-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US MARKETS ANALYSIS - Greenback Softer, But Above Weds Lows

Highlights:

- USD softer, but above yesterday's lows

- PPI to shed more light on US inflation picture

- Equities remain in near-term uptrend, with S&P 500 at multi-month highs

US TSYS SUMMARY: PPI Inflation Comes Into Focus, 30Y Auction Later

- Cash Tsys bull steepen on the day to reverse a bear flattening seen later in yesterday’s US session. The net result is that the majority of yesterday’s initial post-CPI bull steepening is left intact, with 2s10s at -40.5bps having been closer to -50bps prior to CPI, but in doing so is only back to Monday’s levels.

- The curve remains heavily inverted with still strong CPI pressure despite the latest moderation and FOMC members wanting to see sustained downward pressure whilst currently sticking with prior rate forecasts.

- 2YY -3.9bps at 3.175%, 5YY -2.4bps at 2.898%, 10YY -1.1bps at 2.764% and 30YY +0.2bps at 3.034% (auction later).

- TYU2 trades 3 ticks higher at 119-27, well within wide ranges established after both CPI and payrolls releases, with average volumes for this time of year. The trend direction remains up with trendline support at 119-16 (drawn from Jun 16 low) and resistance at 120-29 (Aug 4 high).

- Data: PPI for July and weekly jobless claims – 0830ET

- Bond issuance: US Tsy 30Y Bond auction (912810TJ7) – 1300ET

- Bill issuance: US Tsy $55B 4W, $50B 8W bill auctions – 1130ET

STIR FUTURES: Fed Terminal Rate Still Seen Higher Than Pre-Payrolls

- Fed Funds implied hikes cool again having partially retraced yesterday’s post-CPI slashing lower, leaving a 61bp hike priced for the Sept FOMC before a cumulative 116bps to year-end (3.49%) and 124bps to a Mar’23 peak (3.58%).

- The implied peak is down from just under 3.7% prior to CPI but still notably above the 3.45% pre-payrolls.

- The 50bps of cuts priced to 3.07% by Dec’23 continues to be much lower than FOMC member views. Evans (’23) and Kashkari (’23) yesterday stuck to Evans wanting 3.25%-3.5% by year-end, 3.75-4% end-23 and Kashkari 3.9% year-end, 4.4% end-23.

- This morning, Daly (’24) said it’s too early to declare victory on inflation but also stuck to a 50bp hike in Sept as her baseline – not ruling out 75bps but with increased support for a slowdown in the pace – and still wants rates of just under 3.5% by year-end. A re-appearance from Daly is the only scheduled Fedspeak at 1930ET on BBG TV.

FOMC-dated Fed Funds futures implied rate at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures implied rate at specific meetingsSource: Bloomberg

EGB/GILT SUMMARY: Trading Lower

European government bonds have broadly traded lower this morning while the dollar remains on the back foot against most G10 FX and equities have traded mixed.

- Gilts have sold off with cash yields pushing up 5-7bp.

- As the fight to succeed UK PM Boris Johnson heats up ahead of the final vote, Liz Truss' team have claimed that Rishi Sunak frustrated efforts to realise the gains from Brexit, while the former Chancellor has accused Truss of U-turning on helping households with soaring energy bills.

- Bunds have weakened with yields up 2-4bp on the day.

- OATs have slightly underperformed bunds with yields up 2-5bp and the curve bear flattening.

- BTPs have broadly firmed with yields up to 6bp lower at the short end.

- There was no European supply this morning and no tier-one data releases.

- Data focus shifts to US PPI and initial claims for July, which will be published later today.

How Confident Investors Should Be in Recent Equity Recovery?

Executive summary

- Global equities have experienced a significant 'bull' consolidation in recent weeks, with the MSCI world index up by over 10% since its mid-July low.

- However, fundamentally the macro picture has not changed with global and local leading indicators pricing in a significant deterioration in the economic activity in the coming 6 to 12 months.

- Is the market experiencing a ‘bear’ rally?

