-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, February 21

MNI BRIEF: EU Defence Needs To Rise EUR250bn Annually- Bruegel

MNI Monthly Macro Data Round Up

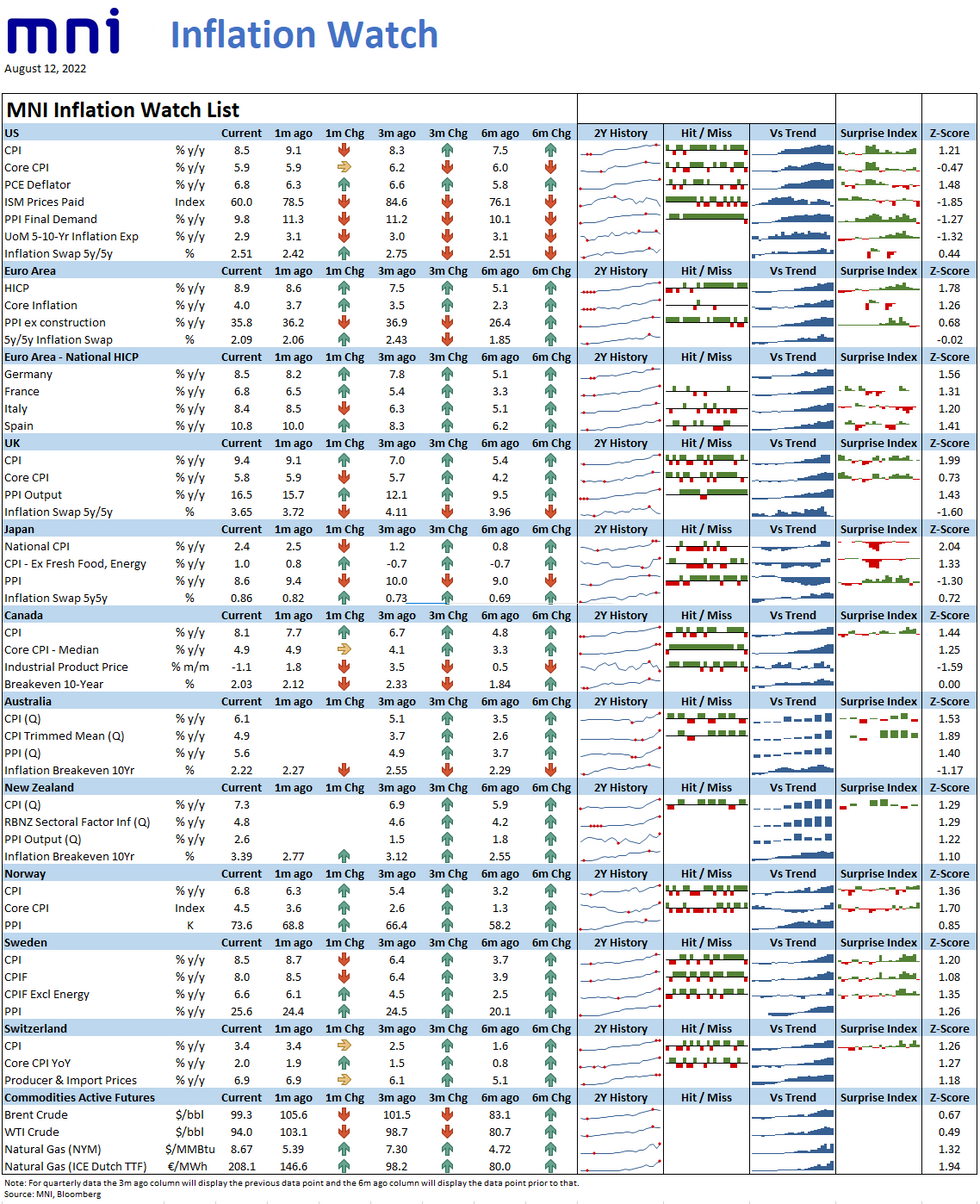

In the document below we review the major data releases of the past month, including the major releases from the US, Eurozone, UK, Germany, France, Italy and Spain.

US DATA

Broadening Core Inflation Pressures

- In a month when shelter inflation took off even more, core CPI ex shelter and used cars was back at cycle highs of 0.70% M/M, similar to overall core CPI of 0.70% M/M.

- That adds to evidence of broadening of inflationary pressures from median CPI metric beforehand, especially considering airfares also finally fell -1.8% M/M.

- Some other upside surprise came from apparel accelerating to +0.79% M/M after +0.67% M/M after some analysts had expected a decline with markdowns on excess inventory.

