-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI US MARKETS ANALYSIS - Markets Drift Ahead of Fedspeak

HIGHLIGHTS:

- Equities drift after multi-day run higher

- EGBs remain under pressure in extension of post-Fed move

- First on-the-record commentary from the Fed due, with Powell, Clarida, Mester and others due

US TSYS SUMMARY: Fed Speakers Return; Evergrande Still Making Headlines

Heavy overnight volumes (TYZ1>520k) as Tsys trade mildly higher for the most part, 30s little weaker, levels near recent highs on narrow range as China's Evergrande continues to generate angst in mkts after couple bond payments missed overnight.- Equities pare back some of Thu's gains (ESZ1 -16.0 at 4422.0), small US$ bounce (DXY +.057). Little knock-on help from weaker EGBs, Italy 10Y +3.6 vs. Bunds.

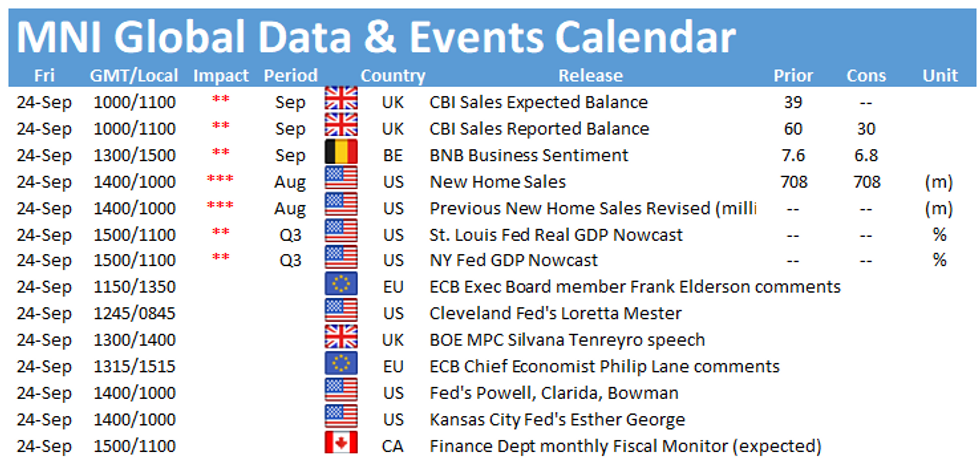

- Fed out of blackout, Chairman Powell joins list of speakers today (Fed Chair Powell, Gov Bowman and VC Clarida, Fed Listens event at 1000ET). Otherwise limited data with New Home Sales (712k est vs. 708k prior; MoM (1.0% est) on tap at 1000ET.

- Oct Tsy options expiring generating some two-way hedging, next week's Tsy 2s, 5s and 7Y auctions helping keep rates in range. Yield curves mixed with short end little flatter (2s10s -1.7 at 114.9) after surging to mid-July levels; 5s30s little steeper but still under 100bp at 99.5.

- Large Eurodollar volumes, EDZ1 >145k after seller -50k 99.82 (+0.010).

- Currently the 2-Yr yield is down 1bps at 0.2512%, 5-Yr is down 3.1bps at 0.9174%, 10-Yr is down 2.7bps at 1.4028%, and 30-Yr is down 2.5bps at 1.9152%.

EGB/GILT SUMMARY: EGBs Under Pressure

European sovereign bonds have broadly traded weaker this morning alongside fresh downside for equities. Lingering uncertainty over whether Evergrande will pay an interest payment to bondholders has contributed to an unfavourable risk backdrop.

- The gilt curve has steepened on the back of the short-end firming and yields inching higher at the longer end. The 2s30s spread has widened 2bp on the day.

- Bunds have traded weaker with cash yields 1-2bp higher across much of the curve.

- OAT yields are similarly up 1-2bp on the day.

- BTPs have underperformed core EGBs with yields pushing up 3-5bp and the belly of the curve leading the way.

- The German IFO report for September was slightly mixed. The Current Assessment and Business Climate components were a touch weaker than expected, while the Expectations component surprised higher (97.3 vs 96.5 survey).

- Supply this morning came from the UK (UKTBs, GBP2bn) and Italy (BTP Short Term E2.5bn, BTPei EUR1bn).

