-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI European Morning FI Analysis: Core FI Sees Mixed Flows

US TSYS: A Feeling Of Misplaced Fiscal Optimism?

A distinct lack of macro headline flow has allowed T-Notes to stick to a 0-03 range in Asia-Pac hours, last -0-01+ at 138-28, with cash Tsys showing marginal twist flattening, as yields mostly sit within -/+ 0.5bp of their respective closing levels across the curve. E-minis have edged away from their late NY lows in post-settlement/Asia-Pac trade after a little more optimism re: fiscal talks in DC emerged on narrower differences between the Trump administration and the Democrats, although it is fair to say that many hurdles remain, which is reflected in the relative levels of e-minis vs. their Monday highs. There were also some positive musings re: the publication of COVID-19 vaccine trial results in Nov, although this doesn't really move the widely held timeframes re: broad distribution of a vaccine.

- To recap, it was the Senate Republicans' focus on a targeted/piecemeal round of fiscal relief and Democrat commentary re: significant differences surrounding the matter that weighed on Wall St. into the cash equity close on Monday, before the aforementioned fiscal optimism became evident in post-settlement trade. A contact noted continued real money a/c buying of the front end in the NY morning along with some longer dated weakness linked to the T-Mobile corporate deal also being evident, which would have aided the steepening impetus on Monday.

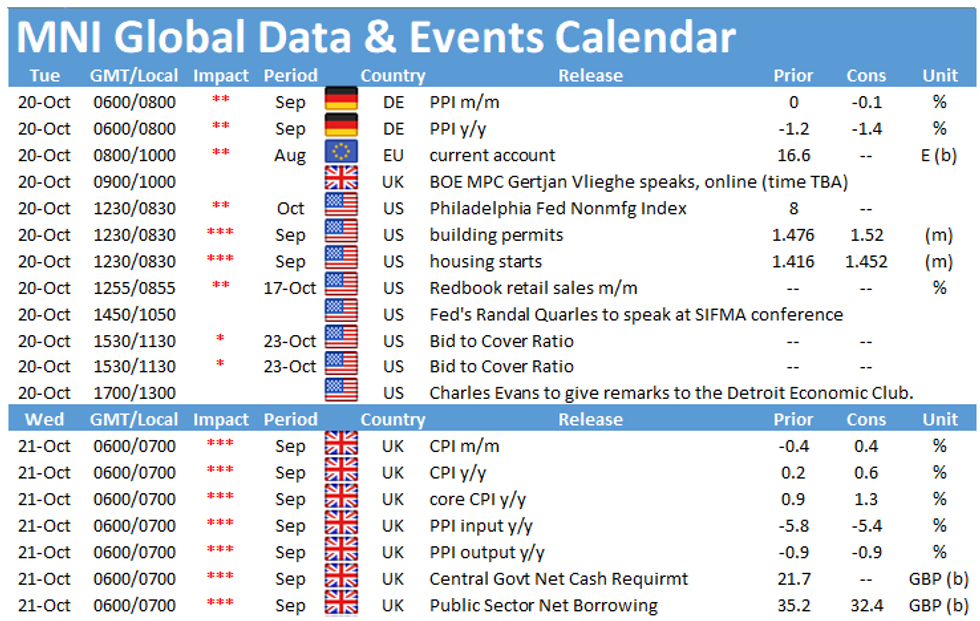

- Another raft of Fedspeak is due today, as is U.S housing starts & building permits.

JGBS: Early Swap Receiving Supports Long End, 20-Year Supply Well Received

JGB futures drew support from the curve flattening evident in cash JGB trade, with the contract last +5 vs. Tokyo settlement levels. In terms of the bull flattening witnessed in cash trade, it looks like receiving in super-long swaps was the driving factor, with 30- and 40-Year swaps tighter vs. their JGB equivalents for most of the day. There has been a lack of macro headline flow, and the aforementioned round of swap receiving looks to have offset any U.S. Tsy/20-Year JGB supply related pressure.

- The latest 20-Year JGB auction passed smoothly, with the carry on offer likely underpinning demand as the low price topped expectations (BBG dealer poll of 100.00), cover ratio nudged higher and tail narrowed vs. previous auction. The lower % allocated at the high yield was also noted, given the narrower tail.

