-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

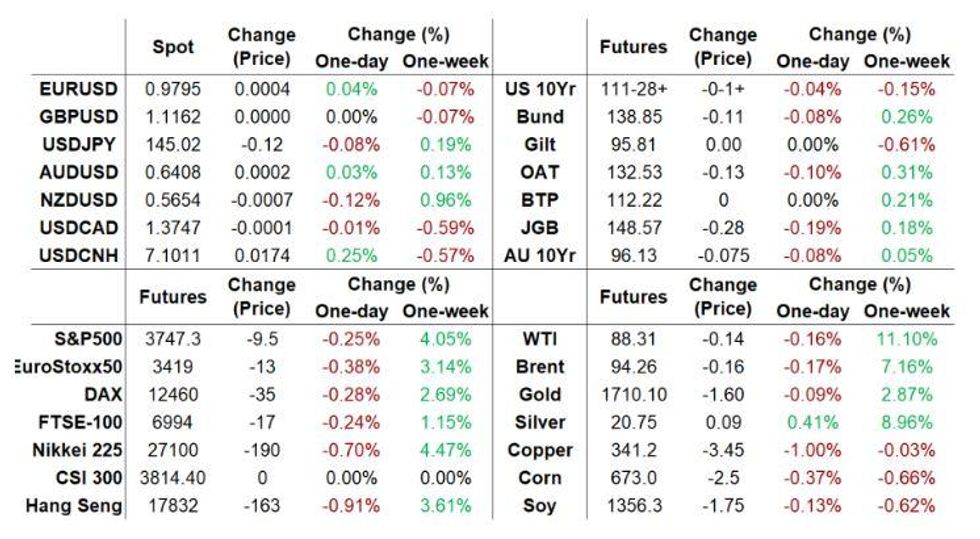

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Tick Lower In Pre-NFP Asia Trade

- Asia-Pac equity indices are mostly lower at typing, tracking a negative lead from Wall St. Semiconductor stocks across the region struggled, sliding after AMD reported disappointing preliminary financials after the bell, adding to bearish pressure as optimism re: a Fed pivot from earlier in the week has faded.

- Thursday's rally in the greenback lost steam in Asia and the currency lagged all its G10 peers. Headline flow failed to offer much in the way of notable catalysts, keeping most major FX pairs in tight ranges, with all eyes on much-awaited U.S. jobs data today.

- The U.S. NFP report provides the single focal point on Friday.. German industrial output and Canadian unemployment will also cross the wires today, while Fed's Williams, Kashkari & Bostic will speak, as will BoE's Ramsden.

US DATA: MNI US Payrolls Preview: Significant Two-Sided Risk

- Consensus sees NFP growth moderating to 260k in Sept after the 315k from August’s ‘goldilocks’ report.

- Indications of tightness from AHE and the u/e rate combined with recovery in participation will help shape the market reaction after the u/e rate ticked up two tenths and wage growth cooled moderately in Aug.

- Analyst expectations imply a reasonable chance of small beats for the u/e rate and wage growth, at least at a first glance on rounding, potentially paving way for an initial overreaction to small surprises.

- That said, recent market moves open significant two-sided risk to larger surprises in the report, even with CPI and other important data releases still to come before the Nov 2 FOMC decision.

