-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Global Industrial Activity Slowly Recovering

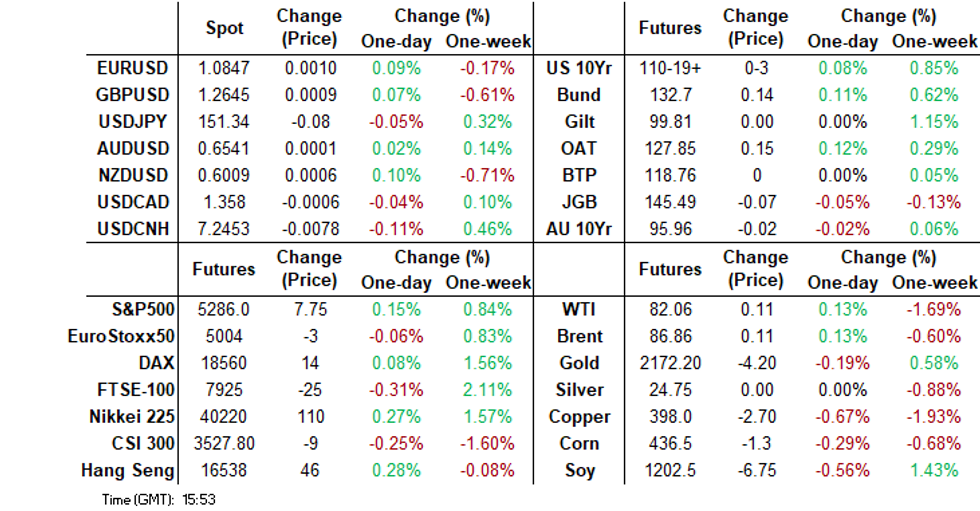

- We saw further FX warnings from the Japan authorities (this time from the FinMin), but there was no follow yen support. The CNY fixing was set stronger again, but spot USD/CNY has been supported on dips.

- In the US Tsy space, Jun'24 10Y futures gapped higher earlier, and volumes spiked with about 21,000 contracts trading inside a minute, there was little in the way of market catalyst, the 10y contract hit a high of 110-23+ and has now settled back at 110-19+ up + 03 for the day.

- More broadly, data is showing that global industrial activity at the start of 2024 was slowly recovering but remains lacklustre. CPB reported global industrial production volumes for January slowed with the index falling 0.5% m/m to be up 1.2% y/y after +2.5% y/y, the slowest annual growth since October, see below for more details.

- Later US February durable orders, January CoreLogic house prices, March consumer confidence and Richmond Fed indices print. ECB’s Lane speaks.

MARKETS

GLOBAL: Industrial Activity Slowly Recovering

Data is showing that global industrial activity at the start of 2024 was slowly recovering but remains lacklustre. CPB reported global industrial production volumes for January slowed with the index falling 0.5% m/m to be up 1.2% y/y after +2.5% y/y, the slowest annual growth since October. It remains within the range it has been in since end 2022 though, and 3-month momentum in metal prices is positive and increasing. They tend to be a lead indicator of IP growth and thus signal that it should improve in coming months, but with March oil prices up almost 10% since end-2023, there remains a risk from energy and transport prices.

- The global S&P Global manufacturing PMI is also signalling improving activity in the sector. It continues to point to moderate but positive Q1 growth. The February PMI improved slightly to 50.3 from January’s 50, the first time it has been at the breakeven level since August 2022.

- Also, global merchandise trade growth continued to recover at the start of the year with exports rising 2.5% y/y and 3-month momentum positive.

Global growth

Source: MNI - Market News/Refinitiv/Bloomberg

GLOBAL: Asia Driving Global Export Recovery

Global trade volumes picked up in January according to CPB data. Exports drove a 0.9% m/m rise in trade, the largest monthly increase since March last year, to be up 0.4% y/y after falling 0.5% y/y in December. Global export volumes rose 1.8% m/m to be up 2.5% y/y up from 1.0% y/y driven by Asia. Manufacturing PMI data and momentum in metal prices are pointing to a moderate recovery in trade and IP but given rising oil prices and risks to shipping the outlook is very uncertain.

