MNI EUROPEAN MARKETS ANALYSIS: US Tech Earnings Buoys Risk Mood

- The BoJ kept its interest rates unchanged, which was widely expected. Focus largely rested on the forecast outlook, references to the weaker yen and planned bond purchases. The bank said it would buy government bonds in line with its March decision but dropped a footnote saying it had purchased about 6 trillion yen per month in the past.

- USD/JPY has risen to fresh cycle highs post the meeting outcome. JGB futures are exhibiting weakness, -16 compared to settlement levels, but are sitting higher than the morning’s range.

- Elsewhere, US equity futures sit higher, aided by Alphabet and Microsoft earnings results from late Thursday in the US. This has helped AUD and NZD outperform in the G10 FX space. USD/Asia pairs have shown more sensitivity to weaker yen levels. US Treasury futures are little changed today.

- Looking ahead, the US PCE Core Deflator crosses. UMich consumer sentiment and inflation expectations will round off the week’s data calendar.

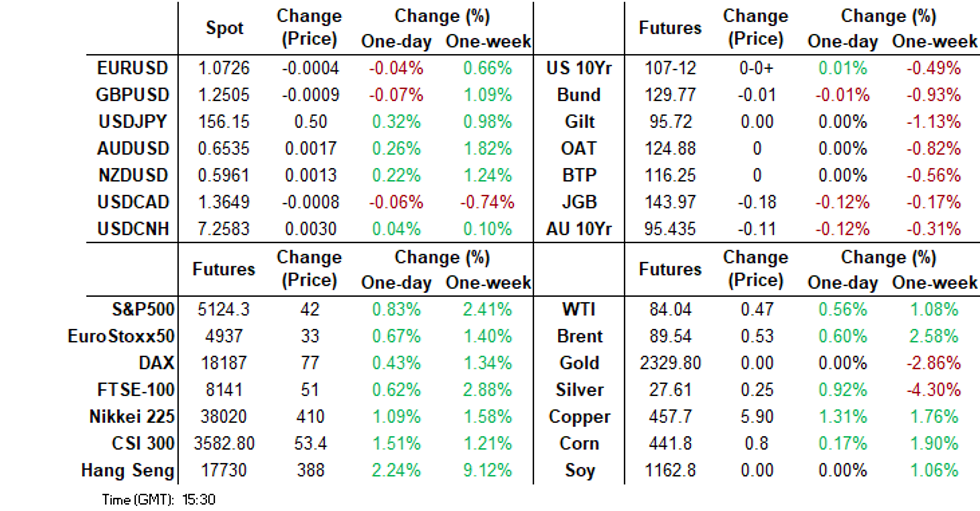

MARKETS

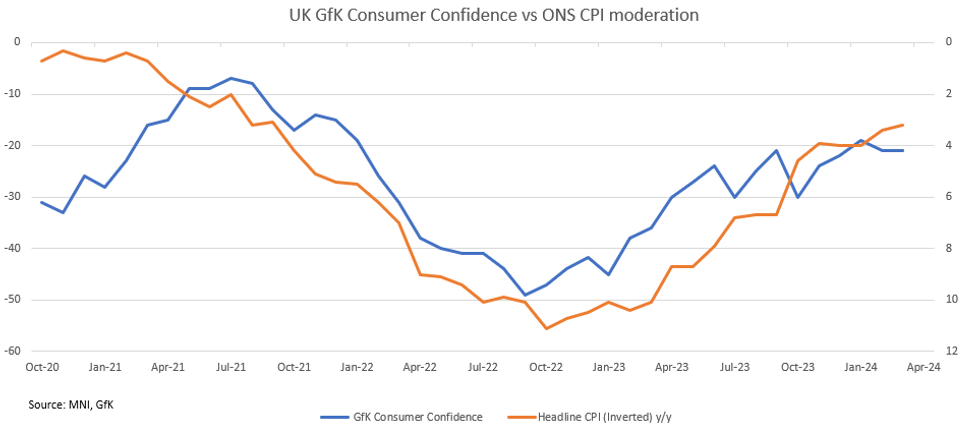

UK DATA: UK GfK Returns to Jan-24 High

UK GfK Consumer Confidence rose more than expected by 2 points to -19 (vs -20 consensus, -21 prior) in April, and rose 11 points on a year-on-year basis.

