-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Yields Backtrack as Biden Set to Meet McCarthy

Highlights:

- Yields retrace, USD firmer ahead of Wednesday CPI

- Equities on the backfoot, but pullback limited so far

- Debt limit to the fore, Biden to meet McCarthy Tuesday

US TSYS: Debt Limit Talks, Fedspeak, 3Y Supply & Corporate Issuance All Ahead

- Cash Tsys have steadily rallied with major benchmark yields running 2.5-3bps richer and no sign of spillover from hawkish ECB commentary. It sees 2Y yields pull back lower after yesterday’s push above 4% in UK holiday-thinned trade for the first time since last week’s JOLTS miss.

- Fed Funds implied rates see last week’s hike as the last of the cycle with 70bp of cuts to year-end, trimmed from 85bps before Friday’s payrolls.

- With CPI tomorrow lurking on the horizon, focus today is on Biden’s meeting with congressional leaders, Fedspeak from high-ranking FOMC members and 3Y supply.

- 2YY -2.5bp at 3.976%, 5YY -2.9bp at 3.462%, 10YY -2.3bp at 3.484%, 30YY -2.3bp at 3.800%

- TYM3 trades 8 ticks higher at 115-13+ on subdued volumes of 210k. It’s off support at yesterday’s low of 115-05 but with some way to resistance at 116-12 (May 5 high)

- Debt limit: US President Biden, House Speaker McCarthy to hold debt limit talks -- no set time but hear Biden will be meeting with congressional leaders around 1600ET.

- Fedspeak: Gov (and nominated Vice Chair) Jefferson at 0830ET, NY Fed’s Williams (1205ET).

- Data: Nothing left on the slate. NFIB saw a smaller than expected decline from 90.1 to 89.0 (cons 89.7) in April.

- Note/bond issuance: US Tsy $40B 3Y Note auction (91282CHB0) – 1300ET. On issuance more broadly, there is also a heavy corporate slate, headlined by an Apple multi-parter.

MNI Employment Insight, May'23: Moderating Jobs Growth But Historically Tight

- We have published and e-mailed to subscribers the MNI Employment Insight, including MNI analysis and summaries from fourteen sellside analysts on Friday's payrolls report.

- Find the full report here: https://marketnews.com/mni-us-employment-insight-may-23-moderating-jobs-growth-but-historically-tight

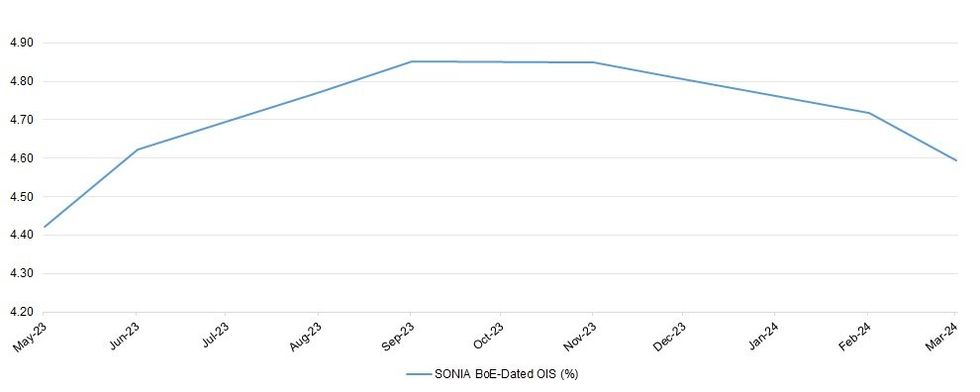

BoE Terminal Pricing Remains In Familiar Zone, With Hike this Week Virtually Fully Priced

As we have noted elsewhere, a 25bp hike come the end of this week’s BoE meeting is priced with near certainty (expect our full preview of that event to be published at some point today), while terminal rate pricing indicates just under 70bp of cumulative tightening from current effective SONIA levels, to the ~4.85% mark, leaving benchmark BoE terminal rate pricing in the familiar 4.90-5.00% window. Just over 25bp of rate cuts are then priced by Mar ’24.

- Cost of living pressures (albeit with energy prices well shy of their well-documented, recent peaks) and the political backdrop continue to garner the bulk of the domestic headline flow.

| BoE Meeting | SONIA BoE-Dated OIS (%) | Difference Vs. Current Effective SONIA Rate (bp) |

| May-23 | 4.423 | +24.5 |

| Jun-23 | 4.621 | +44.4 |

| Aug-23 | 4.773 | +59.5 |

| Sep-23 | 4.852 | +67.5 |

| Nov-23 | 4.849 | +67.1 |

| Dec-23 | 4.805 | +62.8 |

| Feb-24 | 4.718 | +54.0 |

| Mar-24 | 4.594 | +41.6 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

ACGBS: Flat To A Touch Firmer Vs. Pre-Budget Levels, Surplus Delivered, Although Deficits Seen Ahead

Aussie bond futures are flat to a little firmer vs. pre-Budget levels (YM/XM flattens a touch), with the government pencilling in the ~A$4bn surplus for the current FY that was touted via various press-outlets pre-release (facilitated by full employment-related tax takes & commodity price levels), more than reversing the deficit projected in the October update. Still, the government expects a slide back into deficit in the next FY (A$13.9bn), which is expected to widen further in the FY that follows (A$35.1bn) before peaking in FY25/26 (A$36.6bn), albeit with much more favourable deficit/GDP ratios than the G20 average.