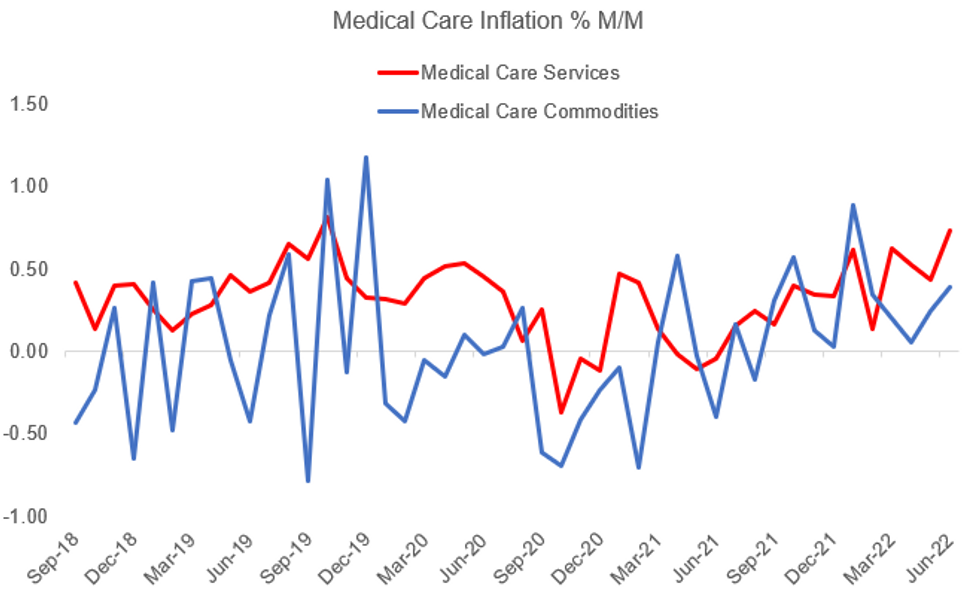

Medical Care Services Costs Gaining Momentum

An unsung contributor to the surprisingly high July CPI reading was accelerating medical care services inflation - the sector represents about 7% of overall CPI (by comparison, a little less than rent of private residences ) and continues to show steady upward momentum.

- It hit a 33-month high in June and was one of the highest M/M prints since the early 1990s (+0.73% M/M, vs +0.43% prior).

- Also of note is that medical care services looks like it represented the median inflation category in June (according to inflation fund manager Michael Ashton on Twitter), which if true would mean another fresh post-1982 high for median (to be confirmed by the Cleveland Fed's monthly release later today), vs +0.58% median M/M In May.

Source: BLS, MNI

Source: BLS, MNI

Surging Payrolls Close Pre-Pandemic Gap

- With payrolls surprisingly surging 528k in July (cons 250k) and with small upward revisions, payrolls have closed the gap with pre-pandemic levels in what's been a historically fast recovery compared to prior recessions - first chart.

- Monthly payrolls gains were led by the same three sectors as June: professional & business services, health & social assistance and a strong ramp up in food & drinking places, typically a discretionary spending-heavy component. Surprising resilience in interest-rate sensitive construction.

Q2 Arguably The Weakest Quarter in Two Years

At a glance: a weak advance GDP number for Q2. Putting aside the question of technical recession, the details suggesting unsettling underlying dynamics and arguably the weakest quarter since Q2 2020 despite a modest uptick vs the prior quarter (-0.9% Q/Q annualized, vs -1.6% prior).

- Disappointing private consumption growth (goods consumption saw the biggest drop since Q3 2021 though services picked up)

- Biggest drop in residential investment, nonresidential structures, and equipment investment since Q2 2020.

- Inventories subtracted 2.0pp from the headline figure but this miss wasn't all about that.

- That's because underlying demand was also poor. Final sales to domestic purchasers went negative for first time since Q2 2020; to private domestic purchases flat (also worst figure since Q2 2020).

- A higher-than-forecast price deflator also of note (though core PCE in line).

Notable Beat For ISM Services With Increases In Activity And Orders

- ISM Services came in notably stronger than expected in July, rising from 55.3 to 56.7 (cons 53.5) and contradicting the slide seen in the US PMI to 47.3 which in turn had marked the weakest growth outside of lockdown months since the GFC.

- The prices index decreased for the third consecutive month, falling 7.8pts to 72.3%, but “availability issues with overland trucking, a restricted labor pool, various material shortages and inflation continue to be impediments for the services sector”.

- In further signs of bottlenecks hindering supply, “services businesses continue to struggle to replenish inventories, as the Inventories Index contracted for the second consecutive month”.

- The release sparked an aggressive further sell-off in Tsys, with the front-end jumping 5bps on the snap election, continuing on to a 12bp increase to a peak 3.20% before trimming the surge to 3.16% currently, huge moves after yesterday’s overnight low of 2.815%. Similarly, Fed Funds futures currently price a 64bp hike at the Sept FOMC, pushing above a 50/50 chance of a 75bp hike for the first time since last week's FOMC.

EUROZONE DATA

Q2 GDP Sees Surprise Strengths, CPI Soars to 8.9%

EUROZONE FLASH JUL CPI +0.1% M/M (FCST -0.1%); JUN +0.8% M/M

EUROZONE FLASH JUL CPI +8.9% Y/Y (FCST 8.7%); JUN +8.6% Y/Y

EUROZONE Q2 2022 FLASH GDP +0.7% Q/Q; Q1 +0.5%r Q/Q

- The aggregate euro area headline inflation surged a further 0.3pp to a fresh high of +8.9% y/y in the July flash.

- This follows decent upside surprises to German, French and Spanish HICP. Only Italian HICP managed to edge down (by 0.1pp).

- Forecasts were beaten across the board by 0.2pp on the headline and month-on-month and by 0.1pp on the core print. Three countries (Estonia, Latvia and Lithuania) saw year-on-year rates over 20%.

- Core inflation excluding food and energy also saw a 0.3pp boost, reaching +4.0% y/y after a small 0.1pp deceleration in June. As such underlying inflation is at over double the ECB's target inflation rate.