- In particular, 4 of 5 subcomponents improved. The 'General Economic Situation over last 12 months' rose 4 points, whilst 'Personal Financial Situation over the next 12 months', 'General Economic Situation over the next 12 months' and 'Major Purchase Index' all rose 2 points. 'Personal Financial Situation over next 12 months' remained unchanged at +2 , although 15 points higher than it was a year ago, in April 2023.

- While the overall index remains negative, it is comfortably above the 2023 average of -29, and all subcomponents have improved since April last year.

- The GfK Client Strategy Director highlights the improvements are reflecting "the impact on household budgets of lower inflation and the anticipation of further tax cuts" - although the Savings Index (which is not included in the overall measure) has increased to 26 in April, a 7 point rise compared to April 2023.

- The chart below shows, as inflation has begun to approach more 'normal' levels, the relationship between consumer confidence and inflation is weakening, as price increases become less dominant in consumers' minds, but more recently shows that as inflation has began to plateau so has confidence.

- April's survey was conducted among a sample of 2009 individuals from April 2nd to April 15th 2024.

US TSYS: Treasury Futures Little Changed, Personal Income & Spending Later

- Treasury futures are little changed today. The 2Y is trading up 0.25 to 101-13.875, 10Y is +01 higher at 107-12+ while Initial supports holds at 107-07+ (76.4% of the Oct - Dec ‘23 bull leg (cont)), a break back above 108-22+ would be needed to break the trend lower.

- Cash Treasury yields are 0.5bp lower with the 2Y yield -0.6bps to 4.993%, 10Y -0.8bp to 4.700%, while the 2y10y is unchanged at -29.771

- Across local rate markets, NZGBs yields are 6-8bps higher, ACGBs are 11-14bps higher with yields now at the highest point for the year while JGBs yields are 0.5-2bps higher

- Projected rate cut pricing vs. pre-data levels: May 2024 -2.6% w/ cumulative -2.6bp at 5.322%; June 2024 at -8.9% from -16.2% earlier w/ cumulative rate cut -2.9bp at 5.300%. July'24 cumulative at -8.6bp from -12.1bp, Sep'24 cumulative -18.6bp from -24.4bp.

- Looking ahead: Personal Income/Spending, UofM Sentiment, while May Treasury options expire.

STIR: $-Bloc Continues To Pare Year-End Easing After This Week’s Inflation Data

STIR markets within the $-bloc continue to price out dovish policy projections for this year. Year-end official rate projections have firmed by 5-29bps compared to levels from a week ago, with the most notable increase observed in Australia. The other markets are around 5bps firmer.

- The Australian market's move was triggered by the release of Q1 CPI data on Wednesday, which surpassed expectations, indicating hotter-than-anticipated inflationary pressures.

- Overnight, the US GDP report for Q1 showed weaker growth and higher inflation than expected. Weekly claims were also lower than expected.

- US GDP rose by an annualised 1.6%, below the 2.5% consensus, partially explained by a shortfall in private consumption (2.5% against 3.0% expected). The core PCE deflator was stronger than expected, running at an annualised 3.7% (3.4% expected).

- US rates markets focused on the latter, with a further paring of year-end rate cut expectations.

- December 2024 expectations and the cumulative easing across the $-bloc stand at: 4.99%, -35bps (FOMC); 4.44%, -56bps (BoC); 4.43%, -8bps (RBA); and 5.26%, -25bps (RBNZ).

Figure 1: $-Bloc STIR (%)

Source: MNI – Market News / Bloomberg

JGBS: Rates Unchanged, Upside Inflation Risks, Growth Lower, Bond Purchases Remain

JGB futures are exhibiting weakness, -16 compared to settlement levels, but are sitting higher than the morning’s range.

- The BoJ kept its interest rates unchanged, which was widely expected. Focus largely rested on the forecast outlook, references to the weaker yen and planned bond purchases.

- The bank said it would buy government bonds in line with its March decision but dropped a footnote saying it had purchased about 6 trillion yen per month in the past.

