-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Taper Talk Underpins Short End Tsys

- MNI US FED: Fed Sticks To Three Cuts This Year, Hold Rates

- MNIFED BRIEF: Fed's Powell Says Road To Price Stability Bumpy

- MNI BRIEF: Fed's Powell-Appropriate To Taper QT 'Fairly Soon'

- Business Inflation Expectations Broadly Unchanged – Atlanta Fed

US

US FED (MNI): Fed Sticks To Three Cuts This Year, Hold Rates: Federal Reserve officials said Wednesday they need more confidence inflation will keep falling before cutting interest rates, which they expect to do three times this year, as they unanimously left borrowing costs on hold at 23-year highs for a fifth meeting in a row.

- Policymakers see the federal funds rate ending 2024 at 4.6% on median, unchanged from the December projection, and core PCE inflation closing the year at 2.6%, up from 2.4%.

- The Fed revised up its expectations for the fed funds rate in 2025 and 2026, and pushed up its view of the long-run funds rate seen as a proxy for the natural rate or r-star to 2.6% from 2.5%.

- "The committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%," the FOMC said in its policy statement.

NEWS

FED BRIEF (MNI): Fed's Powell Says Road To Price Stability Bumpy: Federal Reserve Chair Jerome Powell said Wednesday the last two months of stalling disinflation have not added greatly to policymakers confidence that inflation is coming down sustainably, but nor has it altered the expectation that price pressures will keep abating.

FED BRIEF (MNI): Fed's Powell-Appropriate To Taper QT 'Fairly Soon': Federal Reserve officials generally believe the time is coming to start reducing the pace of balance sheet shrinkage or quantitative tightening, Fed Chair Jerome Powell said Wednesday in opening remarks to his post-meeting press conference. "While we did not make any decisions today on this, the general sense of the committee is that it will be appropriate to slow the pace of run-off fairly soon," he said.

US (MNI): Biden To Announce USD$20b Intel Investment In Swing State Arizona: President Joe Biden will announce a USD$20 billion of package of grants and loans to chipmaker Intel for semiconductor manufacturing in Arizona. The funds, which will be allocated from the CHIPS and Science Act pot, will be a major boost for Biden who has touted an investment boom in states like Arizona ahead of the presidential election in November.

US (MNI): United Steelworkers Endorse Biden: The Untied Steelworkers have issued a statement formally endorsing US President Joe Biden's re-election bid - a significant win for the White House which has aggressive pursued the union vote.

IRELAND (MNI): New PM Could Be In Place By 9 April; Science Min Harris Early Favourite: Following the announcement by Taoiseach (PM) Leo Varadkar that he intends to resign his office and as leader of the centre-right Fine Gael party, attention will now inevitably turn to who will succeed him.

ISRAEL (MNI): Hamas Official-Israeli Response To Our Ceasefire Proposal Was Negative: Speaking in Beirut, senior Hamas official Osama Hamdan has said that the Israeli response to the group's ceasefire proposal was 'negative.'

INDONESIA (MNI): Prabowo Confirmed As Next President: As had widely been expected, Defence Minister Prabowo Subianto has been confirmed as the winner of the February presidential election, and will succeed the outgoing incumbent Joko 'Jokowi' Widodo in October.

US TSYS: Tsy Curves Steepen on Fed Projections

- Treasury futures look to finish the session mostly higher/off highs after the Fed held rates steady while projecting three rate cuts by the end of 2024. After the bell, TYM4 trades 110-12.5 (+8) vs. 110-22 high - just off technical resistance at 110-24 (20-day EMA).

- Treasury futures had reversed course and extended session lows in 10s-30s briefly after Chairman Powell discussed the FOMC decision and policy projections. Jun'24 10Y tapped 110-01.5 (-3) low while curves held steeps (2s10s marked -33.119 high).

- Tsys rebounded (as did stocks) as Chairman Powell said the Fed had "discussed issues related to slowing the pace of decline in our securities holdings. While we did not make any decisions today on this, the general sense of the committee is that it will be appropriate to slow the pace of run-off fairly soon."