- A small slowdown in energy prices was recorded at +39.7% y/y in July, following +42.0% y/y in June, however this was cancelled out by a strong 0.8pp uptick to a +9.8% y/y acceleration in food prices.

- Euro area GDP saw a solid 0.5pp beat of forecasts at +0.7% q/q in the Q2 flash estimate, underscoring a robust end to H2 despite soaring commodity prices and deterioration of economic outlooks and supply chains exasperated by the Ukraine war.

- As prices continue to soar across the Eurozone and regional GDP prints for Q2 remained robust, this data puts a 50bp hike very much on the table for the ECB's September meeting.

PPI Sees Modest Deceleration for Second Consecutive Month

EUROZONE JUN PPI +1.1% M/M, +35.8% Y/Y (FCST +35.7% Y/Y); MAY +36.2%r Y/Y

- Euro-area factory gate inflation was only marginally hotter than expected, up +1.1% m/m and by +35.7% y/y in June.

- This is down a modest 0.4pp from May in the second month of decelerating PPI, largely due to the slowing of energy prices (+92.8% vs +94.4% in May) and intermediate goods (+23.8% vs +25.0%).

- The highest yearly increases were recorded in Romania (+61.2%), Denmark (+55.5%) and Lithuania (+52.5%).

- Excluding energy, PPI increased to 15.6% y/y in June, which is 0.4pp lower than in May and hints at a more widespread gentle deceleration of prices. This will come as welcome news to the ECB, however, slowing factory-gate inflation is yet to spill over into consumer prices which continued to soar to a record +8.9% in July.

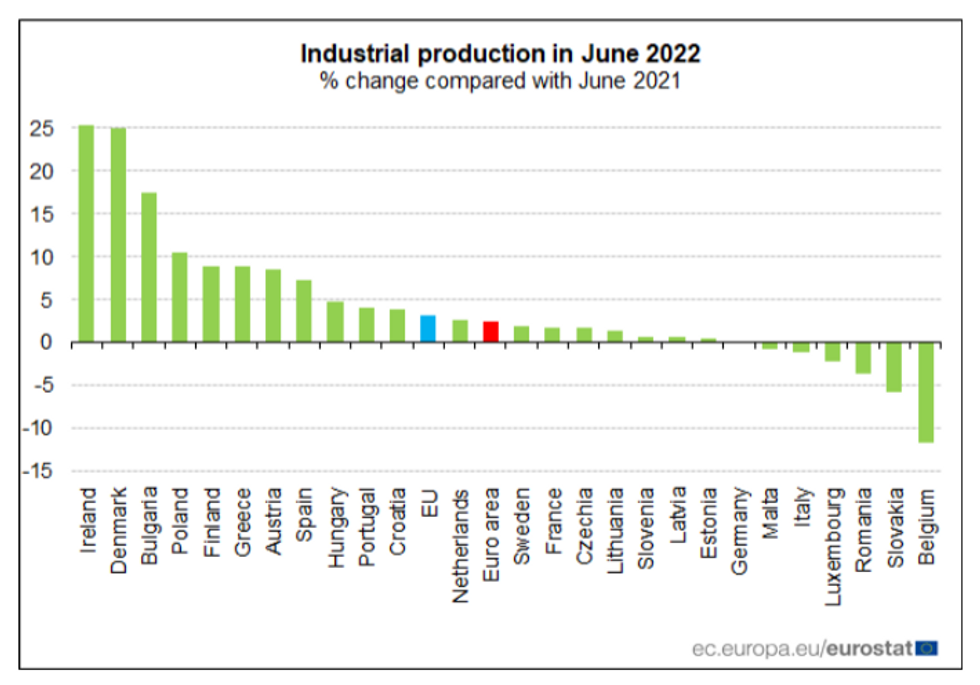

Robust June Industrial Production, Gas Supply Concerns Going Forward

EUROZONE JUN INDUSTRIAL PRODUCTION +0.7% M/M (FCST +0.2%), MAY +2.1%r M/M

EUROZONE JUN INDUSTRIAL PRODUCTION +2.4% Y/Y (FCST +1.0%); MAY +1.6% Y/Y

- Industrial production saw a robust June expansion in the eurozone, up 2.4% y/y (up 0.8pp from May). The month-on-month expansion was 0.7% m/m, following the substantial upwards revision in the May data, from +0.8% m/m to +2.1% m/m.

- The June data is all above expectations, at a 0.5pp beat month-on-month and 1.4pp beat for the annual print.

- Expansions were registered in the production of capital goods (+7.6% y/y) and durable g=consumer goods (+4.0%), whilst energy stabilised (+0.0%). Soft contractions were seen for intermediate goods (-0.5% y/y) and non-durables (-1.1%), hinting at slowdowns in demand.

- Substantial discrepancies are seen across national IP numbers (see graph below).

- More recent developments in the gas supply through Russia are cause for concern regarding euro area industry going forward, leading some sell-side analysts to shift forecast a German industry contraction for Q3 and Q4.

- The ECB will be closely monitoring signs of contraction across the bloc ahead of the September 8 meeting, with a front-load-and-pause tactic remaining the most likely.

Euro-Area Consumer Sentiment Signals Recession Ahead

- The latest EC economic confidence survey recorded a 4.5-point dive to 99.0 in July for the eurozone, slipping below the long-term average for the first time since February 2021. The report detailed substantial broad-based falls across industry, services, retail and consumer confidence. The latter index saw outlooks on future financial situation hit an all-time low and propensity to make major purchases fell to April 2020 levels.