- On the forecast side, for inflation the 2024 FY core CPI forecast was kept at 1.9%, but with upside risks. 2025 was nudged up to 1.9% (from 1.8% prior). The first 2026 forecast was at 2.1%.

- On growth, the 2024 FY forecast was nudged down to 0.8% from 1.2% prior. 2025 was kept at 1.0%, while 2026 is also seen at 1.0%.

- The cash curve bear-steepening has remained but has been pared. Yields are flat to 1bp higher versus 1-3bps higher at the lunch break. The benchmark 10-year yield is 1.5bps higher at 0.914% versus the fresh YTD yield high of 0933%, set this morning.

- The swaps curve is holding a twist-steepener, pivoting at the 40s, with rates -5bps to +2bps. Swap spreads are tighter out to the 30-year.

- The local market is closed on Monday.

BOJ: Unchanged, Upside inflation Risks, But Growth Lower, Bond Purchases Maintained

The BoJ kept its interest rates unchanged at the April policy meeting, which was widely expected by the consensus. Focus largely rested on the forecast outlook, references to the weaker yen and planned bond purchases. The actual policy statement was very short, which noted the policy decision was unanimous.

- It also stated that bond purchases would continue with the decisions made at the March 2024 policy meeting. That statement noted the current run rate of purchases was around ¥6trln per month and that the bank "will continue to announce the planned amount of JGB purchases with a range and will conduct the purchases while taking account of factors such as market developments and supply and demand conditions for JGBs." Hence no major changes on the surface there, although tapering of the bond buying program will remain a focus point.

- On the forecast side, for inflation the 2024 FY core CPI forecast was kept at 1.9%, but with upside risks. 2025 was nudged up to 1.9% (from 1.8% prior). The first 2026 forecast was at 2.1%.

- On growth the 2024 FY forecast was nudged down to 0.8% from 1.2% prior. 2025 was kept at 1.0%, while 2026 is also seen at 1.0%.

- The BoJ expects easy financial conditions to continue for now, while noting FX shifts need to be monitored.

- No major surprises from the BoJ has seen JPY weaken further, USD/JPY hitting fresh cycle highs above 156.00 post the meeting outcome. In the JGB futures space, we are higher, last at 144.00.

- JGB futures continue to exhibit weakness, -20 compared to settlement levels, as the initial strengthening observed during early afternoon trading following the BoJ Policy Decision has moderated.

- The cash curve bear-steepening has remained but has been pared. Yields 1-2bps higher versus 1-3bps higher at the lunch break. The benchmark 10-year yield is 1.5bps higher at 0.914% versus the fresh YTD yield high of 0933%, set this morning.

JAPAN DATA: Tokyo CPI Well Below Expectations As Education Sub-Index Plunges

Tokyo's April CPI print was much weaker than expectations. The headline was 1.8% y/y, versus 2.5% projected (prior was 2.6%). The ex fresh food measure was 1.6% y/y, versus 2.2% forecast (2.4% prior). The ex fresh food, energy measure was 1.8% y/y in April (2.7% forecast and 2.9% prior).

- Momentum on the core measures is back to 2022 levels, while headline printed 1.8%y/y back in January. The core ex energy and all food index eased back to 1.4% y/y from 2.3% in March.

- The biggest drag by sub-sector came from education, down 9.4% m/m. This reflected the start of education subsidies in Tokyo. There was some uncertainty as to what the impact would be prior to the release. The plunge is not expected to be replicated at the nationwide CPI level (see this BBG link for more details).

- Most other sub-categories were near their respective March outcomes. The main exception being household goods, up 2.4%m/m, versus a -0.7% fall in March.

- in y/y terms, education fell -8.8%, versus a 1.9% y/y gain in March. 8 out of 11 sub-categories saw slower y/y momentum compared with March. Fresh food rose, along with housing, while the utilities drop became more modest at -3.0% y/y.

- The sharp drop in education prices should help offset the market impact, although we continue to see some softening in y/y in most other sub-categories.

AUSSIE BONDS: Heavy Session, Narrow Ranges, Retail Sales Next Tuesday

ACGBs (YM -10.0 & XM -9.0) are holding cheaper after dealing in narrow ranges during the Sydney session. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Q1 PPI data.

