-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Bounce Tops Out As Yields Falter At Friday Peaks

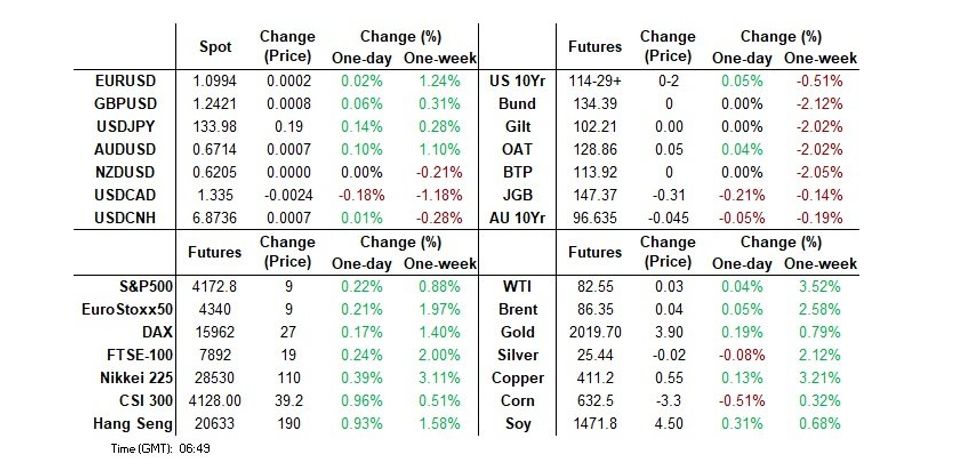

- The early positive USD impetus lost momentum as US yields failed to break above Friday session highs. The BBDXY did break through Friday's highs, getting close to 1224.60, but we now sit back near 1222.90, around +0.10% above NY closing levels.

- China and Hong Kong shares outperformed, while the regional Asia-Pac trend has been less positive elsewhere, mostly notably for Indian stocks, which have been weighed down by the IT sector.

- Empire Manufacturing & NAHB housing market readings will be seen in the NY session. We will also hear from Fed's Barkin, BoE’s Cunliffe & ECB’s Lagarde. Charles Schwab probably presents the highlight of the day’s corporate earnings releases.

US TSYS: Curve Twist Flattens

Cash Tsys sit ~1bp cheaper to ~1bp richer across the curve into London hours, twist flattening, pivoting around 5s. Tsys ticked away from session cheaps after a lack of follow through on the initial move higher in yields at the cash re-open (which was driven by Asia-Pac reaction to Friday’s news flow and bear flattening), with ranges remaining contained. Note that none of the major cash Tsy benchmarks managed to better their respective Friday yield peaks during the early move. TYM3 is +0-02 at 114-29+, just off the peak of a narrow 0-05 range. Volume in the contract runs at a mundane ~57K.

- Weekend headline flow was dominated by familiar ECB speak and sources of geopolitical tension, in addition to Tsy Secretary Yellen pointing to the potential for less Fed tightening owing to credit conditions. Asia-Pac news flow was particularly light.

- In the background we also flag the latest WSJ survey, which noted that "the economy is proving more resilient and inflation more stubborn than economists expected a few months ago, and as a result the Federal Reserve will keep interest rates high for longer.”

- Empire Manufacturing & NAHB housing market readings will be seen in the NY session. We will also hear from Fed's Barkin, BoE’s Cunliffe & ECB’s Lagarde. Charles Schwab probably presents the highlight of the day’s corporate earnings releases (see our earnings release schedule here).

JGBS: Futures Add To Overnight Losses, Curve Twist Steepens

JGB futures added to the bearish impulse derived from U.S. Tsy price action on Friday, extending through post-Tokyo lows registered ahead of the weekend, printing -30 into the bell, a few ticks off session lows. Wider cash JGB trade has seen some twist steepening, with the major benchmarks running 1.0bp richer to 2.0bp cheaper, little changed to richer through 5s and cheaper beyond that point. Cash 10s trade around 0.48% in yield terms, ~2bp off the BoJ’s YCC cap. Swap spreads are wider across the curve, pointing to payside swap flows adding an extra layer of pressure to the JGB weakness (once again most likely influenced by Friday’s broader price action). Local headline flow has been limited since the re-open.

