-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: JGB Yields Climb As BoJ Scales Back Bond Buying

EXECUTIVE SUMMARY

- GOOLSBEE SEES NO ‘LAST MILE’ INFLATION PROBLEM - MNI BRIEF

- BIDEN TO HIKE TARIFFS ON CHINA EVS, OFFER SOLAR EXCLUSIONS - BBG

- BOJ CUTS SCALE OF 5-10YR JGB BOND BUYING BY JPY50BN - MNI BRIEF

- BOJ EYES YEN DESPITE SMALL IMPACT SO FAR - SEKINE - MNI INTERVIEW

- CHINA APRIL M2 UNEXPECTEDLY SLOWS TO RECORD LOW - MNI BRIEF

- CHINA SAID TO PLAN FIRST ULTRA-LONG CENTRAL DEBT SALE ON FRIDAY - BBG

- AUSTRALIAN TREASURY SEES INFLATION HITTING RBA TARGET IN ‘24 - BBG

Fig. 1: JGB Nominal 10yr & 20yr Yields

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Rishi Sunak will pitch himself as the best candidate to achieve a “more secure future” for Britain in a political speech designed to re-capture the narrative ahead of the UK general election, just over a week after his party suffered heavy losses in local votes.

ISRAEL (BBC): A UK ban on selling arms to Israel would only strengthen Hamas, the foreign secretary has told the BBC. Lord Cameron said while he would not support a major ground offensive in the Gazan city of Rafah, the UK would not copy US plans to stop some arms sales. He said the UK supplies just 1% of Israel's weapons and warned Israel must do more to protect civilians and allow humanitarian aid through.

EUROPE

RUSSIA (RTRS): Russian President Vladimir Putin tapped a civilian economist as his surprise new defence minister on Sunday in an attempt to gird Russia for economic war by trying to better utilise the defence budget and harness greater innovation to win in Ukraine.

UKRAINE (BBG): Ukraine’s leader Volodymyr Zelenskiy called on his people not to panic amid Russia’s ongoing advance in the Kharkiv region that’s jeopardizing a local city.

UKRAINE (FRANCE 24): Russia said Sunday it had captured four more villages in Ukraine's Kharkiv region, as thousands of residents were evacuated from the offensive in an area where Russian troops were repelled in 2022.

FRANCE (FRANCE 24): US retail giant Amazon is expected to announce a €1.2-billion ($1.3-billion) investment in France, the French government said Sunday, while pharmaceutical giants Pfizer and AstroZeneca have pledged nearly €1 billion ahead of the annual Choose France summit on foreign investment starting Monday.

SPAIN (BBG): Spanish Prime Minister Pedro Sanchez’s Socialist party won a local election in Catalonia, affirming his decision to negotiate with the separatist movement in the wealthy Northeastern region.

U.S.

FED (MNI BRIEF): Chicago Federal Reserve President Austan Goolsbee on Friday rejected the idea inflation has a so-called 'last mile' problem and was hopeful recent setbacks reflect a "bump" on the way back to price stability.

FED (MNI BRIEF): Gov. Bowman (voter) told Bloomberg News in an interview that she doesn’t see rate cuts being warranted this year. “I, at this point, have not written in any cuts” for 2024, Bowman said in the interview, referring to the economic projections officials submit each quarter. “I’ve sort of had an even expectation of staying where we are for longer. And that continues to be my base case.” She wants to see a “number of months” of better inflation data and expects it will probably be “a number of meetings” before she’s ready to cut.

LOANS (MNI BRIEF): Commercial real estate and consumer loan delinquencies have been increasing but asset quality in the U.S. banking system is generally sound, the Federal Reserve said Friday in its semiannual supervision and regulation report. Deposits have also increased in the first three months of the year after falling sharply during the regional bank crisis of March 2023, the regulator said.

US/CHINA (BBG): President Joe Biden will quadruple tariffs on Chinese electric vehicles and sharply increase levies for other key industries this week, unveiling the measures at a White House event framed as a defense of American workers, people familiar with the matter said.

