-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Follow EGB Rally, Weighing On USD Index

HIGHLIGHTS

- Having first rallied in the shadow of EGBs on German fiscal headlines and Lagarde talking about looking at PEPP reinvestment soon, Treasuries continued to rally once 2Y and 5Y supply had been absorbed relatively smoothly.

- Lower yields weighed on the USD index, with JPY one of the main beneficiaries, whilst the inflation breakeven- rather than real yield-led nature of the FI rally provided little tailwind to equities which ended the session with small losses.

- Oil also fell further today as weaker demand, partly implied by lower than expected industrial profits in China, weighed against a backdrop of continued uncertainty ahead of the delayed OPEC+ meeting Thursday. Gold stands out in commodities space, holding onto to a clearance of resistance overnight.

- Ahead, Australia retail sales data and RBA Governor Bullock in a panel discussion highlight Tuesday's APAC docket. US house prices, consumer confidence and Richmond manufacturing will precede a slew of Fed speakers scheduled during the US session, with further supply in focus with 7Y paper.

US TSYS: Modest 5Y Auction Trade Through Allows Further Step In Day's EGB-Led Rally

- Cash Tsys are close to or pushing fresh highs late in the session, now 5.5-8bps richer.

- The day’s rally followed in EGB footsteps after German fiscal matters concerning no net new debt issuance this year and Lagarde looking at PEPP reinvestments in the not-too-distant future (and indeed Bund yields closed -9.5bps, 10Y BTPs -11bps). This was aided by softer than expected lower tier data in new home sales and Dallas Fed manufacturing activity offsetting a paring of WTI losses.

- The largest tail for a 2Y auction at 1130ET briefly stalled this even if the cheapening impulse was quickly unwound, before a modest 0.5bp trade through for the 5Y auction at 1300ET allowed the rally to take another step (the auction being better than October’s weakest of the year but certainly not stellar with bid-to-cover and dealer take-up both suggesting a weaker auction than the five-auction average).

- TYZ3 has pushed to a new session high of 109-00+ as it plays to the bullish trend structure for a step back closer to resistance at the bull trigger of 109-08+ (Nov 17/22 high).

- Fed Funds pricing meanwhile sees little change over nearer-term meetings, with a first cut seen coming in June (27bp cumulative from current levels) but cuts to end-2024 have built some more from levels earlier in the session to a cumulative 88bps.

- Tomorrow sees house prices and the Conference Board consumer survey in focus for data, as well as a heavy Fedspeak schedule including text from Governor Waller (voter) on the economic outlook. Additional note issuance no doubt is watched closely as well, with $39B of 7-year paper.

EGBs-GILTS CASH CLOSE: Strong Start To Week

Core European FI started the week on the front foot, with yields steadily dropping through the session and the German and UK curves bull flattening Monday.

- Bunds outperformed, supported in part the latest fiscal developments, as Fin Min Lindner confirming Germany wouldn't take on new net debt this year despite the supplementary budget.

- With the German cabinet agreeing to the 2023 supplementary budget today, attention turns to Chancellor Scholz addressing the Bundestag Tuesday morning on the fiscal situation.

- Soft US housing data and softer oil prices helped the core FI bid; other than that, there were few Europe-specific drivers in the session.

- It was a slightly less constructive story for periphery EGBs, after ECB President Lagarde mentioned that PEPP reinvestment would be reassessed in the "not-too-distant future".

- We get some speakers overnight including ECB's De Cos and BOE's Ramsden, with Haskel and Lane up Tuesday. Eurozone inflation is the week's focus, with the November flash round starting Wednesday - our preview will be out Tuesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.3bps at 2.999%, 5-Yr is down 10.1bps at 2.515%, 10-Yr is down 9.5bps at 2.548%, and 30-Yr is down 6.7bps at 2.752%.

- UK: The 2-Yr yield is down 6.8bps at 4.643%, 5-Yr is down 7.6bps at 4.254%, 10-Yr is down 7.1bps at 4.212%, and 30-Yr is down 8.1bps at 4.665%.