- Cash US tsys ~1bp richer in today’s Asia-Pac session after yesterday’s post-GDP cheapening. Today’s US data calendar shows Personal Income/Spending and UofM Sentiment.

- Cash ACGBs are 12-13bps cheaper, with the AU-US 10-year yield differential 6bps higher than Wednesday's close at -16bps.

- Swap rates are 13-14bps higher.

- The bills strip has bear-steepened, with pricing -4 to -12.

- RBA-dated OIS pricing is 6-15bps firmer than Wednesday’s closing levels for meetings beyond June. A cumulative 4bps of easing is priced by year-end as the December meeting shunts 28bps firmer versus pre-CPI levels.

- (AFR Joye) This week we were presented with yet more powerful data demonstrating that central banks are repeating past mistakes by actively encouraging an acceleration in consumer price pressures through their dovish prognostications. Australia’s central bank could be forced to fall into line with peers and raise rates again. (See link)

- Next week, the local calendar is empty on Monday ahead of Retail Sales and Private Sector Credit data on Tuesday.

- On Wednesday, the AOFM plans to sell A$800mn of the 3.75% May-34 bond.

NZGBS: Closed On A Weak Note, Spillover Selling From ACGBs

NZGBs closed on a weak note, with benchmark yields 7-8bps higher. The NZGB 10-year rose 8bps to 5.0%, the highest level since November last year. With domestic drivers light on the ground, apart from the previously outlined Consumer Confidence, the local market drifted weaker in the close despite a slight richening in US tsys in today’s Asia-Pac session. Cash US tsys are ~1bp richer after cheapening 6-7bps in post-GDP dealings.

- The ACGB market appears to have triggered some spill-over selling. ACGBs are 11-12bps cheaper after trading resumed after yesterday’s ANZAC Day holiday. NZ-AU 10-year yield differential closed 1bp tighter, while the NZ-US 10-year spread has widened 5bps versus Wednesday's close.

- Swap rates closed 8-11bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 2-10bps firmer across meetings, with Feb-25 leading. A cumulative 46bps of easing is priced by year-end.

- Next week, the local calendar will see Filled Jobs on Monday, ANZ Business Confidence on Tuesday, and the Q1 Employment Report, CoreLogic House Prices and the RBNZ Financial Stability Report on Wednesday.

- Friday's US Data Calendar includes Personal Income/Spending and UofM Sentiment.

FOREX: USD/JPY Through 156.00 Post Unchanged BoJ, A$ & NZD Outperform

USD/JPY has risen above 156.00, fresh cycle highs post the unchanged BoJ decision. Elsewhere the A$ and NZD are slightly firmer. The BBDXY USD index sits a touch higher, last near 1261.

- The BoJ delivered few surprises in its unchanged meeting outcome. The policy statement was very short, noting bond purchases would continue as per the March statement. Inflation forecasts for 2024 were unchanged but seen with upside risks, the 2025 forecast was nudged higher. The growth outlook for this year was revised lower.

- Yen has continued to weaken, with USD/JPY currently in the 156.15/20 region, around session highs and down 0.30% for the session. FinMin Suzuki commented after the decision that they will deal with FX appropriately, but declined to say if recent moves are excessive (so in line with recent rhetoric). Upside targets could rest at 156.47, a technical projection off recent price swings.

- AUD (0.6520/25) and NZD (0.5955/60) are up slightly against the USD. NZD is marginally outperforming but has been unable to convincingly break above the 20-day EMA (0.5959). Data outcomes in both economies haven't impacted sentiment today.

- Aiding the risk on tone has been a surge in US equity futures post late earnings from Alphabet and Microsoft in Thursday US trade. Nasdaq futures are up +1.15% at this stage. US yields are down slightly at this stage, but losses are not much beyond 1bps.

- Looking ahead, the US PCE Core Deflator crosses. UMich consumer sentiment and inflation expectations will round off the week’s data calendar.

