-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI European Morning FI Analysis: Steeper, U.S. Yield Range Breaks Eyed

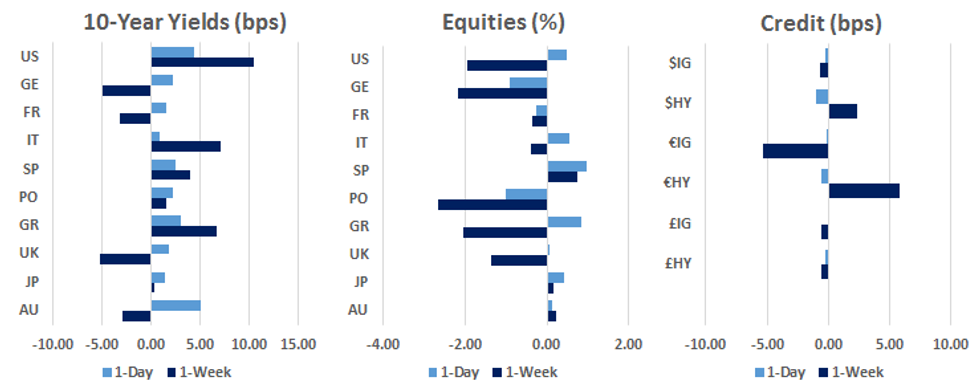

US TSYS: Range Breaks In The Long End

The latest downtick for the U.S. Tsy space comes ahead of European hours after market participants seemingly chose to focus on the prospect of a U.S. fiscal deal, as opposed to when it may occur, given the apparent pushback from Senate majority leader McConnell re: a pre-election pact on Tuesday. Messrs Mnuchin & Peolsi will speak again today.

- This dynamic, coupled with some concession ahead of today's 20-Year Tsy supply, facilitated curve steepening in Asia-Pac hours, with 10- & 30-Year yields pushing through their respective recent range highs. A clean, sustained break here would allow participants to focus on the June highs in both metrics. Yields sit 0.8-5.2bp higher across the curve at typing.

- T-Notes are running on well above average volume (~182K at typing) last -0-08 at 138-14+.

- Eurodollar futures are unchanged to 0.5 tick lower through the reds.

- Focus on Wednesday moves to another slew of Fedspeak, in addition to the aforementioned round of 20-Year Tsy supply.

JGBS: Kicked Steeper By Broader Flow

JGB futures get another kick lower on the latest move in U.S. Tsys, last -23 ticks, with the acceleration in the move in Tsys and upticks in the offer to cover ratios in 1-5 Year BoJ Rinban ops eyed.

- Cash JGBS have generally cheapened, with the long end the underperforming as the curve steepened. There were signs of receiving in the longer end of the swap curve during Tokyo morning trade, although that faded in the afternoon, given the broader market dynamic.

- In terms of details, the purchase sizes of the BoJ's 1-10 Year Rinban operations saw no change, while the offer to cover ratios were as follows:

- 1-3 Year: 3.10x (prev. 2.53x), 3-5 Year 3.94x (prev. 2.35x), 5-10 Year 3.17x (prev. 3.44x).

- The latest address from BoJ's Sakurai added nothing of note to the monetary policy debate.

AUSSIE BONDS: Crowded Longs Weigh, New Lows For 3-Month BBSW

Crowded long positioning on the back of the prospect of imminent RBA easing likely added to the pressure seen in the Aussie Bond space, as some of the weaker XM longs folded on the downtick that was initially driven by the U.S. Tsy market, with YM -1.0 and XM -5.5 as we type.

- The latest ACGB Dec '30 auction was strong, as was expected, with the cover ratio above 6.00x and the average yield stopping through pre-auction mids by ~0.6bp (per BBG prices).

- Bills didn't react to the all-time low seen in today's 3-month BBSW fixing, after the move seen in the space following yesterday's comments from RBA Assistant Governor Kent (wouldn't be surprising to see BBSW pop below zero). Note that 3-Month BBSW fixed -2bp at 0.06%, with implied rates of the white contracts already trading below that level (0.02-0.05%). The space trades +1 to -2 through the reds.

