-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Anticipating Soft to In-Line Job Gains Friday

- MNI US DATA: Q3'23 QCEW Jobs Revised Up, Slightly Lower Downside NFP Revision Risks

- MNI BOC WATCH: Cut Leads G7 And Macklem Sees More Slow Moves

- MNI BRIEF: BOC Says Far From Limit On Rate Divergence With Fed

- MNI US DATA: Stronger May ISM Services Makes Weak April Look Like One-Off

US TSYS Already Anticipating In-Line to Lower NFP

- Treasuries looked to finish moderately higher Wednesday, upper half decent session range after early data-tied volatility. Treasury futures initially gapped higher after lower than expected ADP jobs gain of +152k vs. +175k est (192k prior down-revised to +188k).

- Not much of a reaction to in-line S&P Global US Services PMI final (54.8 vs. 54.8 est), while Composite PMI gains slightly (54.5 vs. 54.2 est).

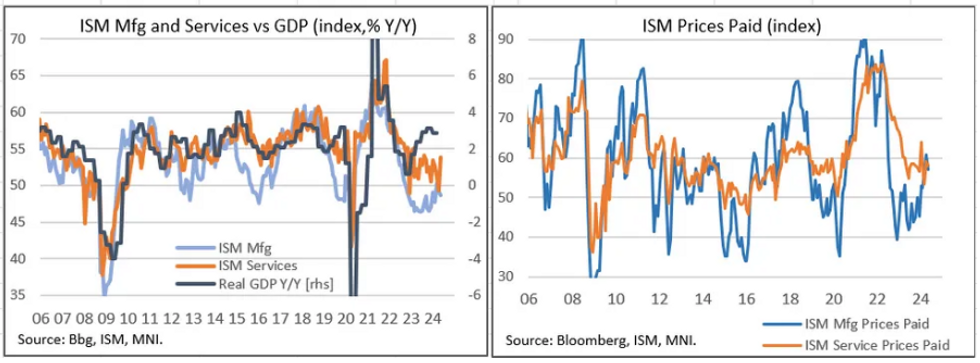

- Fast two-way flow reported as Treasury futures retraced from a gap-bid to new session high of 110-12.5 (near April 5 levels) after mixed ISM Services data: Index higher than exp (53.8 vs. 51.0 est), lower Prices Paid (58.1 vs. 59.0 est), in-line Employment (47.1 vs. 47.2 est), higher New Orders (54.1 vs. 53.2 est).

- Late year rate cut projections have gradually gained vs. late Tuesday levels (*): June 2024 at -1.3% w/ cumulative rate cut -.3bp at 5.328%, July'24 at -18% w/ cumulative at -4.8bp (-4.3bp) at 5.283%, Sep'24 cumulative -19.8bp (-19.3bp), Nov'24 cumulative -28.9bp (-27.8bp), Dec'24 -47bp (-44.3bp).

- Focus turns to Thursday's weekly claims and Unit Labor costs as well as the ECB policy announcement, followed by Friday's headline Non-Farm payrolls data.

NEWS

BOC WATCH (MNI): Cut Leads G7 And Macklem Sees More Slow Moves

Bank of Canada Governor Tiff Macklem lowered the key lending rate for the first time in four years on Wednesday, moving ahead of G7 peers and saying measured further cuts are likely needed amid growing confidence that restrictive policy is returning inflation to target.

CANADA BRIEF (MNI): BOC Says Far From Limit On Rate Divergence With Fed

Bank of Canada Governor Tiff Macklem told reporters Wednesday there remains a lot of potential for interest rates to go below the Federal Reserve, at a time when some investors have speculated that could trigger weakness in the currency.

SECURITY (MNI): IAEA Board Of Governors Passes Resolution To Censure Iran

The IAEA, has passed a resolution calling on Iran to improve cooperation with the UN nuclear watchdog and reverse a decision to bar inspectors from nuclear sites.

