-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA OPEN: Projected Rate Cut Pricing Rises Pre-CPI

- MNI US CPI Preview: A Key Framing Of Trends With June Cut Seen As A Coin Toss

- MNI OUTLOOK/OPINION: Summary Of Analyst Expectations For CPI

- MNI ECB WATCH: ECB Likely To Point To June Cut

- MNI US DATA: NFIB Price Plans Remain In Stubborn Territory

US

US DATA (MNI): A Key Framing Of Trends With June Cut Seen As A Coin Toss: Consensus puts core CPI inflation at 0.3% M/M in March with some skew towards a ‘low’ 0.3 reading.

- Most of the usual drivers are seen exerting downward pressure after a stronger than expected 0.36% M/M in Feb, most notably used car prices after their surprise increase.

- OER inflation will again be watched as methodological-related noise remains top of mind, markets will likely be sensitive to supercore inflation after two particularly strong prints, and we watch for latest supply side effects across core goods categories.

OUTLOOK/OPINION (MNI): Summary Of Analyst Expectations For CPI: The below summary table is taken from the MNI US CPI Preview, the full report of which can be found here.

- Many of the analyst estimates to 2.d.p are for a 'low' 0.3% M/M increase for core CPI.

NEWS

US-JAPAN (MNI): Biden And Kishida To Modernise Military Partnership: Japanese Prime Minister Fumio Kishida arrives in Washington DC this evening ahead of his Official Visit with President Biden on Wednesday and a ‘historic’ trilateral summit with Biden and Philippine President Ferdinand "Bongbong" Marcos on Thursday.

US/UK (MNI): Hamas Should Accept Very Serious Ceasefire Offer - Blinken: US Secretary of State Antony Blinken and UK Foreign Secretary Lord Cameron have delivered a joint press conference following a meeting at the Department of State.

ECB WATCH (MNI): ECB Likely To Point To June Cut: The European Central Bank is expected to hold its deposit rate at 4.00% on Thursday, but to signal that it could be ready for a first cycle cut in June as inflation eases.

POLITICAL RISK (MNI): ICELAND-IP Leader Benediktsson Takes Over As PM: Foreign Minister and chairman of the centre-right Independence Party (IP) Bjarni Benediktsson has been named as Iceland's new prime minister.

IRELAND (MNI): Harris Confirmed As New PM, Little Policy Shift Expected: Simon Harris has been confirmed as Ireland's new Taoiseach (PM) following the resumption of the Dail (lower house of parliament) after the Easter recess.

CHINA-RUSSIA (MNI): Kremlin-No Timeframe For Putin-Xi Talks But 'Is Need For Meeting': Wires carrying comments from Kremlin spox Dmitri Peskov regarding China-Russia relations. On a possible visit from President Vladimir Putin to China for talks with President Xi Jinping, Peskov says that "We are not specifying a time frame yet", but that "There is a need for such a meeting".

SOUTH AFRICA (MNI): Court Rules Zuma Can Run For Parl't In Blow To ANC's Maj Chances: South Africa's electoral court has ruled that former President Jacob Zuma is eligible to run for the National Assembly, overturning a ban issued by the electoral commission just a month ago.

US TSYS Off Lows Ahead US CPI inflation Report

- Treasuries climbed steadily off early week lows Tuesday, shorts pared ahead Wednesday's CPI, FOMC Minutes.

- Consensus puts core CPI inflation at 0.3% M/M in March with some skew towards a ‘low’ 0.3 reading. Most of the usual drivers are seen exerting downward pressure after a stronger than expected 0.36% M/M in Feb, most notably used car prices after their surprise increase.

- Tsys pared gains briefly after weak $58B 3Y note auction (91282CKJ9) tailed: 4.548% high yield vs. 4.527% WI; 2.50x bid-to-cover vs. 2.60x prior month. After the bell, Jun'24 10Y futures trade +12.5 at 109-21 vs. 109-22.5 high, 10Y yield -0.581 at 4.3616%.

- A downtrend in Treasuries remains intact despite the bounce posted across the Tuesday session. An overriding bear trend remains intact. The contract has cleared support at 109-09+, the Apr 3 low, confirming a resumption of this year's downtrend.

- Projected rate cut pricing firmer vs. late Monday levels: May 2024 at -6.7% vs. -4.7bp late Monday w/ cumulative -1.7bp at 5.312%; June 2024 at -53.4% vs. -48.8% w/ cumulative rate cut -15bp at 5.179%. July'24 cumulative at -24.6bp vs -22.1bp, Sep'24 cumulative -41bp vs. -38.2bp.