- Look ahead: focus turns to Thursday's Wkly Claims, S&P Global US PMIs, Home Sales. Fed VC Barr fireside chat "View from the Fed", Q&A at 1200ET.

OVERNIGHT DATA

US DATA (MNI): Business Inflation Expectations Broadly Unchanged – Atlanta Fed: The Atlanta Fed’s Business Inflation Expectations (BIE) survey saw the monthly survey of expected change in unit costs over the next year increase a tenth to 2.39%.

- It has lifted off the recent low of 2.23% in Jan for the highest since Nov’23, and whilst it remains low by post-pandemic standards, it’s to close the gap to the 2019 average of 1.94%.

- The quarterly survey of 5-10Y expectations meanwhile was unchanged at 2.8%.

- It has largely plateaued at this level since 2H23 having returned to the 2.8% averaged through 2012-19.

US DATA (MNI): A Small Dip For Mortgage Applications As Rates Bounce Back To 7%: MBA composite mortgage applications fell a seasonally adjusted -1.6% last week, with purchases -1.2% and refis -2.5%.

- The 30Y conforming mortgage rate increased 13bps to 6.97%, bouncing off the 6.84% that had marked a return close to the ~6.80% averaged between mid-Dec to early Feb before three weeks a little above 7%.

- This bump higher again in mortgage rates could weigh on near-term mortgage activity.

- Mortgage applications have lifted off recent lows but remain less than 50% of pre-pandemic levels.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 401.37 points (1.03%) at 39512.13

- S&P E-Mini Future up 53 points (1.01%) at 5295

- Nasdaq up 202.6 points (1.3%) at 16369.41

- US 10-Yr yield is down 1.4 bps at 4.2787%

- US Jun 10-Yr futures are up 7/32 at 110-11.5

- EURUSD up 0.0055 (0.51%) at 1.0921

- USDJPY up 0.49 (0.32%) at 151.35

- WTI Crude Oil (front-month) down $1.79 (-2.14%) at $81.68

- Gold is up $26.63 (1.23%) at $2184.26

- European bourses closing levels:

- EuroStoxx 50 down 7.61 points (-0.15%) at 5000.31

- FTSE 100 down 0.92 points (-0.01%) at 7737.38

- German DAX up 27.64 points (0.15%) at 18015.13

- French CAC 40 down 39.64 points (-0.48%) at 8161.41

US TREASURY FUTURES CLOSE

- 3M10Y -1.039, -112.011 (L: -117.925 / H: -108.632)

- 2Y10Y +5.634, -33.844 (L: -41.058 / H: -33.119)

- 2Y30Y +8.571, -16.01 (L: -27.886 / H: -14.478)

- 5Y30Y +5.808, 20.051 (L: 11.152 / H: 21.624)

- Current futures levels:

- Jun 2-Yr futures up 4.875/32 at 102-10.625 (L: 102-05.875 / H: 102-11.75)

- Jun 5-Yr futures up 7/32 at 106-27.75 (L: 106-20.25 / H: 107-01)

- Jun 10-Yr futures up 6.5/32 at 110-11 (L: 110-01.5 / H: 110-22)

- Jun 30-Yr futures up 2/32 at 118-25 (L: 118-04 / H: 119-21)

- Jun Ultra futures down 12/32 at 126-9 (L: 125-16 / H: 127-20)

US 10Y FUTURE TECHS: (M4) Gains Considered Corrective

- RES 4: 112-04+ High Mar 8 and bull trigger

- RES 3: 111-24 High Mar 12

- RES 2: 111-02 50-day EMA

- RES 1: 110-24 20-day EMA

- PRICE: 110-11+ @ 10:11 GMT Mar 20

- SUP 1: 109-24+ Low Mar 18

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

Treasuries maintain a softer tone following last week’s sell-off and the latest recovery is considered corrective. The contract traded lower Monday, reinforcing a bearish theme and this resulted in a print below 109-25+, the Feb 23 low and bear trigger. A clear break of this support would confirm a resumption of the downtrend that started late December and open 109-14+, the Nov 28 low. Initial firm resistance to watch is 111-02, the 50-day EMA.

