-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Dollar/Yields Stabilize Somewhat, Powell In Focus Later

- Fighting has resumed in parts of Gaza, with the Israel/Hamas truce not being extended further. The market impact has been limited so far. Oil prices have ticked higher, but remain well below Thursday highs.

- Elsewhere, China and Hong Kong equities remain volatile, struggling for upside momentum. Little support was seen earlier after a manufacturing PMI beat. This has supported some USD/Asia pairs. USD/KRW has rallied firmly, despite better trade and PMI data. The South Korea and Taiwan PMI improvements suggest some modest upside for global trade growth going forward (see below for more details).

- The USD was weaker against the majors earlier, but has recovered off lows, in line with steadying US yields.

- Looking ahead, we have various final PMI prints in the EU/UK, while some ECB speak is due as well. Later in the US, the ISM prints, along with remarks from Fed Chair Powell (ahead of the Fed blackout period).

MARKETS

US TSYS: Subdued Asia-Pac Dealings Ahead Of Fed Chair Powell’s Fireside Chat

TYH4 is trading at 109-30, +0-04+ from NY closing levels, after dealing in a relatively narrow range in today’s Asia-Pac session.

- The session has been subdued with newsflow light. Accordingly, local participants have been content to sit on the sidelines ahead of Fed Chair Powell’s fireside chat later today. The FOMC media blackout begins Friday at midnight ET.

- Today’s US calendar also sees the release of the ISM Manufacturing Index. Chicago PMI strength and other manufacturing surveys point to some upside risk.

- Cash tsys are dealing flat to 1bp cheaper in the Asia-Pac session, with a slight steepening bias apparent, after yesterday’s month-end selling.

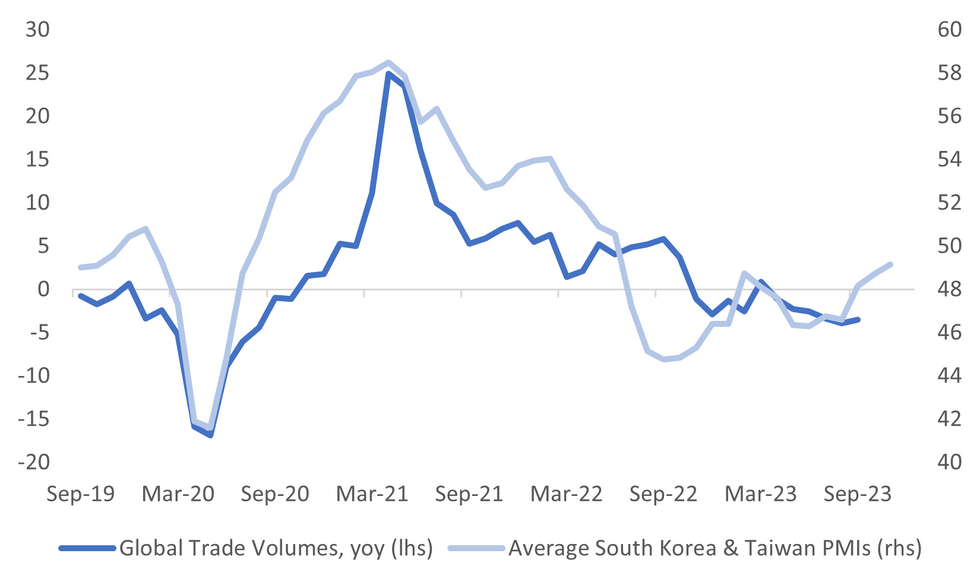

ASIA: South Korea & Taiwan PMIs Hint At Some Improvement In Global Trade

A slightly firmer PMI backdrop for South Korea and Taiwan points to some improvement in the global trade backdrop, all else equal. The chart below plots the average PMI readings for South Korea and Taiwan, overlaid against global trade volumes growth in y/y terms.

- The average PMI reading is now 49.15, aiding by the South Korea move back to 50 in Nov, while the Taiwan PMI rose back to near March highs from earlier this year.

- This fits with the earlier South Korea export beat for Nov, while Taiwan has also show some improving external demand signs, albeit with y/y growth still negative.

- The detail showed firmer new orders for South Korea, to the highest levels since July 2022. Output rose to 49.9 from 48.3 prior (BBG).