ASIA EQUITIES: China & Hong Kong Equities Head Higher As Tech And Property Surge

Hong Kong and China equities are higher today following global markets higher after US Tech giants Alphabet and Microsoft reported strong earnings. Like other big techs, Alphabet has been plowing money into developing AI, a strategy that has helped drive demand for its cloud services. Property names have surged higher after Cifi reported they got government funding, while Iron Ore is near seven week highs on signs of economic recovery in top consumer China and a drop in export flows from Australian producers.

- Hong Kong equities are surging higher today with the HSTech Index up 3.66%, and has now broken above the 200-day EMA for the first time since November, the 14-day RSI has ticked higher again to 63, the Mainland Property Index up 4.79% at 1,295.15 and is now above the 100-day EMA after Cifi reported they got government “white-list” funding support for 24 projects in 1Q, while the wider the HSI is up 1.98%, and has broken through the 200-day EMA something we have not traded above since July 2023. China Mainland equities are again underperforming this morning, with the CSI300 up 1%, the index has once again bounced straight off the 50 & 100-day EMAs. Small-cap indices are performing slightly better with the CSI1000 and CSI2000 both up 1.50% while the ChiNext is up 2.50%.

- China Northbound had an inflow of 0.3b yuan on Thursday, momentum has picked up slightly from the week prior but still remains in the negative territory with the 5-day average at -0.62billion, while the 20-day average sits at -0.66billion yuan.

- China plans to enhance informal guidance, termed as window guidance, among state-owned banks to stabilize credit growth and stimulate economic development, as per a State Council report. Deputy Finance Minister Liao Min presented a report on state-asset management in financial institutions to the National People’s Congress Standing Committee. The report also indicates China's backing for large state-owned banks to issue Total Loss-Absorbing Capacity (TLAC) bonds, although specific details were not provided.

- Looking ahead, China PMI on Tuesday

ASIA PAC EQUITIES: Equities Mixed, Tech Higher After Strong Earnings, BoJ Unchanged

Asian markets are mixed today due to concerns about stagflation in the US economy, which expanded at its slowest rate in nearly two years while inflation surged. Wall Street initially saw a sharp decline in shares after official data revealed that US GDP growth in the first quarter was below expectations at 1.6%, compared to forecasts of 2.5%, although strong earnings from US tech names after hours caused a rally in US futures and have helped most local markets. Locally, major focus was on the BoJ where they kept rates on hold, the Yen continues to make new lows now trading above 156 vs the USD, Australia had PPI which increased from the last quarter, NZ consumer confidence fell to 82.1 from 86.4, while Japan's Tokyo CPI missed forecasts coming in at 1.8% vs 2.5% and well down from March numbers of 2.6%.

- Japanese equities gapped higher after BoJ rate decision while earlier the year-on-year rise in the Tokyo core inflation rate decelerated to 1.6% in April from March's 2.4% for the second straight slow down, below 2% for the first time in three months and lower than the market's 2.2% expectation, data from the Ministry of Internal Affairs and Communications showed on Friday. Both the Topix and Nikkei 225 are up about 0.70% for the day.

- South Korean equities are higher, with tech stocks leading the way. The Kospi is up about 1.10% and is now testing the 20 & 50-day EMA at 2660.

- Taiwan equities are higher today, after US tech stocks rallied post the close on strong earnings from Alphabet and Microsoft. The Taiex is up 1.60%

- Australian equities are lower today, returning from a break yesterday and is the worst performing market in the region after not benefitting from the tech rally post the US market close. All sectors are lower with miners the worst performing sector, BHP has contributed the most to the fall after proposing to buy rival Anglo American, the ASX200 is down 1.23%.

- Elsewhere in SEA, New Zealand Equities are down 1% after consumer confidence fell to an 11 month low, Indonesia equities are down 0.50%, Thailand, Malaysia and Philippines equity markets are unchanged for the day.

ASIA EQUITY FLOWS: Asian Equity Flows Mixed, Momentum Remains Negative

- China equity flows continue to see-saw, with a 0.34b yuan inflow on Thursday, equity markets were slightly higher, the CSI300 continues its rangebound trading, with the 200-day acting as resistance, while we trade on the 50 & 100-day EMA act as support. Flow momentum remains negative with the 5-day average now -0.62b, 20-day average at -0.66b and the longer term 100-day average now 0.32B yuan.

