-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: U.S. Tsys Back to Early Dec'23 Levels

- MNI INTERVIEW: Hot US Economy Complicates Fed Cut Calculus

- MNI: Philly Fed Forecasters Lower Inflation, Jobless Estimates

- MNI CANADA: Canada Unemployment Posts First Fall In A Year, Wages Hot

- MNI US DATA: Latest Three-Month Trends Across Major Core CPI Items

- MNI US DATA: Very Small Recent SA Revisions to Core CPI

US

INTERVIEW (MNI): Hot US Economy Complicates Fed Cut Calculus

A U.S. economy that continues to defy expectations complicates Federal Reserve calculations on when to begin easing monetary policy, not only due to upside risks for inflation but because it also opens up alternative explanations for why inflation has fallen so quickly, Alan Detmeister, who previously headed the wages and prices section at the Fed Board of Governors, told MNI.

NEWS

US (MNI): Philly Fed Forecasters Lower Inflation, Jobless Estimates

Analysts expect a stronger U.S. labor market amid less inflation than they did three months ago and see little slowing in the economy, a Federal Reserve Bank of Philadelphia survey released Friday showed.

CANADA (MNI): Canada Unemployment Posts First Fall In A Year, Wages Hot

Canada's unemployment rate fell for the first time in a year in January on faster-than-expected job creation while wage gains held above the 5% pace the central bank says is slowing the way back to price stability.

US (MNI): Larry Hogan To Run For Open Maryland Senate Seat

Politico reporting that former Maryland Governor Larry Hogan will run for the open Senate seat of outgoing three-term Democrat Senator Ben Cardin (D-MD).

LATAM (MNI): WSJ, Venezeula Deploys Military To Guyana Border As Tensions Escalate

The Wall St Journal is reporting that Venezuela has moved military hardware including "light tanks, missile-equipped patrol boats and armored carriers" to its border with Guyana as a row over a disputed, oil-rich province escalates.

SECURITY (MNI): Axios: Israel Not Shutting Door On Hostage Deal

Axios reporting that although Israel told Egyptian and Qatari mediators late Thursday that it, "rejects most of Hamas' demands in its response to the latest hostage deal proposal, it is ready to launch negotiations based on the original proposal put forth two weeks ago."

US TSYS Back at Dec FOMC Lvls, Minimal Changes to Latest Core CPI Trends

- Treasury futures are looking modestly weaker after the bell, near session lows after futures quickly reversed post-CPI revision support this morning. Curves are flatter with Bonds outperforming, Mar'24 10Y futures -4 at 110-20 vs. 110-16 low - a level not seen since prior to the December 13 FOMC.

- After a brief delay delay, Treasury futures gapped higher (TYH4 tapped 111-01 briefly) after BLS released recalculated seasonally adjusted indexes and adjustment factors for Jan'19-Dec'23. Levels just as quickly reversed as markets digested the 5 years of revisions: very minimal changes to latest trends in core CPI % M/M SA readings.

- Dec’23 0.28% vs 0.31% prior, offset by small upward revisions in Oct and Nov. Largest uplifts back in July and April, largest downward revisions in May and March – all old history now. The Core CPI 3-month annualized rate near enough unrevised: 3.34% vs 3.33% prior. 6-month rate at 3.25% annualized vs 3.21% prior.

- Atlanta Fed's Bostic (’24 voter) local radio interview: still seeing a ways to go on inflation. The remarks are broadly in line with his last main appearance from Jan 19 when he said he wants to make sure we’re well on the way to 2% inflation before cutting.

- Look ahead: Monday data calendar includes NY Fed Inflation Expectations, and more Fed commentary from Fed Gov Bowman, Richmond Fed Barkin MN Fed Kashkar and MN Fed Kashkari.

OVERNIGHT DATA

US BLS ANNUAL REVISIONS: DEC CORE CPI INDEX REVISED TO 313.209 FROM 313.216

US BLS: NOV CORE CPI INDEX REVISED TO 312.349 FROM 312.251

US BLS: OCT CORE CPI INDEX REVISED TO 311.390 FROM 311.365

US BLS: SEPT CORE CPI INDEX REVISED TO 310.644 FROM 310.661

US DATA (MNI): Latest Three-Month Trends Across Major Core CPI Items. Comparing latest 3-month annualized CPI inflation rates vs trends prior to today's revisions.

- Core services: 4.8% vs 5.1% ar

- Of which supercore: 4.0% vs 4.3% ar

- Of which OER + primary rents: 5.4% vs 5.7% ar

- Core goods: -1.2% vs -1.6% ar

- As shown in the charts below, there were smaller changes in the 6-month equivalents.

US DATA: As newswire headlines suggest, very minimal changes to latest trends in core CPI % M/M SA readings.

