-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI ASIA OPEN: Yields Recede Ahead Heavy Thursday Data Docket

- MNI INTERVIEW: Fed Could Cut As Early As June - Quarles

- MNI Fed Goolsbee: Disinflation On Track Even If Prices Bounce

- MNI INTERVIEW: Housing Inflation To Keep Fed Cautious-Fannie

- MNI US DATA: PPI Annual Revisions See Only Marginally Cooler Recent Trend

US

US FED INTERVIEW (MNI): Fed Could Cut As Early As June - Quarles.

Financial stability stresses could bring could prompt the Federal Reserve to cut by June despite the resilience of the economy, former Fed Governor Randal Quarles told MNI. Quarles, a former top banking regulator and Fed vice chair for supervision, expects financial conditions to tighten as the year progresses, allowing the Fed to begin a gradual easing campaign, likely to fall short of market expectations.

US FED (MNI): Chicago Fed Goolsbee-Disinflation On Track Even If Prices Bounce

U.S. inflation is likely to keep falling in a way that allows the Federal Reserve to cut interest rates even if the road to the Federal Reserve's 2% target proves a bit bumpy, Chicago Fed President Austan Goolsbee said Wednesday.

NEWS

INTERVIEW (MNI): Housing Inflation To Keep Fed Cautious-Fannie

U.S. inflation could stumble at higher levels given a strong economy, booming services and persistent housing inflation, making it harder for the Federal Reserve to cut interest rates, Fannie Mae chief economist Doug Ducan told MNI.

SECURITY (MNI): Ranking Dem On House Intel Cmte Downplays "National Security Threat"

Rep Jim Hines (D-CT), the ranking Democrat on the House Intelligence Committee, has told reporters - Erik Wasson of Bloomberg and Mychell Scnnell of the Hill - that, "people should not panic, that is unequivocal” after a statement from House Intelligence Committe Chair Mike Turner (R-OH) today warned of an unspecified national security threat.

US (MNI): House Republicans To Unveil New Foreign Aid/Border Bill As Soon As Thursday

Rep Brian Fitzpatrick (R-PA) told reporters today that a group of House Representatives plan to release an alternative foreign policy aid bill - which includes funding for Ukraine, Israel, and Taiwan - and a border security package as soon as Thursday.

US (MNI) WaPo: ICE Considers Mass Release Of Migrants To Cover Budget Shortfall

The Washington Post reportingthat, "U.S. Immigration and Customs Enforcement has drafted plans to release thousands of immigrants and slash its capacity to hold detainees" due to, "a $700 million budget shortfall."

US TSYS Modest Risk-On Ahead Heavy Data Calendar Thursday

- Tsys look to finish higher Wednesday, off second half highs amid modestly improved risk appetite. Tsys climbed off to new cycle low overnight Mar'24 10Y 109-16.5 low, yield tapped 4.3301% high, levels not seen since early Dec'23) following UK CPI miss (tempered by EU IP strength notably in Ireland).

