-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: South Korea & Taiwan PMIs Hint At Improved Global Trade

- US yields recouped some of Wednesday's losses, a slight flattening of the curve occurring, cash yields are up 1-4.5bps. This helped keep USD dips supported, with AUD underperforming. Easing expectations for December 2024 have been pared 5-10bps in the US and Canada over the past week. In contrast, Australia and NZ have seen cumulative easing by year-end increase by 20bp and 10bps respectively over the same period. Ther AUD/NZD cross is close to 2024 lows.

- JGB futures are sharply higher, +30 compared to settlement levels, after dealing in a relatively narrow range in the Tokyo morning session.

- Elsewhere, South Korea and Taiwan PMIs suggest an improved global trade backdrop all else equal. The Caixin China PMI was unchanged, while ASEAN PMIs were higher in terms of the headline, but details were somewhat softer, see below for more details.

- Looking ahead, there is US Q4 productivity/ULC, jobless claims, January manufacturing PMI/ISM as well as European PMIs and euro area January CPI. The Bank of England meets and is expected to leave rates unchanged. ECB’s Lagarde and Lane make appearances.

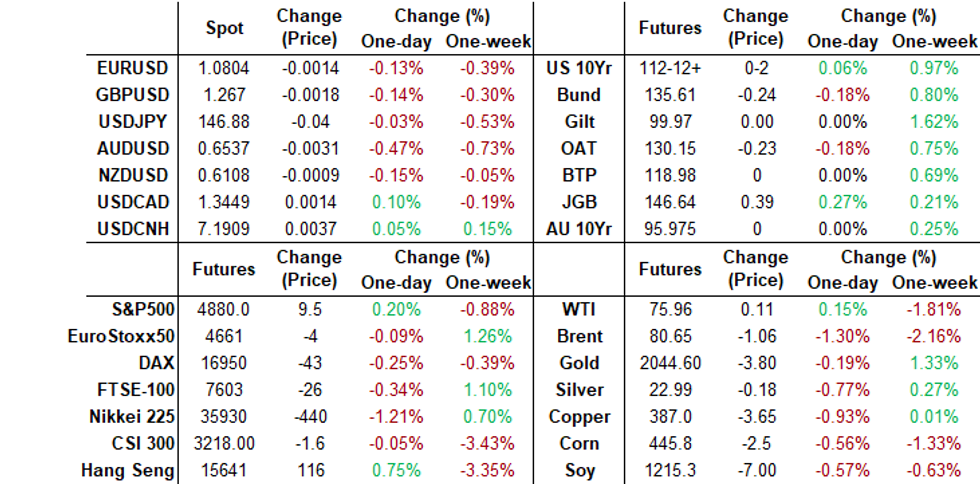

MARKETS

US TSYS: US Yields Recoup Some Of Wednesday's Losses

TYH4 is trading at 112-12+, + 02 from NY closing levels.

Not too much to speak about for Tsys today, we have remained rangebound all day, with a slight flattening of the curve occurring, cash yields are up 1-4.5bps.

- Slightly better selling in the front end of the curve in Asia trading as the 2Y yield is 4.5bps higher at 4.252%, while the 10Y yield is 2.6bps higher at 3.937%.

- Firms are pushing back their forecast for Fed cuts. Goldman Sachs has pushed back its forecast for the 1st Fed cut to May from March. It still expects 5cuts this year (BBG), with Abrdn sees fed cutting rates three times this year (BBG). This may be lending support to today's moves.

- TYH4 is still trading within initial resistance levels of 112-26+ from the highs of Jan 12th, while first support remains back at 110-26 from Jan 19th.

- Data Tonight: Weekly Claims, Flash PMIs, ISMs, followed by Non-Farm Payrolls on Friday

STIR: FOMC Meeting Does Little To Deter $-Bloc Easing Expectations

STIR markets within the $-bloc remain poised for a significant easing cycle in 2024 following the FOMC meeting. Fed Chair Powell pushed back against the prospect of a March easing.

- That said, easing expectations for December 2024 have been pared 5-10bps in the US and Canada over the past week.

- In contrast, Australia and NZ have seen cumulative easing by year-end increase by 20bp and 10bps respectively over the same period.