- This followed another worse-than-expected historic low for the German GfK consumer sentiment index in August, whilst French consumer confidence edged down towards 2013 lows. Consumer confidence in Italy fell to May 2020 levels.

- Across the board, the squeeze of soaring inflation on households and no signs of relief in the Ukraine war underlined increasing pessimism. The deterioration in outlooks has been exacerbated by persistent supply chain disruptions, as well as household concerns regarding the security of gas supplies heading into H2.

- A few small points of optimism can be found in the details: the German propensity to spend on big-ticket items fell less than before, French inflation outlooks eased slightly and minimal upticks were noted in Italian construction and retail sentiment.

- On the employment front, signs of faltering confidence were evident in both the French index and EC aggregate index on the back of waning consumer demand.

June Retail Contracts by 3.7%

EUROZONE JUN RETAIL TRADE -1.2% M/M, -3.7% Y/Y (FCST -1.7% Y/Y); MAY +0.4%r Y/Y

- The June data saw Eurozone retail trade weaker than anticipated, contracting by -1.2% m/m and by -3.7% y/y. The year-on-year print is a substantial 2.0pp below forecast and a 4.1pp slide from the soft May expansion.

- The largest June year-on-year contractions were recorded by Denmark (-9.5%), Germany and Ireland (-8.8%) and the Netherlands (-6.1%).

- This mirrors slowing consumer demand across the bloc, as PMIs flagged falling new orders. Inflation surged further to +8.9% y/y in July, which will likely see retail continue to suffer into the tail end of Summer as consumer confidence slips to record lows.

- With CPI not yet showing signs of easing, the ECB appears to have sights set on prioritising front-loading policy normalisation to restore consumer confidence sooner rather than later.

PMI Data

July PMIs Round-Up: Contractions For All But UK, Signs of Easing Inflation

France: all July flash PMIs were weaker than forecasts. Weak demand on the back of high inflation and recessionary fears was the key driver.

- Final manufacturing fell 1.8 points to 49.5 (1.5 below initial forecast), dipping into the contractionary territory for the first time since November 2020. Manufacturing output contracted to 44.0, a 26-month low.

- Services activity slipped 0.9 points, falling to 53.2 (an upwards revision on the 52.1 flash) and the weakest since January.

- Inflation: Some signs of further price easing was seen in input prices. Wage, energy and fuel price pressures remained acute.

- Employment: Despite slowing, job creation remained strong. Some initial signs of reduced production seeing workforces decline.

- Expectations: Output expectations remain in positive territory, improving from the May 19-month low. Services expectations remain better than manufacturing.

Germany: all flash PMIs were below expectations, all falling into contractionary territory below the 50 breakeven mark.

- Both domestic and export demand fell. Uncertainty regarding the economic outlook against a backdrop of soaring inflation saw demand suffer as tighter budgets generated less new business.

- Final manufacturing output slumped by 3.3 points following a 0.5-point upwards revision to 49.7 as output fell the most since May 2020.

- Services saw a 2.7-point decline after a 0.5-point upwards revision, as staff shortages and falling new business dragged. Sales declined for the second consecutive month.

- Inflation: Input costs and prices charged continue to rise but at a slower pace. Energy/commodities, a weaker euro and higher labour costs remain key upwards pressures.

- Employment: Employment growth steady.

- Expectations: Confidence lowest since May 2020, outlooks significantly negative. Expectations slipped into negative territory for the fist time since May 2020 Service sectors seeing a slowdown for the first time in two years.

Eurozone: all flash PMIs were lower than forecasts, with the manufacturing seeing a contraction.

- Output and new orders fell for the first time since early 2021 lockdowns and services close to stalled in July as lower disposable real incomes saw consumer demand eroded. Manufacturing output saw the largest decline and the slowdown in Germany exerted considerable downwards pressure on the composite reading.

- Manufacturing fell 2.3 points to 49.8 and services fell 1.8 points to 51.2. These final prints were 0.2 and 0.6 points above initial prelim prints.

- Inflation: Selling and input costs edged down on the back of easing supply chain disruptions and weakening demand. Selling price inflation softened across services and manufacturing.

- Employment: Employment growth moderated for second consecutive month to a 15-month low.

- Expectations: Business expectations lowest since May 2020, remaining slightly positive.

UK: all July flash PMIs were marginally stronger than expected, still weaker than in June.

- The UK manufacturing PMI moderated to 52.1 (down 0.7 points), whilst services PMI weakened to 52.6 (down 1.7 points) in July after minimal 0.1-point downwards revisions. Both prints remain in expansive territory and stronger than Euro area prints. These were still substantial lows, as services fell to a 17-month low and manufacturing to a 25-month low. Manufacturing output contracted for the first time since May 2020.

- Moderate increases were seen in new order volumes, signalling relatively robust demand for services, however manufacturing demand weakened significantly.

- Inflation: Input inflation saw considerable easing at a 10-month low. Prices charged eased to the slowest increase since January as demand softened.

- Employment: Employment rose further, however job creation slowed to a 16-month low due to labour shortages and concerns regarding future growth outlooks.

- Expectations: Outlooks saw modest improvements from the 25-month low seen in June. Manufacturing outlooks were downbeat at 1 26-month low.