- Please find the full preview here: USNFPOct2022Preview.pdf

US DATA PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

| Daiwa | +375K | Amherst Pierpoint | +350K |

| Jefferies | +350K | RBC | +330K |

| BNP Paribas | +315K | Bank of America | +300K |

| Credit Suisse | +300K | J.P.Morgan | +300K |

| NatWest | +300K | Scotiabank | +300K |

| TD Securities | +300K | Nomura | +280K |

| Societe Generale | +280K | Deutsche Bank | +275K |

| HSBC | +275K | Wells Fargo | +275K |

| Citi | +265K | Barclays | +250K |

| Morgan Stanley | +250K | UBS | +250K |

| BMO | +225K | Goldman Sachs | +200K |

| Median | +290K | BBG Whisper | +265K |

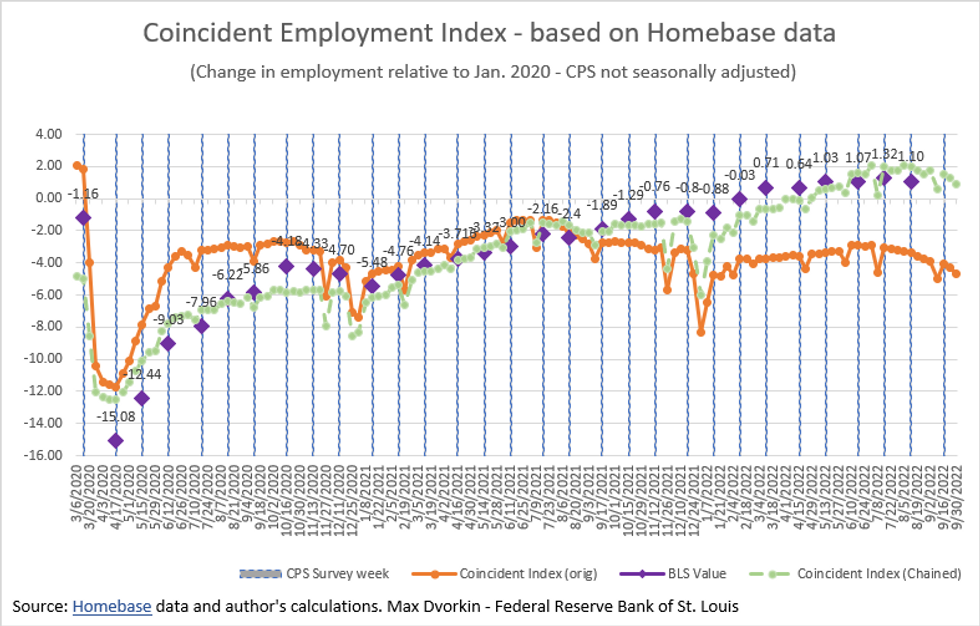

MNI BRIEF: Fed Model Sees Substantial Decline in Sept Hiring

U.S. employment may have declined substantially in September, according to a St. Louis Fed analysis of real-time data from employee scheduling software provider Homebase, economist Max Dvorkin told MNI.

The St. Louis Fed's Coincident Employment Index is showing a downward trend in the past few weeks, "which suggests a substantial decline in employment," Dvorkin said. Negative seasonality factors further drag down the -732,000 unadjusted figure to -913,000, a "very substantial" drop in employment for September. The figures correspond to the BLS's household survey.

He cautioned however that the Homebase sample has a high concentration of small firms in retail and leisure and hospitality and that composition bias may skew the forecast too negative. Real-time data from UKG, a different payroll and time-scheduling company, shows declines in these sectors and in small firms this month, but not so much in others, he said.

Markets are expecting Friday's jobs report to show U.S. payroll gains slowing to 250,000 from 315,000 a month earlier, based on the BLS establishment survey. The Fed is keen to see signs that the overheated labor market is starting to cool off, but has signaled it would only reduce the pace of interest rate increases if inflation slows.

US TSYS: Block Sales Offsets Downtick In Equities Ahead Of Payrolls

Cash Tsys are virtually unchanged across the curve into London hours, with the latest round of hawkish Fedspeak (via Waller & Mester) and block sales in the FV & TY futures contracts cancelling out any bullish impetus from weaker equities during overnight trade.

- TYZ2 made a brief and very limited showing below its Thursday base in the wake of the TY block sales. The contract last deals -0-01+ at 111-28+, sticking to a narrow 0-04+ range, on volume of ~52K.

- A lack of meaningful headline flow, proximity to the impending NFP release and thinner liquidity on the back of the ongoing Chinese holiday left many sidelined.

- A downtick in e-minis and Chinese equities has failed to generate a bid.

- The NFP print provides the highlight of the wider global docket on Friday (see our full preview of that event here), with Williams, Kashkari and Bostic set to round off Fedspeak for the week.

- A reminder that cash Tsys will be closed on Monday owing to the Columbus Day holiday, although there will be no alteration to CME futures trading hours.

AUSSIE BONDS: Holding Cheaper In Narrow Pre-NFP Trade

Aussie bond futures operate off of worst levels into the bell, with weakness in wider equity markets limiting downside impetus during Sydney hours leaving overnight session losses intact. The proximity to the latest U.S. NFP print also limited price action.

- YM & XM both trade -7.0, off of worst levels, after the former had a look through its overnight base.

- Wider cash ACGB trade sees the major benchmarks running 5-7bp cheaper, with the 5- to 10-Year zone leading the weakness.

- TCV mandated banks to issue a new Sep-36 bond, which will launch and price “in the near future,” with hedging flows in XM futures expected around pricing, as the line will be of benchmark size.