- December 2024 expectations and the cumulative easing across the $-bloc stand at: 3.91%, -142bps (FOMC); 4.04%, -96bps (BOC); 3.72%, -60bps (RBA); and 4.55%, -92bps (RBNZ).

Figure 1: $-Bloc STIR

Source: MNI – Market News / Bloomberg

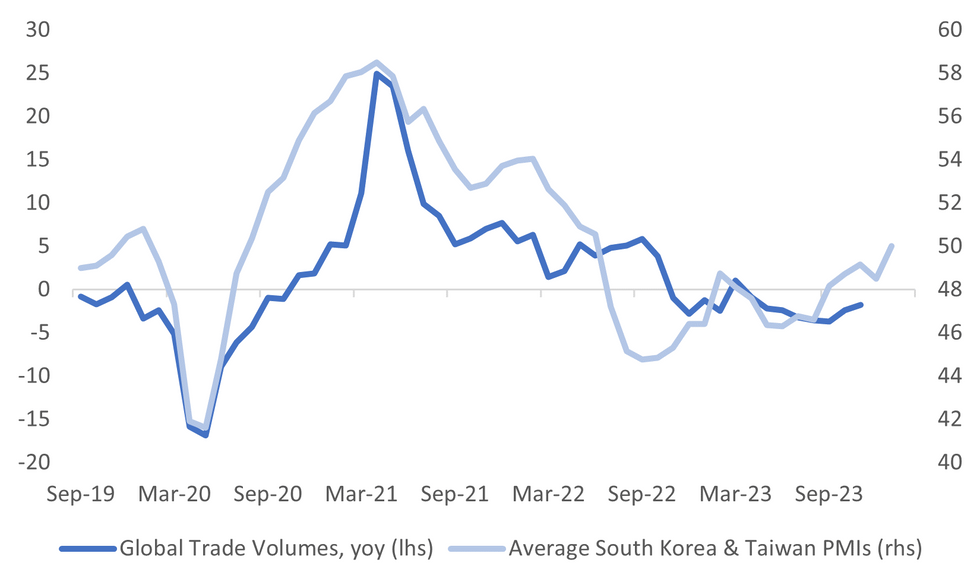

ASIA: South Korea & Taiwan PMIs Point To Improving Global Trade Trend

Both the South Korea and Taiwan PMIs improved in Jan. The South Korea print rose to 51.2 from 49.9 in Dec. The Taiwan print to 48.8 from 47.1.

- For South Korea this is the highest print since mid 2022 and puts us comfortably back in expansion territory. For Taiwan we are back to March 2023 levels.

- Both indices were pushed higher by output readings. The South Korea index rose to 51.6, the highest since Feb 2022. The Taiwan output sub index rose to 47.1 from 45.2. New orders were also up in both PMIs from the prior month.

- The average of the headline PMIs for both countries lines up reasonably well with global trade volume growth, see the chart below. It suggests improving momentum, all else equal, supporting the soft landing hypothesis.

- Earlier we had South Korean trade figures bounce strongly in Jan, although this was inflated by more days this Jan compared to Jan 2023. Still, the trend looks resilient.

- Taiwan trade figures have been mixed, with Dec exports up strongly but export orders surprising on the downside.

Fig 1: Average South Korea & Taiwan PMIs Versus Global Trade Volumes

Source: MNI - Market News/Bloomberg

JGBS: Futures Richer & At Tokyo Session Highs After 10Y Supply

JGB futures are sharply higher, +30 compared to settlement levels, after dealing in a relatively narrow range in the Tokyo morning session. The catalyst for the move higher was a solid 10-year JGB auction. The low price matched wider expectations, the tail shortened, and the cover ratio improved to 3.648x from 2.904x at January’s auction. It is worth noting that the cover ratio has improved for two straight months after December’s cover was the lowest seen at a 10-year auction since 2021.

- Afternoon strength in JGB futures came despite a paring of yesterday’s post-FOMC gains in US tsys in today’s Asia-Pac session. US tsys are currently dealing 1-5bps cheaper across benchmarks. Market commentators have started to push back their forecast for Fed cuts.

- International Investment Flows and PMI Manufacturing data failed to be market-moving.