OVERNIGHT DATA

US DATA (MNI): ADP Payroll Gains Slow, But Shouldn't Shift NFP Consensus Much

- ADP private payroll gains totalled 152k in May, below the 175k consensus and a 4-month low for the series. April's figure was only slightly downwardly revised (to 188k from 192k), a moderate change versus previous large revisions. Firms with 500+ employees led gains, with +98k (+100k prior), with hiring slowing in firms with 1-49 employees (total -10k vs +37k prior).

- The ADP series hasn't been a great predictor of the corresponding month's private payroll gains in the nonfarm report, but it's been close enough in magnitude to give a sense of general sense, albeit often underestimating the NFP figure.

- April's 192k ADP (pre revision) vs NFP private payrolls 167k was about as close as it got this year, with significant undercounts in the previous 5 months.

US DATA (MNI): Stronger May ISM Services Makes Weak April Look Like One-Off

- The ISM Services report for May was surprisingly strong, with the headline index rising 4.4 points to 53.8 - the biggest one-month rise since January 2023, the highest reading since August 2023, and suggesting that April's sub-50 reading was an anomaly.

- This was a "goldilocks" report in the sense that activity indices were steady/higher even as the prices subindex moderated (a still-high 58.1 but down from 59.2 prior). Notably, the business activity/production category soared 10.3 points to 61.2 - joint-highest since December 2021.

- New orders rebounded 1.9 points to 54.1, new export orders soared 13.9 points to 61.8 (an 8-month high, and the biggest one-month increase since April 2023) with imports dropping 10.8 points to 42.8. The employment category, which will be very closely looked at ahead of Friday's nonfarm payrolls report, rose 1.2 points to 47.1, partially reversing a 2.6 point drop in April but still contractionary and below the Q1 average of 49.0.

US MAY FINAL SERVICES PMI 54.8 (FLASH: 54.8); APR 51.3

US MBA: REFIS -7% SA; PURCH INDEX -4% SA THRU MAY 31 WK

US MBA: UNADJ PURCHASE INDEX -13% VS YEAR-EARLIER LEVEL

US MBA: 30-YR CONFORMING MORTGAGE RATE 7.07% VS 7.05% PREV

US MBA: MARKET COMPOSITE -5.2% SA THRU MAY 31 WK

BOC CUTS KEY RATE 25BPS TO 4.75%, SEES SLOW FUTURE CUTS

BOC: MOVING TOO FAST RISKS PROGRESS COOLING INFLATION

BOC HAS INCREASED CONFIDENCE CPI IS RETURNING TO TARGET

CANADA (MNI): BOC Reduces Rates By 25 BPS, Expects Future Cuts To Be Measured

The BoC cut interest-rates for the first time in 4 years by 25 basis points to 4.75% as Governing Council agreed that monetary policy no longer needs to be "as restrictive." The Bank says that they have increased confidence that inflation is moving back to the 2% target.

US DATA

(MNI) Q3'23 QCEW Jobs Revised Up, Slightly Lower Downside NFP Revision Risks: A note on the Quarterly Census of Employment and Wages (QCEW) revisions released this morning:

- Revisions were made to Q1 through Q3 2023, but the Q4 job estimates were completely unchanged - the BLS tells MNI that Q4 will only be revised in subsequent releases. That puts attention squarely on August's release of Q1 2024 prelim data, which also provides the initial basis for the annual benchmarking of nonfarm payrolls in early 2025.

- More specifically, the level of QCEW employment in Q1 and Q2 was revised slightly lower, with Q3 revised sharply higher (255k more employed in Sept 2023 at 154.028m vs an original 153.773m estimate), but then Oct/Nov/Dec are unchanged, with Dec levels staying at 154.848m.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 63.01 points (0.16%) at 38771.06

- S&P E-Mini Future up 52.75 points (0.99%) at 5356.5

- Nasdaq up 293.3 points (1.7%) at 17149.92

- US 10-Yr yield is down 4.1 bps at 4.2851%

- US Sep 10-Yr futures are up 9/32 at 110-9.5

- EURUSD down 0.0006 (-0.06%) at 1.0873

- USDJPY up 1.22 (0.79%) at 156.1

- WTI Crude Oil (front-month) up $0.89 (1.22%) at $74.14

- Gold is up $26.26 (1.13%) at $2353.26

- European bourses closing levels:

