-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - US Dollar Slides After Weaker US GDP Revision

- Treasuries broadly consolidate post JOLTS rally following below estimate US data

- USD index extends downward momentum, EURUSD back above 1.0900

- China manufacturing and non-manufacturing PMIs headline the overnight docket on Thursday, before French and Eurozone CPI data. The greenback and broader currency markets will remain focused on the key data releases due later this week - NFP, Core PCE and ISM.

US TSYS: Treasuries Pare Further Gains To Broadly Consolidate Post JOLTS Rally

- Front end Treasuries have pared more than half of their gains seen on surprise downward revisions for GDP growth and core PCE inflation in Q2, along with ADP missing shortly beforehand albeit with a caveat of an upward revision.

- Yields are 0.5-1.5bp lower on the day, ultimately consolidating yesterday’s large rally on weaker than expected JOLTS and Conference Board boards ahead of tomorrow’s core PCE for July and Friday’s NFP report.

- Curves had seen a further steepening intraday, with 2s10s touching -72.9bps, but are now back at -76.5bps for only +0.5bps on the day, with the long-end reluctant to pare gains after weaker than expected growth.

- TYZ3 trades mid-range at 110-27 (+01) off highs of 111-03+, breaching resistance at the 20-day EMA to next open 111-13+ (Aug 11 high). The trend direction remains lower however, with support at 109-18+ (Aug 25 low).

- Near-term Fed Funds implied rates have reversed most of the hit from the softer US data but are down notably on pre-JOLTS levels. They show +3bp for Sept and a cumulative +12bp for Nov to 5.45% terminal, the latter down 5.5bps from pre-JOLTS levels. Cuts from terminal are seen at 49bp to Jun’24 and 121bp to Dec’24.

- Tomorrow sees a heavy US docket including the July PCE report, MNI Chicago PMI, challenger job cuts and weekly jobless claims data, along with Fedspeak from Bostic and Collins.

EGBs-GILTS CASH CLOSE: Repeating Afternoon Rally

In a near re-running of Tuesday's price action, core European FI weakened for most of the session Wednesday before rallying in the afternoon on weaker-than-expected US macro data.

- The flash August estimates of German state inflation was marginally higher than expected, with a North Rhine Westphalia upside surprise sinking Bund futures at 0630UK, and Gilts joined in the selloff on the open.

- After Spanish data was largely in line, Bunds and Gilts began rallying midday, and soared after more soft US data readings including a downward revision to Q2 GDP and below-expected private payrolls figures.

- The German curve finished mixed, with 10Y underperforming; the UK saw twist steepening with the short-end/belly outperforming. Yields finished off the lows but as noted, also well off session highs.

- Periphery EGB spreads widened modestly, having come off of the session's tightest levels into the close.

- Thursday's European calendar brings Dutch and French inflation data early, with Italian and Euro area figures later in the day; we also get the German unemployment report, the accounts of the ECB's July meeting, and appearances by BoE's Pill, and ECB's Schnabel and Guindos.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3bps at 3.073%, 5-Yr is up 3.2bps at 2.573%, 10-Yr is up 3.5bps at 2.545%, and 30-Yr is up 2.5bps at 2.649%.

- UK: The 2-Yr yield is down 0.8bps at 5.238%, 5-Yr is down 2.1bps at 4.737%, 10-Yr is unchanged at 4.422%, and 30-Yr is up 1.7bps at 4.656%.

