-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI US MARKETS ANALYSIS - UK Recession No Game Changer for GBP/USD

Highlights:

- US yields remain off week's highs, containing greenback rally

- UK in technical recession, but no game changer for GBP/USD

- US retail sales, weekly jobs data make for Thursday highlights

US TSYS: Tsys Angling Higher Ahead Heavy Data Slate

- Cash Tsys angling higher, near early London highs as rates continue to rebound from Tuesday's post-CPI data lows, curves bull flattening with the short end lagging ahead a full docket of US data.

- Similar bull flattening moves in EGBs while off highs following wait and see tones from ECB Lagarde wanting to avoid any "hasty" decisions to cut rates with more evidence of inflation decline needed.

- TYH4 currently +6.5 at 110-07 vs. 110-10 high on decent volumes of 340k. Initial technical resistance at 110-16 (low Feb 9) followed by 111-02.5 (20-day EMA). Support well below at 109-17/16+ (50.0% of Oct 19 - Dec 27 climb / Low Feb 14).

- Heavy data ahead: Weekly Claims, Retail Sales, Import/Export pricing, NY Fed Mfg and Philly Fed Business Outlooks at 0830ET.

- Industrial Production/Capacity Utilization up next at 0915ET followed by Business Inventories and NAHB Housing Market Index at 1000ET. Total Net TIC Flows wraps things up at 1600ET.

- Scheduled Fed speakers include Fed Gov Waller on US$ international role (text, Q&A, livestreamed) at 1315ET, followed by Atlanta Fed Bostic on monetary policy (text, Q&A) this evening at 1900ET.

- US Treasury wraps up this week's supply with $95B 4W, $90B 8W Bill auctions at 1130ET.

STIR: Light Dovish Bias On Macro Data, Heavy Data Slate Eyed

Little net movement in FOMC-dated OIS since the middle of the London morning, with the softer-than-expected macro data (in the form of Japanese & UK Q4 GDP and Australian labour market prints) providing the headline inputs thus far, although the related moves have faded from dovish session extremes.

- ~98bp of cuts are showing through ’24 at present, with that marker operating either side of Wednesday’s post-Goolsbee dovish extremes (range from the time just ahead of the CPI print is 113bp down to 85bp of cuts).

- Further forwards, ~11.5bp of cuts are priced through the May ’24 FOMC, while ~29bp of cuts are seen through the June ’24 FOMC.

- Late on Wednesday we saw Fed Governor Barr note that he's confident inflation is on a path to the central bank's 2% target, but he stressed that more data is needed before interest rates can be lowered.

- Weekly jobless claims and retail sales data headlines the NY docket today, with the latest Philly Fed & Empire manufacturing surveys also due. Elsewhere, Fedspeak from Waller will cross (although it is on the topic of the USD’s international role).

OI Suggests Short Cover Dominated On Wednesday

The combination of yesterday's move higher in Tsy futures and preliminary OI data point to relatively sizeable short cover across most contracts.

- A modest round of apparent net long setting in UXY futures was the only exception to the broader theme.

- UK CPI data and dovish Fedspeak from Goolsbee were key drivers on the headline front.

- Cleaner positioning and the post-CPI shunt higher in yields were also touted as reasons to put fresh longs to work, but as mentioned above, it seemed that cover was the more dominant positioning factor on the day, at least for futures.

| 14-Feb-24 | 13-Feb-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,896,681 | 3,933,570 | -36,889 | -1,342,157 |

| FV | 5,824,724 | 5,848,756 | -24,032 | -1,006,885 |

| TY | 4,630,891 | 4,669,908 | -39,017 | -2,451,230 |

| UXY | 2,199,545 | 2,191,393 | +8,152 | +730,500 |

| US | 1,414,871 | 1,421,146 | -6,275 | -831,927 |

| WN | 1,664,088 | 1,670,576 | -6,488 | -1,345,603 |

| Total | -104,549 | -6,247,301 |

OI Points To Mix Of Long Setting & Short Cover On SOFR Strip On Wednesday

The combination of yesterday's move higher across the SOFR futures strip and preliminary OI data points to the following positioning swings on Wednesday:

- Net short cover seemed to dominate in the whites and reds, albeit with pockets of apparent net long setting seen (SFRZ3, M4 & U5).

