-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

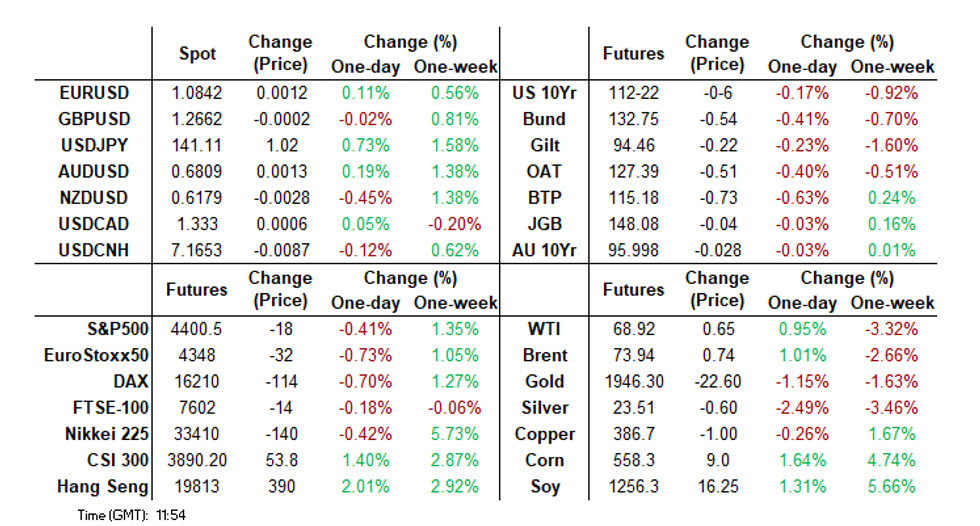

MNI US MARKETS ANALYSIS: Hawkish Fed Dot Plot Pondered Pre-ECB

- ECB & BoE OIS pricing ticks higher in reaction to FOMC dot plot move.

- USD mixed vs. G10 FX, Tsys cheaper but off post-Fed extremes.

- ECB decision eyed.

US TSYS: Cheaper But Off Post-FOMC Lows, Stacked Data Docket Ahead

- Cash Tsys have been under pressure through both Asia and European sessions as participants adjust to hawkish Fed rhetoric with its 5.6% median dot for 2023, but remain off post-announcement lows for both outright and curve levels. There is an unusually stacked data docket today along with continued heavy bill issuance.

- 2YY +4.9bp at 4.737%, 5YY +4.4bp at 4.034%, 10YY +3.1bp at 3.817% and 30YY +1.3bp at 3.895. 2s10s sit at -91.5bps off yesterday’s low of -94.6bps after what was a fresh low since Mar 10 on the decision.

- TYU3 trades 6 ticks lower at 112-22 off support at yesterday’s post FOMC announcement low of 112-12+, after which lies 112-00 (Mar 10 low). Volumes are notably above recent averages approaching 350k.

- Data: Retail sales May (0830ET), Weekly initial claims (0830ET), Empire & Philly Fed mfg index Jun (0830ET), Import prices May (0830ET), IP & cap util May (0915ET), Business inventories Apr (1000ET), TIC flows Apr (1600ET).

- Fedspeak: The blackout continues as usual until midnight, but Bullard and Waller are scheduled for early tomorrow in a potentially interesting start to the day after yesterday’s SEP showed 2 members calling for three more hikes and 1 for four.

- Bill issuance: US Tsy $65B 4W, $55B 8W bill auctions (1130ET)

STIR: Fed Rates Reverse Presser Dip, SEP Sets The Tone

- FOMC-dated OIS rates have pushed higher overnight, unwinding most of the decline seen through the press conference to take them nearer to post announcement levels with the hawkish dot plot with a median 5.6% for 2023 seemingly carrying most weight.

- The upshot of that is July pricing only marginally higher at +17bps vs the cumulative +16bp pre-announcement, but holding sizeable increases further out with even January above current levels at an implied 5.10% .

- Cumulative changes from 5.08% effective: +17.5bp Jul (+1.5bp on the day), +21.5bp Sep (+2.5bp), +20.5bp Nov (+3bp), +14bp Dec (+3bp) and +2bp Jan (+3.5bp)

- More detail plus changes post announcement and presser in the table below.

MNI ECB Preview - June 2023: Tightening Towards The Stop

- The ECB will hike rates by 25bp and confirm the previous decision to end APP reinvestments in July.

- Absent a sharp drop in core inflation, we would expect the ECB to hike again in July.

