank (KDB) ($1B) 5Y +60, $1B 10Y +80

- 02/08 $1.25B #Waste Management $1.75B 7Y +90, $500M 10Y +100

- 02/08 $1B *IDB Invest 5Y SOFR+59

- 02/08 $500M #Synovus Bank 5Y +185

- 02/08 $750M American Airlines 5NC2 7.25%

- 02/08 $Benchmark Westpac NZ 5Y investor calls

- Reverse Yankee issuance:

- 02/08 *GM Financial EU750M 6Y +140, GBP400M 3.5y +195

- May issue Thursday

- 02/09 $Benchmark AFD (French Development Agency) 3Y SOFR+44

EGBs-GILTS CASH CLOSE: Terminal ECB Pricing Ticks Higher On Knot

European curves steepened Wednesday with Gilts outperforming Bunds.

- Fair bit of ECB commentary today, highlighted by MNI's event with Klaas Knot who said a 50bp hike was possible in May (as well as March) pending inflation developments. Kazaks called for "significantly" restrictive rates while de Guindos wouldn't rule out further hikes past March.

- ECB cumulative hike pricing picked up about 3bp following the release of Knot's prepared text, though that faded; ECB and BoE terminal rates are now seen about 1bp higher than they began the day.

- Eurozone swap spreads continued to tighten following yesterday's ECB sovereign deposit renumeration announcement.

- Limited data out today, with more attention on the delayed German CPI readings out Thursday: see MNI's analysis here (1), here (2), and here (3)).

- Thu morning also sees the Riksbank decision and comments from BoE's Bailey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.8bps at 2.717%, 5-Yr is down 0.6bps at 2.368%, 10-Yr is up 1.4bps at 2.363%, and 30-Yr is up 1.9bps at 2.334%.

- UK: The 2-Yr yield is down 4.4bps at 3.468%, 5-Yr is down 3.2bps at 3.185%, 10-Yr is down 0.4bps at 3.313%, and 30-Yr is up 1.8bps at 3.769%.

- Italian BTP spread down 1.3bps at 186.7bps / Spanish up 0.6bps at 94.1bps

FOREX: Mixed G10 Performance As Markets Pause For Breath

- Following the volatile price action in the aftermath of Chair Powell’s remarks late Tuesday, currency markets traded in more subdued fashion today, remaining close to the prior day’s close approaching the APAC crossover.

- A slew of Fed speakers prompted no market reactions and as such, the USD index sits just moderately lower on the session.

- Underperforming is AUD, falling 0.4%, which is largely a reversal of the post-RBA optimism which underpinned the firmer price action on Tuesday.

- Outperforming at the margin are GBP and CHF. For GBPUSD, today’s extension of the bounce stresses the importance of the 200-dma as support, which has successfully contained the most recent slip lower. The level crosses at 1.1948.

- In emerging markets, the was divergent flows across CEEMEA, with USDZAR (+1.14%) printing fresh two-month highs ahead of President Cyril Ramaphosa’s State of the Nation Address on Thursday. Conversely, the Hungarian Forint outperformed, rising 1.2% and cementing the bearish technical trend for EURHUF that is currently in place.

- Tomorrow there will be a lot of focus on the German prelim CPI print for January (due at 0700 GMT). This will likely garner market interest because it has direct implications for the Eurozone aggregate print, which was released last week with a Eurostat estimate for Germany. Additionally, the BOE Governor and MPC members will testify in front of Parliament’s Treasury Committee.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2023 | 0700/0800 | *** |  | DE | HICP (p) |

| 09/02/2023 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 09/02/2023 | 0945/0945 |  | UK | BOE Bailey, Pill, Tenreyro & Haskel at Treasury Select Committee Hearing | |

| 09/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/02/2023 | 1800/1900 |  | EU | ECB de Guindos Speech at Foro Economia y Humanismo | |

| 09/02/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/02/2023 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.