- Italian BTP spread down 1.9bps at 173.6bps/ Greek up 4.1bps at 123.2bps

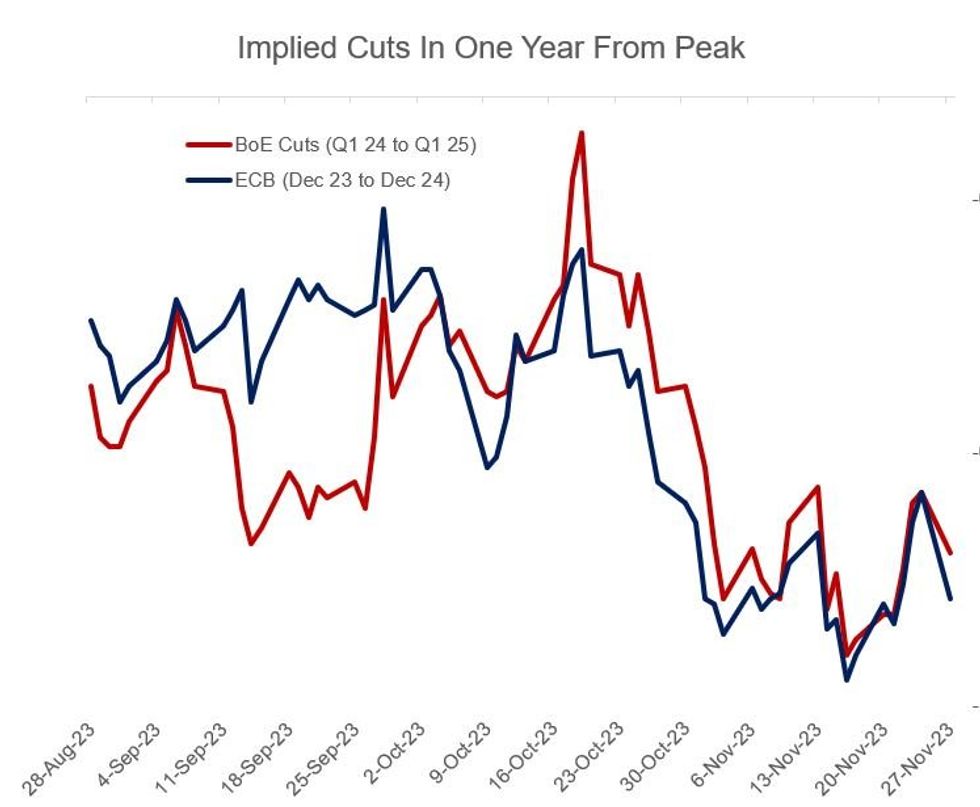

European STIR: ECB / BoE Cut Pricing Increases After Dipping Last Week

Implied ECB/BoE rate cuts increased Monday despite few Europe-specific catalysts, partially reversing the 14-15bp decline in cut pricing last week which had been triggered by stronger-than-expected PMIs (among other factors).

- 85bp BoE Bank Rate cuts are seen in the year following the Feb/Mar 2024 peak, which is the most since the Nov 22 close; there are 90bp of ECB cuts seen in 2024 after the Dec 2023 peak, the most since Nov 21.

- That represents 11bp more ECB cuts and 6bp BoE cuts than seen at Friday's close.

- There's limited change in the timing tempo, with the first 25bp ECB cut fully priced by the June 2024 meeting, with the BoE's in August 2024.

- Focus for the week remains on the November round of Eurozone CPI which runs Wednesday-Thursday - our preview will be out Tuesday.

FOREX: USD Index Starts The Week On A Soft Note, JPY A Beneficiary Of Tsy Rally

- After a mid-session lift, the USD index has returned to moderate weakness seen earlier on to start the week on a soft note. It shock off softer than expected second tier US data but a further slide in Treasury yields with rare double Treasury auctions out of the way has added a headwind for the greenback.

- The Japanese Yen is stronger with USDJPY having extended its session low to 148.55, back below the 149 handle. The bullish price pattern on Nov 21 - a dragonfly doji candle - signals a potential reversal and the end of the recent corrective move down. If correct, it suggests scope for a rally that would expose key resistance at 151.95, the Oct 21 2022 high. For bears, a break of 147.15, the Nov 21 low, would cancel the reversal pattern and instead open 146.38, trendline support drawn from the Mar 24 low.

- AUD has consolidated last week's rally, with the pair benefiting from the first close above the 200-dma since July (0.6584). Resultingly, AUD/USD has touched the best level since Aug10 at 0.6614 on Monday, closely matching touted resistance at the Oct 8 high, although despite heading to the APAC crossover on a strong note can’t quite get back to that level. Price action reinforces the bullish theme and signals scope for a continuation higher near-term.

- Australia retail sales data and the participation of RBA Governor Bullock in a panel discussion highlight Tuesday's APAC docket. US consumer confidence and Richmond manufacturing will precede a slew of Fed speakers are scheduled during the US session.