- While export volume growth from both developed (DM) and emerging markets (EM) was positive in January, the recovery to date has been driven by the latter. EM exports rose 4% m/m to be up 6.4% y/y up from 4.1% y/y in December and while momentum is subdued it is positive. DM exports rose 0.7% m/m to be up 0.4% y/y improving from -0.8%.

Source: MNI - Market News/Refinitiv/CPB

- There are variations within each block but Asian exporters are the outperformers within both DM and EM. While euro area, UK and US annual export volume growth all shrank, Japan and advanced Asia saw positive growth, especially the latter rising 9.6% y/y.

- In EM, China’s exports rose 15.4% y/y and emerging Asia’s 3.8%. Shipments from eastern Europe rose 5.3% y/y but they shrank from Latin America and Africa/Middle East.

Source: MNI - Market News/Refinitiv/CPB

US TSYS: Treasury Futures Erased Most Of Earlier Gains After Volumes Spiked

- Jun'24 10Y futures gapped higher earlier, and volumes spiked with about 21,000 contracts trading inside a minute, there was little in the way of market catalyst, the 10y contract hit a high of 110-23+ and has now settled back at 110-19+ up + 03 for the day, while the 5Y contract moved higher in unison, however volume remained in line with prior days, the 5Y contract trades up + 01¼ at 106-31¼, from a high of 107-02

- Looking at technical levels: Initial support lays at 109-24+ (Mar 18 low/ the bear trigger), further down 109-14+ (Nov 28 low), to the upside resistance holds at 110-30+ (Mar 21 & 22 high), above here 111-00+ (50-day EMA), while a break above here would open a retest of 111-24 (Mar 12 high).

- Cash treasuries are slightly flatter today with yields flat to 1.5bps lower, the 2yr is unchanged at 0 4.627% while the 10yr is -0.8bp to 4.238%, while the 2y10y is +2.871 at -35.342

- Pimco reported earlier that they are holding smaller than usual position in US Treasuries

- Looking ahead: Later today Durable & Capital Goods Orders

STIR: $-Bloc Prices Three Cuts By Year-End, Except For Australia

STIR markets across the $-bloc, except for Australia, have around three 25bps rate cuts priced for year-end.

- In contrast, the Australian market sits with less than two cuts.

- December 2024 expectations and the cumulative easing across the $-bloc stand at: 4.56%, -77bps (FOMC); 4.22%, -79bps (BOC); 3.88%, -44bps (RBA); and 4.83%, -68bps (RBNZ).

Figure 1: $-Bloc STIR (%)

Source: MNI – Market News / Bloomberg

JGBS: Futures Holding A Downtick, BoJ Tamura Speech & 40Y Supply Tomorrow

JGB futures are holding a downtick, -2 compared to the settlement levels, having traded within a relatively constrained range.

- According to MNI’s technicals team, a stronger reversal higher is required to signal the end of the recent corrective phase. The bull trigger has been defined at 147.74, the mid-January high. A break would resume the uptrend. Moving average studies remain in a bull-mode set-up, highlighting an uptrend. For bears, a resumption of weakness would potentially open the 144.60 support.

- There haven't been significant domestic catalysts to note, aside from the previously highlighted PPI Services. Final February machine tool orders are due.

- Cash US tsys are dealing flat to 1bp richer in today's Asia-Pac session after yesterday's 4-5bps cheapening across benchmarks.

- Cash JGBs are mostly richer, with yields +0.2bp to -1.0bp. The benchmark 10-year yield is 0.2bp higher at 0.736% versus the YTD high of 0.801% set on March 15.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates 4bps lower to 1bp higher. Swap spreads are tighter out to the 10-year and wider beyond.

- Tomorrow, the local calendar sees a speech from BoJ Board Member Tamura in Aomori, along with 40-year supply.

AUSSIE BONDS: Cheaper, Narrow Ranges, CPI Monthly Tomorrow

ACGBs (YM -2.0 & XM -4.0) are holding cheaper after dealing in relatively narrow ranges in today’s Sydney session. The domestic calendar has been light.

- Cash ACGBs are 2-4bps cheaper, with the AU-US 10-year yield differential unchanged at -19bps.

- Swap rates are 1bps higher.

- The bills strip is slightly cheaper, with pricing flat to -2.