- Italian BTP spread up 0.7bps at 164.8bps / Spanish up 0.1bps at 101.6bps

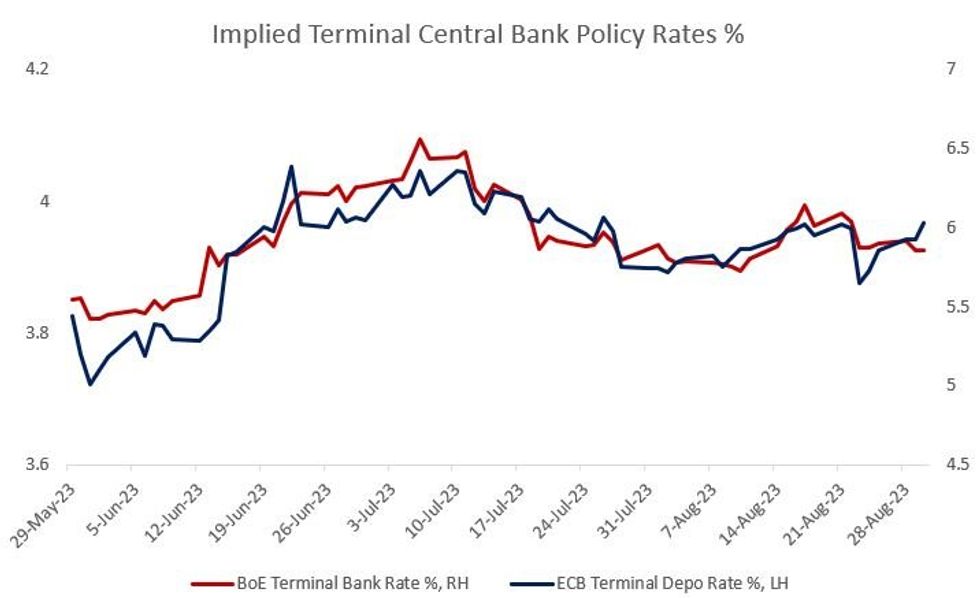

EU STIR: ECB Hike Pricing Picks Up On Flash Inflation; BoE Recovers US-Related Dip

ECB peak hike pricing ticked to the highest since Jul 26th on Wednesday after German and Spanish inflation data set the stage for a slightly higher-than-previously-expected Eurozone-wide number Thursday. BoE pricing was largely unchanged.

- ECB terminal depo Rate pricing +2.5bp to 3.97% (22bp of further hikes left in the cycle to Dec 2023). There's about 52% probability implied of a 25bp hike at the September meeting (up from around 44% at Tuesday's close), with 19bp in hikes cumulatively priced through the next two decisions.

- BoE terminal Bank Rate pricing +0.1bp to 5.86% (61bp of further hikes left in the cycle to Feb 2024). Little on the UK macro calendar today meant terminal pricing fluctuated modestly with Eurozone and US developments, recovering about 2bp of a drop after weak US data, to finish flat. There's a full 25bp hike priced for the September BoE meeting (5% prob of a 50bp hike), with 45bp cumulatively priced through the next 2 meetings.

US FI OPTIONS: Mixed Rates Trade Wednesday

Wednesday's US bond/rates options flow included:

- TUV3 101.375 puts 3.0K given at 0-04.

- SFRZ3 94.87/95.00cs, bought for 1 in 10k (0.95 synth, ref 94.595).

- SFRH4 95.00/95.12cs, bought for 2.75 in 10k.

- SFRZ3 94.25/94.18ps, bought for 0.75 in 12k total.

- SFRZ3 94.25/94.18ps, bought for 0.75 in 2k.

- SFRZ3 93.75p, bought for 1 in 5k, bid over.

- SFRV3 94.50/94.56/94.62/94.75 broken call condor, traded for 1 in 2k.

- SFRX3 94.56/94.68/94.81c fly, traded 3.25 in 2.5k.

- SFRZ3 94.50/94.43/94.37p fly, trades 0.75 in 3k.

- SFRF4 94.7594.68/94.62/94.56p condor, traded 1 in 5k.

- SFRH4 94.75/94.50ps vs 95.25c, traded 3 and 3.5 for the call in 10k.

- SFRH4 95.00/95.12cs, traded 2.5 in 2.5k.2QX3 97.00/97.25cs traded 2.5 in 1k.

- 2QH3 95.00/94.00ps, sold at 4 in 10k.

EU FI OPTIONS: Put Fly Strips And Upside Structures Feature Wednesday

Wednesday's Europe bond/rates options flow included:

- ERU3 96.125/96.25/96.375 c fly, sold at 4.25 in 2.5k

- ERU4 97.00/98.00cs vs 95.75p, bought the cs for half in 12k

- ERU4 96.37/96.25/96.12p fly with ERU4 96.12/96.00/95.87p fly strip, bought for 1.75 and 2 in circa 10k total.

- OEX3 115.00/113.50 1x1.5 put spread paper paid 16.5 on 4K

- DUV3 105.40/105.70cs, bought for 7.5 in 2.5k

FOREX: Greenback Weakness Drags USD Index Back Below 200-Day Moving Average

- A weaker than expected second reading of Q2 GDP in the US prompted another session of weakness for the greenback, extending on Tuesday’s declines following similarly soft data. Broad dollar weakness has seen the USD index briefly slide back below the 200-day moving average and hit the lowest level in two weeks ahead of further key data this week.

- Less optimistic price action in equities relative to Tuesday’s session has seen the likes of AUD and NZD trade lower, countering the theme of broad dollar weakness but extensions for EUR and GBP have been notable, both rising around half a percent.