- Even if the ECB were to raise rates further in September, this would likely be the last turn of the screw.

For the full publication, please see:MNI ECB Preview June 2023.pdf

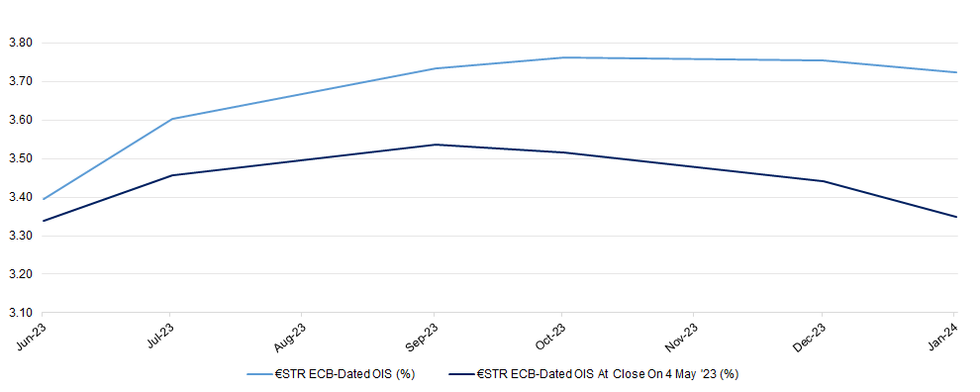

STIR: Fed Impetus Allows ECB Terminal Rate Pricing To Show Above 3.85% Ahead Of Latest Decision

ECB-dated OIS shows terminal rate pricing just above 3.85% as the feedthrough from the FOMC meeting and dot plot biases pricing a touch higher ahead of today’s decision in Frankfurt. Note that we haven’t seen terminal rate pricing close above 3.85% (in deposit rate terms) since late May.

- The strip is higher and steeper when compared to closing levels after the 4 May ECB decision.

- The outcome of the ECB’s impending policy decision has been well-telegraphed: the deposit rate will almost certainly increase by 25bp (an outcome that is essentially fully priced) and the previous decision to end APP reinvestments in July will be confirmed.

- The communication since the May meeting indicates that the dovish members concede that there is still some room to raise rates, while the more hawkish members are no longer calling for larger hikes (50bp+).

- Continuing to hike by a more modest 25bp is the compromise position that the GC seem to be aligning around.

| ECB Meeting | €STR ECB-Dated OIS (%) | €STR ECB-Dated OIS At Close On 4 May '23 (%) |

| Jun-23 | 3.395 | 3.338 |

| Jul-23 | 3.604 | 3.457 |

| Sep-23 | 3.734 | 3.535 |

| Oct-23 | 3.761 | 3.515 |

| Dec-23 | 3.754 | 3.441 |

| Jan-24 | 3.724 | 3.349 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EUROZONE ISSUANCE UPDATE

France auction results:

- E4.106bln of the 2.50% Sep-26 OAT. Avg yield 3.03% (bid-to-cover 3.46x).

- E2.195bln of the 0.75% Nov-28 OAT. Avg yield 2.85% (bid-to-cover 3.83x).

- E5.695bln of the 2.75% Feb-29 OAT. Avg yield 2.89% (bid-to-cover 2.57x).

- E669mln of the 0.10% Mar-29 OATei. Avg yield 0.52% (bid-to-cover 3.14x).

- E600mln of the 0.10% Jul-31 OATei. Avg yield 0.46% (bid-to-cover 2.45x).

- E230mln of the 0.10% Jul-53 OATei. Avg yield 0.62% (bid-to-cover 3.12x).

Spain auction results:

- E2.032bln of the 2.80% May-26 Bono. Avg yield 3.246% (bid-to-cover 1.98x).

- E1.338bln of the 5.15% Oct-28 Obli. Avg yield 3.184% (bid-to-cover 1.88x).

- E1.581bln of the 3.90% Jul-39 Obli. Avg yield 3.842% (bid-to-cover 1.83x).

Slightly soft Spanish auction with only E4.951bln sold (the smallest auction YTD), the midpoint of the E4.5-5.5bln range that itself had been lowered following last week's E13bln 10-year syndication.

Finland ORI auction results:

- E201mln of the 0.50% Apr-26 RFGB. Avg yield 3% (bid-to-cover 1.78x).

- E201mln of the 0.50% Sep-29 RFGB. Avg yield 2.95% (bid-to-cover 2.86x).