Expiries for Nov28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0775-80(E794mln), $1.0835-40(E926mln), $1.0850-55(E1.2bln), $1.0880-00(E1.0bln),$1.0935-55(E2.1bln)

- USD/JPY: Y147.95-90($790mln), Y148.50($1.1bln), Y148.95-00($1.5bln), Y149.85-05($1.4bln), Y152.85-00($1.2bln)

- EUR/GBP: Gbp0.8700-10(E897mln)

- AUD/USD: $0.6285-90(A$1.1bln), $0.6570(A$546mln), $0.6585(A$524mln)

- NZD/USD: $0.6045-50(N$593mln), $0.6100(N$590mln)

- USD/CNY: Cny7.1825($744mln)

Larger FX Option Pipeline:

- EUR/USD: Nov29 $1.0895-00(E1.4bln); Dec01 $1.0900(E1.0bln), $1.0995-00(E1.6bln)

- USD/JPY: Nov29 Y148.00-15($1.5bln), Y149.00-05($1.1bln); Nov30 Y148.30($1.3bln), Y149.00($2.2bln), Y149.85-05($1.5bln), Y151.00($1.0bln); Dec01 Y151.00($1.0bln)

- AUD/USD: Nov29 $0.6500(A$2.5bln), $0.6525(A$1.2bln)

- USD/CAD: Nov30 C$1.3000($2.7bln); Dec01 C$1.3600-20($1.8bln)

US FI OPTIONS: SOFR Call Spread Shifts And Vol Trading Monday

Monday's US rates / bond options flow included:

- SFM4 96.00/97.00cs, sold at 5.5 in 28k total, Paper is said to be long 250k,and buying the SFRU4 call spread.

- SFRU4 97.00/98.00cs, bought for 6 in another 25k, that's 50k total for 5.75 and 6

- SFRF4/SFRG4^ strip, sold at 35 in 1k

- SFRU4 95.50/96.00/96.50 c fly traded 4.5 in 1k.

- 0QZ3 95.37/95.25/95.12p fly traded 2 in 1k

- 0QZ3 95.62/95.50ps traded 7.5 in 2k.

- 0QF4 95.81/95.68/95.56/95.31p condor traded 1 in 1k.

- 2QF4 96.50/96.25/96.00p fly traded 5.5 in 5k (Block and screen)

- SFRZ3 94.62^ sold at 4.25 in 5k

- SFRZ4 95.00c sold at 0.25 in 5k (on screen).

EU FI OPTIONS: Limited Rates Trading To Start The Week

Monday's Europe rates / bond options flow included:

- ERM4 96.375/96.625/96.875 call fly paper paid 3 on 5K

- 0RZ3 97.12/97.50cs, sold at 1.5 in 7k

US STOCKS: Ending A Listless Session On A Softer Note

- The S&P e-mini at 4560 (-0.2%) is ending the session on a weaker note but remains within earlier ranges after a volatile day with little clear trend.

- It continues to sit towards resistance at 4580.5 (Nov 22 high) after which sits key resistance at 4597.5 (Sep 1 high), whilst support is seen at 4501.75 (Nov 16 low).

- Treasuries have seen a solid rally today, but it has predominantly been borne out in lower breakevens with a small decline in real yields, offering less of a macro tailwind to stocks (10Y yield -7.8bps, breakevens -5.2bps).

- The Nasdaq 100 outperforms (unch) whilst the Dow and Russell 2000 marginally underperform (-0.24/-0.3%).

- As for SPX, real estate (+0.6%) and consumer discretionary (+0.3%) lead whilst energy (-0.8%) and health care (-0.7%) lag. Hinted by the Nasdaq outperformance, some large names help aggregate bias returns higher, with Nvidia and Amazon paring earlier gains but both still +1%.

COMMODITIES: WTI Eases Further As Weaker Demand Meets OPEC+ Supply Uncertainty

- Crude erased earlier gains to be trading lower on the day, with a drop in WTI near the close after a volatile session. OPEC+ supply uncertainty is being weighed against a weaker demand picture, worsened by softer-than-expected industrial profits in China.

- The OPEC+ meeting is scheduled for 1PM GMT (8AM ET) Thursday according to a draft agenda seen by Reuters. Separately, OPEC is considering deepening its oil production cuts despite reluctance from some members, an OPEC+ source told Reuters.

- OPEC+ has still not reached an agreement on Nigeria/Angola production quotas for 2024 according to Chief OPEC correspondent Amena Bakr on X.

- Saudi Arabia is asking other OPEC+ members to reduce their oil output quotas but some members are resisting, OPEC delegates said, cited by Bloomberg.

- Efforts to refill the US emergency oil reserve are being hampered by companies delaying their return of borrowed barrels, according to Bloomberg.

- WTI is -0.8% at $74.94 but not testing support at $72.37 (Nov 16 low).

- Brent is -0.7% at $80.02 but not testing support at $76.60 (Nov 8 low).