- Recent bearish technical outlooks for both EURUSD and GBPUSD are now being tested with the former recovery from the channel base extending and the latter piercing resistance at the 20-day EMA. Potential profit taking ahead of the key jobs data on Friday could well be exacerbating the price momentum for both pairs.

- With the slightly backward looking US data, the impact on US yields has been more moderate than Tuesday’s significant bull steepening move. Thus, despite USDJPY briefly making a new low for the week at 145.56, actually sits a little higher on the day around 146.20 as we approach the APAC crossover.

- China manufacturing and non-manufacturing PMIs headline the overnight docket on Thursday, before French and Eurozone CPI data. The greenback and broader currency markets will remain focused on the key data releases due later this week - NFP, Core PCE and ISM.

US STOCKS: Holding Clearance Of Resistance At Bull Channel Base

- The S&P e-mini at 4526 has dipped just slightly off session highs of 4530.75 having earlier cleared resistance at 4515.52 (former bull channel base drawn from Mar 13) as Treasuries rallied on softer US data.

- A clear break could open next resistance at 4560.75 (Aug 4 high) whilst support is seen at the 50-day EMA of 4450.02.

- SPX trades +0.4% with the largest contributions from Apple (+1.7%) and Nvidia (+2.1%) in a mirror of yesterday, to see IT lead on the day (+0.95%).

- Utilities lag (-0.5%) with WTI giving up earlier gains, whilst overall financials at +0.3% belies weakness in banks (-0.4%). The latter’s weakness did however come before Bloomberg quoting sources on the Fed privately ramping up demands for corrective actions by regional banks (KBW regional banking index -0.6% but off lows seen before the headlines), although the news has prevented any further intraday recovery.

- Nasdaq outperforms the S&P 500 with +0.6%, whilst the Dow again underperforms with 0.2%.

COMMODITIES: Crude Pulls Back After Resistance Clearance Despite Large Inventory Drop

- Crude again sees a volatile day but heads towards the end of the US session mid-range for small increase on the day with little clear positive impulse from another substantial inventory drop (DOE crude inventories -10.58M vs cons -1.6M). Softer growth implications from downward revisions to Q2 GDP growth/core PCE inflation and lower than expected ADP employment growth have mostly countered any tailwind from further USD weakness.

- There have been concerns about Hurricane Idalia which has barreled through the rich oil and gas producing Gulf of Mexico but there has been limited production and supply impact so far.

- Barclays raised its 2024 Brent price forecast to $97/bbl, up by $8/bbl previously as market balances are expected to further tighten next year, the bank said in a note.

- Russian Deputy PM Novak said it plans to cut oil exports in Sept by 300kbpd against June levels according to Interfax. Russia is likely to export around 3.1mbpd of crude oil in Sept, which is around 300kbpd lower than June levels, according to Bloomberg vessel tracking.

- WTI is +0.3% at $81.39 off a high of $82.05 that easily cleared resistance at $81.75 (Aug 21 high) to set up a run to its bull trigger at $84.16 (Aug 10 high).

- Brent is +0.0% at $85.49 off its high of $86.23 that cleared $85.86 (Aug 21 high) to open the bull trigger at $88.10 (Aug 10 high).

- Gold is +0.3% at $1944.10 off a high of $1948.95 as the USD slipped after weaker data. It just about cleared $1948.3 (61.8% retrace of Jul 20- Aug 21 bear leg) but will need a more concerted push higher to test next resistance at $1963.3 (76.4% retrace of the same move).

US-CHINA: Raimondo Says "There Were No Setbacks" On "Productive" China Trip

US Commerce Secretary Gina Raimondo has told reporters that her China trip had "no setbacks" and new mechanisms established during her trip mark "a big step forward" for China and the US.

- Raimondo: "There were no setbacks. It was.. three days of productive meetings. And the biggest achievement was just to start regular communication..."

- Raimondo: "This is the first time in more than five years that a U.S. Commerce secretary has come to China to have discussions. So the achievement was to have face-to-face discussions and to put on the table some of the biggest challenges in our trade and investment and our commercial relationship."

- Raimondo: "It’s a big step forward. You can’t solve any problems without first communicating. And now we have to launch these different mechanisms, then see what problems we might be able to solve."

- On a working group established to share information on US export controls, Raimondo said: "That’s not a working group on export controls to seek concessions, but it is an opportunity to share information and increase transparency, and I didn’t receive pushback on any of those."