- EuroStoxx 50 up 82.29 points (1.66%) at 5035.66

- FTSE 100 up 14.91 points (0.18%) at 8246.95

- German DAX up 170.3 points (0.93%) at 18575.94

- French CAC 40 up 68.67 points (0.87%) at 8006.57

US TREASURY FUTURES CLOSE

- 3M10Y -4.196, -112.676 (L: -113.787 / H: -103.976)

- 2Y10Y -0.088, -44.543 (L: -46.257 / H: -43.127)

- 2Y30Y +0.647, -29.252 (L: -32.416 / H: -28.093)

- 5Y30Y +0.497, 13.166 (L: 10.367 / H: 13.734)

- Current futures levels:

- Sep 2-Yr futures up 2.875/32 at 102-5.875 (L: 102-01.625 / H: 102-06.25)

- Sep 5-Yr futures up 6.5/32 at 106-24 (L: 106-13.5 / H: 106-25)

- Sep 10-Yr futures up 8.5/32 at 110-9 (L: 109-26.5 / H: 110-12.5)

- Sep 30-Yr futures up 22/32 at 119-9 (L: 118-10 / H: 119-13)

- Sep Ultra futures up 29/32 at 126-26 (L: 125-18 / H: 127-01)

US 10Y FUTURE TECHS: (U4) Through The Bull Trigger

- RES 4: 110-07+ 2.0% 10-dma envelope

- RES 3: 110-17 High Apr 4

- RES 2: 110-12+ High Jun 5

- RES 1: 110-10 2.0% Upper Bollinger Band

- PRICE: 110-07+ @ 16:57 BST Jun 5

- SUP 1: 109-03+/107-31 20-day EMA / Low May 29

- SUP 2: 107-20+ Low May 29

- SUP 3: 107-12+ Low Apr 25 and the bear trigger

- SUP 4: 107-00 Round number support

Treasuries maintain a firmer short-term tone following the recovery from last week’s 107-31 low (May 29), and have traded through the bull trigger at 110-09 next, the May 16 high. The break above here and a confirmed close would strengthen the bullish condition, opening levels last seen in early April. Any resumption of bearish activity would instead refocus attention on support at 107-31.

SOFR FUTURES CLOSE

- Jun 24 +0.005 at 94.673

- Sep 24 +0.025 at 94.895

- Dec 24 +0.045 at 95.170

- Mar 25 +0.055 at 95.440

- Red Pack (Jun 25-Mar 26) +0.045 to +0.060

- Green Pack (Jun 26-Mar 27) +0.040 to +0.045

- Blue Pack (Jun 27-Mar 28) +0.040 to +0.040

- Gold Pack (Jun 28-Mar 29) +0.040 to +0.040

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00039 to 5.32791 (-0.00190/wk)

- 3M -0.00098 to 5.33751 (-0.00533/wk)

- 6M -0.01397 to 5.28465 (-0.02954/wk)

- 12M -0.03971 to 5.11324 (-0.08873/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (-0.02), volume: $2.092T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $787B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $769B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $100B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $280B

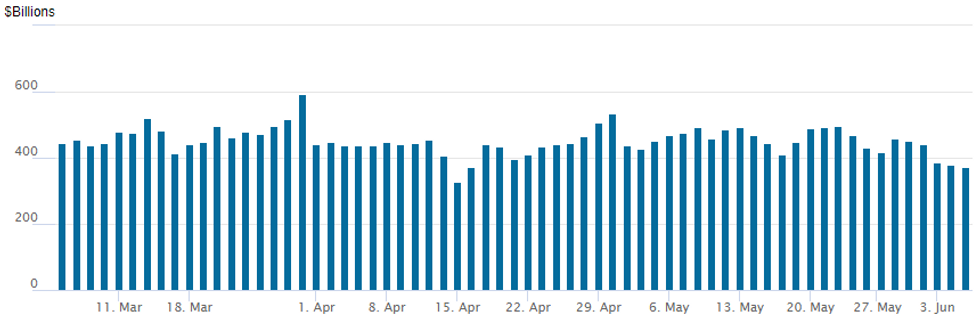

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage slips to $371.841B from $377.825B prior; number of counterparties at 76. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE Late Corporate Debt Issuance Summary