- RBA-dated OIS pricing is slightly mixed. A cumulative 41bps of easing is priced by year-end.

- (AFR) Unions’ push for a 5 per cent increase in minimum rates for 2.9 million workers will ensure interest rates remain higher for longer and restrict hiring, businesses warned. (See link)

- (AFR Ed Shann) I doubt the current optimism that falling inflation will allow interest rate cuts anytime soon. In fact, it is possible rates will need to rise again to tame domestic inflation. (See link)

- Tomorrow, the local calendar will see the CPI Monthly for February. Consensus is at 3.5% y/y from 3.4% in January.

- The Commonwealth Bank is predicting a rise to 3.8% y/y, with expectations that Q1 Trimmed Mean CPI will rise 0.8% q/q when the quarterly data is released on April 24.

- Tomorrow, the AOFM plans to sell A$800mn of the 4.5% Apr-33 bond.

AUSTRALIAN DATA: Westpac Consumer Sentiment Points To Persistent Soft Demand

Westpac consumer confidence for March eased 1.8% to 84.4 after rising the previous three months. It remains above January’s level though. Through the volatility, the series has turned up as the RBA now seems firmly on hold, but it remains at depressed levels and improvement in sentiment is slow. Westpac notes that consumers remain “deeply pessimistic” and are more concerned about the economy, thus weak consumption is likely to persist for now.

- The RBA announcement last week seems to have disappointed households, despite the removal of the implicit tightening bias, as expectations of rate cut have increased. Confidence before the meeting was up 10.3% on February, while afterwards it was down 7.8%, which Westpac says is in line with February’s pattern. 40% of consumers still expect a rate hike with 22% a cut, 22% unchanged and 15% “don’t know”.

- In March, inflation continued to be the news item that respondents recalled the most (down to 43% from over 60%) but it is becoming “less acute” with 51% viewing it as unfavourable compared with 74% a year ago. News on taxation, employment and interest rates was seen as more favourable but not the economy.

- The jobs outlook has been fairly steady with unemployment expectations in line with average despite rising 1% m/m in March, consistent with an easing labour market rather than redundancies.

- “Time to buy a major household item” was lower and still well below average.

- “Time to buy a dwelling” remains pessimistic despite being at a 15-month high. Almost 70% of respondents expect house prices to rise further over the coming year.

- See Westpac’s report here.

Source: MNI - Market News/Refinitiv

NZGBS: Closed Cheaper But Off Worst Levels, May-35 Bond Syndication Launch

NZGBs closed 5-6bps cheaper but well off the session’s worst levels. In the absence of domestic drivers, the local market has moved away from cheaps in line with US tsys in today’s Asia-Pac session. Cash US tsys are dealing 1-2bps richer across benchmarks.

- RBNZ raised its foreign currency intervention capacity to NZ$20b at the end of February.

- Swap rates closed 2-4bps cheaper, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is flat to 3bps firmer across meetings, with Feb-25 leading. A cumulative 68bps of easing is priced by year-end.

- Tomorrow, the local calendar sees the NZ Government Budget Policy Statement at 13:00 NZT.

- NZ Treasury has appointed ANZ Bank, Bank of New Zealand, UBS, and Westpac as joint lead managers for the formation of the panel responsible for syndicating the May 2035 nominal bond. The Treasury anticipates launching this transaction before the conclusion of April, pending favourable market conditions. Consistent with standard procedure, should the syndication proceed, the scheduled bond tender for the corresponding week will be cancelled.

FOREX: USD Supported On Dips, As Stronger CNY Fixing Sees Little Follow Through

The BBDXY index has been supported on dips so far today, although we aren't in positive territory for the session, the index sitting at 1243.3 currently (earlier lows were at 1242.28). Overall moves have remained modest.

- The USD has found some support amid a less positive regional equity market backdrop, with HK and China slightly lower. US yields remain lower though, although losses (-1bps) are only modest compared to gains seen in Monday trade.

- The CNY fix was again set stronger the expected but follow through USD/CNY downside was limited and the pair has rebounded back towards 7.2200, limiting USD weakness elsewhere.