FOREX: Focus is on the ECB

- The Dollar trades more mixed against G10s, as Equities drift lower with Bonds ahead of the ECB.

- Best performer is the NOK, up 0.31%, while the Yen remains the worst performer, down 0.69%, albeit off its low, at the time of typing.

- The main focus in FX is back on the Yen, with the big divergence in rate stance between Europe and Japan, with rate decision tomorrow for Japan, the EURJPY trades at its highest level since 2008.

- The BoJ's Dovish stance and the lack of intervention comment has the Yen also down across the board, albeit off its worst level going into the European session.

- Next resistance in EURJPY will be at 153.00, and in USDJPY at 141.61 High Nov 23 2022.

- Looking ahead, ECB with an expected 25bps hike, and out of the US retail sales/IJC/IP.

- Speakers include, Lagarde, Villeroy, BoE Cunliffe.

FX OPTIONS: Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0830-35(E944mln), $1.0875(E634mln)

- USD/JPY: Y138.90-00($794mln), Y140.00($550mln)

- USD/CAD: C$1.2850($1.0bln), C$1.3180-00($790mln)

CNH Recovers After Another Fresh YtD High In USD/CNH, Foreigners Buy Mainland Equities

Another day and another cycle high/show above the upper boundary of the well-defined trend channel in USD/CNH (which still holds on a closing basis).

- The latest batch of softer than expected Chinese economic data and the PBoC delivering the widely expected 10bp cut to MLF rate were the main drivers of the yuan weakness early on, before a fairly abrupt pullback from session highs, USD/CNH last shows at ~CNH7.1625, off highs of CNH7.1922.

- Policymakers haven’t shown any particular angst re:: yuan weakness, although one of their previous points of focus was the expectation for the Fed tightening cycle to come to a fairly prompt halt. That assumption will not hold if the Fed acts in line with its latest dot plot.

- Stimulus talk continues to do the rounds in the local media, and offshore investors seem to have acted on the latest news flow on that front, lodging CNY9.2bn of net inflows into mainland stocks via the Hong Kong Stock Connect links. This would have added further tailwinds as the CSI 300 gained 1.6%, as well as providing support for the yuan.

- Benchmark Chinese interest rates (10-Year CGB yields and 5-Year NDIRS) operate a little off of their recent lows.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Bulls In Technical Control

- Eurostoxx 50 futures traded higher Wednesday and are trading just off the recent highs. Resistance at 4362.00, the May 29 high has been cleared. This is a bullish development and signals scope for an extension higher towards key resistance at 4409.50, the Nov 18 2021 high on the continuation chart. Clearance of this hurdle would represent an important bullish development. Initial support to watch is at 4285.30, the 50-day EMA.

- S&P E-minis traded higher again Wednesday. The move confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on a climb towards 4452.42, a Fibonacci projection. Firm support is at 4304.28, the 20-day EMA. Initial support is at 4348.75, the Jun 5 high.

COMMODITIES: Oil Trend Needle Points South

- WTI futures continue to trade below resistance at $75.06, Jun 5 high, and the outlook remains bearish The pullback from this level reinforces a bearish theme. Support at $67.03, May 31 low, has been pierced, a clear break would open $63.90, May 4 low. Moving average studies are in a bear mode position highlighting a downtrend. A break of $75.06 is required to signal a reversal. Short-term gains are considered corrective.

- The bear cycle in Gold remains intact. The yellow metal is trading below trendline support drawn from the Nov 3 2022 low - the trendline intersects at $1964.6. The break of this line reinforces bearish conditions and marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this resistance would signal a short-term reversal instead.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/06/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 15/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 15/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/06/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/06/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 15/06/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/06/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/06/2023 | 1245/1445 |  | EU | Post-Meeting ECB Press Conference | |

| 15/06/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/06/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 15/06/2023 | 1400/1000 | * |  | US | Business Inventories |

| 15/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 15/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 15/06/2023 | 1535/1635 |  | UK | BOE Cunliffe at Politico Global Tech Summit | |

| 15/06/2023 | 2000/1600 | ** |  | US | TICS |

| 16/06/2023 | 0200/1100 | *** |  | JP | BOJ policy announcement |

| 16/06/2023 | 0700/0300 |  | US | St. Louis Fed's James Bullard | |

| 16/06/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/06/2023 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 16/06/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 16/06/2023 | 1145/0745 |  | US | Fed Governor Christopher Waller | |

| 16/06/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 16/06/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/06/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.