OVERNIGHT DATA: NFIB Price Plans Remain In Stubborn Territory

- The NFIB small business index surprisingly fell to 88.5 (cons 89.9) in March after 89.4 in Feb.

- It’s the lowest level since December 2012, "as owners continue to manage numerous economic headwinds,” said NFIB Chief Economist Bill Dunkelberg.

- “Inflation has once again been reported as the top business problem on Main Street and the labor market has only eased slightly.”

- Within the price components, actual price changes increased by 7pts to a net 28% increasing (highest since Oct’23) whilst the share expecting to increase prices over the next three months increased 3pts back to 33%.

- The latter has mostly plateaued at similar levels for six months now having lifted off levels in the lower 20s earlier in 2023. This level a little over 30% continues to imply median CPI inflation could struggle to return to pre-pandemic trends.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 48.28 points (-0.12%) at 38839.38

- S&P E-Mini Future up 0.25 points (0%) at 5252.75

- Nasdaq up 29.7 points (0.2%) at 16281.54

- US 10-Yr yield is down 5.6 bps at 4.3636%

- US Jun 10-Yr futures are up 11.5/32 at 109-20

- EURUSD down 0.0003 (-0.03%) at 1.0856

- USDJPY down 0.08 (-0.05%) at 151.74

- WTI Crude Oil (front-month) down $1.14 (-1.32%) at $85.29

- Gold is up $12.2 (0.52%) at $2351.31

- European bourses closing levels:

- EuroStoxx 50 down 55.15 points (-1.09%) at 4990.9

- FTSE 100 down 8.68 points (-0.11%) at 7934.79

- German DAX down 242.28 points (-1.32%) at 18076.69

- French CAC 40 down 70.13 points (-0.86%) at 8049.17

US TREASURY FUTURES CLOSE

- 3M10Y -4.704, -100.989 (L: -102.051 / H: -95.268)

- 2Y10Y -0.805, -38.106 (L: -38.876 / H: -36.267)

- 2Y30Y -0.441, -24.734 (L: -25.731 / H: -22.61)

- 5Y30Y +0.43, 12.195 (L: 11.427 / H: 13.618)

- Current futures levels:

- Jun 2-Yr futures up 2.625/32 at 101-31.5 (L: 101-28.25 / H: 102-00.625)

- Jun 5-Yr futures up 7.5/32 at 106-8.5 (L: 106-00 / H: 106-10.25)

- Jun 10-Yr futures up 12/32 at 109-20.5 (L: 109-06.5 / H: 109-22.5)

- Jun 30-Yr futures up 28/32 at 118-0 (L: 117-00 / H: 118-03)

- Jun Ultra futures up 1-4/32 at 125-18 (L: 124-08 / H: 125-23)

US 10Y FUTURE TECHS: (M4) Bearish Despite Bounce

- RES 4: 111-24 High Mar 12

- RES 3: 111-10+ High Mar 13

- RES 2: 110-24+/31+ 50-day EMA / High Mar 27 and key resistance

- RES 1: 110-06 High Apr 4

- PRICE: 109-21+ @ 1600ET Apr 09

- SUP 1: 109-00 Round number support

- SUP 2: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 3: 108-06+ 2.236 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-00 Round number support

A downtrend in Treasuries remains intact despite the bounce posted across the Tuesday session. An overriding bear trend remains intact. The contract has cleared support at 109-09+, the Apr 3 low, confirming a resumption of this year's downtrend. The break lower opens the 109-00 handle and 108-25+, a Fibonacci projection level. Key short-term resistance has been defined at 110-31+, the Mar 27 high. First resistance to watch is 110-06, the Apr 4 high.

SOFR FUTURES CLOSE

- Jun 24 +0.025 at 94.840

- Sep 24 +0.035 at 95.075

- Dec 24 +0.045 at 95.335

- Mar 25 +0.050 at 95.560

- Red Pack (Jun 25-Mar 26) +0.055 to +0.055

- Green Pack (Jun 26-Mar 27) +0.055 to +0.060

- Blue Pack (Jun 27-Mar 28) +0.060 to +0.065

- Gold Pack (Jun 28-Mar 29) +0.065 to +0.065

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00323 to 5.32065 (+0.00219/wk)

- 3M +0.00863 to 5.30586 (+0.01247/wk)

- 6M +0.01844 to 5.24930 (+0.02896/wk)

- 12M +0.03511 to 5.08765 (+0.05658/Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.807T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $700B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $688B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $82B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $245B