- Net long setting was more prominent in the greens and blues, albeit with some pockets of apparent short cover seen in the blues (SFRZ6 & U7).

- A reminder that dovish comments from Chicago Fed President Goolsbee & feedhtrough from UK CPI data helped counter some of the hawkish repricing seen in the wake of Tuesday's CPI data.

| 14-Feb-24 | 13-Feb-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,133,107 | 1,128,141 | +4,966 | Whites | -26,567 |

| SFRH4 | 1,153,910 | 1,190,097 | -36,187 | Reds | -9,822 |

| SFRM4 | 1,063,274 | 1,056,468 | +6,806 | Greens | +10,168 |

| SFRU4 | 842,826 | 844,978 | -2,152 | Blues | +5,363 |

| SFRZ4 | 1,090,920 | 1,103,147 | -12,227 | ||

| SFRH5 | 617,092 | 622,500 | -5,408 | ||

| SFRM5 | 681,194 | 691,550 | -10,356 | ||

| SFRU5 | 625,107 | 606,938 | +18,169 | ||

| SFRZ5 | 739,465 | 735,900 | +3,565 | ||

| SFRH6 | 472,497 | 468,469 | +4,028 | ||

| SFRM6 | 489,154 | 488,557 | +597 | ||

| SFRU6 | 308,062 | 306,084 | +1,978 | ||

| SFRZ6 | 302,982 | 303,338 | -356 | ||

| SFRH7 | 161,844 | 158,078 | +3,766 | ||

| SFRM7 | 161,560 | 158,980 | +2,580 | ||

| SFRU7 | 151,752 | 152,379 | -627 |

EUROPE ISSUANCE UPDATE:

Spanish Bobo/Obli auction results:

- E1.862bln of the 2.50% May-27 Bono. Avg yield 2.875% (bid-to-cover 1.72x)

- E2.186bln of the 3.50% May-29 Bono. Avg yield 2.873% (bid-to-cover 1.63x)

- E1.848bln of the 2.35% Jul-33 Obli. Avg yield 3.139% (bid-to-cover 1.86x).

- E4.703bln of the 2.50% Sep-27 OAT. Avg yield 2.67% (bid-to-cover 2.66x)

- E4.995bln of the 2.75% Feb-29 OAT. Avg yield 2.62% (bid-to-cover 2.33x)

- E2.294bln of the 0% Nov-31 OAT. Avg yield 2.65% (bid-to-cover 3.72x)

- E732mln of the 0.10% Mar-28 OATi. Avg yield 0.58% (bid-to-cover 2.84x)

- E836mln of the 0.10% Mar-29 OATei. Avg yield 0.48% (bid-to-cover 2.34x)

- E571mln of the 3.15% Jul-32 OATei. Avg yield 0.52% (bid-to-cover 2.35x)

- E349mln of the 0.10% Jul-53 OATei. Avg yield 0.73% (bid-to-cover 2.73x).

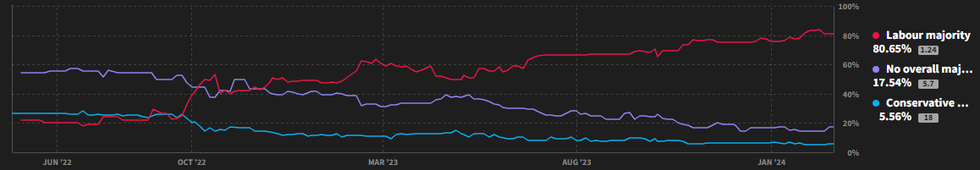

Gov't Faces Damaging By-Elections As Technical Recession Declared

Two parliamentary by-elections take place today. While these sort of elections would not usually garner market focus, the fact that it is an election year and the votes come on the day that ONS figures show the UK has entered a technical recession gives the by-elections some added interest.