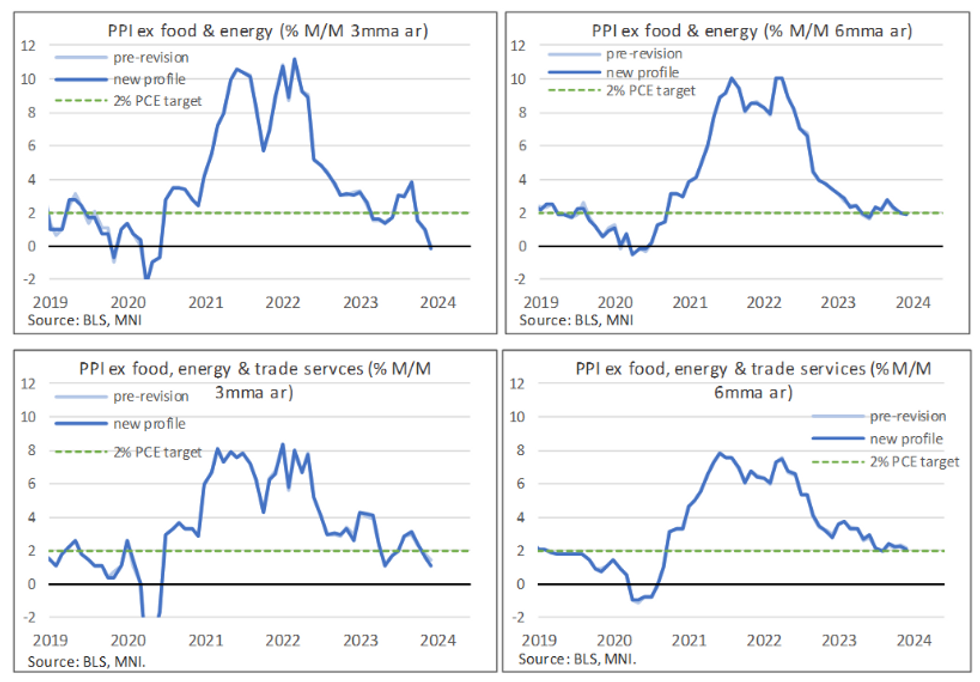

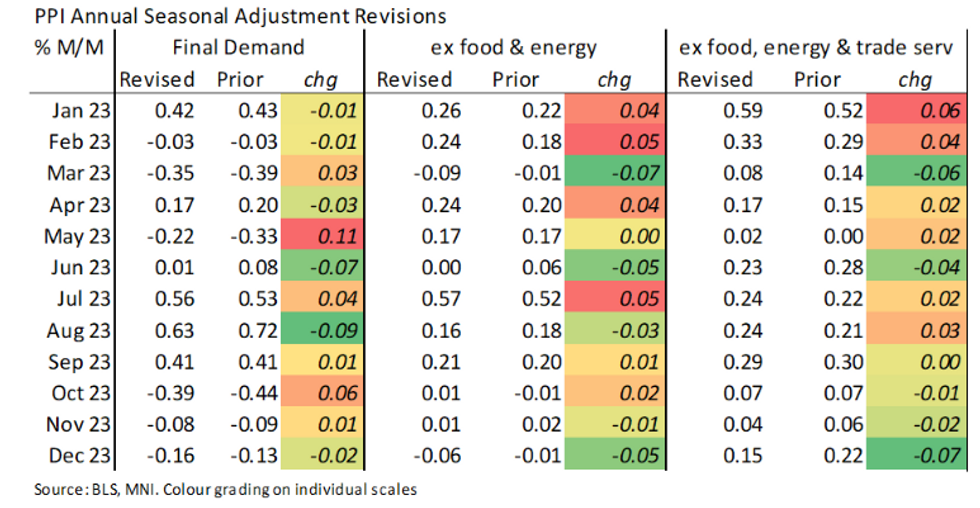

- Support dipped briefly after the BLS down revised PPI data for Dec from -0.1% to -0.2%. Minimal revisions for PPI final demand in latest months, December revised down from just -0.13% to -0.16% M/M with the rounded change heavily flatter by rounding. Recent weakness slightly more pronounced for various core measures: ex food & energy trimmed 5bps in Dec, ex food, energy & trade services trimmed 7bps.

- Futures inched higher over the next four hours with 10s tapping 110-05 high before settling in at 110-00.5 after the bell. Yield curves recovered slightly from Tuesday's bear flattening, 2s10s currently +3.100 at -31.459, 10Y yield -.0511 at 4.2632%.

- Looking ahead: heavy data calendar Thursday with weekly Claims, Retail Sales, Imp/Exp$, IP/Cap-U, TIC Flows. Thursday Fed speak includes Fed Gov Waller on US$ international role at 1315ET, Atlanta Fed Bostic on mon-pol (text, Q&A) later in the evening at 1900ET.

OVERNIGHT DATA

US DATA (MNI): PPI Annual Revisions See Only Marginally Cooler Recent Trend. Minimal revisions for PPI final demand in latest months, December revised down from just -0.13% to -0.16% M/M with the rounded change heavily flatter by rounding.

- Recent weakness slightly more pronounced for various core measures: ex food & energy trimmed 5bps in Dec, ex food, energy & trade services trimmed 7bps.

US DATA (MNI): MBA Mortgage Applications Nudge Lower As Rates Drift Higher. MBA composite mortgage applications fell -2.3% last week, with both purchases (-2.5%) and refis (-2.1%) moving back in sync after some particularly large discrepancies in recent weeks.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 50.47 points (0.13%) at 38322.52

- S&P E-Mini Future up 26.5 points (0.53%) at 4997.5

- Nasdaq up 130 points (0.8%) at 15785.94

- US 10-Yr yield is down 4.7 bps at 4.2672%

- US Mar 10-Yr futures are up 11.5/32 at 109-31.5

- EURUSD up 0.0018 (0.17%) at 1.0727

- USDJPY down 0.23 (-0.15%) at 150.56

- WTI Crude Oil (front-month) down $1.33 (-1.71%) at $76.54

- Gold is down $1.67 (-0.08%) at $1991.67

- European bourses closing levels:

- EuroStoxx 50 up 19.94 points (0.43%) at 4709.22

- FTSE 100 up 56.12 points (0.75%) at 7568.4

- German DAX up 64.65 points (0.38%) at 16945.48

- French CAC 40 up 52.04 points (0.68%) at 7677.35

US TREASURY FUTURES CLOSE

- 3M10Y -3.593, -112.125 (L: -114.737 / H: -107.861)

- 2Y10Y +3.492, -31.067 (L: -34.421 / H: -30.312)