US DATA: GDP Q2 Growth Revised Down From Various Factors, GDI Still Lethargic

- Real GDP was softer than expected in the second Q2 release, revised down to 2.06% annualized (cons 2.4) after 2.41% in the first release, following 2.00% for Q1, and showing no sign of stronger momentum behind the surging Atlanta Fed GDPNow estimates for Q3.

- Personal consumption was revised higher by marginally less than expected to 1.67% (cons 1.8) from 1.64%.

- The main contributions to downward revisions instead came from changes in inventories (-0.23pps), non-residential investment (-0.19pps) and net exports (-0.1pps) rather than one category in isolation.

- Away from revisions, final sales to domestic purchasers dominate the overall contribution at 2.4pps, whilst changes in inventories and net exports see small drags on the quarter.

- Separately, first details for Gross Domestic Income (GDI) show a tepid 0.49% annualized in Q2 after two quarters averaging -2.6% annualized. It leaves an average for GDP/GDI growth at just 1.3% annualized albeit an acceleration from 0.1% in Q1 and -0.4% in Q4.

US DATA: ADP Misses In August, Still Above Private Payrolls Consensus

- ADP employment came in softer than expected at 177k (cons 195k) in August. Recall it follows two months of large overshoots of private payrolls growth for June and July.

- There is however some confusion on revisions. The ADP press release notes that “the July total of jobs added was revised from 324,000 to 371,000”, a figure picked up by wires, although its own data available on the ADP website show what would be a downward revision to 312k.

- From the press release: "This month's numbers are consistent with the pace of job creation before the pandemic."

- Private payrolls consensus prior to the report was seen at 148k.

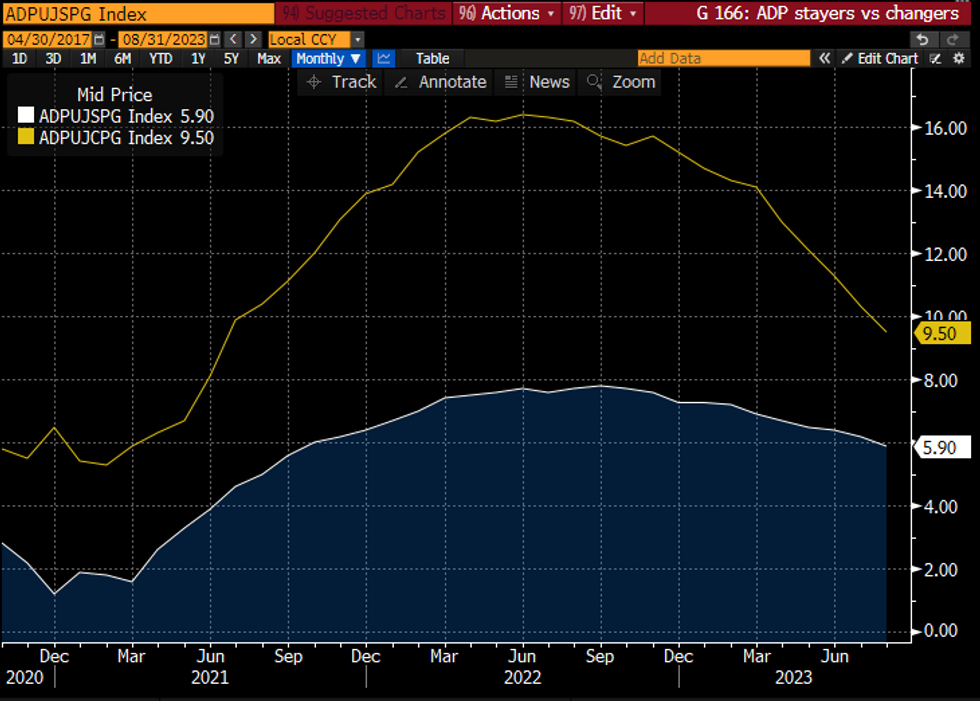

US DATA: ADP Wage Growth Continues Moderation With Further Progress Needed

- The earlier ADP report showed a further marked deceleration in wage growth for job changers in August, although it was still very strong at 9.5% Y/Y after 10.3% for its softest since Jun’21.

- Job stayers continued their steadier moderation, from 6.2% to 5.9% Y/Y for its softest since Sep’21.

- The limited back history for the relatively new series makes a comparison with pre-pandemic growth difficult, but it’s likely that wage growth remains far stronger than prior trends.