- NAB business confidence data, flash CBA PMIs, note supply and an address from RBA Deputy Governor Debelle (on "The Global Foreign Exchange Committee and the FX Global Code") feature on Thursday.

AUCTION/DEBT SUPPLY

BOJ: Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.22tn of JGB's from the market, sizes unchanged from previous operations:

- Y420bn worth of JGBs with 1-3 Years until maturity

- Y350bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

- Y30bn worth of JGBis

AUSSIE BONDS: The AOFM sells A$2.0bn of the 1.0% 21 Dec '30 Bond, issue #TB160:

The Australian Office of Financial Management (AOFM) sells A$2.0bn of the 1.0% 21 December 2030 Bond, issue #TB160:- Average Yield: 0.7672% (prev. 0.8500%)

- High Yield: 0.7675% (prev. 0.8500%)

- Bid/Cover: 6.3665x (prev. 4.1525x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 60.6% (prev. 100.0%)

- bidders 49 (prev. 52), successful 12 (prev. 1), allocated in full 2 (prev. 1)

TECHS

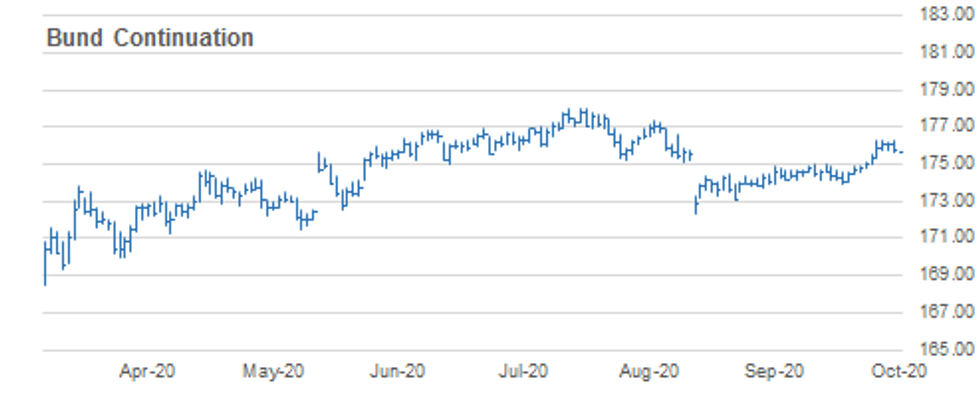

BUND TECHS: (Z0) Corrective Pullback

- RES 4: 176.94 High Sep 8 (cont)

- RES 3: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.32 1.500 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 176.29 High Oct 16 and the bull trigger

- PRICE: 175.54 @ 04:56 BST Oct 21

- SUP 1: 175.35 Low Oct 15

- SUP 2: 175.08 High Aug 4 and recent breakout level

- SUP 3: 175.01 20-day EMA

- SUP 4: 174.49 50-day EMA

Bund gains have stalled with key resistance defined at 176.29, Oct 16 high. The pullback this week is considered a correction following recent sharp gains. Attention turns to the next support at 175.35, Oct 15 low and 175.08, Aug 4 high and the recent breakout level. The 20-day EMA intersects at 175.01. On the upside, clearance of 176.29, the bull trigger, would confirm a resumption of the uptrend and open 176.32/57, Fibonacci projections.