- Bills run 3-8bp cheaper through the reds, with RBA terminal rate price nudging higher on the day, with dated OIS showing a peak of 3.85%.

- The latest RBA FSR came and went without too much to note, with the same holding true for a vanilla weekly AOFM issuance slate.

- There is nothing in the way of major economic releases on Monday’s domestic docket.

JGBS: Futures Hold Cheaper Ahead Of Long Weekend

JGB futures pushed lower in early Tokyo trade, breaching their overnight session base, although bears failed to force a meaningful extension with equities trading on the defensive. The contract is -28 ahead of the bell, just off worst levels, while wider cash JGB trade sees the major benchmarks running little changed to 2.5bp cheaper, with weakness led by 40s after Thursday’s cheapening in wider core global FI markets.

- Local data saw softer than exp. household spending data, while wage growth provided a modest beat vs. expectations (albeit with real wage growth residing comfortably in negative territory in Y/Y terms).

- Japanese Finance Minister Suzuki & Prime Minister Kishida failed to offer much colour on the FX intervention front, as you would expect, with a lack of domestic headline flow observed outside of their run-of-the-mill comments re: FX.

- Japanese markets are closed on Monday as the country observes a national holiday.

NZGBS: NZGBs Cheaper Ahead Of The Weekend

The major NZGB benchmarks finished Friday’s pre-NFP session 9-10bp cheaper.

- The early weakness saw a mild extension as global core FI markets struggled to catch a bid, with participants zeroed in on the aforementioned U.S labour market report.

- Swap rates pressed higher, with 2-Year swaps now ~10bp off their cycle high.

- RBNZ terminal rate pricing nudged 5-10bp higher on the day, with RBNZ dated OIS sitting around 4.80% late in the local session, within the recently observed range.

- Local headline flow was non-existent.

- Next week’s domestic data releases include card spending data, REINZ house sales readings, food prices and the manufacturing PMI.

FOREX: Greenback Tad Softer With Market On NFP Watch

Thursday's rally in the greenback lost steam in Asia and the currency lagged all its G10 peers. Headline flow failed to offer much in the way of notable catalysts, keeping most major FX pairs in tight ranges, with all eyes on much-awaited U.S. jobs data today.

- The BBDXY snapped a two-day winning streak, even as Fed Governor Waller despite reinforcing the Fed’s commitment to fighting inflation during the NY-Asia crossover. The official noted that the Fed does "not face a tradeoff between our employment objective and our inflation objective, so monetary policy can and must be used aggressively to bring down inflation."

- Spot USD/JPY ground lower, returning under the Y145.00 mark, seen as an informal threshold of heightened intervention risk. The pair last sits just shy of there at Y144.96. PM Kishida told parliament that rapid, one-sided JPY moves are not desirable, but was generally laconic on the matter. FinMin Suzuki admitted that the recent FX intervention contributed to the record slump in Japanese foreign reserves last month.

- The Aussie dollar outperformed at the margin, with AUD/NZD extending yesterday's advance as a result.

- Financial markets in mainland China remained shut due to a public holiday, but will re-open on Monday. Offshore yuan has gained ~0.6% versus the greenback this week, which reduces pressure on the PBOC amid its efforts to manage the redback's decline.

- The U.S. NFP report provides the single focal point on Friday, after initial jobless claims rose more than forecast in the week through Oct 1.

- German industrial output and Canadian unemployment will also cross the wires today, while Fed's Williams, Kashkari & Bostic will speak, as will BoE's Ramsden.

FX OPTIONS: Expiries for Oct07 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9730-38(E1.1bln), $0.9750(E695mln), $0.9775(E506mln), $0.9800(E1.6bln), $0.9845-55(E1.8bln), $0.9900-02(E1.8bln), $0.9915-25(E1.8bln), $0.9941-55(E1.2bln), $1.0100(E2.0bln)

- GBP/USD: $1.0923(Gbp668mln), $1.1300(Gbp544mln), $1.1400(Gbp572mln)

- EUR/GBP: Gbp0.8690-00(E1.1bln)

- USD/CAD: C$1.3885-00($1.1bln)

- USD/CNY: Cny6.80($2.4bln), Cny7.09($600mln)

ASIA FX: Softer End To The Week

USD/Asia pairs are higher today, albeit to varying degrees. Weaker equity sentiment in the region has weighed, while Asian currencies have seen some underperformance relative to the majors. Still to come is Taiwan trade figures, while the China Caixin services PMI prints tomorrow. Next week is headlined by the BoK and MAS decisions, along with China data.

