-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - FI Rallies and USD Slides On FOMC Minutes, Data

- Ahead of Thanksgiving, Treasuries rally and the Fed terminal rate is trimmed to 5% in a mixed session with weak US PMI surveys, a rise in initial jobless claims and somewhat dovish FOMC minutes ultimately driving momentum.

- Broad USD weakness extended further following the minutes, with G10 FX strength fairly broad-based and substantial.

- Oil slides on China Covid-demand fears and the EU seen pushing for a Russian oil price cap of $65-70/bbl that might have limited impact on curbing Russian supply, whilst gold and stocks benefit from lower yields and USD.

US TSYS: PMI Miss and FOMC Minutes Help Support TY Bullish Outlook

- Cash Tsys have seen a mixed session, but ultimately rally on a combination of notably weak PMI data and somewhat dovish FOMC minutes. The latter pointed to a “substantial” majority of participants judging a slowing in the pace of hikes would likely soon be appropriate with only “various” participants expecting the terminal rate to be “somewhat higher than they had previously expected”.

- The net result is 2YY -3.1bps at 4.483%, 5YY -5.0bps at 3.896%, 10YY -4.7bps at 3.709% and 30YY -8.0bps at 3.744%, with all majors tenors except the 30Y remaining within pre-FOMC session ranges.

- TYZ2 couldn’t exceed its earlier post-PMI peak of 113-00+ on the minutes, touching 112-31+ before retreating to 112-29 at typing. The technical bullish outlook remains intact, with resistance seen at 113-11 (Nov 16 high).

- Thanksgiving tomorrow sees data/Fedspeak resume on Monday all with an eye on Powell speaking on the economic outlook and labour market on Nov 30.

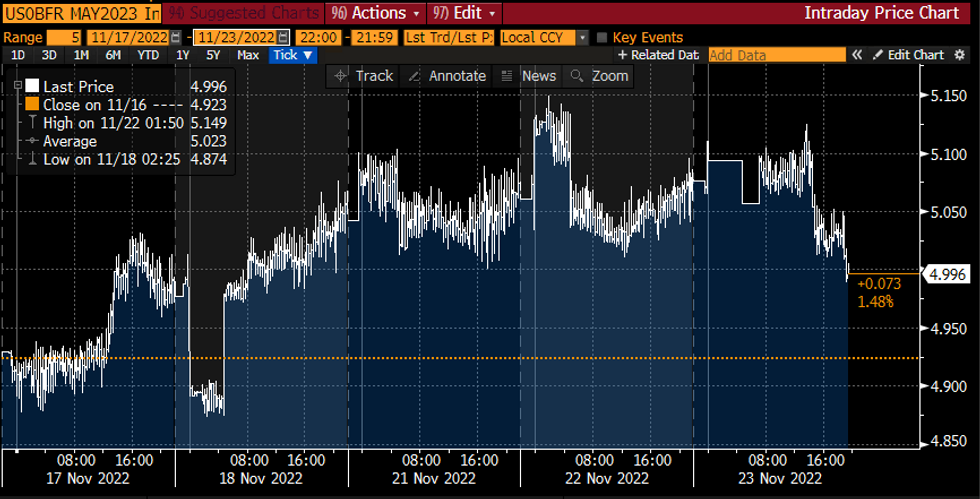

STIR FUTURES: Fed Terminal Dips Below 5% On FOMC Minutes

- The FOMC-dated OIS terminal rate sits at 5.0% having briefly dipped below, down 4bps on the release of the minutes and 6bps on the day.

- Follows “various participants” expecting the terminal rate to be “somewhat higher than they had previously expected”, perhaps an indication of less chance of 2023 dot being bumped up from 4.5-4.75% in the September SEP.

FOMC-dated OIS implied rate with May'23 meetingSource: Bloomberg

FOMC-dated OIS implied rate with May'23 meetingSource: Bloomberg

FOREX: Broad USD Weakness Extends Following FOMC Minutes

- Despite a firmer start for the greenback to start the week, the USD index extended Tuesday’s reversal lower and looks set to post a 1% decline on Wednesday as we approach the APAC crossover and the US Thanksgiving Holiday.