SOFR FUTURES CLOSE

- Jun 24 +0.050 at 94.905

- Sep 24 +0.090 at 95.210

- Dec 24 +0.10 at 95.510

- Mar 25 +0.090 at 95.765

- Red Pack (Jun 25-Mar 26) +0.045 to +0.080

- Green Pack (Jun 26-Mar 27) +0.020 to +0.040

- Blue Pack (Jun 27-Mar 28) -0.005 to +0.015

- Gold Pack (Jun 28-Mar 29) -0.02 to -0.005

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00018 to 5.32882 (+0.00007/wk)

- 3M -0.00448 to 5.33300 (-0.00399/wk)

- 6M -0.00797 to 5.27160 (-0.00354/wk)

- 12M -0.01726 to 5.07960 (+0.00101/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.813T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $698B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $669B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $89B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $253B

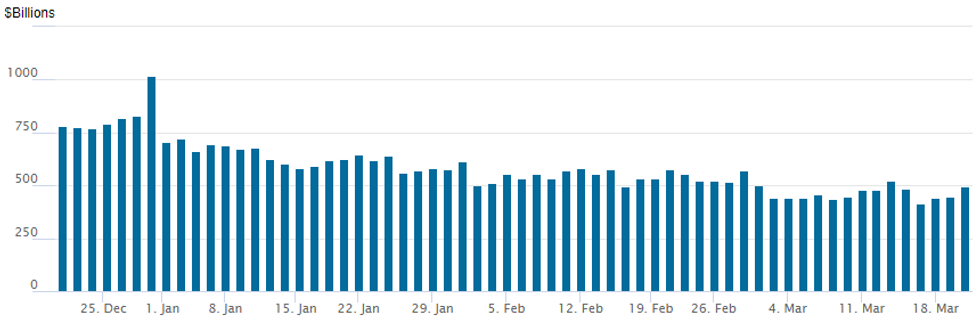

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage bounces back up to $496.245B from $446.978B on Tuesday, potentially driven by influx of GSE flows. Slight delay, Wrightson had expected a $60B increase on Monday but only $27B materialized before $6B gain on Tuesday. Last Friday saw usage fall to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties climbs to 78 vs. 70 yesterday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE: US$ Issuance Pause Ahead FOMC

Corporate debt issuers sidelined ahead of this afternoon's FOMC policy announcement; $17.9B priced Tuesday, $24.8B running total for the week.

- Date $MM Issuer (Priced *, Launch #)

- 3/19 $6B *United Health $500M 3Y +37, $400M 5Y +52, $1B 7Y +70, $1.25B 10Y +80, $1.75B 30Y +95, $1.1B 40Y +107

- 3/19 $4.8B BAE $800M 3Y +68, $1.25B 5Y +90, $500M 7Y +98, $1.5B 10Y +108, $750M 30Y +118

- 3/19 $2.5B *Campbell Soup $400M 2Y +65, $500M 3Y +75, $600M 5Y +90, $1B 10Y +115

- 3/19 $1B *Macquarie Airfinance $500M 5Y +210, $500M 7Y +223

- 3/19 $1B *Anheuser-Busch InBev10.25Y +75

- 3/19 $1B *Fairfax Financial 30Y +192

- 3/19 $1B *Athene 30Y +185

- 3/19 $600M *CNH Ind Capital 5Y +98

- $6.9B Priced Monday

EGBs-GILTS CASH CLOSE: Gilts Outperform On CPI Progress Ahead Of BoE

Gilts outperformed Bunds Wednesday, with soft UK and German inflation data a key theme ahead of the Fed and Bank of England decisions.

- UK inflation data came in slightly lower than expected. As we note in our UK Inflation Insight publication (here), given how close the print was to the Bank of England's forecast, MNI's Markets Team doesn't think there is a significant impact on tomorrow's MPC meeting.

- Nonetheless it spurred a jump in Gilts at the open which only slowly faded through the session, helping buoy the broader space. The UK curve leaned bull flatter on the day.