- AUD/USD couldn't sustain gains above 0.6550, we last tracked near 0.6535/40. The above mentioned equity weakness a headwind, while iron ore is also weaker. The active Singapore contract back under $106/ton, off a little over 2.6%. Copper is also weaker.

- On the data front we had Westpac Australian consumer sentiment drop, while the Japan PPI services came is as expected at 2.1% y/y.

- USD/JPY has traded tight ranges overall, the pair last near 151.35/40. Earlier comments from FinMin Suzuki were in focus in relation to FX. They largely echoed comments made by FX Chief Kanda yesterday.

- NZD/USD is modestly outperforming AUD, but hasn't drifted too far away from the 0.6000 level. The AUD/NZD cross saw selling interest emerge above the 1.0900 level (last near 1.0885).

- Later US February durable orders, January CoreLogic house prices, March consumer confidence and Richmond Fed indices print. ECB’s Lane speaks.

ASIA EQUITIES: HK & China Equities Mixed, As Investors Await Corporate Earnings

Hong Kong and China equity markets have been mixed and well off highs from earlier this morning, as investors await earnings from some major companies including EV maker BYD. Regulators urge banks to adopt a "whitelist" system to speed up loan approvals for private property developers, with a directive last week to complete approvals and issue loans by June-end, covering projects requiring 1.5 trillion yuan in fresh financing, Reuters sources say. Hong Kong has Trade Balance data due later today.

- Hong Kong equities are mostly higher, the Mainland Property Index was up as much as 3.71% in early morning trade and has given up most of those gains are we come back from the break, trading just 0.80% higher, the HSTech Index trades up 0.30% after breifly trading down for the day, while the wider HSI is up 0.30%. In China, equity markets are mixed, with the CSI300 unchanged for the day, while the smaller cap focused CSI1000 down 1.00% and ChiNext up 0.17%

- China Northbound flows were 5.6billion yuan on Friday, with the 5-day average at -1.0billion, while the 20-day average sits at 2.61 billion yuan.

- (Reuters) - China pushes banks to speed approvals of new loans to private developers. (See link)

- China's central bank governor Pan Gongsheng affirms the nation's property market has a solid foundation for long-term health and stability, noting limited financial system impact from market fluctuations. Speaking at the China Development Forum, Pan highlights progress in resolving local debt risks and vows to continue financial sector opening-up efforts. He expresses confidence in meeting the 2024 GDP growth target of approximately 5% and pledges to enhance counter-cyclical policy adjustments, emphasizing the importance of a mild price rebound in monetary policy considerations.

- Top executives of foreign industrial and technology conglomerates highlight China's focus on advancing high-end manufacturing and fostering new quality productive forces, which they believe will create fresh growth points for multinational corporations, especially in green and strategic emerging industries. They note China's rapid adoption of new technologies, making it a highly dynamic market, while emphasizing their continuous investment in the country's green transition and innovation. China's actions to remove restrictions on foreign participation in manufacturing and increase openness in various sectors further attract foreign investment, particularly in high-tech manufacturing, which saw a 10.1% increase in foreign direct investment in the first two months of the year.

- Looking ahead, it's a quiet week for China econ data, while Hong Kong has Trade Balance data later today

ASIA PAC EQUITIES: Regional Asian Equities Mixed, Japan FinMin Warns FX Markets

Regional Asian equities are mixed today, with little in the way of major regional news or eco data out today, investors have turned their focus to US data due out later in the week, while some investors remain cautious and are preparing for the upcoming corporate earnings season, amidst cautionary notes from some analysts who suggest that overly optimistic profit expectations, instrumental in driving various markets to all-time highs, might lead to a market correction if actual reports fall short. Earlier Japanese Finance Minister spoke about the moves in the FX markets, which followed the countries Chief currency official delivering his strongest warning in months around the weakening currency.

- Japan's equities have turned slightly higher in the second half of trading today, earlier equities prices were weighed down by comments from the Japanese FinMin's where he warned the FX market, mentioning they wouldn't rule out any options against excessive FX moves. Exporters are the worst performing sector, on the back of expected higher yen. Earlier PPI services was released coming in line with expectations at 2.1%. The Topix is up 0.12%, while the Nikkei 225 is unchanged.