- The second round of 84-day BoJ US$ ops covering year end saw 0 demand (as was the case in last week's ops), pointing to sanguine year-end $-funding conditions, at least on the part of Japanese banks.

- 1-10 Year BoJ Rinban ops headline locally on Wednesday.

AUSSIE BONDS: The Prospect Of Negative BBSW

YM unchanged, XM -0.5, with focus falling on comments from RBA Assistant Governor Kent. The most notable of which saw him state that a move into -ve territory for BBSW would not be unexpected in the case of further monetary easing. This supported the Bill space, which last sits +1-3 through the reds, with a flurry of lifts seen on the comments. It also provided a bid for the ACGB space, although that particular move subsequently faded back from richest levels.

- The minutes from the RBA's October meeting were released, and didn't really include any shocks, fleshing out the thought process outlined by Governor Lowe in last week's address re: further easing, providing the rubber stamp for the majority of the sell side's calls for deeper easing to be enacted in November in the process.

- The latest round of payrolls data revealed a slight downtick in the number of people working in the latest fortnight covered by the data, while total wages fell over the same period.

- Finally, S&P affirmed Australia at AAA; Outlook Negative.

- Prelim retail sales data and A$2.0bn worth of ACGB 1.00% 21 December 2030 supply headline tomorrow's local docket.

RATINGS: Australia Affirmed At S&P

S&P affirmed Australia at AAA; Outlook Negative

- Click here for full release.

AUCTIONS/DEBT SUPPLY

JGBS AUCTION: Japanese MOF sells Y972.8bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y972.8bn 20-Year JGBs:- Average Yield 0.394% (prev. 0.408%)

- Average Price 100.10 (prev. 99.85)

- High Yield: 0.397% (prev. 0.413%)

- Low Price: 100.05 (prev. 99.75)

- % Allotted At High Yield: 18.5341% (prev. 75.5975%)

- Bid/Cover: 3.860x (prev. 3.693x)

TECHS

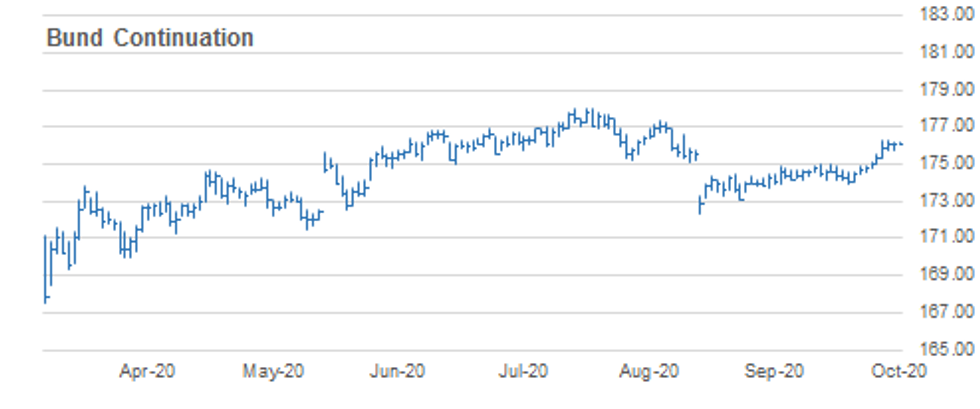

BUND TECHS: (Z0) Holding Onto Recent Gains

- RES 4: 177.18 High Sep 3 (cont)

- RES 3: 176.94 High Sep 8 (cont)

- RES 2: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 176.32 1.500 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- PRICE: 176.09 @ 04:54 BST Oct 20

- SUP 1: 175.35 Low Oct 15

- SUP 2: 175.04 Low Oct 14

- SUP 3: 174.92 20-day EMA

- SUP 4: 174.39 50-day EMA

Bunds are trading near recent highs and maintain a bullish tone following last week's rally. Futures last week cleared resistance at 174.97, Oct 2 high and more importantly, the key level at 175.08, Aug 4 high. The breach of 175.08 confirmed a resumption of the broader uptrend setting the scene for further gains. The next objectives and potential resistance levels are 176.32 and 176.57, both Fibonacci projections. Initial support is at 175.35, Oct 15 low.