OTHER

JAPAN (MNI INTERVIEW): The weak yen could hasten monetary tightening should it feed upside price risks, even if the underlying inflation trend remains below its 2% target, a former Bank of Japan chief economist told MNI, though he noted the impact of currency weakening on inflation so far had been minimal.

JAPAN (MNI BRIEF): The Bank of Japan has promoted Kazushige Kamiyama, director-general of the international department, to the Osaka branch manager and one of the six executive directors, the BOJ revealed Monday.

JAPAN (BBG): The Bank of Japan on Monday revealed it had lowered the scale of Japanese government bond buying with a remaining life of five to 10 years to JPY425 billion from April 24's similar JPY475 billion operation.

AUSTRALIA (BBG): Australia’s Treasury is forecasting that inflation could return to the central bank’s target band before the end of 2024 — earlier than either the government or the bank previously predicted — as part of its upcoming budget.

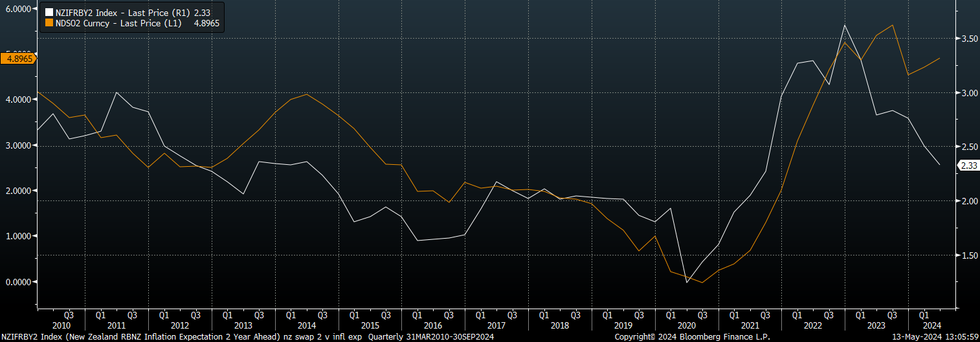

NEW ZEALAND (BBG): New Zealand inflation expectations fell to their lowest level in almost three years, supporting investor bets that the central bank will be able to start cutting interest rates later this year. The kiwi dollar dipped.

BRAZIL (MNI POLICY): The Brazilian central bank's deeply split decision to slow the pace of interest rate cuts to a quarter point this week likely reflected concerns among dissenters that the move could send the wrong signal to investors about policymakers' reaction function, MNI understands.

CHINA

INFLATION (MNI BRIEF): China's Consumer Price Index rose by 0.3% y/y in April, higher than the previous 0.1% increase and outperforming the market consensus of 0.2%, data from the National Bureau of Statistics showed Saturday.

CREDIT/MONEY SUPPLY (MNI BRIEF): China's M2 money supply slowed more than expected to 7.2% y/y, hitting a new low since the data was first recorded in 2009, while aggregate finance declined for the first time in about two decades, data released by the People's Bank of China showed Saturday.

DEBT (BBG): China plans to start selling the first batch of its 1 trillion yuan ($138 billion) of ultra-long special central government bonds on Friday, according to people familiar with the matter, as it seeks to raise funds to support the world’s second-biggest economy.

DEBT (MNI BRIEF): China’s Ministry of Finance published its 2024 schedule for issuing general treasury and ultra-long-term special treasury bonds on Monday. The notice revealed ultra-long-term special treasury bonds would print with maturities of 20, 30 and 50 years. The ministry will start issuance of the 30-year bonds on May 17, 20-year on May 24, and the 50-year on June 14.