- South Korean equities surged higher this morning on stronger tech prices on the back of Micron Technology surge on Monday, we now trade off those earlier highs as investors look to take profits. Earlier SK released consumer confidence data showing a fall from 101.9 in Feb to 100.7 in March, while department store sales rose 7.2% y/y and discount store sales rose 21% y/y, overal Retails sales rose 13.7% y/y vs 8.2% y/y in Jan. The Kospi is 0.76% higher.

- Taiwanese equities opened the day higher,, although have seen selling as the day has progressed and now trade down 0.12%. Taiwan's industrial production index fell by 1.10% compared to the previous year, attributed to declines in mining and quarrying by 9.80% and manufacturing by 1.20%. However, there were increases in water supply by 2.52% and electricity and gas supply by 0.78%.

- Australian equities face the greatest risk of a pullback according to Chris Montagu, Citigroup’s quantitative market strategist, who notes the market's one-sided positioning and extended levels, particularly due to its leverage to China through resources. The ASX 200 closed lower today down 0.41%

- Elsewhere in SEA, NZ equities closed down 0.29%, Indonesian equities are lower by 0.44% Tuesday they broke a 6-day streak of foreign investor equity inflows, Singapore equities are up 0.90% after Mondays CPI data showed a slight beat coming in at 3.4% vs 3.2% and Industrial Productions beat coming in at 3.8% y/y vs 0.5% expected, Malaysian equities are unchanged, while Philippines equities are down 0.50%

OIL: Crude Steady As Geopolitics Create Significant Uncertainty

Oil prices are off their intraday highs to be little changed during the APAC session as OPEC+ members don’t believe it is necessary to change quotas. WTI rose to $82.30/bbl but is now back below $82 at $81.92. Brent is around $86.69 after rising to $87.06 earlier. The USD index is off its lows to also be flat on the day.

- The US waiver of sanctions on Venezuelan oil & gas expires on April 18 and there are growing concerns that it won’t be renewed as Venezuela has failed to meet the condition of free & fair elections. President Maduro has disqualified his main rival from running in July’s vote. India has stopped buying Venezuelan oil because of this scenario, while refusing to take oil on Russian state-owned tankers also because of sanctions.

- With the IEA revising its forecasts to show a small deficit in the oil market and conflicts impacting energy security, US inventory data out later today is being monitored closely. Recent weeks have seen drawdowns in crude stocks.

- Bullish technicals are supportive of oil prices with Brent’s 50-day moving average above the 200-day.

- Attention is on Russia with Ukrainian drone attacks continuing and a tragic terrorist attack in Moscow. Rosneft’s Kuibyshev refinery in Samara, southern Russia, was attacked on Saturday and now half its capacity is offline.

- Later US February durable orders, January CoreLogic house prices, March consumer confidence and Richmond Fed indices print. ECB’s Lane speaks.

GOLD: Holding Near Highs

Gold is slightly lower in the Asia-Pac session, after closing 0.3% higher at $2171.83 on Monday.

- US Treasuries saw losses of 4-5bps across benchmarks to start a holiday-shortened week. US bonds were heavy amid anxiety over the FOMC's policy path with risk the Fed does not cut rates the 3 times projected by the dots this year.

- Comments from Fed Bostic supported that chance too, as he revised his outlook for only 1 easing, versus 2 previously. While Fed Cook said officials must cautiously balance the risk of easing monetary policy too much or too soon, allowing inflation to linger above target, and taking too long to ease, which could harm the economy needlessly and deprive people of economic opportunities.

- The market’s focus is on Friday’s release of US PCE deflators. That said, the scope for any major surprises should be limited in Good Friday trading, with the CPI and PPI figures feeding into that release.

- According to MNI’s technicals team, the trend condition in gold remains bullish and sights are on $2230.1, a Fibonacci projection. Key short-term support has been defined at $2146.2, the Mar 18 low.