- Post-auction dealings have shown a change of fortune for cash JGBs. After cheapening in the morning session, JGBs are now 1-3bps richer across benchmarks, with the 10-year leading. The benchmark 10-year yield is 2.5bps lower at 0.707% versus the morning high of 0.747%.

- The swaps curve is dealing slightly richer beyond the 2-year. Swap spreads are wider.

- Tomorrow, the local calendar sees Monetary Base data, along with BoJ Rinban Operations covering 1-10-year JGBs.

AUSSIE BONDS: Little Changed & Near Cheaps, PPI Data & May-34 Supply Tomorrow

ACGBs (YM -1.0 & XM +0.5) sit little changed and near Sydney session cheaps as US tsys pare yesterday’s post-FOMC rally in today’s Asia-Pac session. Cash US tsys are dealing 1-4bps cheaper, with a flattening bias.

- Market commentators have started to push back their forecast for Fed cuts. Fed Chair Powell yesterday said policymakers were unlikely to pivot to rate cuts in March. Goldman Sachs has pushed back its forecast for the 1st Fed cut to May from March. They still expect 5 cuts this year (BBG). Aberdeen sees the Fed cutting rates three times this year (BBG). This may be lending support to today's US tsy moves.

- Today’s local data drop of House Prices, PMI, Terms of Trade, NAB Business Confidence and Building Approvals failed to be market-moving.

- Cash ACGBs are 1-2bps richer, with the AU-US 10-year yield differential 6bps higher at +6bps.

- Swap rates are flat to 2bps lower, with the 3s10s curve flatter.

- The bills strip has twist-flattened, with pricing -1 to +2.

- RBA-dated OIS pricing is 1-2bps softer across meetings. A cumulative 61bps of easing is priced by year-end.

- Tomorrow, the local calendar sees PPI and Home Loans data.

- Tomorrow, the AOFM plans to sell A$800mn of 3.75% 21 May 2034 bond.

AUSTRALIAN DATA: Home Approvals Falter During A Housing Shortage

The number of dwelling approvals was a lot weaker than expected in December falling 9.5% m/m to be down 24% y/y driven by a 25.3% m/m drop in the multi-dwelling component but private houses also fell 0.5%. Approvals for apartments are at their lowest level since the Covid-impacted June 2020. With the working age population rising 3% y/y, the lack of home building is a problem in a market that is already facing severe shortages and is likely to continue putting pressure on rents.

- Home building has been impacted by large public infrastructure projects being undertaken in most states, which has absorbed the skilled workforce.

- Approvals for private homes are down 4.4% y/y, an improvement from November’s -6.7%, there is also positive 3-month momentum. They are still almost 3% below pre-pandemic levels though.

- The sharp drop in multi-dwelling units in December has resulted in a 44.2% decline on a year ago. The level is almost 40% below pre-Covid levels. The ABS notes 2023 was 19% lower than 2022. But 3-month momentum improved in Q4 2023.

Source: MNI - Market News/ABS

AUSTRALIAN DATA: Rising House Prices Not Uniform, Affordability Continues To Deteriorate

CoreLogic capital city home prices in January rose by 0.4% m/m and 10.4% y/y after 0.3% and 9.5% in December. Prices are running well above trend and are now over 10% higher than the 2023 trough. But recent rises have not been uniform across cities with three seeing house price declines at the start of 2024, including Melbourne, while three posted increases above 1%. So far the housing recovery is not boosting consumption with household spending still soft.

Australia CoreLogic capital city home prices

Source: MNI - Market News/Refinitiv

- CoreLogic notes that house prices continue to outperform units with the January gap rising to a record high of 45.2%.

- With working population growth at 3% y/y due to strong immigration there is robust demand for housing in an environment of tight supply. The December dwelling approval data showed that the situation is unlikely to improve soon and so upward pressure on home prices is likely to persist. CoreLogic reports that sales in the 3-months to January were 0.5% above the 5-year average.

- Assuming Q4 disposable income grows at the average of the previous four quarters, housing affordability deteriorated further in Q4 with the 1.8% q/q rise in prices plus the slight increase in mortgage rates resulting in our index deteriorating 2pp and it now stands over 45% below trend, the worst since the series began in 1980.