CHINA MARKETS

PBOC Conducts CNY2 Bln Via OMO Mon; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo Monday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8267% at 10:05 am local time from the close of 1.8520% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Friday, compared with the close of 43 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1030 on Monday, compared with 7.1011 set on Friday. The fixing was estimated at 7.2261 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND APRIL BNZ SERVICES PSI FALLS TO 47.1; PRIOR 47.2

NEW ZEALAND APRIL FOOD PRICES RISE 0.6% M/M; PRIOR -0.5%

NEW ZEALAND 2Q 2-YEAR INFLATION EXPECTATIONS 2.33%; PRIOR 2.5%

NEW ZEALAND 2Q 1-YEAR INFLATIN EXPECTATIONS 2.7%; PRIOR 3.2%

AUSTRALIA APRIL NAB BUSINESS CONFIDENCE 1; PRIOR 1

AUSTRALIA APRIL NAB BUSINESS CONDITIONS FALL TO 7; PRIOR 9

AUSTRALIA APRIL CBA HOUSEHOLD SPENDING FALLS 1.0% M/M; PRIOR +0.4%

AUSTRALIA APRIL CBA HOUSEHOLD SPENDING RISES 2.6% Y/Y; PRIOR +3.9%

JAPAN APRIL M3 MONEY STOCK RISES 1.6% Y/Y; PRIOR 1.8%

JAPAN APRIL M2 MONEY STOCK RISES 2.2% Y/Y; PRIOR 2.5%

SOUTH KOREA MAY 1-10 EXPORTS GAIN 16.5% Y/Y

SOUTH KOREA MAY 1-10 IMPORTS FALL 6.7% Y/Y

SOUTH KOREA MAY 1-10 TRADE DEFICIT $554M

SOUTH KOREA APRIL HOUSEHOLD LENDING RISES TO KRW1,103.6T; PRIOR KRW1,098.5T

MARKETS

US TSYS: Treasuries Little Changed, Ranges Tight Ahead of US CPI Later This Week

- Treasury futures ticked higher in early morning trading, before the long-end pared gains with weakness in JGBs contributing to the move. The 10Y contract is up (+ 01+) at 108-24, with intraday highs of 108-25+, while the 2Y contract is has held up throughout the day now trade near intraday highs, up ( + 00⅜) at 101-20.75.

- Looking at 10Y technicals, we still sit comfortably above initial support at 108-15+ (20-day EMA) a break here would open a retests of 107-04 (Apr 25 lows), while initial resistance is 109-06+/08+ (Channel top from Feb 1 high / 50-day EMA)

- Cash Treasury curve bull-steepened today, yields are about flat to 1bps lower, with the 2Y -0.9bps at 4.856%, the 10Y -0.2bp to 4.494% with the 2y10y -0.436 at -36.693.

- Looking across local rates markets: NZGBs yields are flat to 0.5bps lower, ACGBs are 1-2bps higher while JGBs are 1-4bps higher.

- The projected rate cut pricing cooled vs. late Thursday: June 2024 at -5% w/ cumulative rate cut -1.2bp (-2.5bp late Thu) at 5.307%, July'24 at -22% w/ cumulative at -6.7bp (-9bp late Thu) at 5.253%, Sep'24 cumulative -19.2bp vs. -22.4bp, Nov'24 cumulative -27.7bp -31.1bp, Dec'24 -40.9bp vs. -45bp.

- Looking Ahead: A slow start to the week, focus is on PPI and CPI on Tue/Wed

JGBS: Eyeing Downside Test Of Late Apr Lows As BoJ Reduced 5-10 JGB Purchases

JGB futures maintain a firm downside bias in afternoon dealings. We were last around 143.92, -.34. This is slightly up from session lows (143.86). April 26 lows rest back at 143.61. Beyond that lies 143.44, which is a key support point.

- Sentiment has remained weak since the BoJ bond buying op curtailed purchases in the 5-10yr tenor space compared with the late April operation (by ¥50bn). Whilst the amount purchased was still within the projected range for the current quarter it will likely sharpen focus around the likelihood of reduced purchases as we progress further into 2024.