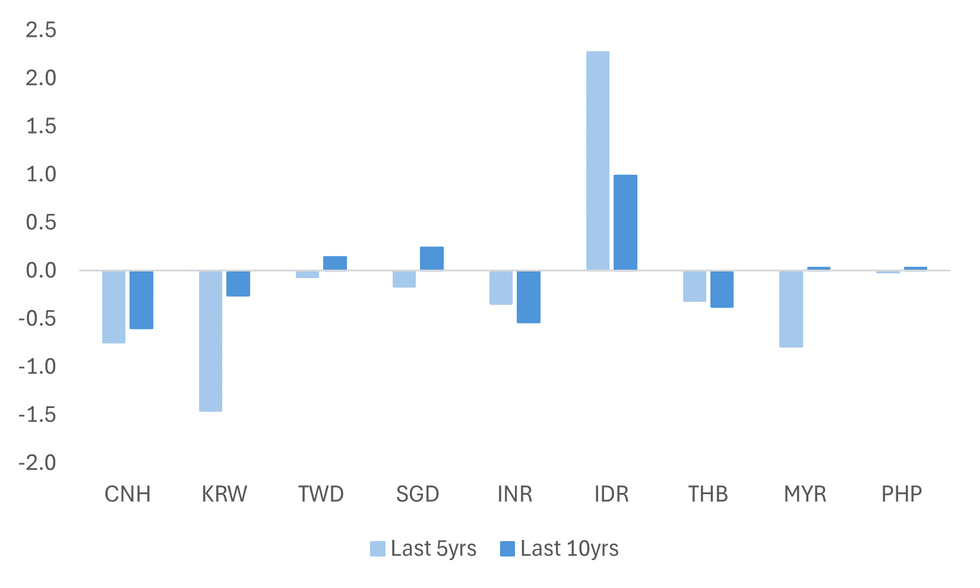

ASIA FX: April Seasonals Not Favorable For Most Currencies

As we approach the end of March and move into April, we are typically entering a period which is less favorable from a seasonal standpoint for most Asia currencies.

- The chart below plots average spot returns, in April, for all the major EM Asia currencies for the past 5yrs and the past 10yrs.

- Only IDR stands out as having positive gains on average in the month. The last 5 years is biased by the very strong rise we saw in Apr 2020 as market risk aversion fell as policy makers responded to the Covid outbreak. It the last 10 years IDR has risen in 5 Apr's and fallen in 5.

- For currencies like KRW and CNH, seasonal weakness has become more pronounced during April in the past 5 years compared to the prior period. A lot of this is related to outflows in terms of dividends/income outflows in terms of offshore holdings of local assets.

- The negative seasonality is less pronounced for other currencies in the region in April, but nevertheless still generally evident. Outside of IDR gains we tend to see TWD, SGD and PHP fair the best.

- It's also noteworthy that negative seasonality persists into May for most currencies in the region. For the BBG Asia Dollar index, the average drop in May is 0.68% for the past 5yrs, versus a 0.50% average drop in April. For the past 10yrs the results are similar in terms of average drop in May.

Source: MNI - Market News/Bloomberg

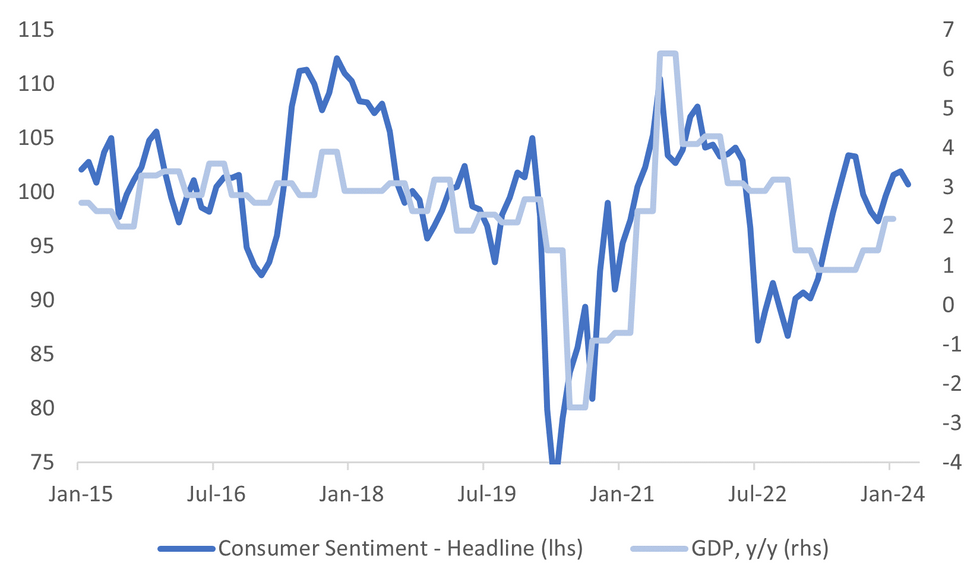

SOUTH KOREA DATA: Consumer Sentiment Dips, Inflation Expectations Rise - Likely To Be A BoK Watch Point