- For Taiwan, new orders fell versus the prior month, while output rose to 47 from 46.5.

- Other Asia PMIs were mostly higher, in Nov, albeit with only Indonesia and the Philippines above the 50 expansion/contraction point.

Fig 1: Average South Korea, Taiwan PMI Versus Global Trade Volumes Y/Y

Source: MNI - Market News/CPB/Bloomberg

JGBS: Futures At Session Lows, Sharp Reversal Off Yesterday’s High, Tokyo CPI Next Week

JGB futures are weaker and near Tokyo session lows, -28 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined labour market and IP data.

- At 146.18, today’s price action looks technically driven after JGB futures reversed off the 200-day moving average (continuation contract) at yesterday’s high of 147.16. According to MNI’s technicals team, 143.44, the Oct 31 low, marks key support should 144.93 give way.

- Cash tsys are dealing flat to 1bp cheaper in the Asia-Pac session after yesterday’s month-end selling. The session has been subdued for US tsys with newsflow light. Accordingly, local participants have been content to sit on the sidelines ahead of Fed Chair Powell’s fireside chat later today.

- The cash JGBs are generally cheaper, led by the belly, with yields 1.3bp lower (2-year) to 4.5bps higher (10-year). The benchmark 10-year yield is 0.716% versus yesterday’s low of 0.638%.

- Swap rates are higher along the curve. Swap spreads are wider apart from the 7- to 30-year zone.

- Next week, the local calendar sees Monetary Base data on Monday, ahead of Tokyo CPI and Jibun Bank Japan Composite & Services PMI data on Tuesday.

- Monday sees BOJ Rinban operations covering 1- to 25-year+ JGBs.

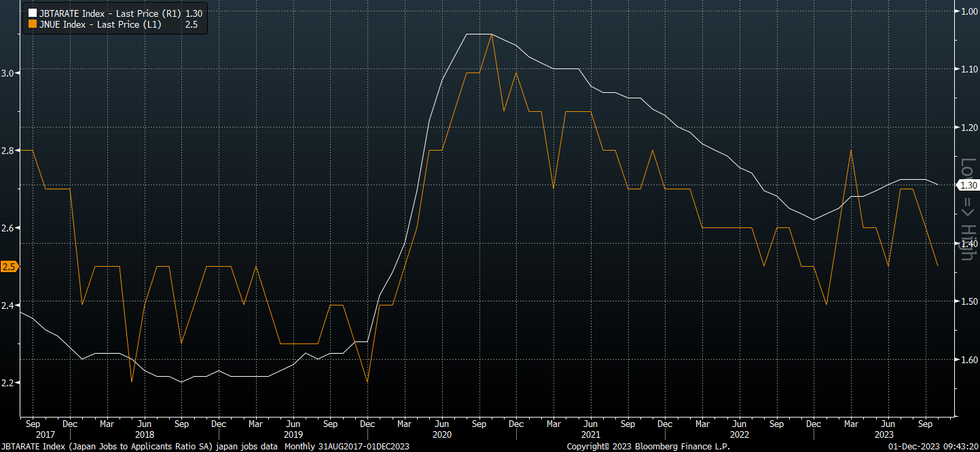

JAPAN DATA: Unemployment Rate Ticks Down, But Detail Not As Firm

Japan's Oct jobless rate ticked down to 2.5%, versus a 2.6% forecast and 2.6% prior outcome. We are still above earlier 2023 lows at 2.4%, but comfortably off highs of 2.8% (seen in March). The job to applicant ratio ticked up to 1.30 from 1.29 prior (1.29 was also the market consensus).

- The detail on the unemployment rate doesn't look as strong, with the number of employed persons dropping 70k in the month, while the participation rate fell to 63.1% from 63.3%. The number of unemployed fell by 20k in the month.

- For the job-to-applicant ratio, this is the first rise since late last year. The chart below overlays this index against the unemployment rate. The new job to applicant ratio also ticked higher to 2.24 from 2.22.

- The authorities will be hoping this is the start of firmer labor market trends, ahead of key wage negotiations early next year.

- Coming up soon is the Q3 Capex/company profits data.