Once Acrisure launches, session total issuance should b just over $10B, $35.7B midweek total:

- Date $MM Issuer (Priced *, Launch #)

- 6/5 $2.5B #Health Care Service Corp $750M 5Y +90, $750M 10Y +120, $1B 30Y +145

- 6/5 $1.875B Acrisure $1.375B 6.5NC2, $500M 5NC2

- 6/5 $1.5B #Duke Energy $750M 10Y +118, $750M 30Y +140

- 6/5 $1.5B *Serbia 10Y +200

- 6/5 $1B Medline Borrowers 6.25% 2029 tap

- 6/5 $600M #F&G Global Funding 3Y +137.5 (3Y SOFR leg dropped)

- 6/5 $550M #MasTech 5Y +160

- 6/5 $500M *FMO (Nederlandse Financierings-Maatschappij) WNG 5Y +38

FOREX JPY Consolidates Early Decline, Moderately CAD Weakness as BoC Cuts

- Following the strong JPY rally this week, more optimistic price action for global equities has seen the Japanese Yen retrace substantially on Wednesday. USDJPY stands up 0.83% on the session, having risen back above the 156 handle, where it has been consolidating across the majority of the US session.

- On Tuesday, initial support was exposed at 154.66, the 50-day EMA. Despite the level being pierced (154.55 low), the strong subsequent bounce keeps this key support zone intact for now. Adding weight to this area, 153.93, a trendline drawn from the Dec 28 low, remains the key support. For bulls, a move above 157.71, the May 29 high, is required to resume a short-term uptrend.

- A first 25bp cut from the Bank of Canada and a signal to likely cuts ahead prompted some sharp initial weakness for the Canadian dollar. The immediate spike higher in USD/CAD saw the pair reach highs of 1.3741 before slowly edging back towards the 1.3700 mark as we approach the APAC crossover.

- With the ECB also taking place this week, it is worth noting that EURCAD printed as high as 1.4929, a fresh 6-month high. The cross notably pierced above trendline resistance from the July 2020 highs, and a close above this mark will be closely monitored in coming sessions.

- The more stable risk backdrop also weighed on the Swiss Franc, although the move lagged the Japanese Yen leg lower, as SNB’s Jordan’s recent hawkish remarks continue to add a short-term boost to the Swiss Franc. EURCHF continues to oscillate either side of 0.9700 and remains 2.2% below last week’s highs.

- EURUSD trades a tight range ahead of the ECB, just below the 1.0900 mark. Despite the pullback in EURUSD from Tuesday’s high, a bull cycle remains in play and sights are on 1.0933, a Fibonacci retracement.

- ECB decision and press conference takes focus on Thursday. US jobless claims is also scheduled, likely to play second fiddle to Friday’s US employment report for May.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/06/2024 | 0130/1130 | ** |  | AU | Trade Balance |

| 06/06/2024 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 06/06/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 06/06/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/06/2024 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/06/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 06/06/2024 | 0800/1000 | * |  | IT | Retail Sales |

| 06/06/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 06/06/2024 | 0830/0930 |  | UK | BOE's Decision Maker Panel Data | |

| 06/06/2024 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/06/2024 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 06/06/2024 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 06/06/2024 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 06/06/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 06/06/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/06/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 06/06/2024 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 06/06/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/06/2024 | 1245/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 06/06/2024 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/06/2024 | 1415/1615 |  | EU | ECB's Lagarde presents monpol decision on podcast | |

| 06/06/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 06/06/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/06/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.