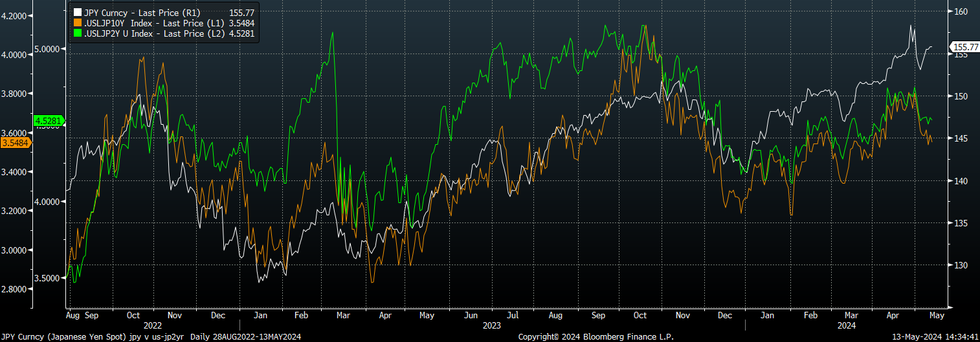

- USD/JPY dipped initially on the news, but hasn't seen any downside follow through. The latest from our Tokyo Policy team notes risks the weaker yen trend could hasten the policy tightening process (see this link).

- In the cash JGB space, the 10yr yield is above 0.94%, +3bps higher. From the 5 yr to 40yr tenor we are around 3bps in yield terms. 10yr swap is above 1.01%, while the 20 and 30yr tenors are up 5bps in yield terms.

- Tomorrow, we have the PPI for April, along with the 5yr debt auction.

AUSSIE BONDS: ACGBs Slightly Cheaper, Federal Budget Tomorrow

ACGBs (YM 0.0 & XM -1.5) are cheaper today, earlier we had NAB Business survey's with business confidence stable at 1 in April but conditions eased further to 7 from 9, only slightly above the series average, while CBA household spending fell 1.0% m/m in Apr, from a 0.2% rise in March.

- Cross-asset moves: US equity futures are a touch lower today, while the ASX200 is down 0.24%, the BBDXY is little changed today the AUD is down 0.13%, while Iron ore is down 0.19% and now trades at $116.45/ton.

- US Tsys curve is slightly steeper today, however we have remained in very tight ranges with yields flat to 1bps lower, with the 2Y -0.9bps at 4.856%, the 10Y -0.2bp to 4.494% with the 2y10y -0.436 at -36.693.

- The ACGB curve has bear-steepened today, yields are flat to 2bps higher with the 2y10y +1.220 at 30.32, while the AU-US 10-year yield differential is 1bps lower, now -16bps

- Swap rates are 2-4bps lower.

- The bills strip is slightly richer, up 1bp

- RBA-dated OIS implied rate now pricing 2-3bps higher into the November meeting, while the market is now pricing just 7bps of easing into year-end to a terminal rate of 4.28%

- Looking ahead, Tuesday we have the Federal Budget handed down

NZGBs: Little Changed As Inflation Expectations Fall

NZGBs are little changed today, earlier inflation expectation data showed a drop in both the 1yr and 2yr, while food prices increased in April to 0.6% from -0.5% in March. US Tsys futures are a touch higher, while the curve has steepened slightly. Elsewhere in the rates space JGB futures gapped lower on the BoJ bond buying announcement, which reduced purchases in the 5-10 year tenor compared to the late April buying op.

- US Treasury futures have ticked up just a touch with the 10Y up (+ 01+) to 108-24, ranges have been tight while volumes have been on the lower side.

- Earlier, the Performance Services Index fell to 47.1 from 47.2 the lowest since October 2022, Food prices rose 0.6% in April from a decline of -0.5% in March, and finally the 1-year inflation expectations eased to 2.73% from 3.22% in Q1 and the 2-year expectations eased to 2.33% from 2.50% in Q1.

- NZGB yields erased the mornings moves higher to trade near best levels for the day now, with yields closing about 0.5bps richer.

- Swap rates are 1-3bps lower. The NZD 2y OIS Swap has typically traded in line with the 2yr RBNZ inflation expectation but has broken that correlation over the past year. Chart 1

- RBNZ dated OIS is 2-3bps softer out past the August meeting with a cumulative 47bps of easing is priced by year-end

- Looking Ahead: REINZ House Sales on Tuesday

Source - BBG

Source - BBG

FOREX: USD/JPY Dips Supported Despite Lower BoJ Bond Buying, NZD Down With Inflation Expectations

The USD BBDXY index sits just a touch higher for the session, last near 1254. We are down from earlier highs as the yen received some support after the BoJ reduced its bond buying pace modestly compared with late April.