- Some highlighted the increase in initial jobless claims as well as weaker S&P PMI data as underpinning the USD weakness. Particularly, input cost inflation softening for the sixth month running, increasing at the slowest rate since December 2020 could be supporting the bid for US Treasuries.

- G10 FX strength was fairly broad based and substantial with GBP, NZD, SEK and NOK all rising in excess of 1.5% against the greenback. Both the AUD and JPY are also seen 1.25% firmer with a slightly less buoyant Euro that grinds back to the 1.0400 mark.

- A combination of lower oil prices as well as geographical proximity to the US sees the Canadian Dollar underperform across G10, with USDCAD close to unchanged on the session.

- Similarly, USDCNH is actually higher as the country is seeing near-record numbers of Covid cases, spurring major cities from Beijing to Shanghai to revert to broad restrictions on people’s movements and mass testing exercises to contain swelling outbreaks. Furthermore, reports of protests at China's iphone factory acted as an additional CNH headwind.

- In emerging markets EURHUF spiked substantially as German newspaper FAZ reported that the EU Commission are to recommend freezing EU7.5B of Hungary funds. EURHUF rallied from around 406 to 412 on the news, narrowing the gap with touted resistance at 416.03, the Oct 24 high.

- German IFO data and BoE Speakers precede the release of the ECB Monetary Policy Meeting Accounts on Thursday.

US DATA: PMIs Suggest Broad-Based Accelerated Decline In Activity

- The PMIs were much weaker than expected in the preliminary Nov release, with manufacturing at 47.6 (cons. 50.0) after 50.4 and the much more heavily weighted services at 46.1 (cons. 48.0) from 47.8.

- “The overall fall in activity was the second-fastest since May 2020 as inflation, rising borrowing costs and economic uncertainty weighed on demand".

- Notably on the price side, input cost inflation softened for the sixth month running, increasing at the slowest rate since Dec’20, whilst firms raised their selling prices at the slowest rate for just over two years. “Some firms stated that concessions and discounts were made to entice customers to place orders amid the weak demand environment."

- The service PMI has already seen weaker this cycle, with a low of 43.7 in Aug, but this latest print goes against hope of a bounce despite continued consumer rotation back from goods to services, in the process adding renewed downside to the ISM Services index which to date has been far more resilient (Nov released Dec 5) - second chart.

- For the full review of today's heavy US data schedule please see the Asia Open e-mail.

US DATA: Small Boost For Mortgages As Financial Conditions Ease

- Slight support for MBA mortgage applications with the composite rising 2.2% (similar gains in refis and purchases) as the 30Y mortgage rate followed the Freddie Mac rate and fell 23bps last week to 6.67%, down from an Oct 21 high of 7.16%.

- Application levels are clearly still historically depressed (close to lows through 2010-15 - see chart) but the increase reflects a quick feedthrough from the recent easing in financial conditions as long-end Treasury yields come off cycle highs, something the Fed will want to limit to help anchor long-term inflation expectations.

MBA mortgage rate (white), 10Y Tsy yields (pink) and MBA purchase applications (green)Source: Bloomberg

MBA mortgage rate (white), 10Y Tsy yields (pink) and MBA purchase applications (green)Source: Bloomberg

FED: Reverse Repo Sees Lowest Uptake Since June

- RRP uptake drops a further $35B to $2.069T, the lowest since Jun 6 prior to the FOMC ramping up its hiking pace.

- In doing so it passed through the most recent low of 2.087T (Nov 15) that was seen partly down to mid-quarter Tsy settlements and cash market repositioning after the US CPI release the prior week sparked a significant Tsy rally that made repo rates relatively more attractive.

- Analysts see a material pullback over the next year, with GS forecasting RRP usage to fall $750B by end-2023 and MS estimating RRP balances of around $1.2T by end-2023.

EGBs-GILTS CASH CLOSE: German Inversions Impress, BTP Spreads Tighten

UK and German long-end yields fell sharply Wednesday, with curves flattening as short-end yields remained buoyed by above-consensus PMI data.

