-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Payroll Gains Seen Slowing, U/E Expected to Tick Higher

Highlights:

- Nonfarm payroll gains seen moderating to lowest since Pandemic

- Equity sentiment stabilises as regional banks pare losses, Apple higher pre-market

- Canadian jobs data also due, with BoC policy in focus

US TSYS: Extending Modest Sell-Off Ahead of Payrolls, First Post-FOMC Fedspeak

- Cash Tsys have cheapened after a late open following a national holiday in Japan. It's led by the front end with only a partial recovery in Fed Funds implied rates after sliding yesterday on regional bank concerns (with cuts to year-end pulling back to 85bps at typing from over 100bps at one point yesterday).

- 2YY +3.5bp at 3.823%, 5YY +2.5bp at 3.354%, 10YY +2.6bp at 3.405% and 30YY +2.4bp at 3.754%.

- TYM3 trades 15+ ticks lower at session lows of 116-02+, having pushed lower through European hours after particularly narrow ranges, but with still subdued volumes of 200k ahead of today’s NFP print. Support seen at 115-31 (Thu low) and 115-17+ (May 3 low).

- Fedspeak: Kashkari (’23 voter) speaks 1245ET ahead of Bullard (non-voter) at a Minneapolis event, neither with text. Gov Cook (voter) also at 1300ET with text but in a commencement address which could limit mon pol discussions.

- Data: Nonfarm payrolls (0830ET, preview here), Consumer credit (1500ET)

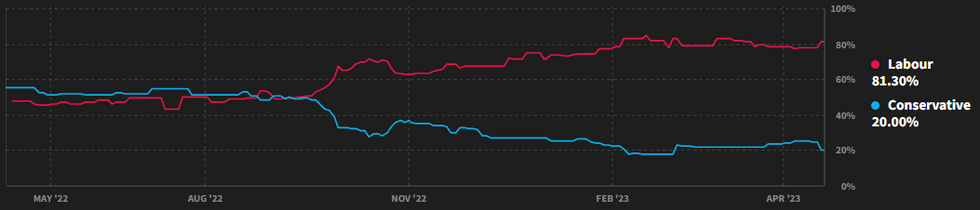

Betting Markets Shift Against Conservatives Amid Local Election Losses

Political betting markets have shown a shift away from the centre-right Conservatives amid PM Rishi Sunak's party losing seats across England in local elections on 4 May (see: https://marketnews.com/difficult-local-elections-f...). According to data from Smarkets, the Conservatives have an implied probability of 20% of winning the most seats at the next general election. This is down from 25% on 3 May ahead of the elections. Meanwhile, bettors give the main opposition centre-left Labour Party an 82% implied probability of winning the most seats, up from 78.1% on 3 May (the total sums to more than 100% due to bookmaker's profit).

- Betting markets currently give a 52.4% implied probability that Labour wins an outright majority in the House of Commons, a 37.3% implied probability that there is a hung parliament with no single party holding a majority, and a 12.5% implied probability that the Conservatives hold onto a majority.

Chart.1 Betting Market Implied Probability of Winning Most Seats at Next General Election, %

Source: Smarkets

Source: Smarkets

MNI Publishes Election Preview

The Turkish general election on 14 May is set to be the most pivotal vote in the major emerging market in a generation. This MNI Election Preview contains a background to why this election has taken on such importance, a briefing on how the electoral system works and who the main candidates and parties are, a chart pack of up-to-date opinion polling and betting market odds, analysis of post-election scenarios with assigned probabilities, and views on the election from sell-side outlets.

Link to PDF article below:

RATINGS: Friday’s Ratings Slate

Potential rating reviews of note scheduled for after hours on Friday include:

- Fitch on the European Financial Stability Facility (current rating: AAA; Outlook Stable), the European Stability Mechanism (current rating: AA), Slovenia (current rating: A; Outlook Stable) & Switzerland (current rating: AAA; Outlook Stable)

- Moody’s on Norway (current rating: Aaa; Outlook Stable)

- DBRS Morningstar on Ireland (current rating: AA (low), Stable Trend)

FOREX: Currencies on a More Stable Footing Pre-Payrolls

- Currency markets trade on a more solid footing relative to the uncertainty seen earlier in the week, pressing the USD lower headed into the NFP release, while haven currrencies retreat. The CHF is the poorest performer across G10, closely followed by JPY. NOK makes up the other end of the table, allowing USD/NOK to extend to three consecutive sessions of losses.

- The USD Index is softer, but off the worst levels of the week. This week's price action has been USD negative more broadly, but markets have steered clear of a major test of horizontal resistance at 101.01 as well as the YTD lows at 100.79-80.

- Across equity markets, sentiment has stabilised somewhat, with headline indices buoyed by a solid set of earnings from Apple after-market Thursday. Their shares trade higher by just over 2% ahead of the open.

- Focus rests on the upcoming NFP release, at which markets expected job gains to slow to around 180k - the slowest pace of job gains since 2020. The Canadian equivalent release also crosses, with markets seeing an uptick in the jobless rate to 5.1% from 5.0% previously.

EQUITIES: E-Mini S&Ps Stabilises Just Above Week's Lows

- A key short-term support in Eurostoxx 50 futures at 4282.60 has been breached this week - the 20-day EMA. The recent move down is considered corrective for now. A continuation lower would signal scope for a deeper pullback towards 4220.60, the 50-day EMA. On the upside, clearance of 4363.00, the Apr 21 high and bull trigger, would confirm a resumption of the uptrend.

- S&P E-minis traded lower Thursday. This week’s move lower has resulted in a breach of both the 20- and 50-day EMAs. Furthermore, the contract has pierced a key support at 4068.75, the Apr 26 low. This highlights a bearish threat and a continuation lower would open 4022.75, the 50.0% retracement of the Mar 13 - May 1 bull leg. Key resistance is far off at 4206.25, the May 1 high.

COMMODITIES: WTI Futures Remain Technically Bearish Despite Thursday's Strong Recovery

- WTI futures remain bearish despite the strong recovery from Thursday’s intraday low of $63.64. The print below $64.58 yesterday, the Mar 20 low and a key support, reinforces a bearish theme. A clear break of this level would confirm a resumption of the broader downtrend. Short-term gains would be considered corrective and would allow an oversold condition to unwind. Initial resistance is at $71.79, Wednesday’s high.

- Gold traded higher Thursday to cancel a recent short-term bearish threat. The yellow metal has breached resistance at $2048.7, the Apr 13 high and confirmed a resumption of the broader uptrend. This maintains the bullish price sequence of higher highs and higher lows and moving average studies remain in a bull-mode set-up. The focus is on $2070.4, the Mar 8 ahead of the all-time high at $2075.5. Key support is 1969.3, the Apr 19 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/05/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 05/05/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/05/2023 | 1230/0830 | *** |  | US | Employment Report |

| 05/05/2023 | 1645/1245 |  | US | Minneapolis Fed's Neel Kashkari | |

| 05/05/2023 | 1700/1300 |  | US | St. Louis Fed's James Bullard | |

| 05/05/2023 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 05/05/2023 | 1900/1500 | * |  | US | Consumer Credit |

| 08/05/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 08/05/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 08/05/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/05/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/05/2023 | 1400/1600 |  | EU | ECB Lane Speech/Q&A at Forum New Economy | |

| 08/05/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.