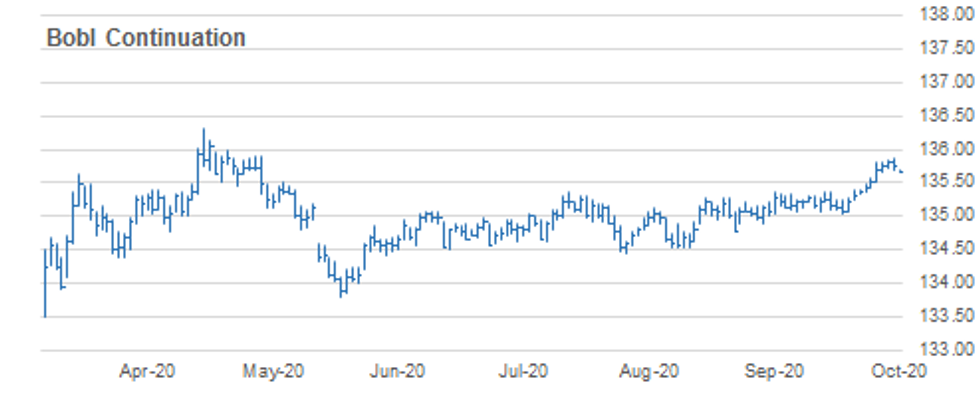

BOBL TECHS: (Z0) Corrective Cycle

- RES 4: 136.060 2.000 retracement of the May - Jun sell-off (cont)

- RES 3: 136.000 Round number resistance

- RES 2: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 1: 135.860 High Oct 20 and the bull trigger

- PRICE: 135.650 @ 05:03 BST Oct 21

- SUP 1: 135.543 38.2% retracement of the Oct 7 - 20 rally

- SUP 2: 135.510 Low Oct 15

- SUP 3: 135.412 20-day EMA

- SUP 4: 135.370 High Sep 21 and Oct 5 and former breakout level

BOBL futures have stalled and are correcting lower. Key resistance has been defined at 135.860, yesterday's intraday high. Attention is on the next support at 135.510, Oct 15 low ahead of the 20-day EMA at 135.412. A break of the average would signal scope for a deeper pullback. On the upside, clearance of 135.860, the bull trigger, would confirm a resumption of the uptrend and open 135.907, a Fibonacci projection and 136.00.

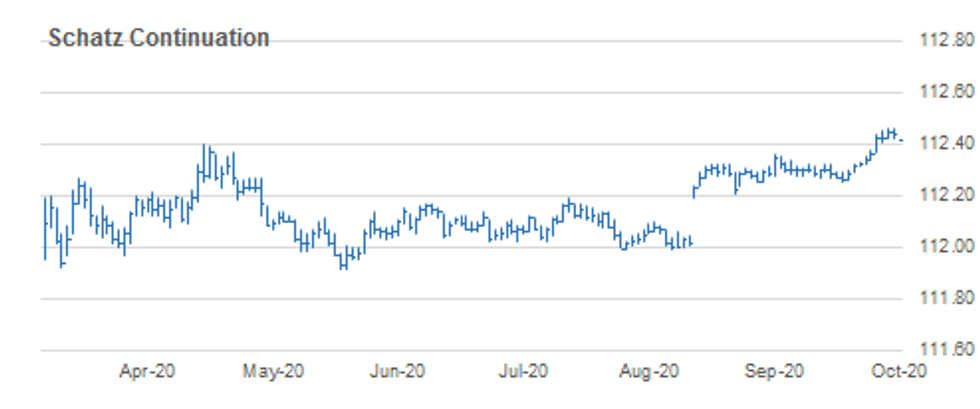

SCHATZ TECHS: (Z0) Finds Resistance

- RES 4: 112.505 61.8% retracement of the Mar - Jun sell-off (cont).

- RES 3: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.457 1.764 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 1: 112.460 High Oct 19 / 20 and the bull trigger

- PRICE: 112.415 @ 04:50 BST Oct 21

- SUP 1: 112.410 Low Oct 16

- SUP 2: 112.360 High Sep 21 and the recent breakout level

- SUP 3: 112.349 20-day EMA

- SUP 4: 112.340 Low Oct 14

Schatz futures are trading lower as a correction unfolds following recent sharp gains. Key resistance has been defined at 112.460, Oct 19 and 20 high. Attention is on the next support at 112.430, Oct 15 low ahead of the recent breakout level at 112.360, Sep 21 high. The 20-day EMA intersects at 112.349. On the upside, clearance of 112.460, the bull trigger, would confirm a resumption of the uptrend and open 112.490 next, a Fibonacci projection.