Link to full publication:

MNI MARKETS ANALYSIS - Global Picture - F.pdf

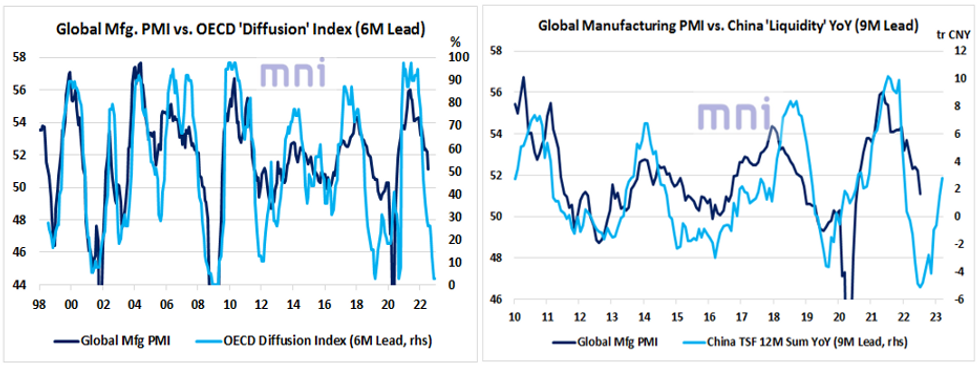

Figure 1 (left frame) shows the OECD 'Diffusion' index, which looks at the percentage of countries with rising Leading Economic Indicators. It is currently pricing in a global PMI at 45, well below the 50-line threshold that separates growth from contraction. Figure 1 (right frame) shows that the sharp contraction in China 'liquidity' in 2021 is still pricing in further downside risk in the near term before a pickup in the activity in early 2023.

Figure

Source: Bloomberg/MNI

EUROPE ISSUANCE UPDATE

Eurozone:

ERV2 98.75/98.50ps 1x2, bought for -0.25 in 4k

ERZ2 98.75/98.875/99.00/99.25 broken call condor, bought for -1.25 (receive) in 4k

0RU2 98.37/98.25ps v 98.87/99.12cs, bought the ps for flat in 4k

UK:

SFIU2 97.00p, bought for half in 3kSFIU2 97.50p sold at 4.5 in 1k

FOREX: EUR Making Furtive Progress Among Crosses

- The greenback is softer ahead of the NY crossover, although the USD Index is yet to test the Wednesday post-CPI lows. For EUR/USD, this keeps the pair below 1.0350, but strength through yesterday's 1.0368 and a close above would mark a bullish signal and could see the pair break out of the YTD downtrend channel drawn off the February high. The upper-end of this channel crosses at 1.0344 today.

- In contrast to yesterday morning's price action, the EUR is making progress in the crosses, and is stronger against all others in G10. This sees a small part of yesterday's EUR/JPY losses erased, with the cross needing to take out 138.40 before resuming the bounce posted off the late July low.

- Equity markets are generally firmer, extending the post-CPI strength as traders watch the waning expectations for a 75bps rate hike from the Fed in September. This points to another positive open on Wall Street, with the S&P 500 trading at the best levels since early May.

- With the CPI event risk now out of the way, implied vols across G10 FX are generally taking a step lower, with EUR/USD 1m implied dropping below 8.5 points and nearing the lowest levels in two months.

- Markets get another insight into the US inflation picture later today, with the PPI release for July expected to show another moderation in prices (down from 1.1% to 0.2% on a M/M final demand basis). Markets also watch the weekly US jobless claims data and the Banxico rate decision.

FX OPTIONS: Expiries for Aug11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0097-05(E1.8bln), $1.0125(E607mln), $1.0200(E700mln), $1.0235(E524mln), $1.0300(E581mln)

- USD/JPY: Y134.25($685mln), Y134.97-00($1.2bln), Y135.15-35($941mln)

- GBP/USD: $1.2000(Gbp552mln), $1.2150-65(Gbp1.1bln)

- EUR/GBP: Gbp0.8350(E780mln), Gbp0.8650(E716mln)

- AUD/USD: $0.6980-00(A$1.6bln)

- USD/CAD: C$1.3200($825mln)

- USD/CNY: Cny6.7000($1.2bln)

Price Signal Summary - EURUSD Waiting For A Clear Breakout Of The Bear Channel

- In the equity space, S&P E-Minis traded higher Wednesday, delivering a fresh trend high that confirms a resumption of the current uptrend. The focus is on; 4226.95 and 4272.35, the 1.618 and 1.764 projection of the Jun 17 - 28 - Jul 14 price swing. On the downside, initial trend support is at 4080.50, the Aug 2 low. The short-term uptrend in EUROSTOXX 50 futures is intact and yesterday’s gains signal a potential resumption of the uptrend. The focus is on 3840.00, the Jun 6 high. Initial firm support to watch is 3613.30, the 50-day EMA.