- Q4 rents rose by 7.3% y/y but rising house prices mean that the dwellings remain overvalued as measured by the ratio of house price to rents. On our measure they are currently 11% overvalued up from 10.4% in Q3.

Source: MNI - Market News/Refinitiv

NZGBS: Strength Given Up As US Tsys Post-FOMC Rally Is Pared

NZGBs closed 3-4bps richer but well off the session’s best levels. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined CoreLogic residential property prices. However, weekly supply saw lacklustre demand metrics, with cover ratios ranging from 1.32x to 1.88x. That likely contributed to the through-the-session cheapening.

- That said, the key driver of the move away from the session’s best levels was likely to have been today’s partial give-back of yesterday’s post-FOMC gains in US tsys. They are currently dealing 2-4bps cheaper across benchmarks in today’s Asia-Pac session.

- Firms are pushing back their forecast for Fed cuts. Goldman Sachs has pushed back its forecast for the 1st Fed cut to May from March. They still expect 5 cuts this year (BBG). Aberdeen sees the Fed cutting rates three times this year (BBG). This may be lending support to today's moves.

- Swap rates closed 1-3bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 4bps softer across meetings, with Oct-Nov leading. A cumulative 94bps of easing is priced by year-end.

- Tomorrow, the local calendar will see ANZ Consumer Confidence and Building Permits data.

NZ DATA: Housing Outlook Positive But Affordability Weak

CoreLogic house prices rose 0.4% m/m in January to be down 2.7% y/y after falling 3.3% y/y in December. Prices are now 2.5% higher than their September 2023 trough as immigration has increased demand and the new government is more supportive of property. But the January rise was less than both November and December and CoreLogic warns that the revival is still tentative.

- The 1.1% rise in home prices in Q4 has resulted in a decline in affordability. Our housing affordability index (HAI) fell in Q4 despite the mortgage rate being little changed in H2 2023. Affordability is now over 36% below trend after 35.6% in Q3, the worst since 2008. Rates have stopped rising but now house prices are.

- While the RBNZ doesn’t have the first rate cut in its projections until H1 2025, the market is expecting a cut by July, which would help housing affordability. But if easing begins this year, the effect is likely to be offset by rising house prices.

- The RBNZ is expected to reduce the LVR requirements around mid-2024 for both owner-occupiers and investors, which is likely to increase demand, especially if it coincides with the first rate cut.

- The ratio of house prices to rents is a good proxy for housing valuation and its decline since Q2 2022 has helped improve the value of NZ housing. The ratio has been signalling that dwellings have been undervalued since Q2 2023 and in Q4 by just under 5%. Rents rose 4.5% y/y in Q4.

Source: MNI - Market News/Refinitiv/Bloomberg

FOREX: USD Up From Earlier Lows, A$ Underperforms

JPY and NZD are modestly higher against the USD, but the rest of the G10 block has struggled as Thursday session has unfolded so far. The BBDXY got close to 1235.7 in earlier trade, but we now sit back near 1237, down only slightly for the session.

- Cross asset focus has been on some modest recover in US yields post Wednesday's slump. Some sell-side names have shifted out their expectation for when the Fed starts cutting. The front end has led the moves, the 2yr up nearly 4bps to 4.24%.

- This has likely kept USD/JPY dips supported to a degree. For this pair, we saw lows of 146.48, but we sit back near 146.75 now. Earlier highs were at 147.08.

- NZD has firmed back to 0.6125, but remains within recent ranges (highs for the session at 0.6141). Some support likely evident from the better US equity futures tone, with Nasdaq futures up close to 0.45%.

- The same can't be said for AUD, last near session lows in the 0.6555/60 region. Earlier highs came close to 0.6580. This underperformance may reflect market pricing around potential RBA cuts in Q2 of this year post yesterday's Q4 CPI update. Metals prices are mixed, with iron ore slightly higher, while copper is down.