- European flash Nov PMIs mostly beat expectations, and pointed to both a potentially milder recession and softening price pressures as demand pulls back.

- That said, concerns over weak global activity / disinflation appeared to persist: German curve inversion accelerated after poor US PMIs, hitting new cycle lows in multiple spreads (2s10s, 2s5s, 2s30s).

- Periphery spreads tightened as the Euro rose vs USD and equities sustained gains, with BTP/Bund just shy of the tightest closing level since April.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.1bps at 2.141%, 5-Yr is up 0.3bps at 1.966%, 10-Yr is down 4.8bps at 1.93%, and 30-Yr is down 1.4bps at 1.876%.

- UK: The 2-Yr yield is down 1.2bps at 3.13%, 5-Yr is down 3.7bps at 3.184%, 10-Yr is down 12.6bps at 3.011%, and 30-Yr is down 12bps at 3.196%.

- Italian BTP spread down 3.7bps at 189.8bps / Spanish down 1.2bps at 98.2bps

OPTIONS: US Upside Speculation, Mainly Mixed Euribor Plays Wednesday

Wednesday's US rates / bond options flow included:

* TYF3 113/111.50,ps 1x2, bought for 2 and 3 in 10k

* EDZ3 97.50p x1 vs SFRZ3 97.50c x2, sold at 222.5 in 10

* EDZ3 97.25/96.25/95.25p fly, bought for 17.5 in 6.5k

* SFRF3 95.37/95.62cs, bought for 1.25 in 5k

* SFRG3 94.75/94.50ps, sold at 5.75 in 5k

* SFRH3 95.31/95.43/95.50/95.62c condor, bought for 1.25 in 12.5k total now.

* SFRM3 95.00/95.50cs 1x2, bought for 1.5 in 2.5k

Wednesday's Europe rates / bond options flow included:

* ERG3 97.25/97.375/97.625 broken call ladder, bought for 2.5 in 2.5k

* ERZ2 97.75/97.87/98.00c fly, sold at 4.25 in 4k total

COMMODITIES: Oil Slides On China Covid Fears and Relaxed Russia Price Cap

- Crude oil has fallen heavily today on China covid-related demand fears and the EU discussing a softer Russian price cap of $65-70/bbl (up from 60-70/bbl the WSJ noted the G7 was considering yesterday, well above Russia’s cost of production and higher than some countries have been paying for its oil) , potentially having minimal impact on trading. EIA data were somewhat mixed, with a larger than expected draw in crude stocks but larger climbs in gasoline and distillate stocks.

- Losses were limited by Bloomberg reporting EU price cap talks have stalled according to those familiar with the matter before a light boost after the FOMC minutes.

- WTI is -4.0% at $77.75 as it begins to eye a key medium-term support at $74.96 (Sep 28 low).

- Brent is -3.7% at $85.13 compared to next support at $82.31 (Nov 21 low).

- Gold meanwhile is +0.6% at $1751.3, buoyed by a weaker USD post-FOMC minutes, but remains some way off the bull trigger at $1786.5 (Nov 15 high).

MNI NBH Review - November 2022: EU Funding Takes Primacy Over Rates

Markets

MarketsExecutive Summary:

- The NBH kept rates unchanged at 13.0% once again as Deputy Governor Virag highlighted that the central bank needs to see a “significant improvement” in risk sentiment before reducing the spread between the base rate and the effective rate.

- Since there has been no marked improvement in either of these criteria, no change in the monetary policy setup was expected this month, and that will likely remain the case into year-end.

- Analysts are relatively uniform in seeing no change to headline policy rates in the near-future, with most pointing toward the pre-announced tools as carrying the load for monetary policy going forward.

MNI NBH Review - November 2022.pdf

In the post-decision press conference, Virag flagged the suitability of 13% base rates to achieve their medium-term inflation view, with CPI seen edging lower from their forecast of 13.5 – 14.5% for 2022. Virag also struck a somewhat positive tone for Hungary’s current account balance, stating that Hungary is “likely over the worst for the current account shortfall”.