- The weekend saw a reiteration of rhetoric from the IMF re: the BoJ, with the director of the Fund's monetary and capital markets department telling the Nikkei that “if new Bank of Japan Gov. Kazuo Ueda makes any monetary policy changes, careful communication with markets will be key in order to mitigate ripple effects on markets.”

- Elsewhere, Japanese PM Kishida was subject of an apparent smoke bomb attack at a campaign event on Saturday, he was subsequently evacuated with nothing in the way of meaningful injury sustained.

- A liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs headlines locally tomorrow.

AUSSIE BONDS: Weaker, Off Worst Levels, US Earnings Watch

ACGBs sit weaker (YM -5.0 & XM -5.0) but off worst levels as US Tsys firm slightly in Asia-Pac trade. Cash ACGB benchmark yields are 4-5bp higher with the AU-US 10-year yield differential -3bp at -14bp.

- Swaps are 5-6bp cheaper with the 3s10s curve 1bp flatter.

- Bills strip is steeper with pricing -2 to -11.

- RBA dated OIS is 3-5bp firmer for meetings beyond June with Feb-24 leading. May meeting has a 24% chance of a 25bp hike.

- The local calendar is light this week with tomorrow’s release of the RBA Minutes for April as the highlight. After the RBA left the cash rate unchanged at 3.6% (the first pause in this tightening cycle) the market will be searching for clues on the near-term path of policy.

- The market will continue to eye US earnings season after US Tsys were guided cheaper in trade ahead of the weekend in part due to higher-than-expected large bank earnings. The US economic calendar is relatively this week.

- Participants will continue to be on alert for the launch of the new ACGB Dec-34 after the AOFM revealed on Friday that it aims to issue the line via syndication at some point this week.

NZGBS: Weaker, Mid-Range, US Earnings Eyed

NZGBs closed with yields flat to 4bp higher but off session cheaps as Asia-Pac participants digested the negative lead from US Tsy ahead of the weekend. NZGBs outperformed the $-Bloc with the NZ/US and NZ/AU 10-year yield differentials respectively -7bp and -4bp.

- Swap rates closed 3-6bp higher, implying wider swap spreads, with the 2s10s curve 3bp flatter.

- RBNZ dated OIS closed with pricing 1-5bp firmer across meetings with Apr-24 leading. 20bp of tightening priced for May with 25bp of easing priced for Nov-23 off a terminal OCR expectation of 5.49% (July).

- The Performance Services Index fell 1.4pts in March but remained in expansion territory. Activity/Sales component rose 2.8pts but New Orders fell 3.2pts. Food Prices rose 0.8% M/M (+12.1% Y/Y) with weather-impacted fruit & vegetables and grocery food as the key drivers.

- March REINZ house sales and price data are scheduled for release tomorrow ahead of Q1 CPI on Thursday.

- In Australia, the RBA Minutes for April are slated for release tomorrow.

- With the US calendar relatively this week, the market will be eyeing US Tsys reaction to US earning season and Fedspeak. US Tsy yields were guided higher ahead of the weekend in part due to higher-than-expected large bank earnings.

NZGBS: NZ/US Curve Correlation Turns Negative

In early April, global banking concerns lessened, leading to a return to pre-crisis levels ofcross-market curve correlation between AU and the US. This suggested that the market's attention had shifted back towards domestic drivers instead of banking sector stress. It also brought relative curve movements in line with historical trends, where global curve correlations weaken as the tightening cycle matures, and policy rates follow their independent paths.

- There has been an even more significant shift in the cross-market correlation between NZ and the US. As banking sector concerns rose, the NZ cash 2/10 curve steepened in sync with the US curve, reaching a peak correlation of around 0.90 in late March.