Source: MNI / Bloomberg

UK DATA

UK Inflation Surge Underlines BOE Dilemma

- UK inflation rose to a fresh 40-year high in June, with the consumer price index rising 9.4% year-on-year, the biggest increase since the comparable 10.2% increase recorded in February 1982, according to the ONS, outpacing forecasts marginally.

- GBP marginally weaker after the CPI print (despite headline coming in a tenth higher than expected). Going into this print, markets were pricing around 45bp for the August MPC meeting. The MNI Markets team had said after the June MPC meeting that we saw around a 60% probability of a 50bp hike but that it would depend upon the data.

- The data brought the Monetary Policy Committee a step closer to the August 50bps hike, although the increase is within the trajectory policymakers see towards an October 'peak' around 13.3%.

- Once again, the pressure on consumer spending was highlighted by the continued year-on-year surge in the costs of running the household, with the Housing, Water, Electricity and Gas up 19.6% -- although it was flat on the month. Transport costs rose sharply on the month, up 2.3%, extending the annualised gain to 14.9%, driven by an increase in petrol prices to record highs.

UK Real Incomes Declined At Record Pace In May

Real wages in the UK fell again in May, as pay deals and bonus payments failed to keep pace with soaring inflation, dipping even very slightly below analysts' expectations.

Total average earnings rose 6.2% y/y in the three months to May, driven in large part by bonus payments, while pay deals excluding bonuses rose by 4.3% y/y. However, when adjusted for inflation, real wages fell 0.9% y/y and by 2.9% excluding bonuses. Excluding bonuses, "real pay is now dropping faster than at any time since records began in 2001,” according to David Freeman, head of labour market and household statistics at the ONS.

The jobs and wages data remains key to the BOE's reading of the UK economy.

CBI Retail Sales Falling and August Outlooks See Worsening Demand

UK JUL CBI DISTRIBUTIVE TRADES SALES VOLUME JUL -4 (FCST -10); JUN -5

UK JUL CBI DISTRIBUTIVE TRADES EXPECTED SALES VOLUME AUG -14

- The July CBI retail industry report recorded the fourth consecutive month of declining sales volumes and saw a substantial slump in expected reported sales for August.

- Reported sales in July saw a more moderate 4pp contraction (vs -5 in June), which was significantly less than the forecasted -10 decline.

- This has fed through into retailers seeing stock levels as substantially too high in relation to expected sales was at a two-year high in July and anticipated to outweigh further going forward.

- The slide in demand continues to be a result of consumers winding back spending as inflationary pressures see food and energy bills continue to accelerate. This mirrors falling new orders as highlighted by yesterday's CBI industrial trends report.

- As such, the broad-based fall in expected sales sees the economic outlook for upcoming months appearing weak.

BOE: Instant Answers August Meet: Hikes 50 Bps

1) Was the Bank Rate raised, and if so by how much? Yes, by 50bp to1.75%.

2) Number of members voting for a 25bp hike? 1 - Tenreyro

3) Number of members voting for a 50bp hike? 8

4) Number of members voting for a decision other than 25/50bp hike (and if so what?)? (NB: On questions 2-4 we will name the dissenters) Zero

5) Did the MPC announce a likely start date for the active sale of gilts (and if so when)? Yes, shortly after the September meeting, before the end of the month. A confirmatory vote will be held at the meeting.

6) Did the MPC announce the pace of gilt sales? Yes, GBP 80 bln in the first year, with estimated GBP10 Bln a qtr in active sale.

7) Did the MPC drop its previously formulated June guidance? No, the only difference was the use of "the scale, pace and timing of any changes in the Bank Rate ... reflect the outlook" vs any further increases.

8) Did the MPC still point to the possibility of "forceful" action if required? Yes

9) UK CPI rate in two years’ time at market/constant rates (mode)? 2.00% / 2.53% in 2024 Q3.

10) UK CPI rate in three years’ time at market / constant rates (mode)? 0.76% / 1.27% in 2025 Q3.

11) How were the risks to the CPI forecasts described? Two way, largely based on energy price developments.

12) UK GDP forecast for Y/Y Q3-2023/Q3-2024 at market rates (mode)? -2.07% (Q3-2023) / -0.04 (Q3-2024)

GERMAN DATA

July Flash Sees HICP Jump to 8.5%

GERMANY JUL CPI +7.5% Y/Y (BBG FCST +7.4%); JUN +7.6%

GERMANY JUL HICP +0.8% M/M (BBG FCST +0.4%); JUN -0.1%

GERMANY JUL HICP +8.5% Y/Y (BBG FCST +8.1%); JUN +8.2%

- Following a slew of German state CPI data, the flash national German print edged down 0.1pp to +7.5% y/y for and accelerated by 0.8pp to +0.9% m/m in July. This data was unrevised in the final prints.

- This is was in line with the MNI forecast (based on 88.1% of state data), yet above the consensus expectations.

- The HICP index saw a substantial upside surprise, accelerating by 0.9pp to +0.8% m/m and by 0.3pp to +8.5% y/y.

- Energy prices did ease again for the second consecutive month, down 2.3pp at +35.7% y/y in July. This was largely cancelled out by the boost in food prices, up 2.1pp at +14.8% y/y.

- The German Statistics Office highlighted that the effects of both the fuel discount and 9-euro transport ticket will be included in this data.

- This follows the fresh historic low for the GfK consumer sentiment index in August. The accelerated costs of living continue to see confidence plunge, exacerbated by persistent supply chain disruptions worsened by the Ukraine war and concerns regarding the security of gas supplies.