- Taiwan equities flows were again negative on Thursday while the market sold off over 1% erasing most of the prior days move higher, with US GDP the driver of the move lower. The 5-day average is now -$578m, vs the 20-day at -$392m, while the 100-day average is now just $48m.

- South Korean equity flows were again negative on Thursday as investors worried about US GDP, the Kospi was down 1.76% erasing the prior days move higher and trading back below the 20 & 50-day EMA. The 5-day average is now -$211m, the 20-day average to $83m and the 100-day average to $170m.

- Philippines equities ended their 14-day run of outflows with a small 2.2m inflow on Thursday. The PSEi has bounced off the 6,400 level and now trades at the 200-day EMA. The 5-day average is -$12m, the 20-day average is -$9.5m, while the 100-day average continues to edge lower now at $0.38m.

- Indonesian equities saw a tiny inflow on Wednesday, which ended a 15-day run of outflows, although the trend has now continued with another $79m outflow on Thursday, the market has now seen a net outflow of $1.12B over the past 17-days. The 5-day average is now -$39m, the 20-day average is -$52m, while the longer term 100-day average is still positive at $12.7m.

- Thailand's SET has been one of the worst performing equity markets in the region over the past year, and has recently broken back below the 20, 50, 100 & 200-day EMA's and broke the 1,350 level which we had traded above since November 2020. The 5-day average is $0.87m, 20-day average is $4.29m, while the longer term 200-day average is -$20m

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | 0.3 | -3.1 | 49.5 |

| South Korea (USDmn) | -385 | -1058 | 13214 |

| Taiwan (USDmn) | -877 | -2890 | -1879 |

| India (USDmn)** | 507 | -627 | 320 |

| Indonesia (USDmn) | -80 | -196 | 681 |

| Thailand (USDmn) | 49 | 4 | -1845 |

| Malaysia (USDmn) ** | 65 | -29 | -608 |

| Philippines (USDmn) | 2 | -64.1 | 13 |

| Total (Ex China USDmn) | -719 | -4860 | 9896 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 24th |

OIL: Slightly Above Thursday Highs, Tracking Up For The Week

Brent crude has largely tracked sideways in the first part of Friday dealing. We were last around $89.35/bbl in terms of the front month contract, leaving us around 0.40% firmer versus end Thursday levels. This follows Thursday's +1.10% gain. WTI front month was last around $83.85/bbl. Both benchmarks are tracking higher for the week at this stage.

- Thursday's rally was aided by a USD pull back, with oil markets not too concerned around higher US yields. Nor did the weaker than expected US Q1 GDP figures.

- Reported lower US inventories from earlier in the week, coupled with timespreads, continue to point to a tight market, and offsetting demand/monetary policy concerns.

- In terms of technicals for the WTI, futures have recovered from their recent lows and price remains above key short-term support at $81.03, the 50-day EMA. On the upside, key resistance and the bull trigger has been defined at $86.97, the Apr 12 high.

- We have the US PCE Core Deflator latest in US trade, while Tuesday next week delivers the China official PMI update.

GOLD: Heading For A Weekly Decline Despite Thursday’s Gain

Gold is little changed in the Asia-Pac session, after closing 0.7% higher at $2332.46 on Thursday.

- Nevertheless, bullion is on track for a weekly close as persistent inflationary pressures force a continued paring of market easing expectations for the US Fed.

- Overnight, US Treasuries reacted negatively to the Q1 GDP report, with 2- and 10-year yields 6-7bps higher.

- US GDP rose by an annualised 1.6%, below the 2.5% consensus, partially explained by a shortfall in private consumption (2.5% against 3.0% expected). The core PCE deflator was stronger than expected, running at an annualised 3.7% (3.4% expected).

- Weekly claims were also lower than expected.

- According to MNI’s technicals team, the precious metal has recently pierced the 20-day EMA and a continuation lower would signal scope for an extension towards $2229.4, the 50-day EMA. Key resistance and the bull trigger have been defined at $2431.5, the recent Apr 12 high.