- Similar to AU, the NZ/US cross-market curve correlation decreased significantly in early April. However, unlike AU, the NZ curve correlation with the US turned negative after the RBNZ unexpectedly hiked the cash rate by 50 bp, causing the NZ 2/10 cash curve to flatten by 18bp.

Fig. 1: Rolling 10-day Correlation – NZGB 2/10 Curve Vs. US Tsy 2/10 Curve

Source: MNI – Market News / Bloomberg

FOREX: USD Rally Loses Momentum As Yields Can't Breach Friday Highs

The early positive USD impetus lost momentum as US yields failed to break above Friday session highs. The BBDXY did break through Friday's highs, getting close to 1224.60, but we now sit back near 1222.90, around +0.10% above NY closing levels.

- Much of the focus was on the early upward impetus in US yields with the 2yr getting to 4.12%, a continuation from Friday NY trade, which was buoyed by the rise in consumer inflation expectations and hawkish Fed. We couldn't through Friday's highs though and now sit back at around 4.105%.

- There was some NZ data but that didn't move market sentiment (PSI and food prices). NZD/USD sits down slightly, last around 0.6195/00, with some support evident ahead of the 0.6180 level, which is a multi-week low.

- AUD/USD hasn't drifted too far away from 0.6700 (last 0.6705/10), with a chunky option expiry at this level potentially a factor.

- USD/JPY got to a high of 134.13, and we sit just below these levels currently, despite the pull back in US yields from earlier highs. Dips in USD/JPY to 133.60/70 were supported.

- ECB's Nagel stated that core inflation should slow before the summer, but stated the central bank still has work to do on the inflation front. EUR/USD sits slightly lower for the session, last around 1.0985.

- Looking ahead, BoE's Cunliffe will speak, along with ECB President Lagarde. Later on in the US, the Empire manufacturing prints, along with the NAHB index. The Richmond Fed's Tom Barkin is also due to speak.

FX OPTIONS: Expiries for Apr17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0920(E528mln), $1.0935(E931mln), $1.0950-55(E637mln), $1.1050(E2.0bln)

- USD/JPY: Y132.50($1.0bln), Y133.00-11($1.1bln)

- AUD/USD: $0.6700(A$2.3bln)

ASIA FX: USD Firms, Q1 China GDP & March Monthly Activity Prints Due Tomorrow

USD/Asia pairs are higher across the board. Part of this is catch up from the USD's rebound late last week, although the dollar has generally stayed on the front foot against the majors today, which has spilled over into Asia FX as well. Still to come is Indian wholesale inflation, while tomorrow the focus will largely rest on China Q1 GDP, and March activity figures. The BI decision, no change expected, is also out.

- USD/CNH was slightly weaker in early trade, but couldn't sustain sub 6.8700 levels, and we now sit back around the 6.8750/60 level. The CNY fixing was close to neutral, while the 1yr MLF rate was held steady as expected at 2.75%. There was a slight net injection though of 20bn. Tomorrow delivers Q1 GDP and March activity figures, which are expected to show uniform improvement.

- 1 month USD/KRW continued to recover from the NPS swap announcement induced sell-off from late last week. We are now back above 1309/10, around +0.50% firmer versus NY closing levels from the end of last week. Onshore equities are slightly weaker in terms of the Kospi, while offshore investors are back to net-sellers, -$235.7mn in outflows so far today.

- Singapore export growth was better than expected but this didn't aid SGD FX sentiment much. USD/SGD got to 1.3334, above Friday highs, but we have drifted lower since, last around 1.3315/20. The NEER has recovered somewhat, but still holds most of its post MAS losses from last Friday.

- USD/IDR is back above 14780, +0.55% for the session. While the USD/IDR technical set up still looks bearish. However, if we see further upside in the pair, the 14830/40 region, which we broke down through early last week is likely to be eyed (this previously marked the YTD low for the pair). Weighed on the margins was a trade surplus below forecast, +2.9bn, +$4.25bn expected.

- USD/PHP has continued to track higher, last in the 55.65/70 range. This is +0.80% above closing levels from the end of last week. It is also fresh highs back to early January from this year. The pair is back above all key EMAs, with the simple 200-day MA sitting higher around 56.08.