- Treasurer Chalmers pointed to the government’s combination of fiscal restraint & a willingness to help those struggling to make ends meet.

- The government expects inflation to moderate back to 3.25% by mid-24, in line with the RBA view (although it’s view beyond there sees a slightly more aggressive downtick in headline CPI vs. available RBA projections), while wage price index growth is seen peaking at 4% and unemployment is seen at 4.25% in Q224 (roughly in line with RBA projections).

- S&P have since noted that the country’s commitment to fiscal discipline is critical to its AAA sovereign rating, although warned that an economic slowdown may pressure its rating.

- ACGB market participants now look ahead to the related AOFM issuance update, which should come early Wednesday Sydney time.

FOREX: USD, JPY Make Modest Gains Ahead of NY

- The greenback sits furtively higher ahead of the Tuesday crossover, although recent ranges have largely been respected headed into US hours. Inching higher of the dollar puts EUR/USD within range of the Friday lows at 1.0967. Any weakness through here would shift downside focus to the 50-dma, sitting just below at 1.0855.

- Equity futures are lower across the board, although the pullback has been relatively contained so far. The softer equity backdrop is working in favour of the JPY, which is modestly firmer against all others in G10.

- AUD, NZD are toward the bottom-end of the pile amid relatively thin trade overnight.

- More broadly, markets are treading water ahead of the US CPI release due Wednesday, ahead of which overnight implied USD vols are on the front foot: EUR/USD overnight vols have cleared 12 points - roughly matching the levels seen ahead of the March CPI release back on April 12th.

- Focus Tuesday is solely on the speaker slate, as ECB's Vasle, Vujcic, Villeroy and Schnabel are all set to speak. Fed's Jefferson and Williams are also on the docket.

FX OPTIONS: Overnight Vols Bid Ahead of US CPI

- FX options activity makes for a quieter start to the week, with quieter EUR/USD, USD/JPY trade countering more active USD/CNY, AUD/USD and USD/TWD trade. This is mirrored in the modest downtick for front-end G10 vols early Tuesday.

- AUD/USD notional has been supported by trades consistent with a $0.70/0.74 six-month call spread. The structure breaks even on a move above ~0.7075 in the spot rate.

- Looking ahead, USD implied vol has been marked higher ahead of tomorrow's CPI. EUR/USD overnight vols have cleared 12 vol points - roughly equivalent to the levels seen ahead of the last inflation release on April 12th.

FX OPTIONS: Expiries for May08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E532mln), $1.1000(E1.1bln), $1.1045-50(E958mln), $1.1125(E1.2bln)

- USD/JPY: Y134.35($523mln), Y135.90-00($864mln)

- EUR/JPY: Y150.00(E514mln)

- USD/CAD: C$1.3750-70($720mln)

- USD/CNY: Cny6.8500($1.4bln), Cny6.9500($675mln)

EQUITIES: European, US Equity Futures Pullback Contained So Far

- Eurostoxx 50 futures is holding on to its most recent gains and remains above support at 4228.60, the 50-day EMA. The recent move down is considered corrective and the broader uptrend remains intact. A continuation higher would signal scope for a test of 4363.00, the Apr 21 high and bull trigger. Clearance of this level would confirm a resumption of the uptrend. A clear break of the 50-day EMA is required to signal a top.

- S&P E-minis reversed course last Friday and prices have climbed back above the 50-day EMA, which intersects at 4101.79. A continuation higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A breach of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A break through this support would be bearish.

COMMODITIES: WTI Futures Remain Technically Bearish Despite Recovery Since Thursday

- WTI futures remain bearish despite the strong recovery from last Thursday’s intraday low of $63.64. The trend condition was oversold last week and the recovery is allowing this to unwind. Initial resistance is at $73.93, the Apr 28 low ahead of $76.92, the Apr 28 high. On the downside, last week’s print below $64.58, the Mar 20 low and a key support, reinforces a bearish theme. A clear break of it would confirm a resumption of the broader downtrend.

- Despite Friday’s move lower, Gold remains in an uptrend. The yellow metal has breached resistance at $2048.7, the Apr 13 high to confirm a resumption of the broader bull cycle. This maintains the bullish price sequence of higher highs and higher lows and moving average studies are in a bull-mode set-up. The focus is on $2070.4, the Mar 8 high ahead of the all-time high at $2075.5. Key support is 1969.3, the Apr 19 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/05/2023 | 0800/1000 |  | EU | ECB Lane in Policy Panel at IMF event | |

| 09/05/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/05/2023 | 1230/0830 |  | US | Fed Governor Philip Jefferson | |

| 09/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/05/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/05/2023 | 1605/1205 |  | US | New York Fed's John Williams | |

| 09/05/2023 | 1700/1900 |  | EU | ECB Schnabel Lecture at Hessischer Kreis e.V. | |

| 09/05/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 10/05/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 10/05/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 10/05/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 10/05/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 10/05/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/05/2023 | 1230/0830 | * |  | CA | Building Permits |

| 10/05/2023 | 1230/0830 | *** |  | US | CPI |

| 10/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 10/05/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/05/2023 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.