Latest source reports in FAZ suggest that the European Union finance ministers could keep cohesion fund payments frozen, with Hungary failing to meet the judicial reform and anti-corruption criteria – as flagged in the European Parliament last week. The report suggested that EU are looking to tie together both funding lines from the cohesion funds (E7.5bln) as well as from the yet-to-be-approved COVID recovery fund (as much as E5.8bln).

OECD Sees Weaker Growth Ahead Amid Risks of Worsening Energy Crisis(1/2)

The OECD’s latest Global Economic Outlook report has downgraded longer-term global growth projections, forecasting 3.1% growth in 2022 (vs 3.0% in June's projections), slowing to 2.2% in 2023 (vs 2.8% in June) and only moderately improving to 2.7% in 2024.

- Persistently high inflation, weaker real income growth, pessimistic sentiment and tightening financial conditions will all depress growth. Labour markets remain tight, yet employment growth is slowing.

- US and European growth are anticipated to decelerate sharply, with the eurozone and US on the verge of recession,whilst stronger expansions in Asian emerging markets will account for close to 3/4 of global GDP growth.

- That said, the Chinese growth outlook remains clouded, due to property-market weakness, rising non-performing loans and disruptions of Covid restrictions.

- Lower-income economies are more susceptible to higher inflation hurting growth. Signs of debt distress heightened by the strong dollar and global tightening of financial conditions have increased risks faced by emerging markets.

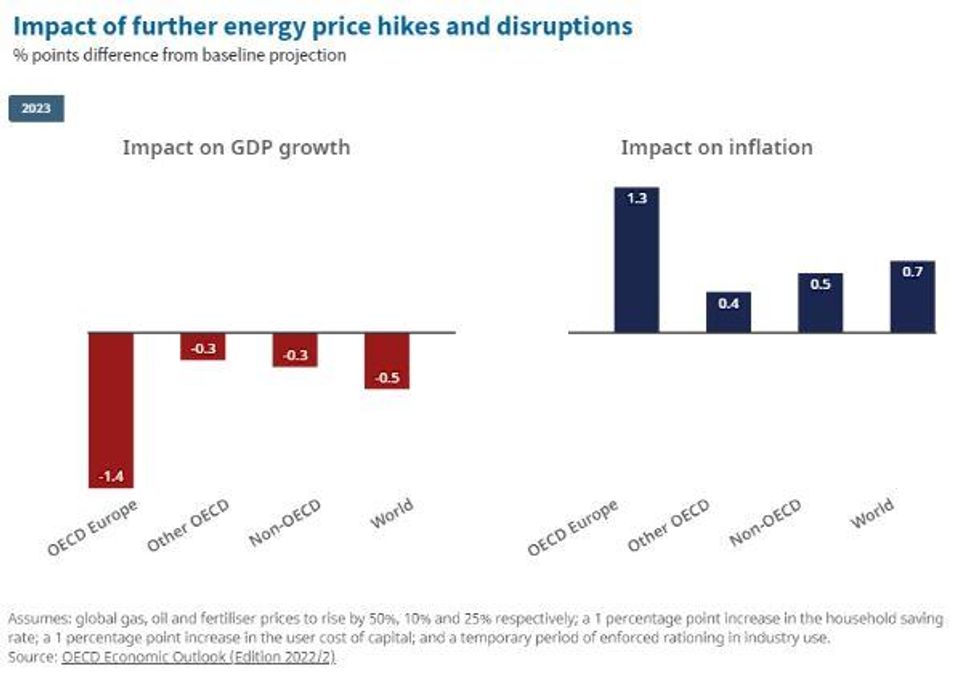

OECD Sees Weaker Growth Ahead Amid Risks of Worsening Energy Crisis(2/2)

Alongside the Russia-Ukraine war, energy expenditure as a percentage of global GDP is forecasted to reach 17.7% in 2022, akin to the costs of the first and second oil crises (1974 and 1980/1).

- The OECD’s energy price scenarios estimate another intense shock in 2023 would push European inflation up by a further 1.3pp while cutting GDP by 1.4pp.

- Global energy prices could be driven higher if the European winter proves to be colder/longer than anticipated and if Chinese demand were to rebound, a result hinging on whether Covid restrictions ease.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.