CHINA: Q1 GDP Expected To Bounce, While March Activity If Forecast To Improve Across The Board

A reminder that China Q1 GDP and March monthly activity indicators print tomorrow. The consensus looks for improvement across the board relative to previous outcomes, as the economy emerged from lockdowns late last year.

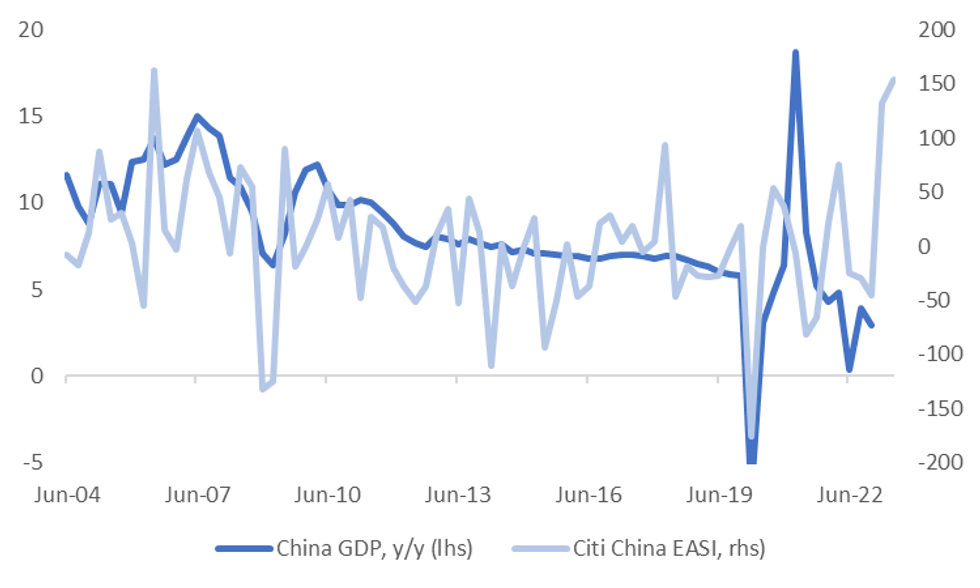

- For Q1 GDP the consensus is 2.0% q/q (prior 0.0%, range 1.0%-2.8%), in y/y terms it is 4.0% (prior 2.9%, range 2.2%-4.9%). The Citi China EASI is not too far off fresh cyclical highs and consistent with a GDP pick up, see the first chart below.

Fig 1: Citi China EASI Versus China Y/Y GDP

Source: Citi/MNI - Market News/Bloomberg

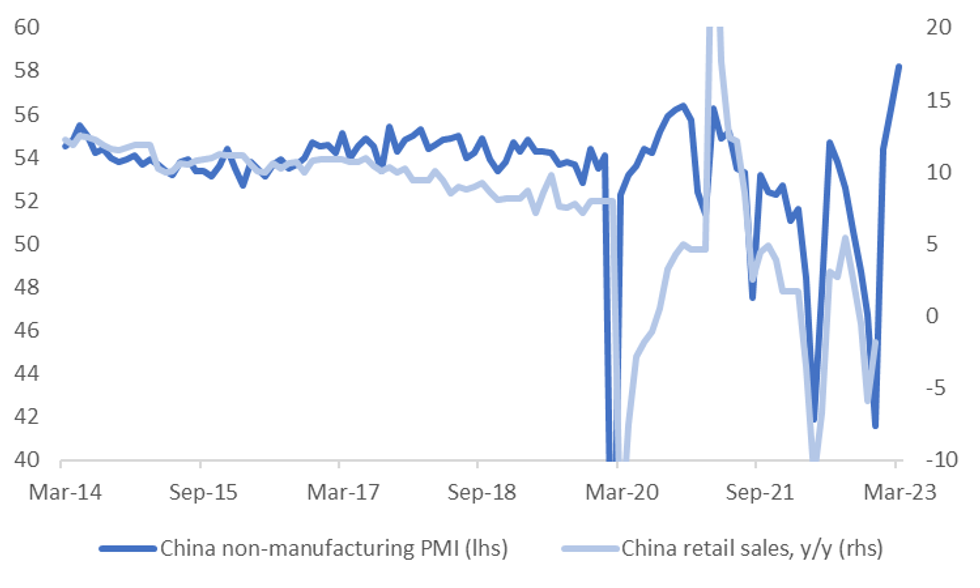

- In terms of the monthly activity indicators, there is arguably more certainty around the consumer/services side given recent PMI prints, where non-manufacturing outperformed manufacturing.