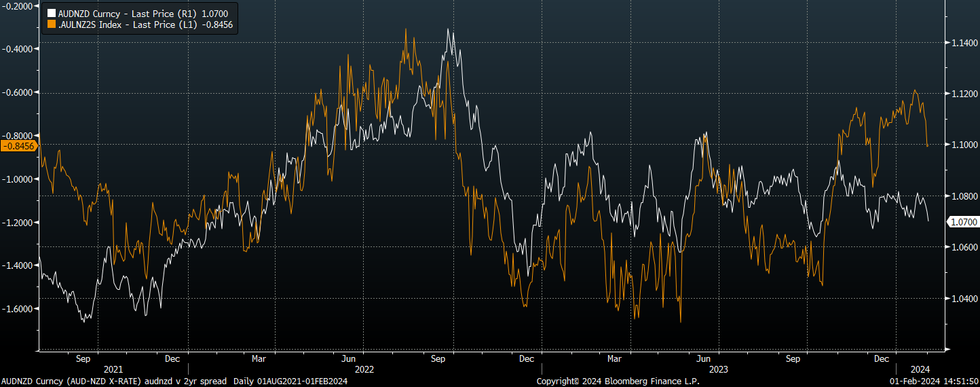

- The AUD/NZD cross is back close to 1.0700, near Jan lows.

- EUR/USD has spent most of the session fairly close to 1.0800.

- Looking ahead, there is US Q4 productivity/ULC, jobless claims, January manufacturing PMI/ISM as well as European PMIs and euro area January CPI. The Bank of England meets and is expected to leave rates unchanged. ECB’s Lagarde and Lane make appearances.

FOREX: AUD/NZD Close To 2024 Lows, AU-NZ 2yr Spreads Down Sharply In Recent Weeks

AUD/NZD is back close to Jan lows. The pair currently sits near 1.0700. A fresh break below this level could see Dec lows near 1.0655 targeted, while Oct lows rest at 1.0624. All key EMAs sit above spot, the 200 day around 1.0805.

- Downside momentum in the pair is consistent with weaker AU yield momentum versus NZ. The chart below overlays the AUD/NZD cross against the 2yr swap spread.

- The spread has come off around 25bps in recent weeks, with a good part of the move happening over the past week.

- We have had a hawkish rebuff from the RBNZ Chief Economist around domestic inflation pressures, while yesterday's downside Q4 surprise in Australia has helped raised RBA easing odds.

- Of course, we hear from the RBA next week in its first policy meeting of the year. No changes are expected, but the RBA language around the policy bias will clearly be watched closely.

Fig 1: AUD/NZD Versus AU-NZ 2yr Swap Spread

Source: MNI - Market News/Bloomberg

CHINA EQUITIES: Equities Rebound, After Vice FinMin Pledges Support For Economy

Hong Kong and Mainland China Equities are higher today, erasing early morning moves after Comments from the Vice Finance Minister around continuing to develop the chip and tech sectors has likely aided sentiment in this space. The minister also stated that broader fiscal policy will continue to aid the domestic demand recovery. The CSI 300 rebounding to +0.75%, Hang Seng up 1.35%, while the tech Index is up 3.20%

- Hong Kong, is being led higher by the tech index, trading 3.20% higher so far, as they brush of poor earnings from some of the Big US Tech stocks this week. The HSTECH sub index may also be seeing some support around the 3000 level, which has marked recent lows. Elsewhere the property index is trading 0.75% higher, after being down 1.1% at one point after new home sales from the nation’s largest developers tumbled and “underwater mortgage” levels in Hong Kong surged to a two-decade high.

- China had PMI data out earlier, holding steady at 50.8, markets initially didn't react positively to the PMI data, with all major benchmarks trading lower on the day, however once the Vice Finance Minister spoke markets keeping changed directions, CSI 300 now up 0.75%, ChiNext up 1.90%.

ASIA EQUITIES: Asia Equities Mostly Lower, Higher PMIs Help Some Markets

Asia equities are mostly lower today, largely on the back of the FOMC rate decision and Powell's comments around not cutting in March. While regional PMI prints have mostly been to the upside for Jan, helping some local markets.