Fig 1: Japan Jobless Rate Versus Job-To-Applicant Ratio (Inverted

Source: MNI - Market News/Bloomberg

JAPAN DATA: Q3 Capex Rise May Aid GDP Revisions, Profits Better Than Expected

Japan Q3 capital spending was right on consensus estimates at 3.4%y/y, but slowed versus Q2's 4.5% pace. Q3 was the softest pace since the start of 2022 in y/y terms. Ex software spending was below expectations, +1.7% y/y (+3.4% forecast and 4.4% prior). Momentum is now back to 2021 levels.

- Still, in q/q terms capex rose 1.4%, up 0.3% ex software. This contrasts with the initial Q3 business investment figures (in the GDP print), which showed a -0.6% dip. Note we get GDP revisions on the 8th of Dec (next Friday).

- Manufacturing investment was -0.4% q/q, while non-manufacturing rose 2.4%.

- Company profits were much stronger than forecast, rising 20.1% y/y, versus+13.8% forecast (11.6% prior). Company sales were at 5.0% y/y for Q3 (4.5% forecast and 5.8% prior).

- We were up 0.8% q/q (after Q2's +10.0%). Manufacturing rose 4.9%.

- Again, the authorities will be hopeful that the bumper profit backdrop allows companies to raise wages more, a key domestic political/BoJ focus point.

AUSSIE BONDS: Cheaper, Subdued Session Ahead Of Fed Chair’s Chat, RBA Decision On Tuesday

ACGBs (YM -5.0 & XM -7.0) are cheaper and at or near Sydney session lows. The session has been subdued with the domestic data drop failing to provide a market-moving event. Local participants have been content to sit on the sidelines ahead of Fed Chair Powell’s fireside chat later today. The FOMC media blackout begins Friday at midnight ET. The US calendar also sees the release of the ISM manufacturing index.

- Cash ACGBs are 6-8bps cheaper, with the AU-US 10-year yield differential 7bps wider at +16bps.

- Swap rates are 5bps higher, with EFPs around 2bps tighter.

- The bills strip bear-steepens, with pricing -1 to -8.

- RBA-dated OIS pricing is flat to 3bps softer across meetings.

- Next week, the local calendar sees Q3 Inventories and Company Profits on Monday, along with Melbourne Institute Inflation Gauge, Home Loans and ANZ-Indeed Job Ads monthly data. Judo Bank Composite & Services PMIs and Q3 BOP data drops on Tuesday ahead of the RBA Policy Decision. 23/24 economists surveyed expect the RBA to leave the cash rate at 4.35%. The market attaches a 9% chance of a 25bp hike next week. Q3 GDP is due for release on Wednesday.

- The AOFM plans to sell A$700mn of the 3.75% April 2037 on Wednesday.

NZGBS: Closed With Curve Sharply Steeper Ahead Of Fed Chair Powell’s Fireside Chat

NZGBs closed flat to 10bps cheaper, with the 2/10 curve steeper. The benchmarks finished 2bps off the session’s worst levels after a quiet session. With the domestic data calendar relatively light, local participants have been content to sit on the sidelines ahead of Fed Chair Powell’s fireside chat later today.

- Swap rates closed 6-11bps higher, with the 2s10s curve steeper and implied swap spreads wider.

- RBNZ dated OIS pricing closed little changed, with terminal OCR expectations at 5.53%.

- The RBNZ can’t afford to ignore a surge in immigration, even though it’s expected to subside next year, because inflation has been above target for so long, Deputy Governor Christian Hawkesby said. “When you’re an environment where inflation is at target and inflation expectations are well anchored, you’ve got the luxury to look through things and bide your time,” however we “don’t have that luxury.” (See Bloomberg link)

- The local calendar sees the release of the Terms of Trade Index on Monday.

- Later today sees the release of the ISM manufacturing index before Fed Chair Powell's fireside chat at 1100ET including text. Chicago PMI strength and other manufacturing surveys point to some upside risk. The FOMC media blackout begins Friday at midnight ET.

EQUITIES: Hong Kong Index Close To Recent Lows, Despite Caixin PMI Beat

Regional equities are mixed in the first part of Asia Pac Friday trade. Hong Kong and China markets are weaker at the break, despite a Caixin manufacturing PMI beat. Trends are mixed elsewhere. US futures sit modestly lower at this stage, having tracked tight ranges for much of the session. Eminis were last near 4574, -0.07%, while Nasdaq futures sit off 0.20%, at 15953.