- Still, for IP y/y the forecast is 4.4% (prior 1.3% from Dec last yr, range 2.2%-5.6%).

- Retail sales is estimated at 7.5% y/y (prior -1.8% from Dec last yr, range 4.0% -11.0%). The second chart below is the y/y print against the services PMI.

- Fixed asset investment is forecast at 5.7% ytd y/y (prior 5.5%), while property investment is forecast at -4.7% ytd y/y (prior -5.7%). Property sales for March are also out, with no consensus but the prior was 3.5% ytd y/y.

- The jobless rate is forecast to improve to 5.5% from 5.6%.

Fig 2: China Services PMI Versus Retail Sales Y/Y

Source: MNI - Market News/Bloomberg

MNI Bank Indonesia Preview - April 2023: BI On Hold, Cuts Some Way Off

EXECUTIVE SUMMARY:

- Bank Indonesia (BI) is highly likely to keep rates at 5.75% for the third consecutive month when it announces its decision on 18 April. This expectation is unanimous amongst the 29 forecasters surveyed by Bloomberg. With the currency appreciating and core inflation returning to the mid-point of the ±3% target band in March plus the tone of the March statement, there isn’t a driver for BI to do anything else.

- BI believes that the current interest rate is sufficient to contain inflation and inflation expectations and to bring it back to the target band. Core returned to just below the mid-point of the range in March posting a 2.9% increase down from 3.1%. Headline is projected to return to target in H2 2023, helped by base effects. It moderated to 5% in March from 5.5%.

- It appears that BI is now on hold for the foreseeable future and that 5.75% is the peak in rates this cycle. If BI has stopped tightening, then the question is when will it begin to ease policy? Given that it doesn’t expect headline inflation to reach target until H2 2023 and it is predicting stronger domestic demand, then any rate cuts will probably be deferred into 2024.

- Click to view full preview: BI Preview - April 2023.pdf

EQUITIES: China/HK Outperform, Indian Markets Weaker

The main positives today have been in terms of China and Hong Kong shares, while the trend has been less positive elsewhere, mostly notably Indian stocks, which have been weighed down by the IT sector. US and EU futures are modestly higher, but for Eminis we are slightly down on best levels for the session, last near 4170.

- The HSI is up 0.54% at the break, with the underlying tech index up by a similar amount. The CSI 300 is faring better, up 0.86%, the Shanghai Composite near 1% firmer.

- The 1yr MLF rate was held steady, as expected, at 2.75%, while there was a modest liquidity injection via the 1yr MLF. Tomorrow we also get Q1 GDP and March monthly activity figures, which are expected to show uniform improvement.

- Indian markets are noticeably weaker in the first part of trade, with the Nifty and Sensex benchmarks off by more than 1%. Tech company Infosys has slumped on weak earnings guidance and analyst downgrades. This has weighed on broader tech equity related sentiment.

- The Kospi and Taiex are both down modestly, while offshore investors have sold -$220.4mn of local Korean shares.

- In SEA, Malaysian, Indonesian and Philippine stock indices are lower, with only Thai stocks managing to gravitate higher.