- Japan equity indices are lower across the board today, the biggest news coming out is from Aozora Bank, as their shares plunged 21.5% on the back of losses in their US commercial property exposure, this coming on the back of NY Community Bancorp slashing it's dividend and stockpile reserves, due to bad loan exposure to US property, causing the stock to fall 38%. Currently the Topix is 0.75% lower, while the Nikkei trades 0.90% lower

- South Korea equities indices are higher today as PMI data showed a return to growth 51.2 up from 49.9 in Dec, while headlines out earlier from the Finance Minister around resolving the "Korea Discount" in stock markets are helping push the Kospi higher, currently up 1.50%

- Taiwan PMI out earlier improved from last month at 48.8 vs 47.1, the Taiex is currently trading flat.

- Australia equities have ended their winning run by giving all gains from yesterday back, after Powell dampened hope of a US rate cut in march, the ASX200 is trading lower by 1.20%, elsewhere in Aus the 3Y hit 3.50% for the first time since June, while a rate cut is fully priced in for June.

- Elsewhere in SEA, PMI data has been released showing Indonesia the standout in the region coming in at 52.9 vs 52.2, equities higher by 0.70%, elsewhere Thailand's PMI data improved from last month, but still showing signs production is contracting 46.7 vs 45.1, equities lower by 0.40%, while Philippines PMI fell to 50.9 vs 51.50 last month with equities lower by 0.65%

JAPAN DATA: Offshore Inflows Into Local Stocks Continued For 4th Straight Week

The pace of offshore inflows into Japanese stocks picked up last week, see the table below. Foreign investors purchased net ¥720.3bn worth of local stocks, building on inflows from the prior week. Since the start of the year, we have seen a cumulative ¥2506.1bn in net inflows into this segment. In terms of bond purchases, we returned to net outflows last week, ending a positive 2 week run of inflows into this space.

- In terms of Japan outflows to the rest of the world, we saw a ¥382.9bn rebound to offshore bonds, which have generally been on a positive trend since the start of the year (3 out of 4 weeks with positive inflows).

- We saw modest net selling of offshore stocks by local investors, but this only partially unwound the prior week's inflow.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending Jan 26 | Prior Week |

| Foreign Buying Japan Stocks | 720.3 | 287 |

| Foreign Buying Japan Bonds | -207.5 | 359.9 |

| Japan Buying Foreign Bonds | 382.9 | -43.5 |

| Japan Buying Foreign Stocks | -55.2 | 130.2 |

Source: MNI - Market News/Bloomberg

OIL: Crude Up Moderately Following Wednesday’s Sharp Fall

Oil prices are off Wednesday’s lows during APAC trading today. Continued geopolitical uncertainties with better risk sentiment have supported crude. WTI is up 0.7% to $76.38/bbl but off the intraday high of $76.50 and Brent is 0.7% higher at $81.08 after reaching a high of $81.20. A slightly lower US dollar has also provided some support.

- The US said that is shot down Iranian drones and a Houthi missile in the Gulf of Aden off Yemen’s coast. Threats to shipping in the area are yet to abate. Also, an expected US response to the killing of 3 soldiers is keeping markets alert. Iran has denied supplying the weapons and has warned against retaliating.

- Total US production rose 5.7% in the latest week, rebounding from weather-impacted closures. But strong US output over recent months has been one of the factors keeping a lid on oil prices.

- Bloomberg is reporting that the problems in the Red Sea are pushing European diesel prices higher due to the longer routes to avoid the area. Europe has found other sources of refined products since it banned Russian diesel following its invasion of Ukraine.

- Later there is US Q4 productivity/ULC, jobless claims, January manufacturing PMI/ISM as well as European PMIs and euro area January CPI. The Bank of England meets and is expected to leave rates unchanged. ECB’s Lagarde and Lane make appearances.

GOLD: Slightly Stronger But Still Below Yesterday’s ADP Employment-Induced High

Gold is slightly higher in the Asia-Pac session, after closing 0.1% higher at $2039.52 on Wednesday following the FOMC Policy Decision.

- The bullion market experienced considerable volatility during the session, marked by a peak of $2055.92. This surge in gold occurred as the USD dollar weakened and US Treasury yields declined due to disappointing US economic data. ADP Employment showed a change of 107k vs. 135k est (prior down revised to 158k from 164k), ahead of Friday’s Non-Farm Payrolls for January.

