-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US MARKETS ANALYSIS - Equities Off Lows, But PPI Highs a Way Off

Highlights:

- China government advisers could recommend 4.5 - 5.5% 2023 growth target

- Emergency NATO meeting concludes errant Ukraine missile to blame for Polish blast

- Risk appetite stabilises, but equities still well below post-PPI highs

US TSYS: Cheaper With Missile Friendly Fire Ahead Of Stacked Docket

- Cash Tsys sit cheaper after indications from both the US and Poland that there is no indication yesterday’s missile strike was launched from Russia, more likely Ukrainian air defense. Poland’s Duda says it may not be necessary to invoke NATO Article 4.

- Elsewhere, Target’s disappointing earnings help keep a small bid (EPS $1.54 vs 2.15 expected) whilst globally, Reuters report China government advisers recommending a 2023 growth target of 4.5-5.5%.

- 2YY +2.5bps at 4.363%, 5YY +1bps at 3.906%, 10YY +1.3bps at 3.783%, and 30YY +0.9bps at 3.97%.

- TYZ2 trades 2 ticks higher at 112-20, between session lows of 112-08 and overnight highs of 112-27. Initial resistance is seen at yesterday’s high of 112-31+.

- Fedspeak: NY Fed Williams (0950ET), VC Supervision Barr (1000ET), Daly (1000ET), and Gov. Waller (1435ET).

- Data: Highlights are likely retail sales (0830ET) and IP (0915ET) but also see the NAHB housing index, international trade prices, business inventories, TIC flows plus usual weekly MBA mortgage applications/rate.

- Bond issuance: US Tsy $15B 20Y Bond auction (912810TM0) – 1300ET

- Bill issuance: US Tsy 17W bill auction – 1130ET

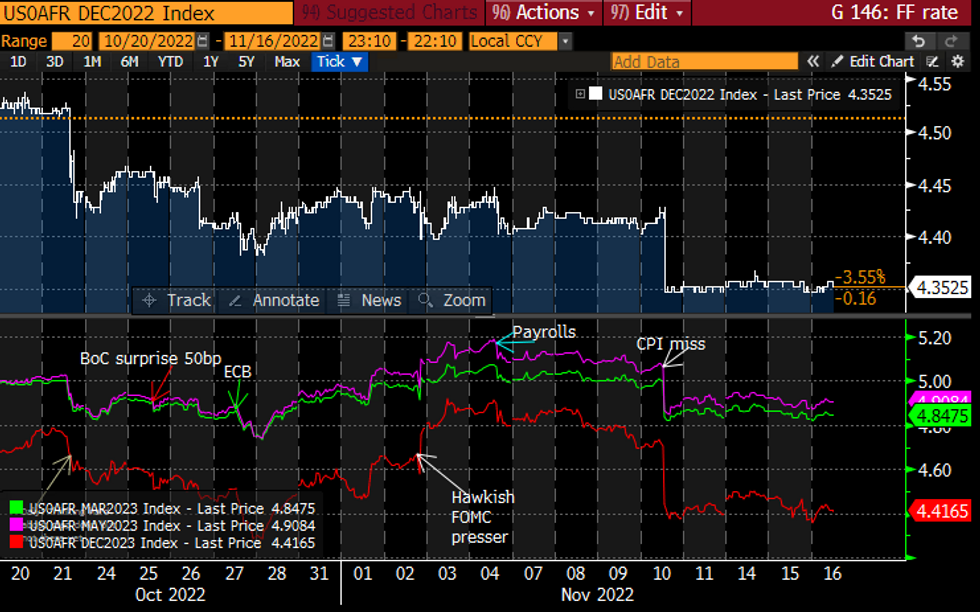

STIR FUTURES: Fed Rate Path In Middle Of Post-CPI Range

- Fed Funds implied hikes show 50bp for Dec (+0.5bp), 85bp to 4.70% for Feb (+1.5bp), terminal 4.91% May/Jun’23 (+2.5bp) and 4.42% Dec’23 (+4bp).

- George (’22 voter) joined others calling to slow the pace of rate hikes but with a need to continue hiking with a challenge to avoid prematurely ending the hiking cycle and inflation at risk of getting entrenched.

- Permanent voters ahead with Williams at a US Tsy market conference and Waller later watched after hawkish weekend comments (both with text). Barr also speaks at the House after Senate yesterday (expects to see significant softening in economy).

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

CHINA: Advisers Could Recommend Growth Target of 4.5 - 5.5% Next Year

- Reuters report that Chinese government advisers will recommend a 2023 economic growth target of 4.5 - 5.5% at the working conference next month.