- USD/CNH pushed above 7.1000 early and we currently sit fairly close to this level. Onshore covid case numbers are trending back up. FX reserves didn't fall as much as expected in September, holding above $3000bn. Onshore markets return from holidays on Monday.

- USD/KRW rebounded from the low 1400 level (last 1411). The authorities once again pledged to curb excessive volatility in financial markets. This has helped the Kospi outperform, but the index is still down on the day. Comments from BoK Governor Rhee point towards a 50bps hike next week.

- USD/TWD has rebounded off the 20-day MA (31.514), last at 31.63, with TWD weighed by tech outlook concerns. Still to come is September export figures.

- USD/INR has surged through 82.00, last at 82.37, around +0.60% above closing levels from yesterday. RBI intervention was reported around 82.30, so the central bank could look to curb further weakness as the session progresses.

- SGD has outperformed. USD/SGD has remained wedged below 1.4300 for much of the session. The MAS policy announcement is next Friday, where further tightening is expected.

- IDR has seen little relief from yesterday's strong equity inflow ($266.8mn). USD/IDR last traded at 15241, +53.5 figs on the day. 5-yr CDS continues to drift wider.

- USD/THB is back to 37.46, +0.32% for the session, in line with moves seen in the rest of the region. BoT Asst Gov Piti said in an interview that markets should be listening to the central bank's communications instead of focusing just on interest rate moves. He noted that the BoT will "not deliberately surprise the market," but this will not stop it from "doing what we think is needed."

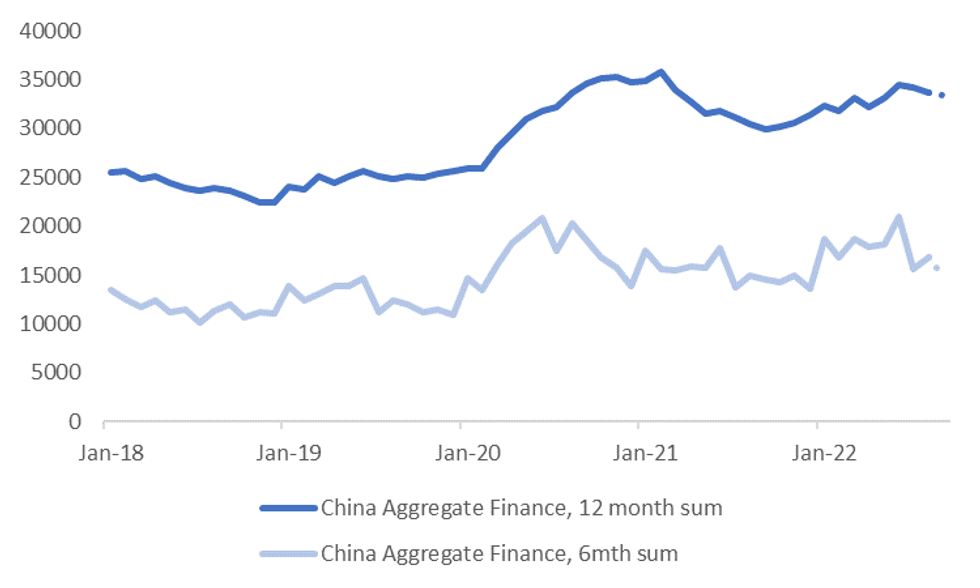

CHINA DATA: Data Back In Focus Over The Coming Week

China's activity data calendar swings back into gear tomorrow, with the Caixin services PMI out. The market expects a 54.4 print from 55.0. Recall the official services PMI surprised on the downside at the end of September (50.6 against 52.4 expected).

- From Sunday onwards until the end of next week, September aggregate financing figures are due. The market expects a slight uptick in both aggregate finance (CNY2700bn versus CNY2432.2bn previously), and new loans (CNY1800bn against CNY1254.2bn last month).

- Such outcomes would do little to change the moderate picture in terms credit expansion. The chart below plots the rolling 6 and 12 month sums for aggregate finance (with the dots assuming the consensus forecast for September is realized).

- Bloomberg stated the 1yr MLF decision could come in the second half of next week, although there is a risk it slips to the start of the following week. In any event the market expects no change in the 1yr rate at 2.7%.