- However, later in the session, there was an intraday resurgence in the USD and yields as Fed Chair Powell expressed reservations about the possibility of a Fed rate cut in March.

- The market is now assigns around a 35% chance to a 25bp rate cut in March. This compares to the near 70% chance seen a couple of weeks ago.

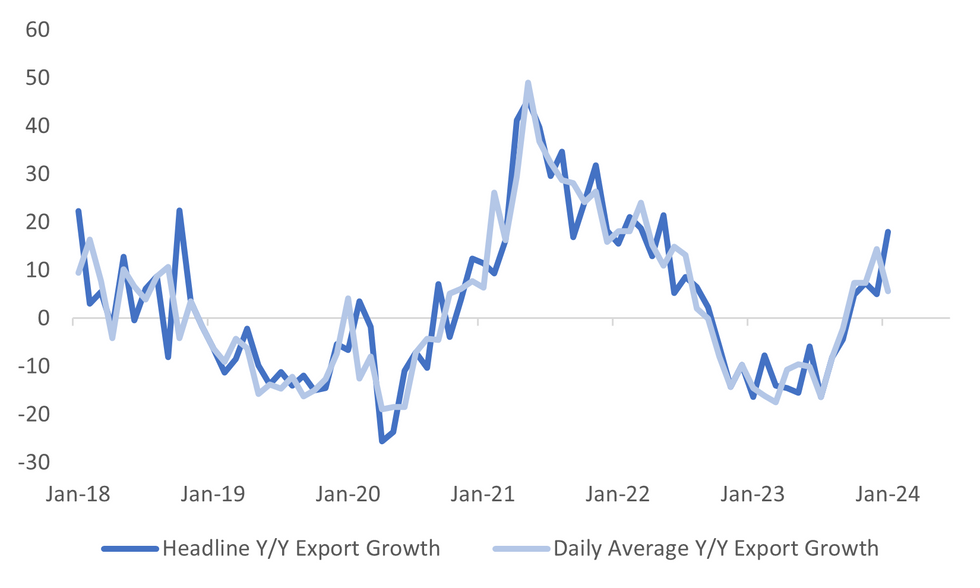

SOUTH KOREA DATA: Exports Surge On Day Count Effect, But Trend Still Resilient

South Korea Jan exports were inflated by a higher number of days compared to Jan 2023, with headline growth at 18% y/y, versus a +5.0% gain in Dec. Imports were close to expected at -7.8% y/y ( -8.1% forecast and -10.8% prior). The trade surplus narrowed noticeably though to $300mn, versus $1000mn forecast and $4457mn prior.

- Daily average export growth in y/y terms was 5.7% for Jan. This was down from the average pace through the end of 2023, (dec 14.4%, Nov 7.4%), but remained comfortably in positive territory.

- Recall that the daily average y/y print for the first 20days of the month was +2.2% (from 13% in Dec). Hence this was already hinting at some moderation. The trend still looks positive for this series, albeit less so than the headline print, see the chart below.

- In terms of the detail, chip exports surged 56%. Exports of cars was also strong. Exports to the US were +27%, while China exports rose +16% y/y. These figures will be inflated by the day count impact though.

Fig 1: South Korean Export Growth - Day Count Impact Seen In Jan, But Trend Still Looks Positive

Source: MNI - Market News/Bloomberg

ASIA DATA: PMIs Improve But Orders & Price Pressures Concerning

Asian manufacturing started the year more positively driven by accelerating production. There were broad based increases in the January S&P Global manufacturing PMIs with Korea returning to growth. While the ASEAN PMI rose above the breakeven 50-level for the first time since August, orders continued to fall, which is negative for the outlook. The other area of concern was price pressures at their highest rate in ten months with both costs and selling prices accelerating, but there was no mention of rising shipping costs yet.

- Indonesia continues to be the ASEAN outperformer with the PMI rising to 52.9 from 52.2 with both production and domestic and export orders growth rising, although foreign demand remains lacklustre. There was no change in employment but business expects economic conditions to advance. Unlike the rest of ASEAN, inflation eased (January CPI data due later today), costs continued to rise but at a 3-month low and selling price inflation fell further below its historical average.