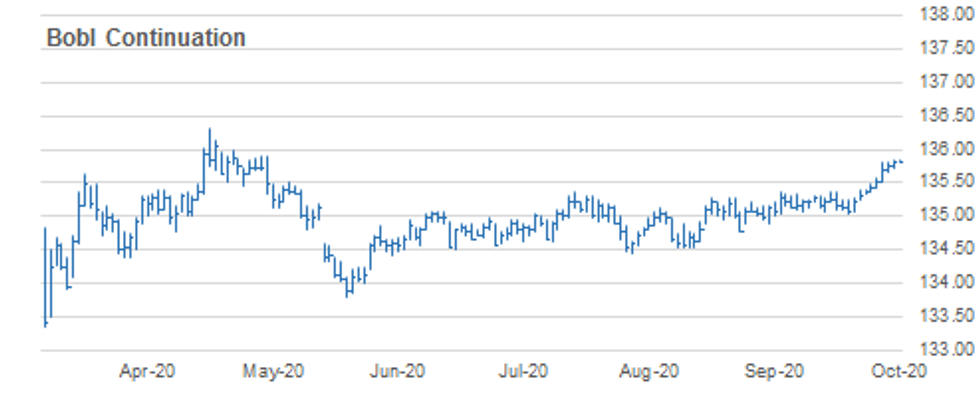

BOBL TECHS: (Z0) Bullish Theme Intact

- RES 4: 136.060 2.000 retracement of the May - Jun sell-off (cont)

- RES 3: 136.000 Round number resistance

- RES 2: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 1: 135.840 High Oct 19

- PRICE: 135.820 @ 05:01 BST Oct 20

- SUP 1: 135.660 Low Oct 16

- SUP 2: 135.510 Low Oct 15

- SUP 3: 135.376 20-day EMA

- SUP 4: 135.370 High Sep 21 and Oct 5 and former breakout level

BOBL futures maintain a bullish tone following last week's gains and edged higher yesterday. Last week's gains resulted in a clear breach of resistance at 135.370, Sep 21 and the Oct 5 high. The break confirmed a resumption of the uptrend that started early September. The next objectives and potential resistance levels are at 135.907, a Fibonacci projection and 136.00. Initial support lies at 135.660, Oct 16 low.

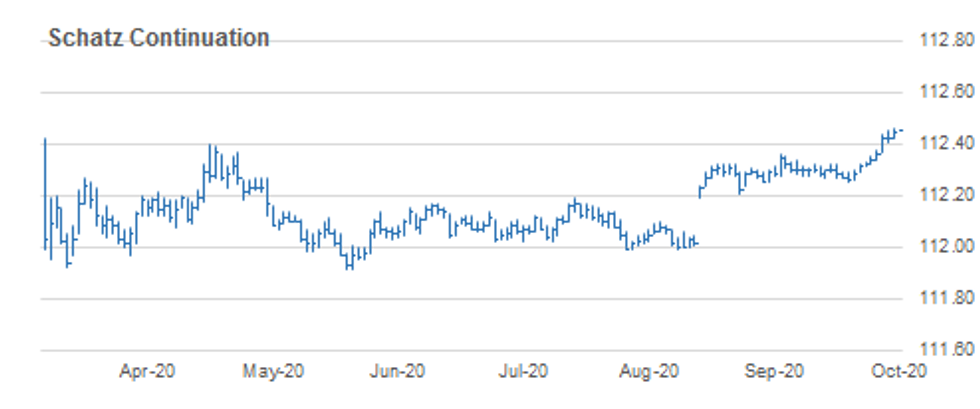

SCHATZ TECHS: (Z0) Fresh High Print

- RES 4: 112.505 61.8% retracement of the Mar - Jun sell-off (cont).

- RES 3: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.457 1.764 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 1: 112.460 High Oct 19

- PRICE: 112.455 @ 05:15 BST Oct 20

- SUP 1: 112.410 Low Oct 16

- SUP 2: 112.365 Low Oct 15

- SUP 3: 112.340 Low Oct 14

- SUP 4: 112.339 20-day EMA

Schatz futures outlook remains bullish following last week's accelerated gains and futures edged higher yesterday. The contract last week cleared key resistance at 112.360, Sep 21 high, confirming a resumption of the broader uptrend. The move higher has opened 112.490 next, a Fibonacci projection. Moving average studies are in a bull mode too, reinforcing current trend conditions. Initial support is at 112.410, Oct 16 low.