- 2Y30Y +6.847, -12.863 (L: -19.857 / H: -12.299)

- 5Y30Y +5.56, 20.085 (L: 14.122 / H: 20.598)

- Current futures levels:

- Mar 2-Yr futures up 4.375/32 at 102-2.25 (L: 101-29 / H: 102-03.625)

- Mar 5-Yr futures up 9.25/32 at 106-23 (L: 106-11.5 / H: 106-26.25)

- Mar 10-Yr futures up 12/32 at 110-0 (L: 109-16.5 / H: 110-05)

- Mar 30-Yr futures up 16/32 at 118-15 (L: 117-26 / H: 118-26)

- Mar Ultra futures up 12/32 at 124-10 (L: 123-16 / H: 124-26)

US 10Y FUTURE TECHS: (H4) Remains Vulnerable

- RES 4: 112-00 Round number resistance

- RES 3: 111-21+ High Feb 5

- RES 2: 111-06 20-day EMA

- RES 1: 110-16 Low Feb 9

- PRICE: 110-00 @ 1500 ET Feb 14

- SUP 1: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

- SUP 2: 109-05+ Low Nov 28

- SUP 3: 108-19+ 61.8% of the Oct 19 - Dec 27 bull phase

- SUP 4: 108-14 Low Nov 15

A bear threat in Treasuries remains present and yesterday’s sell-off reinforces the current bear cycle. The break lower has confirmed a resumption of the downleg that started Dec 27. The 110-00 handle has been cleared and sights are on 109-17, a Fibonacci retracement. It has been tested, a clear break would open 109-05+, the Nov 28 low. Initial firm resistance is at 111-06, the 20-day EMA.

SOFR FUTURES CLOSE

- Mar 24 +0.005 at 94.725

- Jun 24 +0.045 at 95.005

- Sep 24 +0.070 at 95.335

- Dec 24 +0.085 at 95.670

- Red Pack (Mar 25-Dec 25) +0.085 to +0.090

- Green Pack (Mar 26-Dec 26) +0.065 to +0.080

- Blue Pack (Mar 27-Dec 27) +0.055 to +0.065

- Gold Pack (Mar 28-Dec 28) +0.040 to +0.055

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00371 to 5.32135 (+0.00063/wk)

- 3M +0.01869 to 5.32568 (+0.01663/wk)

- 6M +0.06080 to 5.25695 (+0.06829/wk)

- 12M +0.11897 to 5.01897 (+0.13872/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.714T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $682B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $662B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $98B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $274B

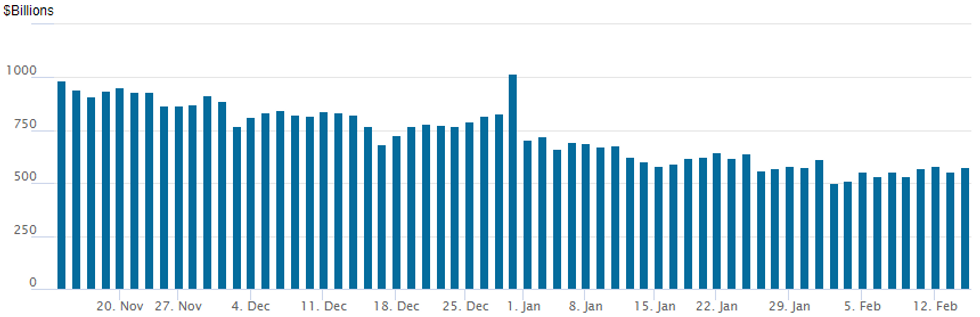

US FED REVERSE REPO OPERATIONS

NY Federal Reserve/MNI

- RRP usage rebounded to $575.332B vs. $553.648B Tuesday - remains well above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 91 from 84 Tuesday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $13B Bristol-Meyers Squibb 9Pt Jumbo Issuance Launched, Tsys Gain?

Bristol-Meyers Squibb deal book had risen to $85B prior to the $13B launch. Note, Treasury futures are extending highs at the moment - partially due to specs unwinding shorts as the jumbo issue came out in line with estimates.

- Date $MM Issuer (Priced *, Launch #

- 2/14 $13B #Bristol-Meyers Squibb $1B 2Y +40, $500M 2Y SOFR+49, $1B 3Y +55, $1.75B 5Y +70, $1.25B 7Y +85, $2.5B 10Y +95, $500M 20Y +100, $2.75B 30Y +115, $1.75B 40Y +125

- 2/14 $2.25B #Cummins $500M 5Y +70, $750M 10Y +93, $1B 30Y +105

- 2/14 $1.5B #BNP Paribas PerpNC7.5 8%

- 2/14 $1.15B #Cardinal Health $650M 5Y +90, $500M 10Y +120

- 2/14 $1B #Marsh & McLennan $500M 10Y +90, $500M 30Y +103

- 2/14 $Benchmark Synchrony Financial investor calls

- Expected to issue Thursday:

- 2/15 $Benchmark World Bank 3Y SOFR+28a

EGBs-GILTS CASH CLOSE: Soft UK CPI Print Sets Bullish Tone For Short End

Gilt yields fell sharply Wednesday on softer-than-expected UK inflation data, with Bunds following suit in a generally constructive session.