- US yields recovered from an earlier dip, while US real yields rebounded on Thursday, which may be tempering equity sentiment to a degree. This comes ahead of more US data (including ISM) and Fed Chair Powell speak later.

- At the break, the CSI 300 is off 0.91%, with the real estate sub index off a more modest 0.36%, although this the 6th straight session loss for the index. BBG noted that sales data from the top 100 real estate companies continued to show weakness in homes sales through Nov.

- The HSI is off 0.69% at the break. The index is not too far from recent lows sub 16900. The Caixin PMI beat only provided a brief respite for sentiment.

- Japan's Topix is up 0.50%, while the Nikkei is closer to flat. Earlier data showed better company profits data for Q3, while capex data points to positive GDP revisions next week.

- The Kospi is underperforming, down 1%, with offshore investors selling local stock. The Taiex is close to flat.

- In SEA, most markets are firmer (gains are under 0.50% though), although Indonesia stocks are down 0.45% at this stage.

FOREX: Dollar Claws Back Earlier Losses, NZD Still Best Performer In The Past Week

The USD has clawed some losses as the Friday Asia Pac session has progressed. The BBDXY sits back close to unchanged at 1238.60. Earlier lows were at 1236.62.

- US yields have ticked up from earlier lows, which has helped. The 10yr last approaching 4.34%, against earlier lows sub 4.31%.

- Slightly better data out of Japan (implying upside GDP revisions from the capex side next week), haven't had a lasting positive impact on sentiment. Earlier lows in USD/JPY were at 147.61, and we now sit back at 148.10/15, close to unchanged for the session.

- NZD/USD remains slightly higher, last 0.6160, but drew selling interest on an earlier move above 0.6190. This high coincided with the Caixin China PMI beat.

- Still, NZD/USD is the best G10 performer in the past week, up 1.45% over this period (CHF is the next best at +0.91%.

- AUD/USD is back close to 0.6600, underperforming the NZD so far today. We have option expiries at nearby levels, which may be influencing spot. HK and China equities have generally remained weaker, which may be weighing as well (despite the PMI beat outlined above).

- Looking ahead, we have various final PMI prints in the EU/UK, while some ECB speak is due as well. Later in the US, the ISM prints, along with remarks from Fed Chair Powell.

OIL: Lower On Skepticism Around OPEC Voluntary Cuts

WTI (CLF4) tracks slightly weaker at $75.72/bbl in Friday Asain trade, after a steeper fall on Thursday (off 2.44%). We are close to unchanged for this benchmark on week-ago levels.

- OPEC announced additional voluntary cuts following Thursday's meeting, with a total reduction of 2.2m b/d, OPEC said in a statement. See this link for more details.

- The cuts were met with market scepticism. Crude regained some ground after further details of the cuts were revealed, but it remained lower on the day. The resumption of loadings from Black Sea Ports has added some further downside.

- For WTI, on the downside, the bear trigger lies at $72.37, the Nov 16 low. Clearance of this level would resume the downtrend.

- Headlines crossed earlier that the US has bought 2.73 million barrels for its reserves at $79/bbl (see this BBG link).

GOLD: On Track For Third Weekly Gain

Gold is 0.1% higher in the Asia-Pac session, after closing 0.4% lower at $2036.41 on Thursday on the back of a firmer USD and higher US Treasury yields.

- Cash tsys finished 4-7bps cheaper, with the 10-year leading. The US tsy 10-year yield rose 7bps to 4.33% but is still down 65bps from the cycle high of 5.01%.

- Nevertheless, bullion is on track for a third weekly rise amid growing market expectations that the US Federal Reserve has achieved peak funds rate and that the next move will be a cut. This expectation was supported yesterday by the release of the core PCE inflation data, which printed in line with expectations, and continuing jobless claims data that rose more than expected.

- However, with around 100bps of easing priced in by the market, Fedspeak pushed back against the market's dovish policy outlook ahead of Fed Chair Powell’s fireside chat later today. Fed Daly said that she is not thinking about rate cuts, and it is too early to call an end to hikes. Fed Williams noted that monetary conditions are restrictive but should remain so for some time to bring inflation back to 2%.