- Dec’23 0.28% vs 0.31% prior, offset by small upward revisions in Oct and Nov.

- Largest uplifts back in July and April, largest downward revisions in May and March – all old history now [see table below].

- The Core CPI 3-month annualized rate near enough unrevised: 3.34% vs 3.33% prior.

- 6-month rate at 3.25% annualized vs 3.21% prior.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 61.16 points (-0.16%) at 38664.15

- S&P E-Mini Future up 23.5 points (0.47%) at 5040.75

- Nasdaq up 186.3 points (1.2%) at 15979.91

- US 10-Yr yield is up 2.9 bps at 4.1832%

- US Mar 10-Yr futures are down 5/32 at 110-19

- EURUSD up 0.0003 (0.03%) at 1.0781

- USDJPY up 0.01 (0.01%) at 149.33

- WTI Crude Oil (front-month) up $0.38 (0.5%) at $76.59

- Gold is down $10.14 (-0.5%) at $2024.38

- European bourses closing levels:

- EuroStoxx 50 up 5.09 points (0.11%) at 4715.87

- FTSE 100 down 22.9 points (-0.3%) at 7572.58

- German DAX down 37.33 points (-0.22%) at 16926.5

- French CAC 40 down 18.11 points (-0.24%) at 7647.52

US TREASURY FUTURES CLOSE

- 3M10Y +2.891, -120.728 (L: -127.425 / H: -119.689)

- 2Y10Y +0.326, -30.091 (L: -31.646 / H: -29.381)

- 2Y30Y +0.346, -10.329 (L: -12.325 / H: -8.778)

- 5Y30Y +0.103, 23.351 (L: 21.477 / H: 25.101)

- Current futures levels:

- Mar 2-Yr futures down 2.125/32 at 102-9.375 (L: 102-08.625 / H: 102-13.375)

- Mar 5-Yr futures down 4.25/32 at 107-5 (L: 107-03 / H: 107-14.25)

- Mar 10-Yr futures down 5/32 at 110-19 (L: 110-16 / H: 111-01)

- Mar 30-Yr futures down 2/32 at 119-20 (L: 119-15 / H: 120-14)

- Mar Ultra futures down 2/32 at 125-25 (L: 125-21 / H: 126-28)

US 10Y FUTURE TECHS: (H4) HAS TRADED THROUGH KEY SUPPORT

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-16/113-06+ 20-day EMA / High Feb 1

- PRICE: 110-19 @ 1450 ET Feb 9

- SUP 1: 110-16 Low Dec 13 and intraday low

- SUP 2: 109-31+ Low Dec 11

- SUP 3: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

- SUP 4: 109-05+ Low Nov 28

A bear threat in Treasuries remains present and the contract is trading lower today. The bear trigger at 110-26, the Jan 19 low, has been breached. A clear break would highlight a stronger reversal and open 110-16, the Dec 13 low (tested), ahead of 109-31+, Dec 11 low. Initial key resistance has been defined at 113-06+, Feb 1 high, where a breach would reinstate a bullish theme. First resistance is 111-16, the 20-day EMA

SOFR FUTURES CLOSE

- Mar 24 -0.005 at 94.775

- Jun 24 -0.025 at 95.120

- Sep 24 -0.040 at 95.485

- Dec 24 -0.045 at 95.820

- Red Pack (Mar 25-Dec 25) -0.045 to -0.04

- Green Pack (Mar 26-Dec 26) -0.04 to -0.03

- Blue Pack (Mar 27-Dec 27) -0.025 to -0.02

- Gold Pack (Mar 28-Dec 28) -0.02 to -0.01

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00272 to 5.32072 (-0.00139/wk)

- 3M +0.00770 to 5.30905 (+0.01859/wk)

- 6M +0.01633 to 5.18866 (+0.09256/wk)

- 12M +0.03395 to 4.88025 (+0.18745/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.669T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $679B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $669B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $271B

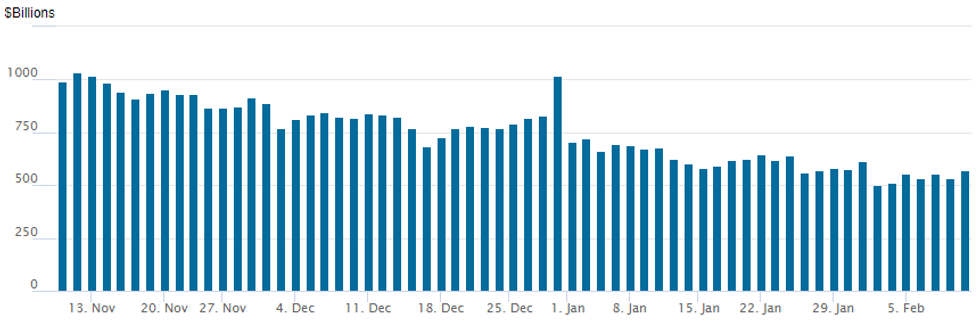

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage climbs to $569.175B vs. $535.705B Thursday. Holding above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 80 from 78 Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE: $4.75B Philip Morris 4Pt Debt Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 2/9 $4.75B #Philip Morris $750M 3Y +70, $1B 5Y +95, $1.25B 7Y +120, $1.75B 10Y +135