Latest views among sell-side generally see growth below that mark:

- Goldman Sachs expect GDP growth to be soft in Q4 (3.5% q/q ann) and think the reopening boost to growth may not materialize until H2 next year.

- Meanwhile, TD Securities see growth at 3.1% this year, and should zero covid rules be removed in Q1, growth could move back to around 6-6.5% rather than the 4.7% they currently assume for 2023.

FOREX: Sentiment Stabilises as Likelihood Points to Errant Ukrainian Missile

- Following the late knock to risk sentiment on Tuesday following reports of a missile strike crossing the Ukrainian border into Poland, the market fallout looks more contained Wednesday. The USD is resuming the weakening trend and the JPY giving back the entirety of the Tuesday rally. Similarly, the 2% rally in EUR/PLN has been erased to put prices on a much more stable footing. The stabilisation of markets follows firm intelligence reports that the errant missile strike was Ukrainian in origin, rather than Russian, leaving the triggering of NATO's collective defence far less likely after an emergency meeting this morning.

- Nonetheless, the sharp moves continue to underpin the fractious nature of markets at present, with front-end implied vols generally higher across G10.

- UK inflation data left little lasting mark on GBP, with higher-than-expected CPI countered by a much more moderate core inflation reading. This keeps focus on tomorrow's Autumn Statement, at which the government are expected to outline a tighter, more fiscally-focused grip on government finances.

- USD and JPY are the weakest in G10 on an intraday basis, while NOK and EUR are trading more favourably.

- Focus turns to the October US retail sales release, seen rising 1.0% on the month and 0.2% ex-auto and gas. Central bank speakers due Wednesday include ECB's Villeroy, Panetta and Lagarde, as well as Fed's Williams, Barr and Waller.

Price Signal Summary - Gold Trend Needle Points North

- On the commodity front, the Gold traded higher again Tuesday and conditions remain bullish. Last week’s rally resulted in the break of a number of important resistance points. The yellow metal has cleared $1729.5, the Oct 4 high. This strengthens the current bullish theme and opens the $1800.0 handle and a key resistance at $1807.9, the Aug 10 high.

- In the Oil space, WTI futures appear vulnerable following last week’s bearish price activity and this week’s move lower. A bearish shooting star candle on Nov 7 was followed by a bearish engulfing candle the following day and these patterns highlighted an early reversal signal. A continuation lower would open $81.30, the Oct 18 low and a key support. On the upside, key short-term resistance is at $93.74, Nov 7 high. Initial resistance is at $90.10, the Nov 11 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 16/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 16/11/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 16/11/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/11/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/11/2022 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 16/11/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/11/2022 | 1415/1415 |  | UK | BOE Treasury Select Committee hearing on Nov Monetary Policy Report | |

| 16/11/2022 | 1450/0950 |  | US | New York Fed's John Williams | |

| 16/11/2022 | 1500/1000 | * |  | US | Business Inventories |

| 16/11/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/11/2022 | 1500/1600 |  | EU | ECB Lagarde Speech at European School Frankfurt Anniversary | |

| 16/11/2022 | 1500/1600 |  | EU | ECB Panetta at ABI's Executive Committee Meeting | |

| 16/11/2022 | 1500/1000 |  | US | Fed Vice chair for Supervision Michael Barr | |

| 16/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/11/2022 | 1935/1435 |  | US | Fed Governor Christopher Waller | |

| 16/11/2022 | 2100/1600 | ** |  | US | TICS |

| 17/11/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 17/11/2022 | 0720/0220 |  | ID | Bank of Indonesia Rate Decision | |

| 17/11/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 17/11/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/11/2022 | 1230/0730 |  | US | Atlanta Fed's Raphael Bostic | |

| 17/11/2022 | 1230/1230 |  | UK | BOE Pill Speech at the Bristol Festival of Economics | |

| 17/11/2022 | - |  | UK | Autumn Statement with New OBR forecasts / Updated DMO Remit | |

| 17/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 17/11/2022 | 1300/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/11/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 17/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/11/2022 | 1415/0915 |  | US | Fed Governor Michelle Bowman | |

| 17/11/2022 | 1430/1430 |  | UK | BOE Tenreyro Speech at Asociacion Argentina de Economia Politica | |

| 17/11/2022 | 1440/0940 |  | US | Cleveland Fed's Loretta Mester | |

| 17/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/11/2022 | 1540/1040 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/11/2022 | 1540/1040 |  | US | Fed Governor Philip Jefferson | |

| 17/11/2022 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 17/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 17/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/11/2022 | 1845/1345 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.