- The constituencies of Kingswood and Wellingborough were both held by Conservative members of parliament, with Kingswood MP Chris Skidmore resigning in opposition to legislation to offer new oil and gas drilling licences in the North Sea, while Wellingborough MP Peter Bone was removed by a recall petition having been suspended from the House of Commons due to inappropriate conduct.

- Kingswood in southwest England has been Conservative since 2010 and was held with a 11k majority in 2019, while Wellingborough in the Midlands has been Conservative since 2005 and was held with a 18.5k majority in 2019. Despite these sizeable majorities, both seats are expected to be won by the main opposition centre-left Labour Party. Results in Wellingborough ~0400GMT, and in Kingswood from 0200-0500GMT on Friday.

- Compounding the issue for the Conservatives are the figures from the ONS showing the economy shrinking 0.3% in Q423, confirming a technical recession after another decline in Q323. PM Rishi Sunak has put significant political capital into his 'five pledges', one of which was 'growing the economy'. With today's figures this pledge becomes more difficult to achieve, dealing the Conservatives a blow ahead of the election expected in Q424.

Source: Smarkets

Source: Smarkets

GBP: Soft Activity Data No Game Changer for GBP/USD Range

- We wrote yesterday that the softer inflation data had made little change to the options-implied range for GBP/USD over the coming three months - with contracts capturing the next two BoE decisions, the May MPR as well as the 6th March UK Budget - and assigning a 50% likelihood for the pair holding between 1.2283-1.2820 at expiry.

- That pattern persists despite the weak UK growth data today and confirmation of technical recession - evident in the continued pullback in GBP/USD put vol - the 3m contract sits at a new pullback low of 7.06 points and the lowest level in two years.

- Spot remains in the lower-half of the '24 range, trading either side of the 1.2565 200-dma. The bear trigger sits just below at 1.2519/00, a break below which open further losses. This turns attention to Friday's retail sales release and June meeting BoE pricing, for which 17bps of rate cuts are currently priced.

FOREX: GBP the Poorest Performer for a Second Session

- For a second consecutive session, GBP is the poorest performer in G10 as GDP came in softer than expectations, confirming that the UK has entered a technical recession. GBP/USD has re-entered the bottom half of the '24 range, trading either side of the 200-dma at 1.2565. The bear trigger sits just below at 1.2519/00, a break below which open further losses. This turns attention to Friday's retail sales release and June meeting BoE pricing, for which 17bps of rate cuts are currently priced.

- GBP/JPY price action over the past two days has seen the cross reverse off 190.08 - the near ten-year high posted this week. The two-day move puts prices within range of 187.31 as the next support, and a sentiment shift for the BoE and renewed JPY intervention concerns could accelerate any pullback.

- Bucking the recent trend, CHF is a touch firmer, helping USD/CHF edge off the recovery high posted this week at 0.8886. The pair has dipped back below the 200-dma level, with next support seen into 0.8789 and 0.8807.

- The US retail sales release takes focus going forward, alongside weekly jobless claims data as well as import/export price indices. ECB's Lane and Nagel are set to speak as well as BoE's Greene and Mann later in the session. Fed's Waller follows, speaking on the reserve status of the US dollar.

Expiries for Feb15 NY cut 1000ET (Source DTCC)

- USD/JPY: Y149.10($1.0bln), Y150.20-25($550mln)

- USD/CAD: C$1.3550($823mln)

EGBS: Firmer But Off Highs as Lagarde Strikes Cautious Tone

Core/semi-core EGBs sit firmer this morning, but an early rally lost steam as ECB President Lagarde cast a cautious tone at an ECON hearing.

- Lagarde warned that the ECB would avoid making a "hasty decision" on rates, noting that more evidence was still required to be confident inflation was heading back to target. This wait-and-see rhetoric echoes that of Bundesbank's Nagel and Bank of Spain's de Cos, who spoke yesterday evening and this morning respectively.

- Bunds are +41 ticks at 133.98, after reaching a high of 134.18 earlier. The 20-day EMA at 134.27 is the first resistance.