- As this data feeds into the Eurozone aggregate and ECB considerations, the probability of the ECB frontloading hikes is increasing. 50bp is again on the table for September (markets currently price 46bp).

Source: MNI / Bloomberg

Retail Sales See Sharpest Fall on Record

GERMANY JUN SA RETAIL SALES -1.6% M/M, -8.8% Y/Y

- German retail trade contracted by -1.6% m/m and -8.8% y/y in June. The year-on-year plunge was again weaker than expectations and the largest recorded since the series began in 1994.

- Food sales fell by -1.6% m/m in June and by -7.2% y/y, and the +11.9% y/y food price inflation remains largely to blame.

- This followed GDP data which saw the German economy stall in Q2.

- The continued effects of supply chain disruptions, concerns regarding the Ukraine war and global inflationary pressures have generated a substantial slowdown for the German economy.

- This data confirms concerns are spilling over into retail demand, with consumer confidence currently sitting at a historic low, underlining the ECB's dilemma as soaring inflation and a sharply slowing economy impinge on policymaking.

Surprise Surplus and Substantial Revisions in German Trade Balance

GERMANY JUN TRADE BALANCE EUR 6.4 BLN; MAY EUR 0.8r BLN

- German trade data for June saw significantly stronger exports (+4.5% m/m vs +1.3%r m/m in May) and softer imports (+0.2% m/m vs +3.2%r m/m in May).

- This generated a more healthy trade surplus of EUR 6.4bln, a massive beat of the 0.2bln forecast. The surplus remains less than half of that in 2021.

- The first German trade deficit since 1991 was initially reported in the May data at -1.0bln, however, this has been revised to +0.8bln in the June release.

- High commodity prices and food prices have generated inflated imports, as energy prices soar due to the effects of the ongoing Ukraine war. This coupled with lower manufacturing exports of an industry hampered by supply disruptions has accounted for a slowdown in German trade.

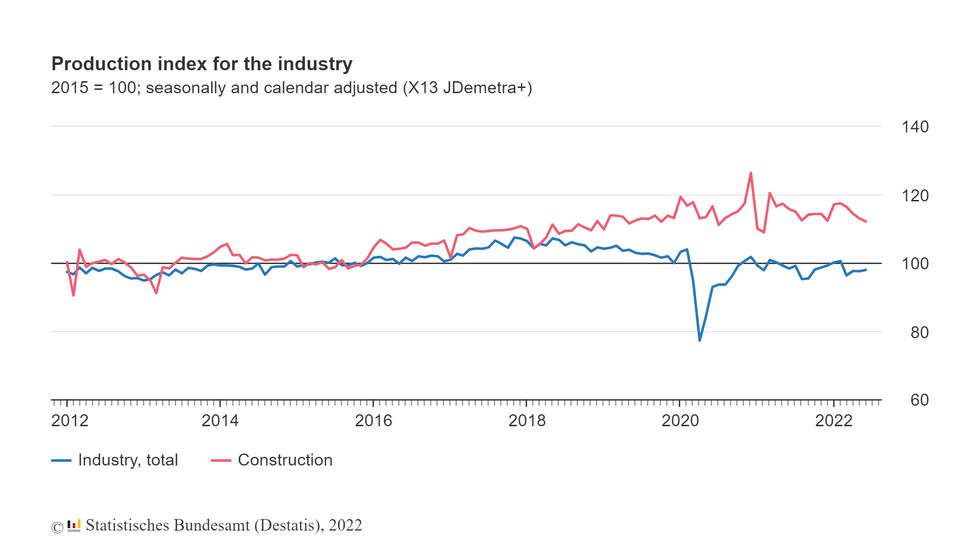

Industrial Production Sees Softer Decline in June

GERMANY JUN IP +0.4% M/M (FCST -0.3%); MAY -0.1%r M/M

GERMANY JUN IP -0.5% Y/Y (FCST -1.3%); MAY -1.7%r Y/Y

- German industrial production was more resilient than anticipated in the June report, seeing a small +0.4% m/m increase and a softer fall in the annualised print at -0.5% y/y (vs. May -1.7% y/y and the forecasted slide of -1.3% y/y).

- Both May readings saw downwards revisions of 0.2-0.3pp.

- Energy and construction industries were the key downwards drivers of the headline number, with energy production stalling at 0.0% m/m in June and Production declining by -0.8% m/m. Excluding energy and construction, IP would've expanded by a stronger +0.7% m/m.

- Supply bottlenecks and extreme shortages continue to hamper German production due to distortions caused by the Ukraine war and the lasting effects of the pandemic, highlighted by 3/4 of firms expressing persisting issues.

- Expectations of further substantial slowdown into the end of the year would feed into the ECB’s calculations regarding the resilience of a fragile euro area economy.

GDP Stagnates in Q2, Weaker than Expectations

GERMANY Q2 2022 FLASH GDP +0.0% Q/Q (FCST +0.1%); Q1 2022 +0.8%r Q/Q

GERMANY Q2 2022 FLASH GDP +1.4% Y/Y (FCST +1.7%); Q1 2022 +3.6%r Y/Y

- The German economy stalled in the flash Q2 2022 GDP print, following a 0.6pp upwards revision of Q1 GDP to +0.8% q/q.

- Compared to 2021, Q2 saw +1.4% y/y growth, weaker than +3.6% y/y in Q1 and 0.3pp below forecast.