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXX1 168.5/167ps, bought 16.5 in 20k Vs futures 2k at 170.45 ( short cover of the bottom legs of a put condor from this week)

OEX1 135.25/135.50/135.75c ladder, bought for 4.5 in 2.5k

IKX1 156/157cs, bought for 5 in 2.5k

3RZ1 100/99.87/99.75/99.62p condor, sold down to 1.5 in 7k (ref 100.095, -10 del)3RH2 100.37/100.62cs, bought for 2.5 in 29k (reference 100.23, 21 del)

UK:

0LZ1 99.62/99.37ps with 0LZ1 99.50/9937ps, sold down to 32 in 20k vs 9922.52LZ1 99.50/99.25ps 1x2, bought for 1.25 in 1.5k

SFIH2 (SONIA) 99.80/99.90cs 1x2, bought the 1 for 1.25 in 14k

FOREX: Markets Consolidate After Busy Week

- Markets are largely consolidating early Friday, with equities reversing a small portion of the solid gains posted over the past few days, working in favour of haven currencies and against high beta growth FX. As a result, the USD trades firmer alongside the JPY, while the AUD and NZD are the poorest performers on the day.

- German IFO data for September came in mixed, with expectations beating forecast while the current assessment and business climate components came in just below. EUR/USD was little changed and holds close to the week's best levels but still below key resistance at the 1.1786 50-dma.

- The data calendar thins out headed into the weekend, with just August New Home Sales left on the docket.

- There are a number of ECB and Fed speakers on the docket, with ECB's Elderson, Lane, Fed's Powell, Clarida Mester, Bowman, Bostic and George on the schedule.

FX OPTIONS: Expiries for Sep24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E664mln), $1.1675(E663mln), $1.1700(E1.3bln), $1.1765-85(E879mln)

- AUD/USD: $0.7275(A$685mln)

- USD/CAD: C$1.2585-00($1.2bln), C$1.2620-40($1.0bln), C$1.2650-55($1.2bln), C$1.2680-00($1.3bln), C$1.2800($1.6bln)

Price Signal Summary - Bond Bear Cycle Extends

- In the equity space, S&P E-minis have recovered from Monday's sharp sell-off and the low of 4293.75. The contract has cleared a key short-term resistance at 4418.00, Sep 20 high and importantly is also back above the 50-day EMA. An ability to hold above the EMA would be promising for bulls and signal scope for gains towards 4478.50 next, the Sep 16 high. Key support has been defined at 4293.75. EUROSTOXX 50 started the week on a bearish note but sentiment has shifted and the contract rebounded from 3974.00, Sep 20 low. Further gains would open the bull trigger at 4223.00, Sep 6 high.

- In FX, EURUSD outlook remains bearish despite yesterday's gains. The focus remains on key support at 1.1664, Aug 20 low. GBPUSD reversed higher Thursday. The strong bounce leaves a key support at 1.3602 unchallenged, Aug 20 low. Furthermore, it also means triangle support at 1.3635 remains intact. The next resistance is at 1.3755, the 20-day EMA. The USD Index (DXY) key resistance resides at 93.73, Aug 20 high and the bull trigger. A break would confirm a resumption of the uptrend that started May 25.

- On the commodity front, the Gold traded lower yesterday and cleared former support at $1742.3, Sep 20 low. This confirms a resumption of the bear cycle and opens $1742.5, 76.4% of the Aug 9 - Sep 3 rally. WTI futures maintain a bullish outlook as this week's rally extends. The focus is on $74.08, 0.764 projection of the Aug 23 - Sep 2 - Sep 9 price swing.

- In FI, Bund futures remain in a downtrend and yesterday's sharp sell-off opens 169.90, 1.236 projections of the Sep 9 - 17 - 21 price swing. Gilt futures remain heavy despite finding support at today's low. A resumption of weakness would open 125.72, 3.00 projection of the Aug 20 - 26 - 31 price swing. Treasuries cleared a number of supports yesterday paving the way for a move to 131-27+, 1.00 projection of the Aug 4 - 11 - 17 price swing.

EQUITIES: Indices Fade After Multi-Day Run Higher

- Headline indices across Europe are lower in early Friday trade, with prices rolling off their Thursday highs after several sessions of strength.

- Consolidating and profit-taking are largely responsible for the price action, with Europe's tech, real estate and consumer discretionary names leading the way lower. Energy is the sole sector in the green, with the run-up in WTI and Brent crude futures still buoying the sector.

- The e-mini S&P sits slightly lower, with the index holding either side of the 50-dma at 4434.37, a level that bulls need to clear and close above to secure any recovery toward the alltime highs posted in early September.

- Fed speakers due later today including Powell, Bowman, Mester, Bostic and others will be a market focus, with the first on-the-record commentary since Wednesday's Fed decision.

COMMODITIES UPDATE: Smaller moves today but NatGas still up 2.25%

- WTI Crude up $0.14 or +0.19% at $73.43

- Natural Gas up $0.11 or +2.25% at $5.086

- Gold spot up $12.19 or +0.7% at $1754.93

- Copper down $0.5 or -0.12% at $422.65

- Silver up $0.17 or +0.77% at $22.6857

- Platinum down $7.32 or -0.74% at $984.9

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.