- Supply from Spain and France will have also pressured the EGB space in the background, while this morning's data were not really market movers (Spain Jan inflation confirmed flash, UK activity data was weaker than expected).

- The German and French cash curves have lightly bull flattened, while periphery spreads to Bunds are tighter as Estoxx futures push above Tuesday's high. The 10-year BTP/Bund spread is 1.6bps tighter at 150.0 at typing, still just above January's narrowest levels.

- The remainder of today's docket sees appearances from Chief Economist Lane at an online seminar on "Monetary Policy and Banks' Business Strategies" (1200GMT/1300CET), while the Bundesbank's Nagel also speaks. US data (in particular jobless claims and retail sales) will also be of cross-market interest.

EQUITIES: Eurostoxx 50 Futures Return Back Toward Its Recent Cycle Highs

- Eurostoxx 50 futures remain in an uptrend and the move lower Tuesday is considered corrective. The contract traded higher Monday delivering another fresh cycle high, confirming an extension of the current uptrend. This reinforces bullish conditions and the importance of the recent break of resistance at 4634.00, the Dec 14 high. Sights are on 4788.10, a Fibonacci projection. Initial firm support lies at 4663.90, the 20-day EMA.

- The trend condition in S&P E-Minis is unchanged and remains bullish. The pullback from Monday’s 5066.50 high is considered corrective and support to watch lies at 4947.87, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possibly towards the 4866.00 key support, the Jan 31 low. For bulls, the trigger for a resumption of gains is 5066.50, the Feb 12 high.

COMMODITIES: Gold Continues to Trade Below Key Short-Term Support at $2001.9

- Recent gains in WTI futures, since Feb 5, appears to be a correction - for now. Key short-term resistance has been defined at $79.29, the Jan 29 high. Clearance of this level would be a bullish development. On the downside, support to watch lies at $71.41, the Feb 5 low. A break of this level would reinstate the recent bearish theme and pave the way for a move towards $69.56, the Jan 3 low.

- Gold has traded lower this week and in the process, the move has resulted in a break of $2001.9, the Jan 17 low and a key short-term support. The breach highlights a resumption of the bear leg that started Dec 28. A continuation lower would open $1973.2, the Dec 13 low and the next key support. On the upside, the yellow metal needs to clear resistance at $2065.5, the Feb 1 high, to reinstate a bullish theme.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2024 | 1200/1300 |  | EU | ECB's Lane seminar at Florence School | |

| 15/02/2024 | 1300/1300 |  | UK | BOE's Greene fireside chat with Fitch Ratings | |

| 15/02/2024 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 15/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/02/2024 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/02/2024 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 15/02/2024 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2024 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/02/2024 | 1350/1350 |  | UK | BOE's Mann panellist at 40th NABE Conference | |

| 15/02/2024 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2024 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2024 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 15/02/2024 | 1815/1315 |  | US | Fed Governor Christopher Waller | |

| 15/02/2024 | 2100/1600 | ** |  | US | TICS |

| 15/02/2024 | 0000/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/02/2024 | 0700/0700 | *** |  | UK | Retail Sales |

| 16/02/2024 | 0700/0800 | ** |  | SE | Unemployment |

| 16/02/2024 | 0745/0845 | *** |  | FR | HICP (f) |

| 16/02/2024 | 0845/0945 |  | EU | ECB's Schnabel lecture at EMU Lab | |

| 16/02/2024 | 1300/0800 |  | US | Richmond Fed's Tom Barkin | |

| 16/02/2024 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/02/2024 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 16/02/2024 | 1330/0830 | *** |  | US | PPI |

| 16/02/2024 | 1330/0830 | *** |  | US | Housing Starts |

| 16/02/2024 | 1410/0910 |  | US | Fed Vice Chair Michael Barr | |

| 16/02/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 16/02/2024 | 1710/1210 |  | US | San Francisco Fed's Mary Daly | |

| 16/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 16/02/2024 | 1940/1940 |  | UK | BOE's Pill panellist at 40th NABE Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.