- Elsewhere, copper is up by 1.3% at $454.6/lb, having hit a near 23-month high of $458.6 earlier in the session. A bullish theme in copper futures remains intact, with attention on $460.76 next, a Fibonacci projection. Key support is seen at $415.53, the 50-day EMA, according to MNI’s technicals team.

ASIA FX: Weaker Yen Weighs, China PMIs Next Tuesday

USD/Asia pairs are higher with weaker yen levels (post the unchanged BoJ) aiding broader USD sentiment in the region. USD/CNH is a touch higher, while CNY spot holds close to its daily trading limit. FX losses are fairly modest elsewhere but consistent. It is a reasonably quiet start to the data week on Monday, but on Tuesday China official PMIs for April will be in focus.

- USD/CNH sits back around 7.2610, slightly above end NY levels from Thursday. Onshore spot continues to track very close to the upper daily trading limit, last around 7.2465. Today's daily trading limit is 7.2477 after the steady fixing earlier. For USD/CNH moves back towards the 20-day EMA (currently 7.2525/30) remain supported. Recent highs remain intact in the 7.2730/40 region. Speculation continues around a possible yuan devaluation. With rising metal holdings onshore cited as a factor around local concern on further FX weakness (our London team touched on this earlier in the week, as well as yuan weakness on crosses, see this link).

- 1 month USD/KRW has firmed, unable to test sub 1370 amid yen weakness. The pair was last near 1375, around 0.35% weaker for the session so far. Some offset is coming from a stronger local equity market backdrop, but the Kospi's +1% gain keeps it within recent ranges. Downside focus for the 1 month we be on the 20-day EMA around 1366.

- USD/PHP sits slightly higher in the first part of Friday trade, the pair last near 57.85. We are off yesterday's highs which printed near 58.00 (57.96). At this stage PHP is tracking as the weakest Asian FX performer in April to date, down around 2.8%, with IDR the next worst (off 2.2%). This weakness appears to be getting the authorities attention. Headlines cross late yesterday from BSP Governor Remolona that the central bank was prepared to intervene, if necessary, to curb PHP weakness (per BBG). This may heighten expectations that the 58.00 level is somewhat of a short term line in the sand for the authorities.

- USD/SGD sits back above 1.3600, slightly weaker in SGD terms for the session. March IP figures were weaker than expected (-9.2% y/y, versus -1.5% forecast), which follows the softer CPI prints from earlier in the week.

- USD/THB is relatively steady, last a little above 37.00. It remains down 0.50% in THB terms for the past week, the largest drop in EM Asia FX over this period.

INDONESIA: INDON Sov Curve Steepens, GDP Forecast Higher

The Indonesian sov curve has bear-steepened today with yields 3-6bps higher. Government forecasts GDP growth at 5.17% in 1Q, higher than 5.04% a year ago and the budget will remain in surplus, Finance Minister Sri Mulyani Indrawati said today.

- The INDON sov curve is flatter today, the 2Y yield is 3.5bp higher at 5.33%, 5Y yield is 4.5bps higher at 5.385%, the 10Y yield is 4.5bps higher at 5.50%, while the 5-year CDS is down 1bps at 79bps.

- The INDON to UST spread diff has widen in the front-end overnight as the treasury curve bear-steepened, the 2Y is now 354bps (-1bps), 5yr is 67.5bps (+1.5bps), while the 10yr is 81bps (+1bps)

- In cross-asset moves, the USD/IDR is up 0.23% at 16,225, the JCI is 0.55% lower, Palm Oil is unchanged, while US Tsys yields are 0.5-1bps lower

- Foreign Investors continue to offload Indonesian debt with selling momentum picking up in the short-term the past 8 trading days have seen a total of $868m of outflows, with the 5-day average is now -$100m, vs the 20-day average at -$66m, while the 100 & 200-day averages are about -$8m.

- Looking forward, S&P Global Indonesia PMI Mfg and CPI on Thursday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/04/2024 | 0800/1000 | ** |  | EU | M3 |

| 26/04/2024 | 0800/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 26/04/2024 | 0800/1000 |  | EU | ECB's De Guindos at Academia Europea Leadership | |

| 26/04/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/04/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 26/04/2024 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 26/04/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |