-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA MARKETS ANALYSIS: A Hiking We Will Go

US TSYS: Yld Curves Bull Flatten Ahead FOMC, Early ADP Employ Data

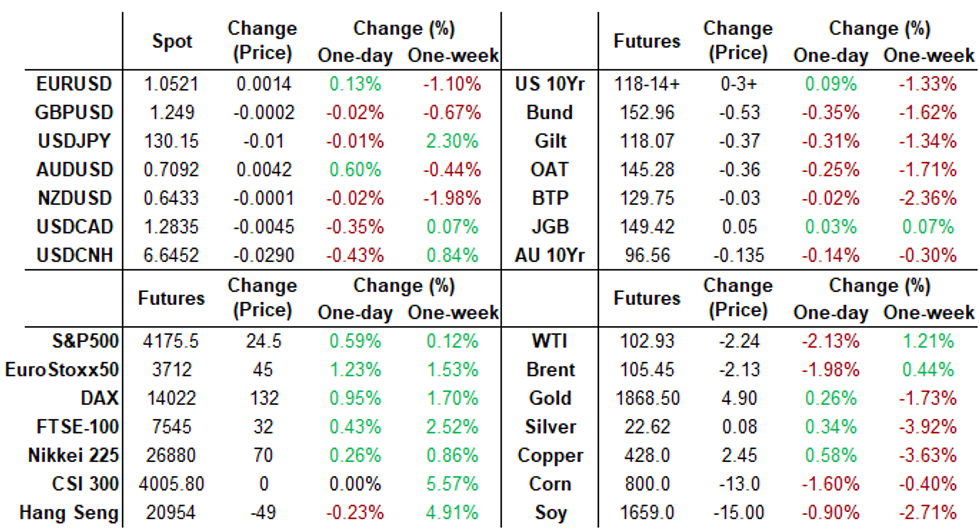

US Rates traded mixed Tuesday, futures rebounded from the week opener's broad based sell-off, curves bull flattening (2s10s -4.060 at 20.487) as long end rates outperformed in the lead-up to Wednesday's FOMC policy annc at 1400ET (Chairman Powell presser at 1430ET).

- Front end support in Eurodollar futures reversed in late trade, however, White pack (EDM2-EDH3) trading -0.005 in the lead quarterly to -0.050 across the balance of the strip. While market expectations of multiple 50bp hikes has expanded to 250bp by year end, the late reversal in the short end has some desks pondering a more aggressive forward guidance from the Fed may be revealed soon.

- Goldman Sachs agrees with consensus on a 50bp hike and QT announced at the May meeting, and they say the key question is what comes next. Despite Bullard raising the possibility of 75bp hikes in future, this is unlikely (but not implausible under certain circumstances).

- Aside from the FOMC, Wednesday data focus on ADP Employment Change (455k, 385k) at 0815ET that may provide some incite to Friday's Nonfarm Payrolls for April (+390k est vs. +431k prior).

- The 2-Yr yield is up 3.9bps at 2.7702%, 5-Yr is up 0.4bps at 3.0081%, 10-Yr is down 1.2bps at 2.9692%, and 30-Yr is down 1.6bps at 3.0167%.

Goldman Sachs: Attention On Powell Hinting At 50bp Hikes Beyond June

Goldman Sachs agrees with consensus on a 50bp hike and QT announced at the May meeting, and they say the key question is what comes next.

- Despite Bullard raising the possibility of 75bp hikes in future, this is unlikely (but not implausible under certain circumstances).

- Statement: Minimal changes apart from rate hike and balance sheet runoff; overall, “lower-than-normal risk of either a hawkish or dovish surprise.”

- Press conference: Pay close attention to any Powell comments that suggest 50bp hikes beyond June. “For example, a shift in language indicating an intention to hike expeditiously “to neutral” (vs. “toward neutral”) would likely signal the FOMC intends to continue hiking in 50bp increments past June.”

- Future action: Another 50bp hike in June, then 25bp per meeting for rest of 2022. But “reasonably high chances” of 50bp hikes until reaching 2.25-2.50% (which is the FOMC median “neutral” rate).

- The March FOMC minutes opened the door to MBS sales, but “our best guess” is that they won’t “since FOMC participants have a strong preference for using the policy rate as the primary tool for adjusting monetary policy and MBS holdings as a share of the Fed’s balance sheet will most likely never rise to an uncomfortable level.”

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements- O/N +0.00029 to 0.33029% (+0.00357 total last wk)

- 1M +0.02842 to 0.83171% (+0.09986 total last wk)

- 3M +0.02843 to 1.36329% (+0.12125 total last wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.07015 to 1.98086% (+0.08700 total last wk)

- 12M +0.06629 to 2.69486% (+0.02186 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $77B

- Daily Overnight Bank Funding Rate: 0.32% volume: $253B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $984B

- Broad General Collateral Rate (BGCR): 0.30%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $345B

- (rate, volume levels reflect prior session)

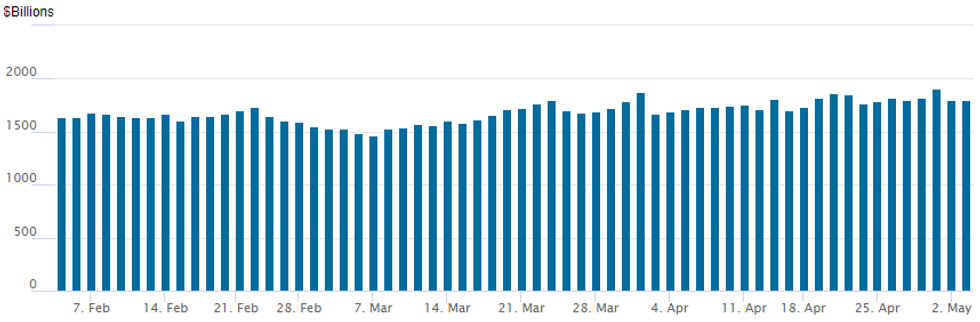

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage at 1,796.252B w/ 83 counterparties vs. prior session's 1,796.302B (all-time high of $1,906.802B on Friday, March 29, 2022).

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI derivatives saw moderate volume trade in wing options Tuesday, positioning ahead an expected 50bp rate hike from the FOMC on Wednesday.- Front end support in Eurodollar futures reversed in late trade, however, White pack (EDM2-EDH3) trading -0.005 in the lead quarterly to -0.050 across the balance of the strip. While market expectations of multiple 50bp hikes has expanded to 250bp by year end, the late reversal in the short end has some desks pondering a more aggressive forward guidance from the Fed may be revealed soon.

- In the meantime, underlying rate futures rebounded from the week opener's broad based sell-off, curves bull flattening as long end rates outperformed.

- 2,000 Red Dec 95.25/97.50 put spds

- -9,000 Dec 97.00/97.50/98.00 put trees, 19.5

- Overnight trade

- Block, total 11,900 Green Jun 97.00 calls, 8.5 ref 96.66

- 6,500 Green Jun 98.25/98.31/98.43 call trees

- 3,000 short May 96.50/96.62 put spds

- 2,000 short May 96.0/96.25 2x1 put spds

- Block, 4,000 Blue Jun 96.37/97.12 3x2 put spds

- 12,250 TYM 119.5 calls, 34

- 3,750 TYM 120.75/121.25 call spds, 1

- 2,000 TYM 116.5/117.5 put spds, 14

- +2,000 FVN 115 calls, 9

- -4,000 TYM 118.5 puts, 51 vs. 118-24.5/0.40%

- 6,250 FVN2 114.25 calls, 15-15.5

- Overnight trade

- 2,000 TYM 117.5/118/118.5 put flys, 4

- +10,000 FVM 110.5/111.5 put spds, 14.5-14.0

- 11,000 wk1 TY 117.5/118 put spds

- 3,000 TYM 118.5/119 put spds

EGBs-GILTS CASH CLOSE: Yields Back Off Multi-Year Highs

UK yields underperformed their German counterparts Tuesday, particularly at the long end as Bund and Buxl yields dipped. Overall, yields drifted lower after hitting multi-year highs (notably Bund >1%) this morning.

- The Gilt move of course reflected a catch-up following the UK markets reopening from a long weekend, but was also seen in context of Thursday's BoE decision (MNI's preview went out today).

- Periphery spreads widened modestly, with BTP/Bund spreads hitting a fresh post-May 2020 high.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.3bps at 0.275%, 5-Yr is up 2.6bps at 0.708%, 10-Yr is down 0.3bps at 0.965%, and 30-Yr is down 5.2bps at 1.087%.

- UK: The 2-Yr yield is up 5.5bps at 1.646%, 5-Yr is up 5.6bps at 1.727%, 10-Yr is up 5.3bps at 1.958%, and 30-Yr is up 4.2bps at 2.079%.

- Italian BTP spread up 2.5bps at 191.7bps / Spanish up 1.3bps at 105.9bps

EGB Options: Large Call Spreads Feature

Tuesday's Europe rates/bond options flow included:

- DUM2 110.50/110.70 cs bought for 5 in 5k, 10k all day

- RXM2 154.5/156cs, bought for 38 in 20k

- IKN2 125/122ps vs 127/128cs, bought the put spread for 31 and 34 in 10k

- ERZ2 99.37/99.50/99.62/99.75c condor, bought for 2.25 in 8k

FOREX: USD Pares Some Gains Ahead Of May FOMC, AUD Outperforms

- EURUSD had a sharp squeeze as the US session commenced. The pair rallied from 1.05 to 1.0578 on the back of little news headlines, echoing the price action throughout Monday’s European session. However, strength was short-lived and the pair continues to be well offered on rallies with supportive conditions for the greenback continuing to preside over currency markets.

- With that said the USD index trades 0.3% lower on Tuesday amid firmer equity indices and ahead of the long-awaited May FOMC decision.

- Technically, the USD is in a clear uptrend and this was reinforced in April. The bull theme is clearly highlighted in the USD Index (DXY) chart. A number of important technical factors are evident on the monthly frequency: see latest MNI analysis for details: https://marketnews.com/dxy-candle-pattern-reinforces-bullish-conditions-2657257678

- AUD held on to gains on Tuesday, following the RBA surprising markets overnight with a 25bps rate hike to 0.35% vs. expectations of a 15bps tweak. In the subsequent press conference, Governor Lowe flagged that the bank could raise rates as high as 1.5% by the end of 2022, and to 2.5% at a cyclical peak.

- In response, AUD/USD settled around the 0.71 mark after rallying to just shy of 0.7150 in the aftermath of the decision.

- The RBNZ Financial Stability Report will kick off the APAC session with Governor Orr due to hold a press conference about the report shortly afterwards. Additionally, New Zealand employment data shortly afterwards. Additionally, New Zealand Q1 Employment data will be released.

- China and Japan remain out for local holidays before a fairly light European calendar headlined by Spanish unemployment.

- US ADP employment data will be released on Wednesday which is unlikely to influence the market before the May FOMC decision and subsequent press conference with Governor Powell.

FX: Expiries for May04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550-70(E820mln), $1.0600(E1.9bln), $1.0700(E1.1bln)

- USD/JPY: Y130.30-50($656mln)

Late Equity Roundup: Near Highs Ahead Next Round of Earnings

Stocks trading near modest session highs after the FI close, SPX emini futures ESM2 currently +18.25 points (0.44%) at 4168.75 vs. 4129.5 low.

- Downtrend remains despite the carry-over bounce off Mon's lows, fresh lows have reinforced underlying bearish conditions and yesterday’s move lower resulted in a probe of key support at 4094.25, the Feb 25 low. Next key support would be 4056.00 (Mon's low) followed by 4029.25 High May 13 2021. On the upside: firm short-term resistance is at 4303.5.

- Earning after the bell: Prudential Fncl (PRU), AIG, Air BNB (ABNB), Starbucks (SBUX), Advanced Micro Devices (AMD) to name a few.

- SPX leading/lagging sectors: Energy extends gains (+3.03%) as O&G shares outperform energy equipment and servicers. Next up, Financials (+1.68%) with banks outpacing insurance and diversified shares, Materials (+1.36%).

- Laggers: Consumer Staples (-0.34%) weighed down by Estee Lauder (EL) -4.92% and Procter Gamble (PG) -1.53%; Consumer Discretionary (-0.25%) as hotels weigh on consumer services; autos outperforming (GM +4.42%, Borg Warner +2.79%).

- Meanwhile, Dow Industrials currently trades +70.68 points (0.21%) at 33132.07, Nasdaq +16.9 points (0.1%) at 12553.29.

- Dow Industrials Leaders/Laggers: Financials/insurers leading w/ Boeing (BA) (+5.74 at 154.35) overtakes Goldman Sachs (GS) +5.03 at 315.45 and JPM +3.31 at 123.36. Laggers holding: Nike (NKE) -3.02 at 123.06, Visa (V) -2.37 at 209.16.

- RES 4: 4631.00 High Mar 29 and key resistance

- RES 3: 4588.75 High Apr 5

- RES 2: 4509.00 High Apr 21 and a key short-term resistance

- RES 1: 4303.50/4355.50 High Apr 26/28 / Low Apr 18

- PRICE: 4172.0 @ 1530ET May 3

- SUP 1: 4056.00 Low May 2

- SUP 2: 4029.25 High May 13 2021

- SUP 3: 4000.00 Psychological round number

- SUP 4: 3958.00 2.00 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis remain in a downtrend, despite the recovery from yesterday’s low. Fresh lows have reinforced underlying bearish conditions and yesterday’s move lower resulted in a probe of key support at 4094.25, the Feb 25 low. A clear break of this level would reinforce bearish conditions and open the 4000.00 handle. 4056.00, Monday’s low, has also been defined as an important bear trigger. Firm short-term resistance is at 4303.5.

COMMODITIES: Oil Falls On Renewed China Demand Fears

- Oil prices have slid ~2.5% today as a return of China lockdown fears weighs on demand (Beijing asking city residents not to leave unnecessarily, postponing of school re-opening) against little further news on the EU’s push to ban Russian oil imports.

- Prices softened further after WSJ headlines that the CIA chief met with the Saudi Crown Prince last month in a bit to mend ties.

- WTI is -2.7% at $102.39 but doesn’t yet trouble support at $99.8 (Apr 27 low) whilst resistance is eyed at triangle resistance of $109.2.

- On a light day for volumes, the most active strikes have been $90/bbl and $85/bbl puts.

- Brent is -2.4% at $105.00, again not troubling support at $99.25 (Apr 25 low).

- Gold prices recover only marginally after sliding yesterday, hurt more recently by a renewed pricing in of Fed hikes. Up +0.25% at $1867.61, it is considered still vulnerable, with support at $1854.7 (May 2 low) and initial resistance at $1900.0 (May 2 high).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/05/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 04/05/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 04/05/2022 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 04/05/2022 | 0600/0800 | ** |  | DE | trade balance |

| 04/05/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/05/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/05/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/05/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/05/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 04/05/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/05/2022 | 0900/1100 | ** |  | EU | retail sales |

| 04/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/05/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 04/05/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/05/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 04/05/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 04/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 04/05/2022 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.