- Private and government consumption managed to avoid German GDP slipping into contractive territory, whilst the export industry saw a substantial slowdown.

- The continued effects of the pandemic, supply chain disruptions, global inflationary pressures and the war in Ukraine have generated substantial downwards growth pressure on the German economy and outlooks remain bleak.

- The stark upwards revision of Q1 numbers was largely due to significant recalculations of GDP back to 2018.

- This follows the hot inflation surprise of +8.5% y/y in July and labour market data holding strong despite a large influx of Ukrainian nationals.

- As inflationary pressures continue to be the key driver of record-low consumer confidence ECB will continue to stick to frontloading rhetoric despite the largest eurozone economy on the edge of contraction.

GfK Consumer Confidence at Fresh Low as Gas Supply Concerns Mount

GERMANY AUG GFK CONSUMER CONFIDENCE -30.6 (FCST -28.9); JUL -27.7r

- Another worse-than-expected historic low for the German GfK consumer sentiment index in August. The index began in 1991.

- Economic and income expectations were again the key downwards drivers, however, a softer decline was seen in propensity to buy.

- Following the hot inflationary uptick to +8.5% y/y in July, the accelerated costs of living and looming recessionary fears see no improvement in consumer outlooks for the time being.

- The deterioration in outlooks has been exacerbated by persistent supply chain disruptions worsened by the Ukraine war, as well as consumer concerns regarding security of gas supplies adding significant downwards pressure.

Ifo Survey Sees the German Economy "on the Cusp of Recession"

GERMANY JUL IFO BUSINESS CLIMATE 88.6 (FCST 90.1); JUN 92.2r

GERMANY JUL IFO CURRENT ASSESSMENT 97.7 (FCST 97.5); JUN 99.4r

GERMANY JUL IFO EXPECTATIONS 80.3 (FCST 83.0); JUN 85.5r

- The German Ifo survey saw another miss in both the business climate index and expectations in the July print.

- The business climate index slipped by 3.6 points to 88.6, falling a further 1.5 points than anticipated to a June 2020 low. The business expectations index saw a 5.2-point fall, a further 2.7 points than expected whilst the assessment of the current business climate was marginally higher than forecasts, seeing a softer 1.7-point fall.

- High energy prices and fears of gas shortages are feeding into further recessionary fears in Germany.

- Manufacturing pessimism was at an April 2020 high, and new orders contracted for the first time in two years, confirming waning demand as outlooks cloud over.

- The assessment of the current situation in construction nosedived to the lowest in over six years and all retail sectors turned to negative outlooks.

- Following the surprise dive in the ISM services PMI, the Ifo services index saw services expectations collapse, undoing the June optimism boost.

- As such, Ifo described the German economy as "on the cusp of a recession" and with the service sector buckling, the survey saw no silver lining.

FRENCH DATA

French CPI Accelerates To +6.8% in July

FRANCE JUL CPI +0.3% M/M (FCST +0.3%), +6.1% Y/Y (FCST 6.0%); JUN +5.8% Y/Y

FRANCE JUL HICP +0.3% M/M (FCST +0.2%), +6.8% Y/Y (FCST 6.7%); JUN +6.5% Y/Y

- French inflation came in 0.1pp stronger than anticipated in the July year-on-year prints, both accelerating by 0.3pp to +6.1% y/y (CPI) and to +6.8% y/y, respectively.

- The increase in inflationary pressures was largely due to a boost in Summer service prices (+3.9% y/y vs Jun +3.3%) and food prices (+6.7% y/y vs Jun +5.8%).

- Energy prices slowed in July to +28.7% y/y following the acceleration to +33.1% y/y in June.

- The uptick in service charges highlights more broad-based entrenched inflationary expectations.

- This further boost to headline inflation coupled with the robust Q2 2022 GDP print suggests the French economy currently offering no reasons for the ECB not to push ahead with monetary tightening.

Flash July GDP and June Consumer Spending Remain Robust

- French GDP came in stronger than anticipated for Q2, expanding 0.5% q/q (vs +0.2% forecast) and by 4.2% y/y (vs +3.7% forecast). This is a solid beat of the -0.2% q/q contraction seen in Q1, and only modestly slower than the strong +4.5% y/y growth of Q1.

- Stronger foreign trade was a key upwards growth driver, adding 0.4-points to the headline expansion and boosted by strong service exports and declining imports. The decline in household consumption was also significantly softer in Q2.

- Consumer spending remained robust in June, expanding by a modest 0.2% m/m, significantly outpacing the forecast of a -0.9% m/m contraction. The year-on-year contraction was 0.2pp softer than anticipated at -4.4% y/y (vs -3.4% y/y in May).

- The June report highlighted that a sharp rebound in energy consumption accounted for the growth in consumer spending, whilst consumption of manufactured and food goods both decreased. As such, the growth in spending is unlikely to translate into stronger underlying demand.

- Hot inflation coupled with a robust Q2 GDP print will likely add confidence to more hawkish ECB intentions going forward.

Robust June IP Sees Energy Sector Resurgence, as in Germany & Spain

FRANCE JUN INDUSTRIAL PROD. +1.4% Y/Y (FCST -0.3%); MAY -0.3%r Y/Y

FRANCE JUN INDUSTRIAL PROD. +1.4% M/M (FCST -0.3%); MAY +0.2%r M/M

- French industrial production saw surprise growth in June, expanding by 1.4% in both the month-on-month and annualised print.