- Thailand saw a slight improvement in the PMI to 46.7 from 45.1 driven by better output as producers work through backlogs, but the index continues to signal that production is contracting as new orders continue to fall significantly. Foreign orders were not as soft as the aggregate. Weak new business is resulting in a drop in headcount. December production fell 6.3% y/y. Business confidence is improving on hopes of better demand. Raw material costs boosted input inflation and producers passed this onto customers with both measures of price pressures rising above their historical averages.

- The PMI for the Philippines remains above 50 but showed easing activity growth as it fell to 50.9 from 51.5 due to softer orders and production. But price pressures remained “historically muted, and even softened” in January.

Source: MNI - Market News/Bloomberg

INDONESIA: Non-Food Price Inflation Well Contained

January CPI was close to Bloomberg consensus with headline slightly higher at 2.6% but in line with December and core slightly lower at 1.7% down from 1.8%. Bank Indonesia’s (BI) target band has shifted down 0.5pp for 2024 to 1.5%-3.5% but inflation is well within the lower range.

- Governor Warjiyo said that BI’s focus remains on rupiah and price stability. Inflation looked well contained at the start of the year. USDIDR rose 2.4% during January and BI intervened towards the end of the month. The pair has come down again this week, but remains above where BI would like to see it. Warjiyo also said that the rate cut window is in the second half of the year, once the rupiah has strengthened.

- Food prices remain problematic with rice up 15.7% y/y and the index for volatile food up 7.2% y/y from 6.7% in December.

- Most categories aside from food are seeing inflation rates below 2% though. State administered price inflation was steady at 1.7% y/y and utilities rose only 0.6% y/y, helped by subsidies.

Source: MNI - Market News/Refinitiv

ASIA FX: Mixed USD/Asia Trends, CNH Maintains Tight Ranges

USD/Asia pairs are mixed in the first part of Thursday trade. CNH remains steady, as it has largely done for much of the past week. KRW is marginally stronger, but remains within recent ranges. PHP has firmed, while INR is higher as the interim Indian budget is being delivered. Tomorrow is a quieter one from the data standpoint, with the main focus likely to rest on the South Korea CPI print.

- CNH vol remains quite low. USD/CNH sits near 7.1900, little changed for the session but supported on dips. Local equities are higher on supportive comments from the Finance Ministry around tech support and broader fiscal growth aiding the demand recovery. We are away from best levels though. The Caixin Jan manufacturing PMI was unchanged at 50.8.

- 1 month USD/KRW sits lower, but hasn't been able to sustain sub 1330 levels. Local equities have risen strongly, as the Government pledged to resolved the "Korea Discount" in stock markets. The Kospi last up 1.6%. BoK Governor Rhee also pushed back against easing expectations, stating the central bank will have to stay restrictive for a while. Earlier Jan export data was close to expectations. Headline export growth was inflated by the higher day count, but the export trend looks reasonable.

- Spot USD/INR is down marginally, last under 83.00. We remain within recent ranges, as mid Jan lows came in at 82.77. Local equities are volatile as the Interim Budget gets delivered. On the data front, the Jan F PMI read for manufacturing was 56.5, versus 56.9 prior.

- USD/PHP is down around 0.3%, last near 56.15. The oil price pull back has likely helped. The simple 200-day MA is near 55.94, while recent highs have been marked just above 56.50.

- In Indonesia, January CPI was close to Bloomberg consensus with headline slightly higher at 2.6% but in line with December and core slightly lower at 1.7% down from 1.8%. Bank Indonesia’s (BI) target band has shifted down 0.5pp for 2024 to 1.5%-3.5% but inflation is well within the lower range. USD/IDR is little changed, last tracking near 15775.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 01/02/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/02/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/02/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/02/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/02/2024 | 1130/1230 |  | EU | ECB's Lane remarks at EIEF | |

| 01/02/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 01/02/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 01/02/2024 | 1230/1230 |  | UK | BoE Press Conference | |

| 01/02/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 01/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/02/2024 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 01/02/2024 | 1400/1400 |  | UK | DMP Data | |

| 01/02/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 01/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/02/2024 | 1630/1130 |  | CA | BOC Governor Macklem testifies at House finance committee. |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.