Job changers (yellow), job stayers (white)Source: Bloomberg

Job changers (yellow), job stayers (white)Source: Bloomberg

US DATA: Pending Home Sales Beat But Subdued Trend Intact

- Pending home sales were stronger than expected in July, rising 0.9% M/M (cons -1.0%) after a minimally revised 0.4% (initial 0.3%).

- The increase was led by the Wet (+6.2%) and less so South (+2.0%) whilst Northeast and Midwest sales declined. Note from the press release: “Interestingly, the West region experienced a meaningful price decline in the past year and buyers are quickly returning as a result".

- Overall sales do little to change the trend of existing home sales seeing a meaningfully softer trend to that of new home sale, the latter seeing greater supply relative to available stock.

- Pending sales are more than 25% below their 2019 average vs new home sales back above the pre-pandemic average.

EUROZONE: Initial HICP Estimates Look A Bit Low After German/Spanish Prints

We've had 44% of the countries in the Eurozone HICP weighting report so far, and headline looks set to come in at around 5.1-5.2% Y/Y in Thursday's flash print if the French (20% of the basket) and Italian (17%) prints are roughly in line.

- That would be a little above the 5.1% consensus coming into today's German and Spanish (and Belgian and Irish) prints.

- As for core, sell-side analysts' updated forecasts suggest mixed views vs the 5.3% Y/Y initially projected, though we remind that the majority of the HICP basket is yet to report (we also hear from the Netherlands, Austria, Slovenia and Portugal - totaling 12% of the HICP weighting - prior to the Italy/EZ simultaneous release).

Updates from this afternoon include the following - note the mixed core outlooks:

- Goldman: Headline: 5.3% Y/Y; Core 5.3%

- JPMorgan: Headline 5.2% Y/Y; Core 5.1%

- Nomura: Headline 5.2% Y/Y ("nowcast" 5.16%); Core "nowcast" (5.37%) shows upside risks of 5.4-5.5% vs Nomura's 5.3% forecast

Busier CHF Options Trading Coincides with Inflation-Adjusted CHF Near Multi-Year Highs

- CHF options are a standout Tuesday thanks to a series of trades consistent with volatility hedges through the European open: sizeable demand in 0.8900-05 and 0.9035-75 call strikes traded alongside 0.8250 and 0.8730 puts.

- The trades generally cover Q4’23 and Q1’24, thereby capturing the September and December rate decisions. The trades standout given the more muted G10 hedging market ahead at the NY crossover, despite more active currency futures as AUD, JPY and EUR futures post above-average volumes for this time of day.

- EUR/CHF trades well within range of the YTD lows of 0.9516 and the post-peg removal lows at 0.9410, moves that are keeping the CPI-adjusted CHF exchange rate close to the best levels since 2015 – a welcome development for the SNB that have been leaning on currency strength to provide tighter domestic conditions.

- The reliance on a stronger currency for monetary policy purposes could become increasingly important into year-end, as the SNB approach the assumed peak rate of 2.00%, with the SARON futures pricing little/no chance of rate hikes beyond.

FED: RRP Usage Stabilizes

- RRP usage was near unchanged today at $1,697B after $1,693B yesterday.

- It consolidates Friday’s new recent low of $1,687B at what was the lowest since Apr 1, 2022, but doesn’t break lower just yet as some had expected.

- Oxford Economics’ Canavan said beforehand that “RRP demand may dip further as the week progresses though, as a result of the bill and coupon auction settlements”.

- The number of counterparties fell back to 96 (-2).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/08/2023 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 31/08/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/08/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/08/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/08/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 31/08/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/08/2023 | 0630/0730 |  | UK | DMO to publish Oct-Dec issuance calendar | |

| 31/08/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/08/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/08/2023 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/08/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/08/2023 | 0700/0900 |  | EU | ECB's Schnabel Speaks at Conference | |

| 31/08/2023 | 0715/0315 |  | US | Atlanta Fed's Raphael Bostic | |

| 31/08/2023 | 0715/0815 |  | UK | BoE's Pill speaks at South African Reserve Bank conference | |

| 31/08/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/08/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/08/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/08/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/08/2023 | 1130/1330 |  | EU | ECB MP Meeting Account Publication | |

| 31/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/08/2023 | 1230/0830 | * |  | CA | Current account |

| 31/08/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 31/08/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/08/2023 | 1300/0900 |  | US | Boston Fed's Susan Collins | |

| 31/08/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/08/2023 | 1345/0945 | *** |  | US | MNI Chicago Report |

| 31/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/08/2023 | 1600/1800 |  | EU | ECB's de Guindos Speaks at Conference | |

| 01/09/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.