- This is above the anticipated forecast of -0.3% contractions for both readings and adds to German and Spanish IP data from this morning which also came in more robust than forecasts.

- France experienced a broad-based solid month-on-month rebound across capital goods production (+3.5% in June vs +0.2%), agriculture (+2.2% in June vs -0.7%), other transport equipment (+6.2% vs -5.7%) and most notably extractive industries and energy (+2.4% in June vs -4.1%).

- Diving into the detail of German and Spanish reports highlights a recurrent theme of substantially stronger energy production in June, likely linked to efforts in generating gas stocks ahead of Winter as supply from Russia has become increasingly concerning over the past months.

Consumer Confidence Edges Down Further, Inflation Concerns Ease

FRANCE JUL CONSUMER CONFIDENCE 80; JUN 82

- French consumer confidence took another hit in July, edging down a further 2 points in the seventh consecutive month of decline to 80 in July.

- This was the lowest reading since Spring 2013 and in line with expectations. The long-term average is 100.

- Future financial situation outlooks fell again, as did the propensity to make major purchases and savings capacity.

- Despite remaining very low, unemployment fears increased slightly again in July.

- On a different note, inflation outlooks eased again in July. This is welcome news after the 0.3pp uptick to +6.8% y/y in the harmonised July print.

ITALIAN DATA

Small HICP Deceleration to 8.4% Masks Jump in Core

ITALY JUL HICP -1.1% M/M (FCST -0.9%); JUN +1.2% M/M

ITALY JUL HICP +8.4% Y/Y (FCST 8.8%); JUN +8.5% Y/Y

ITALY JUL HICP CORE +4.3% Y/Y; JUN +4.0% Y/Y

- Italian inflation deceleration in July, coming in at +8.4% y/y, down 0.1pp and a significant 0.4pp below forecasts.

- On the month a -1.1% contraction was recorded, following June's +1.2% m/m expansion.

- A substantial slowdown in energy prices was recorded (+42.9% y/y in July vs +48.7% in June).

- ISTAT states that the July slowdown was largely due to a small easing of goods prices, whilst services continued to accelerate.

- Despite the decrease in headline inflation, core CPI jumped 0.3pp to a 1996 high of +4.3% y/y, underscoring the continued growth of broad-based prices. As such, the softer headline surprise consitutes continued inflationary growth in Italy.

Source: ISTAT

Italian Consumer Confidence Dives to May 2020 Levels

ITALY JUL CONSUMER CONFIDENCE 94.8 (FCST 96.6); JUN 98.3

ITALY JUL MANUF CONFIDENCE 106.7 (FCST 108.0); JUN 109.5r

ITALY JUL ECON SENTIMENT 110.8; JUN 113.4r

- All Italian confidence indicators fell further than anticipated in the July report.

- Consumer confidence fell 3.5 points to 94.8, in line with May 2020 levels as consumer future outlook levels slumped from 98.8 to 92.9 in July. Consumer sentiment on the economy saw the largest hit, plunging by 9 points to 84.9.

- This data follows both French and German consumer confidence prints this morning, which all saw outlooks deteriorating as consumers felt the squeeze of surging inflation and pessimistic economic outlooks.

- Manufacturing confidence slid by 2.8 points to 106.7.

- The shift in manufacturing sentiment follows the unexpected June uptick as production and order book expectations saw a fleeting surprise improvement.

- Economic sentiment decreased by 2.6 points to 110.8.

- The sectorial breakdown of the July report delivered mixed messages: the services index weakened on the back of pessimistic outlooks, whilst some improvement was seen in both construction and retail trade sentiment.

Source: ISTAT

SPANISH DATA

July CPI Jumps to 10.8%, GDP Sees Upside Surprise

SPAIN JUL CPI -0.3%r M/M (FCST -0.2%), +10.8% Y/Y (FCST 10.6%); JUN +10.2% Y/Y

SPAIN JUL HICP -0.6%r M/M (FCST -0.8%), +10.7%r Y/Y (FCST 10.5%); JUN +10.0% Y/Y

SPAIN Q2 2022 FLASH GDP +1.1% Q/Q (FCST +0.4% Q/Q); Q1 2022 +0.2% Q/Q

SPAIN Q2 2022 FLASH GDP +6.3% Y/Y (FCST +5.5% Y/Y); Q1 2022 +6.3% Y/Y

- Spanish inflation jumped to +10.7% y/y in the July release for the HICP headline (CPI +10.8%). This is 1984 high and a substantial 0.6pp and 0.8pp acceleration on June and 0.2-0.3pp above market expectations.

- Monthly contractions were softer than anticipated at -0.2% m/m (CPI) and -0.6% m/m (HICP). Both HICP readings and CPI M/M were revised down 0.1pp in final prints.

- The key underlying drivers were again food and energy prices. A fall in fuel costs saw a more muted bounce in energy.

- Core inflation ex. food and energy expanded by a hot 0.6pp to 6.1% y/y, a fresh 1993 high.

- Spanish GDP saw a substantial boost in the Q2 flash print. GDP advanced by 1.1% q/q (vs +0.4% forecast), after nearly stalling at +0.2% q/q in Q1.

- The Spanish data follows a similar trajectory as French data: hotter inflation, and robust GDP, setting the stage for further ECB policy normalisation.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.