- Finally, next Friday delivers September CPI (2.8% f/c versus 2.5% in August) and PPI prints (1.1% f/c from 2.3% previously). Trade is also out, export growth is expected to slow further (4.0% f/c from 7.1%), but the trade surplus is forecast to remain very elevated ($80.75bn).

Fig 1: China Aggregate Finance Trends

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia; Tech Stocks Slip As AMD Disappoints

Asia-Pac equity indices are mostly lower at typing, tracking a negative lead from Wall St. Semiconductor stocks across the region struggled, sliding after AMD reported disappointing preliminary financials after the bell, adding to bearish pressure as optimism re: a Fed pivot from earlier in the week has faded.

- The TAIEX (-1.2%) is accordingly one of the worst performers region-wide, dragged lower by the semiconductor sub-gauge (-2.3%), with index heavyweight TSMC (-2.6%) leading the way lower.

- The Hang Seng deals 1.1% softer at typing, with China-based tech (HSTECH: -2.7%) and property (Hang Seng Mainland Properties Index: -4.4%) contributing the most to losses.

- Chinese EV stocks were notable underperformers, with the likes of Li Auto (-16.0%) and XPeng (-7.1%) experiencing sharp declines amidst jitters over the outlook for EV sales.

- The ASX200 trades 0.5% lower at typing, with the benchmark still on track to close ~4.8% firmer on the week after its strong post-RBA rally.

- E-minis sit 0.1% softer apiece at writing, sticking to the bottom end of their respective ranges on Thursday, having struggled to make meaningful headway above neutral levels throughout Asia-Pac dealing.

GOLD: Holding Above $1,700/oz Ahead Of NFPs

Gold deals ~$3/oz softer to print ~$1,709/oz at writing, extending a move away from three-week highs established on Tuesday as the USD (DXY) and U.S. real yields have simultaneously unwound some of their recent declines.

- To recap, gold closed ~$4 lower on Thursday, having consolidated an earlier move lower despite weekly jobless claims printing above expectations, succumbing to an uptick in the DXY and U.S. real yields.

- Thursday’s deluge of Fedspeak was uniformly hawkish, with several speakers reiterating the Fed’s commitment to the inflation fight, and pushing back against the idea of a Fed pivot.

- Nov FOMC dated OIS now price in ~72bp of tightening at that meeting, operating at their highest levels for the week.

- Total known ETF holdings of gold are on track to decline for a 17th straight week, pointing to no let-up in weaker sentiment towards the yellow metal.

- From a technical perspective, gold has established a short-term bull cycle. Initial resistance is seen at ~$1,729.5 (Oct 4 high), with further resistance located at $1,735.1 (Sep 12 high and key resistance), while initial support is seen at $1,695.2 (former trendline resistance).

OIL: On Track For Higher Weekly Close; U.S. Response To OPEC+ Cuts Eyed

WTI and Brent are little changed, operating just shy of the respective best levels observed on Thursday. Both benchmarks are on track for their largest weekly gain in months, with WTI sitting >10% firmer for the week at typing.

- Participants will be watching for the U.S. response to the OPEC+ output quota cut, with some of the measures possibly involving a further release of crude from the SPR, or restrictions on U.S. energy exports.

- Meanwhile, U.S. Senate Majority Leader Schumer stated that the “NOPEC” bill (allowing the U.S. to file antitrust lawsuits against members of OPEC) remains on the table, although BBG sources reported that there are no plans to bring the measure to the floor at present.

- Elsewhere, Norway announced that it expects crude production capacity at the Johan Sverdrup oilfield to rise by ~220K bpd in ‘23.

- Looking ahead, leaders from >40 nations will meet at the inaugural summit of the European Political Community later on Friday, with energy-related issues likely to rank highly on the agenda amidst a mix of multilateral and bilateral meetings.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/10/2022 | 0545/0745 | ** |  | CH | Unemployment |

| 07/10/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/10/2022 | 0600/0800 | ** |  | DE | Retail Sales |

| 07/10/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 07/10/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 07/10/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 07/10/2022 | 0645/0845 | * |  | FR | Current Account |

| 07/10/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/10/2022 | 0800/1000 |  | EU | ECB Consumer Expectations Survey Results - August | |

| 07/10/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 07/10/2022 | 1025/1125 |  | UK | BOE Ramsden Speech at Securities Industry Conference | |

| 07/10/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/10/2022 | 1230/0830 | *** |  | US | Employment Report |

| 07/10/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 07/10/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 07/10/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.