- Gold is +0.6% at $2013.42 having touched a high of $2018.21 overnight to pierce resistance at $2009.4 (Nov 7 high). The modestly softer USD index and rally in US Tsy yields has further supported this earlier move. A clear break of this hurdle would confirm a resumption of the uptrend and open $2022.2, the May 15 high.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX

1M 5.35156 0.0044

3M 5.39321 0.00663

6M 5.40090 0.00938

12M 5.27346 0.01384

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.32%, 0.01%, $1521B

* Broad General Collateral Rate (BGCR): 5.30%, no change, $588B

* Tri-Party General Collateral Rate (TGCR): 5.30%, no change, $577B

On Nov 24, SOFR ticked back up to 5.32% after three days at 5.31% for what had been the lowest since Oct 30. Volumes fell further back from the Nov 16 joint recent high of $1640B.

New York Fed EFFR (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $101B

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $252B

Fed Funds volumes edged down just $1B on Nov 24, remaining in recent ranges.

FED: RRP Counterparties Fall To Joint Lowest Since Nov 2022

- RRP usage at $867B today consolidates Friday’s sizeable $66B decline, to what was the lowest since Jul'21.

- The number of counterparties fell further to 92, its lowest since Nov 15 and before that late Nov, 2022.

MNI Fed Balance Sheet Tracker - Nov 27, 2023

We've just released our latest Fed Balance Sheet Tracker (see PDF link below):

- Bank reserves have risen to the highest level since mid-April at over $3.48T, defying expectations of being run down alongside QT and Treasury cash rebuilding post-debt limit crisis.

- With their rise of over $400+B since just prior to March’s banking turmoil, we’re probably beginning to approach the limits of how high they can climb given ongoing Fed balance sheet runoff.

- Our latest Fed Balance Sheet tracker looks at latest estimates of when - and if - takeup of the overnight reverse repo facility (ON RRP) will fall to zero.

Full PDF here

US DATA: New Home Sales Miss In October But Keep To Recent Range

- New home sales were weaker than expected in October at a seasonally adjusted 679k annualized (cons 723k). However, it only takes it back close to levels seen in August as volatility remains, and with sales broadly flatlining between 660-730k since April.

- The latest monthly change was broadly in keeping with consensus (falling -5.6% vs -5.1%), with the miss driven by some of last month’s notable strength being revised away (8.6% vs initial 12.3%) along with some downward revisions to July and August.

- The regional breakdown offers no clear trends, with latest M/M rates ranging between -23% M/M and +13% M/M.

- Despite the trend flatlining in new home sales, they paint a notably different picture to existing home sales, with new home sales at pre-pandemic levels vs new home sales almost 30% lower.

US DATA: Dallas Fed Mfg Survey Sees 18th Monthly Decline For New Orders

- The Dallas Fed manufacturing survey slipped further from -19.2 to -19.9 in Nov, contrary to consensus for a small rise to -16.0.

- The near unchanged monthly reading masks a sharper decline in new orders, from -8.8 to -20.5, which aside from the -22.8 in Nov’22 is its lowest since Mar-May’20 and before that 2009.

- This is the eighteenth consecutive monthly decline for new orders, although the overall index trumps it with a nineteenth consecutive decline.

- Nevertheless, the six-month ahead production index remains in positive territory at 13.7, similar to the level its averaged over the past year with some noise.

- “Labor market measures suggest slightly slower employment growth and shorter workweeks in November. The employment index edged down from 6.7 to 5.0, a reading below the series average of 7.8” [although this measure was lower in August at 4.3].

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/11/2023 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 28/11/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/11/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 28/11/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 28/11/2023 | 0900/1000 | ** |  | EU | M3 |

| 28/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 28/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/11/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/11/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 28/11/2023 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/11/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 28/11/2023 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/11/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/11/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 28/11/2023 | 1500/1000 |  | US | Chicago Fed's Austan Goolsbee | |

| 28/11/2023 | 1505/1005 |  | US | Fed Governor Christopher Waller | |

| 28/11/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 28/11/2023 | 1545/1045 |  | US | Fed Governor Michelle Bowman | |

| 28/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/11/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 28/11/2023 | 1700/1700 |  | UK | BOE's Haskel UK Inflation Speech | |

| 28/11/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/11/2023 | 1805/1305 |  | US | Fed Governor Michael Barr | |

| 28/11/2023 | 1830/1930 |  | EU | ECB's Lane lecture on Macroeconomic policy | |

| 28/11/2023 | 2030/1530 |  | US | Fed Governor Michael Barr | |

| 28/11/2023 | 2325/1825 |  | CA | BOC Executive Director of Supervision Ron Morrow speech. |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.