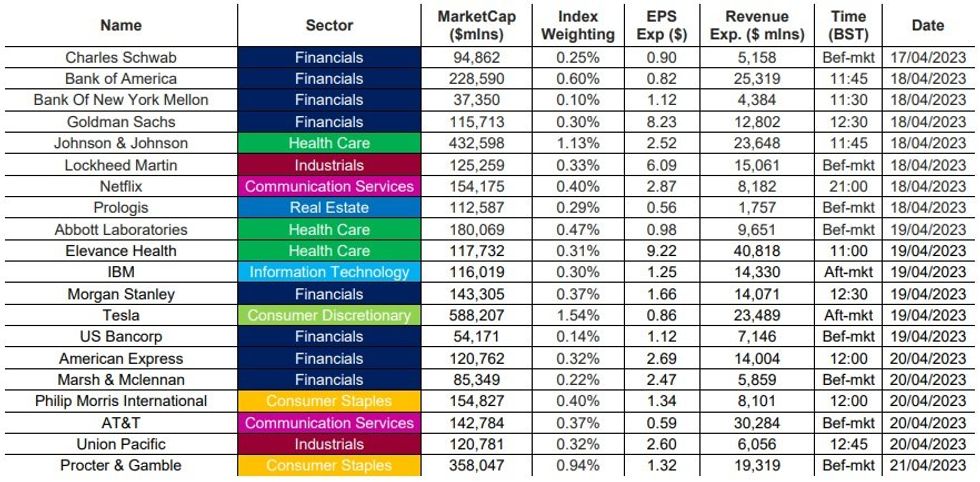

MNI US EARNINGS SCHEDULE - Big Banks off to Strong Start

EXECUTIVE SUMMARY

- Earnings season is underway for Q2, with large-cap financials reporting a strong start to the cycle so far.

- JP Morgan, Citigroup and Wells Fargo reported revenues ahead of expectations.

- Financials and large cap banks remain a focus in the coming week, with Bank of America, Goldman Sachs, US Bancorp and BNY Mellon set to follow.

- Click for full schedule including timings, EPS and revenue expectations.

GOLD: Prices Holding Just Above $2000 Following Friday’s Slide

Gold prices are flat during the APAC session today after falling 1.8% on Friday and reaching a low of $1992.44/oz following stronger US consumer confidence and a jump in inflation expectations. The greenback fell and yields rose in response to the data. Currently bullion is trading around $2004.44, up from the intraday low of $1995.52 but well off last week’s high of $2048.74. The USD index is up 0.1%.

- Friday’s move down unwound the week’s gains but support is still at $1981.70, the April 10 low.

- Citigroup increased its average 2023 gold price forecast to $2050/oz, an upward revision of 7.9%, on the back of expectations that the Fed is close to its terminal rate.

- According to Bloomberg, bullish hedge fund positions were reduced in the week to April 11 and purchases of gold-backed ETFs stopped after reaching the highest since late January.

- There is little data scheduled for later but there are a number of central bank speakers outside of the US. ECB President Lagarde will speak, as will Buba President Nagel and BoE’s Cunliffe.

OIL: Prices Stabilise After Rallying On Signs Of Market Tightening

Oil prices have been trading in a narrow range during the APAC session after rising about 0.6% on Friday on growing signs that the market is tightening. WTI is around $82.50/bbl after reaching an intraday low of $82.45 and Brent is about $86.25. Both remain above their 200-day moving averages. The USD index is 0.1% higher.

- The global diesel market is signalling a sharp slowdown in economic activity, which could put downward pressure on crude prices. It is used for heavy machinery and trucks and can be a leading indicator of growth. The number of trucks on China’s highways has fallen recently and Europe’s diesel premium has narrowed, according to Bloomberg. S&P Global says US diesel demand is likely to fall 2% this year. Distillates are also showing softer refining margins.

- Tanker data from Bloomberg showed that Russian shipments fell by 1.24mbd last week.

- There is little data scheduled for later but there are a number of central bank speakers outside of the US. ECB President Lagarde will speak, as will Buba President Nagel and BoE’s Cunliffe.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/04/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/04/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/04/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 17/04/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/04/2023 | 1300/1400 |  | UK | BOE Cunliffe Speech at Innovate Finance Global Summit | |

| 17/04/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/04/2023 | 1500/1700 |  | EU | ECB Lagarde Speech at Council on Foreign Relations | |

| 17/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/04/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 17/04/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.