- 2/9 $1.75B #Ardonagh $750M 7NC3 7.75%, $1B 8NC3 8.875%

EGBs-GILTS CASH CLOSE: 10Y Yields Close At 2-Month Highs

Bunds and Gilts weakened for a 3rd consecutive session and 5th in 6 on Friday, as rate cuts continued to get priced out.

- With little important data/speaker flow in early trade, core FI continued to drift lower, with hawkishness from some late Thursday speakers still reverberating (BoE's Mann, ECB's Holzmann).

- The only release of note was the seasonal revisions of US CPI, which contrary to many expectations for an upward revision, portrayed largely unchanged inflation at end-2023. That saw Treasuries rally, pushing Bunds and Gilts to session highs, but the move fully reversed.

- The German and UK curves bear flattened as ECB and BoE cut prospects faded further in keeping with the recent theme: 114bp of ECB cuts are priced for 2024, 4bp fewer on the day and ~15bp on the week. BoE 2024 implied cuts pulled back by ~6bp to 76bp, around 21bp on the week.

- 10Y Bund yields posted their highest closing yield since November 30; Gilts since Dec 4. Periphery spreads were little changed.

- Ratings reviews for Germany (Moody's), Finland (Fitch), and Italy (Scope) come after Friday's close.

- Attention next week will be on UK data, with labour market figures (Tues) and CPI (Weds) featuring.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.6bps at 2.716%, 5-Yr is up 5.2bps at 2.336%, 10-Yr is up 2.8bps at 2.382%, and 30-Yr is unchanged at 2.569%.

- UK: The 2-Yr yield is up 4.9bps at 4.602%, 5-Yr is up 4.8bps at 4.1%, 10-Yr is up 3.5bps at 4.086%, and 30-Yr is up 0.4bps at 4.613%.

- Italian BTP spread up 0.7bps at 158.4bps / Greek down 0.5bps at 114.7bps

FOREX NZD Remains Best Performer Friday, USDJPY Weekly Close Above 149.00

- After an early extension of post-NFP strength, which saw the USD index climb to its best level since mid-November, the greenback has retraced back to broadly flat on the week as we approach the close. Higher US yields continue to support the dollar, however, the continued rally for major equity indices is providing some resistance to the advance.

- NZD is Friday's best performing currency, pushing NZDUSD (+0.85%) to a one-week high, trading above 0.6150 and topping resistance at the 0.6125 20-day EMA. Moves follow ANZ's view change that it sees 25bps hikes for the RBNZ across the February and April meetings this year. 0.6174 provides the initial resistance for the pair.

- The risk-on tone across markets has also leant support to the Australian dollar on Friday, rising 0.5% on the session. With a bearish theme intact, key short-term resistance to watch is unchanged at 0.6625, the Jan 30 high.

- USDJPY continues to benefit from the higher US yields and the continued dovish rhetoric from the central bank this week. The pair looks set to close above 149.00 for the first time this year, with the pair narrowing the gap to the 150.00 handle, levels not seen since mid-November. Given the constructive technical tone, this opens a move to 149.75, the Nov 22 high and then 150.78, the Nov 17 high.

- US CPI headlines the docket next Tuesday, landing after the significant trimming of Fed rate cut expectations post-NFP and the subsequent FOMC rhetoric calling for patience with cuts. Core CPI is expected at 0.3% M/M in Jan and today’s revisions shouldn’t have materially swayed these estimates. There will be holidays in China and Japan next week.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2024 | 0900/1000 |  | EU | The ECB Podcast on future euro banknotes | |

| 12/02/2024 | 0945/1045 |  | EU | ECB's Lane at conference on statistics post pandemic | |

| 12/02/2024 | 1315/1415 |  | EU | ECB's Lane participates in 'post-pandemic' roundtable | |

| 12/02/2024 | 1420/0920 |  | US | Fed Governor Michelle Bowman | |

| 12/02/2024 | 1550/1650 |  | EU | ECB's Cipollone participates in panel on Euro@25 | |

| 12/02/2024 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/02/2024 | 1800/1800 |  | UK | BOE's Bailey lecture at Loughborough University | |

| 12/02/2024 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.