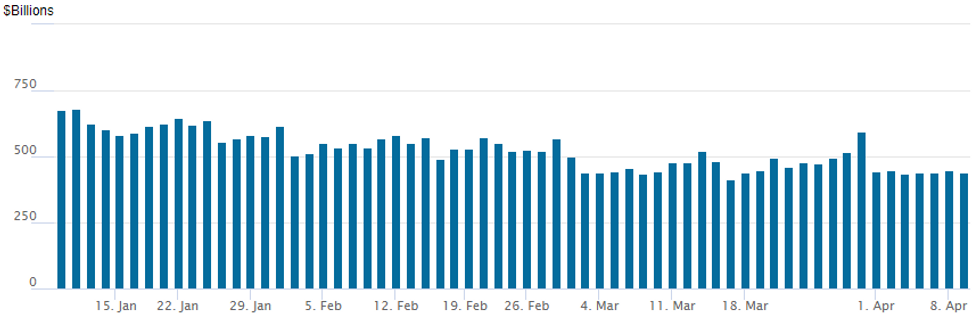

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches recedes to $441.792B vs $448.597B on Monday. Compares to mid-March low of $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties at 73 vs. 74 Monday.

PIPELINE $5.5B Diamondback (FANG) 5Pt Launched, Rentenbank Rolled to Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 4/9 $5.5B #Diamondback $850M 3Y +65, $850M +5Y +80, $1.3B 10Y +107, $1.5B 30Y +127, $1B 40Y +142

- 4/9 $1.32B #Nippon Life 30NC10 5.95$

- 4/9 $1B *JBIC 10Y SPFR+69

- 4/9 $1B #Public Storage $700M 3Y SOFR+70, $300M 2053 Tap +97

- 4/9 $760M #Aegon 3Y +100

- 4/9 $600M #TD Synnex 10Y +175

- 4/9 $500M #Vistra Operation 10Y +165

- 4/9 $Benchmark Jefferies investor calls

- Rolled to Wednesday:

- 4/10 $Benchmark Rentenbank 5Y SOFR+38a

- 4/9 $Benchmark FHLB 3Y Global +7a

EGBs-GILTS CASH CLOSE: Bunds See Support From Sell-off In Risk, Shy of Resistance

Core/semi-core EGBs and Gilts have continued to move higher following the latest sell-off in risk. As noted above, no specific headline to drive the move which began in the equity space, with a sizeable sell program at 1530BST noted.

FOREX USD Index Remains Close To Unchanged As US Inflation Data Awaited

- The USD had been trending a touch lower in early trade on Tuesday, although price action remained subdued given the lack of data/speakers and the close proximity to key US inflation data tomorrow.

- However, as equities underwent a sharp bout of weakness, putting the e-mini S&P at new pullback lows, the broad USD index received a near 30 pip boost to trade close to opening levels on the session.

- AUD and NZD are rising once again with the recent bounce in AUDUSD cementing the break of resistance around the 50-day EMA. As mentioned, this marks a bullish development and confirms the recent bout of weakness between Mar 8 - Apr 1 has been a correction. NZDUSD is up 0.36% which extends the April recovery back above 0.6050 ahead of the overnight RBNZ decision.

- USDJPY had a brief push lower to 151.57 as equities dropped, however the pair remains well within range of the key 152.00 level. The yen’s sensitivity to major US data points has remained a key theme for global markets in recent months, however, USDJPY’s proximity to multi-decade resistance and the potential threat of MOF intervention is placing the Yen’s tradability into question at current levels.

- We highlight some key topside levels for USDJPY and the crosses ahead of the US CPI release and the potential downside targets should market sentiment prompt a yen recovery: https://roar-assets-auto.rbl.ms/files/60797/FX%20Market%20Analysis%20-%20JPY%2009-04.pdf

- Both the RBNZ and the BOC are widely expected to hold rates on Wednesday, keeping US CPI the highlight of the docket. This will later be complemented by the FOMC minutes later in the session.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/04/2024 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 10/04/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 10/04/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 10/04/2024 | 0800/1000 | * |  | IT | Retail Sales |

| 10/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/04/2024 | - | *** |  | CN | Money Supply |

| 10/04/2024 | - | *** |  | CN | New Loans |

| 10/04/2024 | - | *** |  | CN | Social Financing |

| 10/04/2024 | 1230/0830 | *** |  | US | CPI |

| 10/04/2024 | 1230/0830 | * |  | CA | Building Permits |

| 10/04/2024 | 1345/0945 |  | CA | BOC Monetary Policy Report | |

| 10/04/2024 | 1345/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 10/04/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 10/04/2024 | 1430/1030 |  | CA | BOC Governor Press Conference | |

| 10/04/2024 | 1645/1245 |  | US | Chicago Fed's Austan Goolsbee | |

| 10/04/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/04/2024 | 1800/1400 | ** |  | US | Treasury Budget |

| 10/04/2024 | 1800/1400 | *** |  | US | FOMC March Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.