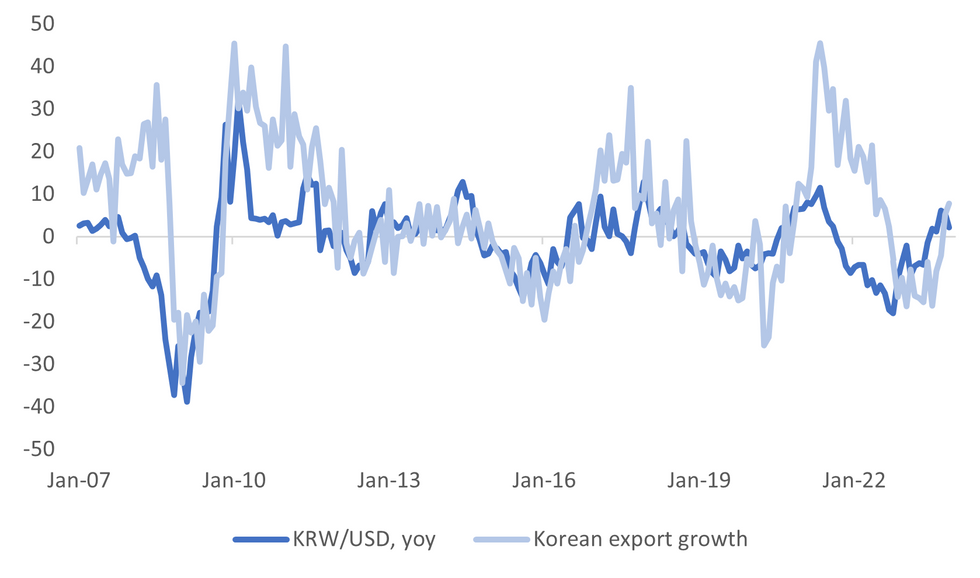

SOUTH KOREA DATA: Exports & Trade Surplus Post Positive Surprises, PMI Rises To 50.0

South Korea's Nov trade figures were better than expected. Export growth rose 7.8% y/y (5.0% forecast and 5.1% prior). Imports fell more than expected -11.6% y/y (forecast -8.6%). This left the trade surplus much higher than projected at $3.8bn ($1bn forecast and $1.63bn prior).

- This is the firmest pace of export growth, in y/y terms, since mid 2022. Won gains, in y/y terms are trailing the improved trend, but only at the margin, see the chart below.

- Export in m/m terms rose 1.3%, against a 0.80% gain in October.

- Chip exports ended their run of y/y falls, rising 12.9% (aided by base effects). Car exports remained strong, up 21.5%, while battery exports rose 24.8%.

- By country, exports were down 0.2% y/y to China, but this has been on improving trend. Export growth to the US remained positive.

- Today's data, coupled with the Nov PMI, moving back to 50 (from 49.8), provides some modest optimism around the growth backdrop as we move into 2024.