South Korea's headline consumer sentiment index fell to 100.7 from 101.9 in March. This was the first fall since Nov last year, ending a 3 month run of gains. The index is comfortably above 2022 lows, but isn't suggesting a run away pick up in GDP growth. The first chart below plots the headline CSI against y/y GDP growth.

- This is consistent with parts of the domestic economy still feeling pressure from tighter monetary policy settings.

- In terms of the details from the survey, expectations around the economy were unchanged from Feb, although living standards slipped. Consumer spending plans were unchanged versus Feb levels.

Fig 1: South Korea CSI Headline Versus GDP Y/Y

Source: MNI - Market News/Bloomberg

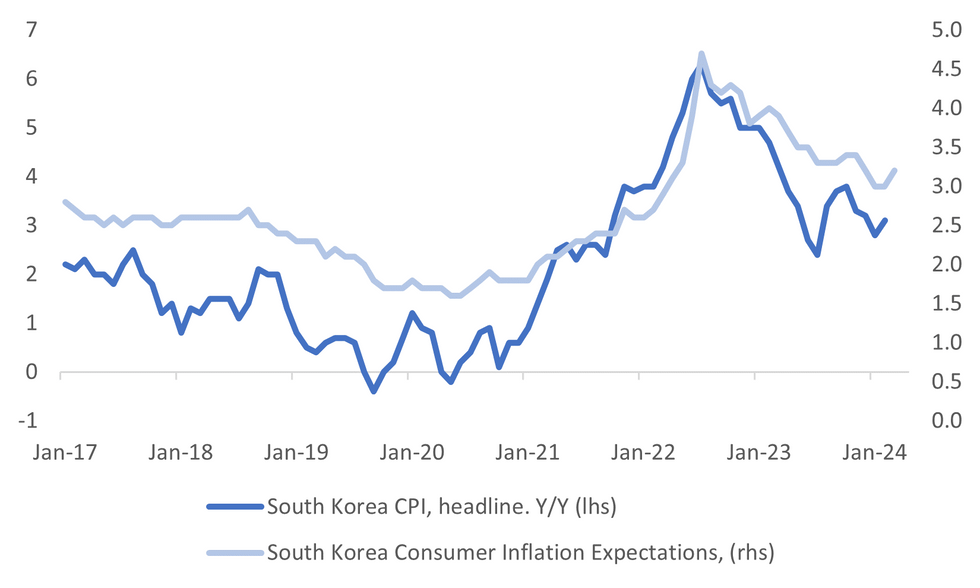

- On the prices front, we saw an uptick in terms of the expected inflation level. The second chart below plots this measure against headline CPI Y/Y.

- This is likely to be a watch point for the BOK. The authorities have been mindful of a pick up in inflation pressures in the early part of 2024, but have expected such pressures to dissipate as the year unfolds.

- While inflation expectations are comfortably sub 2022 highs, we are also some distance from being back at levels consistent with the inflation target of around 2%. The BoK is unlikely to cut rates until it is confident inflation is heading back to this level.

Source: MNI - Market News/Bloomberg

THAILAND DATA: Customs Trade Deficit Narrows But Export Growth Slows

Thailand’s February customs trade deficit narrowed close to expectations at $554mn after a deficit of $2758mn. Export growth slowed to 3.6% y/y from 10% y/y but continued to outpace imports at 3.2% up from 2.6%. The Commerce Ministry expects exports to slow further in Q1 with the quarter averaging 1-2% y/y growth as March base effects are unfavourable. USDTHB rose slightly on the data and is currently around 36.39 to be little changed on the day.