- In FX, EURUSD traded higher Wednesday, clearing resistance at 1.0294, the Aug 2 high. Price also briefly traded above the bear channel top, currently at 1.0344. The channel is drawn from the Feb 10 high. 1.0344 and yesterday’s high of 1.0368 marks a key resistance zone and a clear break would strengthen bullish conditions. Note that a deeper pullback and a breach of 1.0123, the Aug 3 low, would instead signal a reversal lower inside the channel. A bullish short-term theme in GBPUSD remains intact and yesterday’s gains reinforce this theme. The focus is on 1.2332, Jun 27 high. Potential is also seen for a climb towards 1.2406, the Jun 16 high and a key resistance. Initial support to watch is 1.2004, the Aug 5 low. USDJPY traded sharply lower Wednesday. This signals a possible reversal of the recent correction between Aug 2 - 8. A bearish theme remains in place and a continuation lower would expose 130.41, the Aug 2 low and the bear trigger. Firm resistance has been defined at 135.58, the Aug 8 high.

- On the commodity front, Gold traded higher yesterday and did breach trendline resistance at $1794.6. The trendline is drawn from the Mar 8 high and the break represents an important technical breach plus highlights a stronger bullish reversal. A break of Wednesday’s $1807.9 high would reinforce bullish conditions. Watch support at $1754.4 the Aug 3 low. In theOil space, WTI futures are trading higher today and the contract has traded above $92.65, the Aug 9 high. This cancels a recent doji candle reversal pattern and instead suggests scope for a continuation higher. The next resistance is at $94.40, the 20-day EMA. Key support and the bear trigger is at $87.01, the Aug 5 low.

- In the FI space, a short-term bull cycle in Bund futures remains intact. Scope is seen for a climb to 159.79 next, the Apr 4 high (cont). Initial firm support is 155.32 the 20-day EMA. The trend direction in Gilts remains up and the recent pullback is considered corrective. Two support levels to watch are; 116.46, 50-day EMA and 116.79, trendline support drawn from the Jun 16 low. A break of this support zone would threaten the uptrend.

EQUITIES: Futures Point to More Equity Strength at the Opening Bell

- US index futures sit higher ahead of the NY crossover, indicating another positive open for Wall Street in a few hours' time. This would keep the S&P 500 at the best levels since early May, with the index now higher by over 15% off the mid-June lows.

- Strength across the e-mini S&P reinforces short-term bullish conditions and continued gains would maintain the positive price sequence of higher highs and higher lows. The focus is on 4272.35 next, a Fibonacci projection. On the downside, initial trend support is at 4080.50, the Aug 2 low.

- Across Europe, markets are more mixed, with peripheral Italian, Spanish markets firmer, while the UK's FTSE-100 lags. Europe's energy names are firmer, with positive Brent and WTI prices supporting the likes of Total and Repsol in early morning trade. Healthcare is the poorest performing sector, reinforcing the risk-on backdrop.

COMMODITIES: Gaining, Precious Metals Aside

- WTI Crude up $0.64 or +0.7% at $90.12

- Natural Gas up $0.09 or +1.04% at $7.99

- Gold spot down $2.63 or -0.15% at $1792.6

- Copper up $2.85 or +0.78% at $365

- Silver down $0.1 or -0.51% at $20.7223

- Platinum up $13.25 or +1.4% at $950.02

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/08/2022 | 1230/0830 | *** |  | US | PPI |

| 11/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/08/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/08/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

| 12/08/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/08/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/08/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/08/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/08/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/08/2022 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/08/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 12/08/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/08/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/08/2022 | 0900/1100 | ** |  | EU | industrial production |

| 12/08/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/08/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/08/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.