- USD/JPY looked set to challenge the 156.00 level but the reduced pace of bond buying in the 5-10 tenor aided sentiment. The pair pulled back to 155.52, but didn't see any further follow through. We sit back at 155.75/80, unchanged for the session.

- Japan yields are marching higher, which is weighing on US-JP yield differentials, particularly at the back end of the curve. USD/JPY looks too high relative to such trends, see the chart below, although broader USD sentiment has mostly remained firmer today. Our Tokyo policy team notes the central bank could hasten the policy tightening process given the weak yen backdrop (see this link).

- USD/CNH has climbed above 7.2400 amid weaker data and fresh easing expectations. Higher US tariff prospects have weighed.

- NZD/USD is back close to 0.6000 post a further easing in Q2 inflation expectations. Some support was evident around this figure level though and the onshore rate impact has been limited. AUD/USD is also down, albeit outperforming NZD at the margins. The pair was last under 0.6600. We saw the AUD/NZD cross spike above 1.0990 on the weaker inflation expectations outcome but we have since lost momentum.

- Later the Fed’s Mester and Jefferson discuss central bank communications. In terms of data there is just US NY Fed 1-year inflation expectations for April. The Eurogroup meeting is being held and the ECB’s Buch is scheduled to speak. The focus this week will be on Wednesday’s US April CPI release.

Fig 1: USD/JPY & US-JP Yield Differentials

Source: MNI - Market News/Bloomberg

ASIA STOCKS: HK Continues To Outperform Mainland Stocks As Tariffs Hurt EV Names

Hong Kong and China equities are mixed today with HK equities outperforming. On Saturday, we had CPI which was slightly above expectations, while PPI missed estimates. Chinese Biotech stocks climbed this morning after the US issued a revised version of a bill aimed at blocking foreign biotech firms from acquiring US federal contracts, a provision was added that the deadline for US companies to stop working with blocked firms is now 2032, WuXi Apptec was up as much at 15% earlier before paring gains and trading up 6.70%, China EV names are lower as the US continues to mull over Tariffs. While in the property space Country Garden made payment on two onshore bonds within the grace period and Logan has proposed to suspend payment on all onshore bonds.

- Hong Kong equities are mostly higher today with the HSTech Index is up 1.05% at 4,004 we have failed to hold above 4,000 multiple times this month, the Mainland Property Index is down 0.40% today after rallying 4.20% on Friday, the China EV Index is trading down 1.30%, while the HSI is up 0.44%. China onshore markets are lower today, with the CSI300 unchanged and closed the week above the 200-day EMA, while small-cap index the CSI1000 is down 0.77% and the ChiNext off 0.61%.

- China Northbound saw a -6.2b yuan outflow on Friday, flows over the week were +4.8b yuan with equity flow momentum declining over the same period, 5-day average now at 0.95b, sitting just above the 20-day average at 0.83b and the 100-day average at 0.66b yuan.

- In the property space, Country Garden made interest payments totaling 66 million yuan ($9.1 million) for two bonds within a grace period after missing the initial deadline. Despite government support measures, the company's mounting cash strains highlight challenges in the Chinese property sector. Logan, has proposed a plan to its bondholders to suspend payment on all of its onshore public debt for 10 months, seeking to delay interest and principal payments on its yuan bonds and asset-backed securities until March or April 2025. If approved, Logan plans to develop a new restructuring plan for its onshore public debt, potentially including options like a discounted tender offer and a trust plan. Finally, China will curb land supplies and further ease restrictions on property purchases to aid the housing market, Securities Times reported.

- Over the weekend China released PPI & CPI data. CPI rose by 0.3 percent year-on-year in April, staying in positive territory for the third straight month while PPI which measures costs for goods at the factory gate, went down 2.5 percent year on year in April.