- Increased global demand, especially for food, is expected to support Thai exports in 2024. They will be an important support for the economy, which has continued to disappoint.

- Thai rice export volumes were strong rising 33.4% y/y to 800.2k tonnes and prices were 15% y/y higher. Rice prices have risen strongly since mid-2023 after weather-affected harvests and India banned the export of non-basmati varieties (see MNI Rice Prices Had Little Impact On Core Inflation But Now Peaking).

- A pickup in shipments of food and some electronics products also supported export growth.

- Thailand saw strong export growth to the US, its largest destination, in January but while still positive it was soft to China, Japan and the EU.

Source: MNI - Market News/Refinitiv

ASIA FX: USD Supported On Dips, As Stronger CNY Fixing Sees Little Follow Through

The BBDXY index has been supported on dips so far today, although we aren't in positive territory for the session, the index sitting at 1243.3 currently (earlier lows were at 1242.28). Overall moves have remained modest.

- The USD has found some support amid a less positive regional equity market backdrop, with HK and China slightly lower. US yields remain lower though, although losses (-1bps) are only modest compared to gains seen in Monday trade.

- The CNY fix was again set stronger the expected but follow through USD/CNY downside was limited and the pair has rebounded back towards 7.2200, limiting USD weakness elsewhere.

- AUD/USD couldn't sustain gains above 0.6550, we last tracked near 0.6535/40. The above mentioned equity weakness a headwind, while iron ore is also weaker. The active Singapore contract back under $106/ton, off a little over 2.6%. Copper is also weaker.

- On the data front we had Westpac Australian consumer sentiment drop, while the Japan PPI services came is as expected at 2.1% y/y.

- USD/JPY has traded tight ranges overall, the pair last near 151.35/40. Earlier comments from FinMin Suzuki were in focus in relation to FX. They largely echoed comments made by FX Chief Kanda yesterday.

- NZD/USD is modestly outperforming AUD, but hasn't drifted too far away from the 0.6000 level. The AUD/NZD cross saw selling interest emerge above the 1.0900 level (last near 1.0885).

- Later US February durable orders, January CoreLogic house prices, March consumer confidence and Richmond Fed indices print. ECB’s Lane speaks.

INDONESIA: Indon Sov Curve Steepens, Foreign Investors End Bond Selling Streak

Indonesian USD sovereign debt curve has bear steepened today, with front-end yields mostly unchanged, while longer ends yields drift 1-3bps higher. There has been very little in the way of market news or economic data today.

- The INDON sov curve has steepened on Tuesday with the 2Y yield unchanged at 4.925%, 5Y yield is unchanged at 4.88%, the 10Y yield is +2bps at 4.995%, while the 5-year CDS is also -.75bp at 71.75bps

- The INDON to UST spread is slightly wider with the front-end lagging moves tighter by US treasuries, the 2yr is 35bps (+2bps), 5yr is 66bps (-2bp), while the 10yr is 76bps (-0.5bps).

- In cross-asset moves, the USD/IDR is unchanged, the JCI is 0.44% lower, Palm Oil is down 0.12%, while US Tsys yields are flat to 1.5bps lower

- Foreign Investors bought bonds on Friday, marking just the 2nd day from the past 12 of net inflows. The 5-day average is now $18m, the 20-day average is -$39m while the longer term 200-day average has turned negative at -$2.37m

- Bank Indonesia announces the suspension of various operations, including real-time gross settlement and electronic trading platforms, with a halt in clearing and monetary operations from April 8th -16th, during which key data such as Jakarta Interbank Offered Rate and Indonesia Overnight Index Average will not be published, leaving local banking activities to individual institution discretion.

- Looking ahead: Indonesia has a very quiet rest of the month in terms of data, with the next major data release not until April 1st

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/03/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 26/03/2024 | 0700/0800 | ** |  | SE | PPI |

| 26/03/2024 | 0800/0900 | *** |  | ES | GDP (f) |

| 26/03/2024 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/03/2024 | 1200/0800 |  | CA | BOC Sr Deputy Rogers speaks in Halifax NS | |

| 26/03/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/03/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/03/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/03/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/03/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/03/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/03/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/03/2024 | 1900/2000 |  | EU | ECB Lane Lecture At Trinity College Dublin |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.