Fig 1: South Korean Export Growth & KRW/USD Y/Y Changes

Source: MNI - Market News/Bloomberg

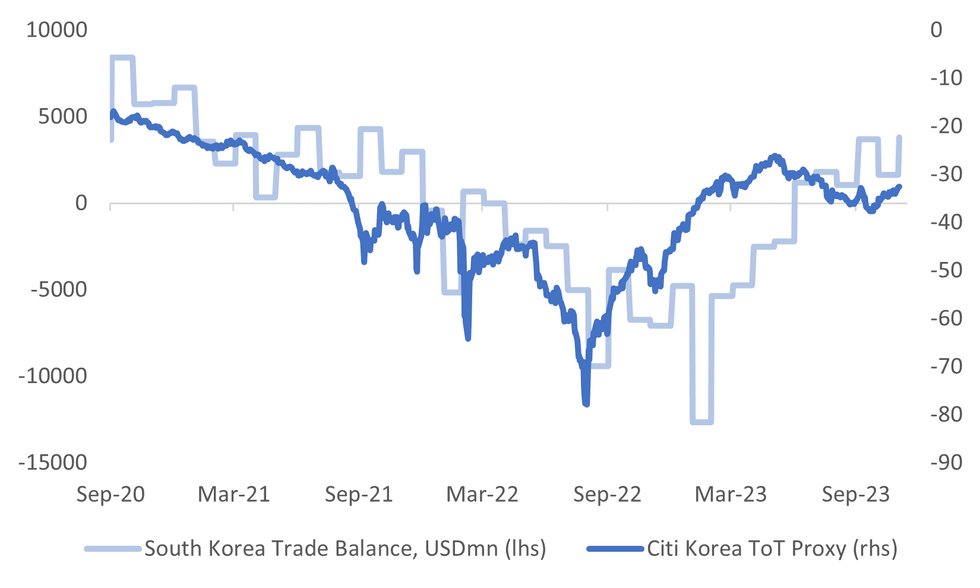

- The trade surplus beat, aided by the import drop, is consistent with some recent improvement in the terms of trade proxy (CITI), see the second chart below. The surplus is at fresh highs back to Q3 2021.

- The won is only marginally firmer in 1 month NDF terms, post today's prints, last near 1297 (+0.10%).

Fig 2: South Korea Trade Position & Citi Terms Of Trade Proxy

Source: CITI/MNI - Market News/Bloomberg

ASIA FX: Most USD/Asia Pairs Higher, KRW Underperforms

USD/Asia pairs have mostly tracked higher as the Friday session has progressed. The won has been a clear underperformer, despite better data outcomes. USD/CNH dips have been supported, while THB, TWD and IDR have also ground. PHP has outperformed somewhat. Looking ahead to next week, the data calendar doesn't swing back into gear until Tuesday when South Korea CPI prints and more China PMI prints are out.

- USD/CNH has been supported on dips (7.1319), the pair last tracking neat 7.1475. Onshore equities, in terms of the CSI 300 index, is tracking towards its weakest close since 2019. This comes despite a Caixin PMI beat earlier. This has helped curb earlier USD weakness, while a firmer US yield back has also helped.

- 1 month USD/KRW has threatened to push back above its 20-day EMA, the pair last near 1303. We had stronger export growth and a decent trade surplus for Nov, while the PMI moved back to 50.0, but this has been offset by equity weakness (-1% for the Kospi) and a firmer USD tone elsewhere.

- 1 month USD/TWD has climbed higher as well. The pair unable to hold recent breaches sub 31.00. We were last near 31.29, which pits us back above the simple 200-day MA 31.26. The country's PMI improved but still remains sub the 50.0 expansion/contraction point.

- USD/IDR has maintained a positive footing, with the pair last near 15540, slightly down from session highs. IDR weakness is in line with US yields regaining some composure. We aren't too far away from the 20 and 50-day EMAs. Nov CPI data was close to expectations. headline rose 2.86% y/y (2.7% forecast), while core was near 1.90% for the second straight month.

- USD/THB has tracked higher, last near 35.24, session highs were 35.34. The Nov PMI suggested little improvement in the soft industrial backdrop. We continue to see Thailand equity outflows (-$160.8mn so far this week). This is helping unwind recent baht outperformance.

- USD/PHP has drifted lower, away from earlier highs above 55.55. We were last near 55.43. Earlier on the data front, the Nov PMI ticked higher to 52.7 from 52.4, continuing to suggest a reasonable domestic backdrop, albeit off 2022 highs. Next Tuesday delivers Nov CPI data. The BSP expects a further easing from the prior 4.9%y/y outcome, stating late yesterday it has a range estimate of 4.0-4.8%. Note the consensus estimate is 4.3%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/12/2023 | 0800/0900 | *** |  | CH | GDP |

| 01/12/2023 | 0800/0300 |  | US | Fed Vice Chair Michael Barr | |

| 01/12/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/12/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0900/1000 | *** |  | IT | GDP (f) |

| 01/12/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/12/2023 | 1000/1100 |  | EU | ECB's Elderson participates in ECB forum panel | |

| 01/12/2023 | 1130/1230 |  | EU | ECB's Lagarde conversation at 5th ECB Forum | |

| 01/12/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/12/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 01/12/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/12/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/12/2023 | 1500/1000 | * |  | US | Construction Spending |

| 01/12/2023 | 1500/1000 |  | US | Chicago Fed's Austan Goolsbee | |

| 01/12/2023 | 1600/1100 |  | US | Fed Chair Jerome Powell | |

| 01/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 01/12/2023 | 1900/1400 |  | US | Fed Chair Powell, Gov. Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.