- While the details of the UK CPI data meant the print wasn't as soft as it initially appeared (e.g. an unexpected drop in volatile airfares), the 0.3pp miss in services Y/Y CPI vs expectations in particular drove a solidly dovish reaction that helped Gilts outperform throughout the session.

- That said, BoE's Bailey noted later in the day that the CPI and previous session's (solid) labour force data "don't broadly" change the timing of the first rate cut.

- Multiple ECB speakers didn't really shift pricing, including Guindos, Makhlouf, Vujcic and Lane. Data (Eurozone GDP / Industrial Production) didn't move the needle either.

- The UK curve closed bull steeper, with Germany's leaning bull flatter. As equity futures regained ground from Tuesday's drop, periphery EGB spreads closed tighter, with BTPs outperforming - the 10Y differential to Bunds fell to its lowest close of the month.

- The heavy UK data slate continues first thing Thursday with GDP figures, while ECB's Lagarde and and Lane, and BoE's Greene and Mann, make appearances.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.7bps at 2.73%, 5-Yr is down 5.6bps at 2.302%, 10-Yr is down 5.6bps at 2.337%, and 30-Yr is down 4.9bps at 2.509%.

- UK: The 2-Yr yield is down 13.6bps at 4.575%, 5-Yr is down 12.8bps at 4.057%, 10-Yr is down 10.7bps at 4.044%, and 30-Yr is down 7.3bps at 4.579%.

- Italian BTP spread down 3.5bps at 151.6bps / Spanish down 2.2bps at 93bps

FOREX USD Momentum Stalls as Yields Partially Retrace Post-CPI Move

- A retracement for US yields on Wednesday, and specific outperformance for the front-end of the treasury curve, has weighed on the USD index. The 0.25% decline, however, remains very small compared to the post-CPI 0.85% advance. A recovery across major equity benchmarks, softer UK CPI inflation and Chicago Fed’s Goolsbee sticking to his dovish guns have all helped stall the greenback's topside momentum.

- Outperformers on the session include the likes of AUD and NZD, to be expected after their punchy declines on Tuesday. They join both the SEK and NOK at the top of the G10 leaderboard.

- EUR/USD crept to a new daily high through the London close, extending the bounce off the overnight lows to just over 30 pips, but highlight the contained ranges on Wednesday. Conditions remain bearish overall, with the recent breach of both 1.0724, the Dec 8 low, and 1.0712, 61.8% of the Oct - Dec bull leg, reinforcing current sentiment. Focus on the downside will be on 1.0656 next, the Nov 10 low, whereas initial resistance comes in at 1.0816, the 20-day EMA.

- A very quiet session for USDJPY, although it is worth noting that neither lower US yields nor verbal warnings from the MOF have been able to prompt a meaningful relief bounce, with the pair consolidating around 150.50 as we approach the APAC crossover. Above here, 151.43, the November 16 high comes into focus, inching ever closer to the multi-decade highs at 151.95. Initial support moves up to 148.03, the 20-day EMA.

- A busy docket on Thursday is kickstarted by RBA Governor Bullock speaking before Australian employment data for January. UK growth data headlines the European session before retail sales, initial jobless claims, Philly fed and industrial production data cross in the US.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2024 | 0030/1130 | *** |  | AU | Labor Force Survey |

| 15/02/2024 | 0430/1330 | ** |  | JP | Industrial production |

| 15/02/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 15/02/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 15/02/2024 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 15/02/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 15/02/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 15/02/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 15/02/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2024 | 0800/0900 |  | EU | ECB's Lagarde statement at ECON hearing | |

| 15/02/2024 | 1000/1100 | * |  | EU | Trade Balance |

| 15/02/2024 | 1200/1300 |  | EU | ECB's Lane seminar at Florence School | |

| 15/02/2024 | 1300/1300 |  | UK | BOE's Greene fireside chat with Fitch Ratings | |

| 15/02/2024 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 15/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/02/2024 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/02/2024 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 15/02/2024 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2024 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/02/2024 | 1350/1350 |  | UK | BOE's Mann panellist at 40th NABE Conference | |

| 15/02/2024 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2024 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2024 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 15/02/2024 | 1815/1315 |  | US | Fed Governor Christopher Waller | |

| 15/02/2024 | 2100/1600 | ** |  | US | TICS |

| 15/02/2024 | 0000/1900 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.