- While below-expected German PPI helped an early Bund bid, the German curve twist flattened Wednesday, with short-end rates broadly unchanged amid ECB speakers bringing little new on near-term policy (Lagarde, Lane and Schnabel).

- Periphery spreads widened again in a continued reversal of the sizeable compression seen earlier in the year, with BTPs underperforming.

- The Federal Reserve decision is the focus overnight, with a busy Thursday that includes the Bank of England (MNI's preview here, noting that the MPC vote split and guidance will be in focus) and flash March PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at 2.925%, 5-Yr is down 0.7bps at 2.446%, 10-Yr is down 1.8bps at 2.432%, and 30-Yr is down 2.2bps at 2.589%.

- UK: The 2-Yr yield is down 2.6bps at 4.234%, 5-Yr is down 3.9bps at 3.915%, 10-Yr is down 4.1bps at 4.016%, and 30-Yr is down 3.4bps at 4.479%.

- Italian BTP spread up 2.7bps at 128.1bps / Spanish up 1.5bps at 81.5bps

FOREX Greenback Weakens As May/June Fed Cut Not Categorically Ruled Out

- Dovish interpretations of the March FOMC press conference have weighed on the greenback late Wednesday, with the USD index reversing roughly 0.7% lower from intra-day highs, sitting down 0.3% on the session as we approach the APAC crossover.

- The focus has been on the Japanese Yen, following the earlier price action in USDJPY narrowing the gap substantially to the multi-decade inflection point at 151.91-95. The key resistance level has held, for now, and the ensuing reversal saw USDJPY briefly print fresh session lows at 150.73 before paring some of these losses back above 151.00. Initial firm support remains much lower at 149.06, the 20-day EMA, while overall, technical bulls remain in the driver’s seat.

- Regarding intra-day adjustments, US equities reaching fresh all-time highs have underpinned the Australian dollar, the standout performer on Wednesday. AUDUSD trades 0.80% in the green and clearance of resistance at 0.6668, the Mar 8 high, is required to resume the recent bull cycle and open 0.6708, a Fibonacci retracement.

- Half a percent gains for the likes of EUR, GBP, NZD and CAD show moderate outperformance to the DXY’s adjustment, with equities strength providing the key tailwind. This has also filtered through to strength in EM currencies, with ZAR, BRL and MXN all outperforming.

- GBPUSD will be in focus Thursday, as the BOE decision is due. Key resistance for the pair is at 1.2894, a break of which would resume the uptrend.

- Australia employment kicks off the data docket Thursday before flash PMIs from the Eurozone. The SNB will also decide on rates. Jobless claims, Philly Fed manufacturing and Flash PMIs highlight the US data docket.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2024 | 0030/1130 | *** |  | AU | Labor Force Survey |

| 21/03/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 21/03/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/03/2024 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/03/2024 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 21/03/2024 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 21/03/2024 | 0830/0930 | *** |  | CH | SNB PolicyRate |

| 21/03/2024 | 0830/0930 | *** |  | CH | SNB Interest Rate Decision |

| 21/03/2024 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 21/03/2024 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 21/03/2024 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 21/03/2024 | 0900/1000 | ** |  | EU | Current Account |

| 21/03/2024 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 21/03/2024 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 21/03/2024 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 21/03/2024 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 21/03/2024 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 21/03/2024 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 21/03/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 21/03/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 21/03/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 21/03/2024 | 1200/1200 |  | UK | BOE's Agents' summary of business conditions | |

| 21/03/2024 | 1200/1200 |  | UK | BOE's MPS and minutes | |

| 21/03/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 21/03/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/03/2024 | 1230/0830 | * |  | US | Current Account Balance |

| 21/03/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/03/2024 | 1335/0935 |  | CA | BOC Deputy Gravelle speech on balance-sheet normalization. | |

| 21/03/2024 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/03/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/03/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 21/03/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/03/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/03/2024 | 1600/1200 |  | US | Fed Vice Chair Michael Barr | |

| 21/03/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/03/2024 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 22/03/2024 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.