GILT TECHS: (Z0) Focus Is On Key Resistance

- RES 4: 137.44 High Aug 7

- RES 3: 137.14 0.764 proj of Aug 28 - Sep 21 rally from Oct 7 low

- RES 2: 137.04 High Sep 21 and a key resistance

- RES 1: 136.97 High Oct 16

- PRICE: 136.97 @ Close Oct 19

- SUP 1: 136.27 Low Oct 15

- SUP 2: 135.50 Low Oct 14

- SUP 3: 135.06 Low Oct 7 and the bear trigger

- SUP 4: 134.96 76.4% retracement of the Aug 28 - Sep 28 rally

Gilts maintain a bullish outlook following last week's gains. Attention is on the next key resistance at 137.04, Sep 21 high and the bull trigger Clearance of this hurdle would reinforce last week's bullish reversal and open 137.14 and potentially 137.78 further out, both Fibonacci projection levels. Initial support lies at 136.27, Oct 15 low. A break would dampen the current positive outlook and signal scope for a deeper corrective pullback.

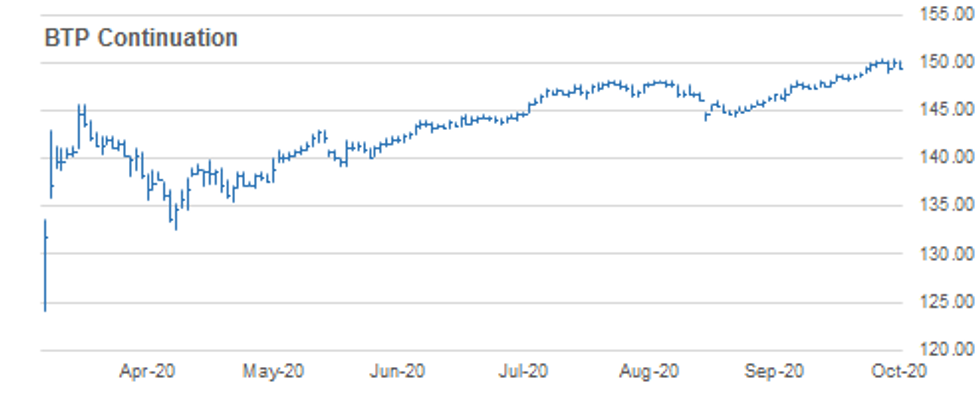

BTPS TECHS: (Z0) Move Lower Considered A Correction

- RES 4: 152.00 Round number resistance

- RES 3: 151.66 Bull channel top drawn off the Sep 8 low

- RES 2: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 1: 150.46 High Oct 16 and the bull trigger

- PRICE: 149.43 @ Close Oct 19

- SUP 1: 149.01 Low Oct 15

- SUP 2: 148.72 20-day EMA

- SUP 3: 147.32 Low Sep 28 and key near-term support

- SUP 4: 146.98 Low Sep 22

BTPS outlook remains bullish despite yesterday's pullback. Last week's gains resulted in the contract extending gains into uncharted territory, maintaining the bullish price sequence of higher highs and higher lows that defines an uptrend. Resistance and the bull trigger is located at 150.43, Oct 14 high. Initial support has been defined at 149.01, Oct 15 low. A break of this level is required to signal scope for a deeper corrective pullback.

EUROSTOXX50 TECHS: Focus Is On Support

- RES 4: 3348.77 High Sep 16

- RES 3: 3326.79 High Sep 18

- RES 2: 3305.77 High Oct 12 and key near-term resistance

- RES 1: 3282.52 High Oct 19

- PRICE: 3242.51 @ Close Oct 19

- SUP 1: 3174.64 Low Oct 15

- SUP 2: 3147.28 Low Oct 2 and key support

- SUP 3: 3097.67 Low Sep 25 and the bear trigger

- SUP 4: 3054.11 Low June 15

EUROSTOXX 50 suffered a sharp setback on Oct 15 extending the pullback from 3305.77, Oct 12 high. The move lower potentially reverses the recent recovery since Sep 25. Attention is on 3147.28, Oct 2 low where a break would expose the key support handle at 3097.67, Sep 25 low. Clearance of this level would represent an important bearish break. The bull trigger is at 3269.87, Oct 12 high.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.