- Looking ahead, 1yr MLF on Wednesday, Industrial Production & Retail Sales on Friday

ASIA PAC STOCKS: Regional Asian Equities Lower, AU Federal Budget Tomorrow

Asian equity markets are mixed today, Taiwan equities are the top performing market led by the semiconductor sector. There isn't much on the data calendar today, earlier we have NZ Food prices which increased from the month prior and Australia's NAB business survey's which show business conditions had fallen from the month prior.

- Japanese equities are little changed today, the real estate sector is the worst performing. There has been little in the way of headlines out of the region, with government officials staying surprising quiet on the currency so far today, the yen continued to slip on Friday and we currently trade little changed on the day at 155.75. The Nikkei 225 is up 4.10% from the lows on Apr 19th but has failed to break back above the 20 & 50-day EMAs and trades down 0.32%, the Topix has performed slightly better over the same period up 5% and holds above all moving averages, however trades down 0.30%

- South Korean equities are lower today, earlier April household spending rose to KRW1,103.6T from KR1098.5t in March. The Kospi continues to comfortably hold above all major moving averages, while the RSI is holding above 50 and MACD indicator is holding steady, signaling buyers still remain in control, the index is down 0.32% today.

- Taiwan equities are the top performers today, flows turned positive again on Friday as investors continue buying up semiconductor stocks. It's a very quiet week on the data front for Taiwan with nothing scheduled. The Taiex opened at new all-time highs this morning, however we trade just off those levels now, up 0.83%.

- Australian equities are lower today, as investors await the federal budget that will be released on Tuesday, while earlier NAB's monthly business survey's showed that conditions eased in April, with trading, profitability and employment all back around their long-term averages. The ASX200 is down 0.25%.

- Elsewhere in SEA, New Zealand equities are down 1% with the 1yr inflation expectation falling to 2.73% from 3.22% and the 2yr falling to 2.33% from 2.50%, Indonesian equities have returned from their break and are trading up 0.10%, Philippines equities are up 1%, Malaysian equities up 0.15% and Indian equities up 0.45%

OIL: Prices Lower On Soft China Data, Reports This Week Should Clarify Outlook

Oil prices are off today’s lows but are still down on the day. Brent is down 0.3% at $82.54 after falling to $82.26/bbl, while WTI is 0.2% lower at $78.08 after reaching $77.78. The latter has spent a reasonable amount of time below $78 today. With geopolitical tensions easing, markets are focused on fundamentals again and feel uncertain re the outlook. The USD index is slightly stronger.

- Data from China over the weekend have made oil markets wary re demand prospects. Lending data was disappointing and CPI inflation remained low.

- On the supply side, attention has shifted to the June 1 OPEC+ meeting where existing output cuts are expected to be extended into H2. Iraq said earlier that it wouldn’t agree to deeper cuts but then later confirmed it would abide with what OPEC+ decides. OPEC and the IEA release monthly reports this week with updated outlooks.

- Later the Fed’s Mester and Jefferson discuss central bank communications. In terms of data there is just US NY Fed 1-year inflation expectations for April. The Eurogroup meeting is being held and the ECB’s Buch is scheduled to speak. The focus this week will be on Wednesday’s US April CPI release.

GOLD: Off Recent Highs But Technical Backdrop Supportive

Gold is down a touch, last near $2355. We are off intra-session highs from Friday last week (which came in near $2380). At this stage we are 0.20% lower for Monday trade, after gaining 2.55% last week.

- A more stable USD backdrop, coupled with higher core yields, led by the US, is likely weighing on gold sentiment at the margins. Onshore analysts in China last week were also cautioning local investors around lofty gold price levels. We have key US CPI data later this week as well.

- The technical backdrop for gold remains supportive though. The end of the corrective leg lower has unwound the overbought condition and allows markets to focus on next resistance at $2431.50 - the bull trigger. Any return lower would eye $2255.0, the 50-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/05/2024 | 0700/0900 |  | EU | ECB's Cipollone in Eurogroup meeting | |

| 13/05/2024 | 1230/0830 | * |  | CA | Building Permits |

| 13/05/2024 | 1300/0900 |  | US | Cleveland Fed's Loretta Mester | |

| 13/05/2024 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 13/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.