GILT TECHS: (Z0) Focus Is On Key Resistance

- RES 4: 137.44 High Aug 7

- RES 3: 137.14 0.764 proj of Aug 28 - Sep 21 rally from Oct 7 low

- RES 2: 137.04 High Sep 21 and a key resistance

- RES 1: 136.97 High Oct 16 and the bull trigger

- PRICE: 136.46 @ Close Oct 20

- SUP 1: 136.27/09 Low Oct 15 / 20-day EMA

- SUP 2: 135.79 61.8% retracement of the Oct 7 - 16 rally

- SUP 3: 135.50 Low Oct 14

- SUP 4: 135.06 Low Oct 7 and the bear trigger

Gilts maintain a bullish outlook despite yesterday's pullback. A deeper setback in price would be considered a correction. With bullish conditions still intact, attention is on the next key resistance at 137.04, Sep 21 high and the bull trigger. A break would reinforce last week's bullish reversal and open 137.14 and potentially 137.78 further out, both Fibonacci projection levels. Initial support lies at 136.27, Oct 15 low.

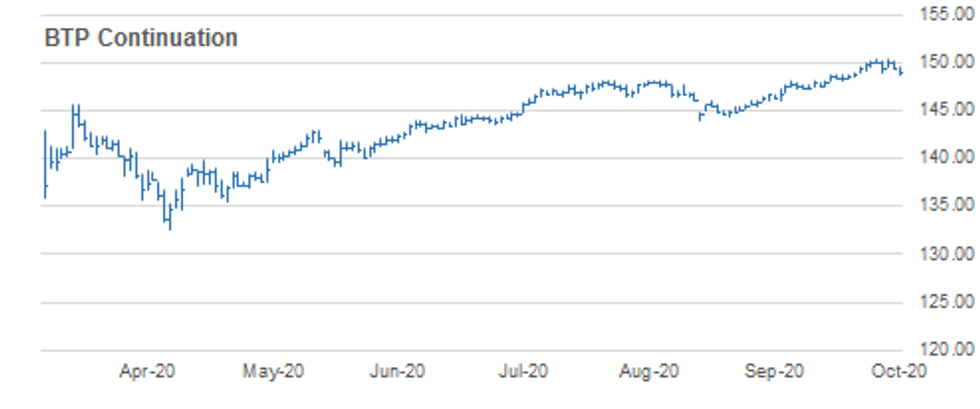

BTPS TECHS: (Z0) Off Recent Highs

- RES 4: 153.09 1.000 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 3: 152.00 Round number resistance

- RES 2: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 1: 150.46 High Oct 16 and the bull trigger

- PRICE: 149.15 @ Close Oct 20

- SUP 1: 148.83 Low Oct 20

- SUP 2: 148.76 20-day EMA

- SUP 3: 148.03 38.2% retracement of the Sp 1 - Oct 16 rally

- SUP 4: 147.27 50.0% retracement of the Sp 1 - Oct 16 rally

BTPS outlook remains bullish despite this week's pullback, a correction. Last week's climb resulted in the contract extending gains into uncharted territory, maintaining the bullish price sequence of higher highs and higher lows that defines an uptrend. Resistance and the bull trigger is located at 150.46, Oct 16 high. Price is approaching the 20-day EMA at 148.76. A breach of the average would signal scope of a deeper pullback towards 148.00.

EUROSTOXX50 TECHS: Bearish Theme

- RES 4: 3348.77 High Sep 16

- RES 3: 3326.79 High Sep 18

- RES 2: 3305.77 High Oct 12 and key near-term resistance

- RES 1: 3282.52 High Oct 19

- PRICE: 3227.87 @ Close Oct 20

- SUP 1: 3174.64 Low Oct 15

- SUP 2: 3147.28 Low Oct 2 and key support

- SUP 3: 3097.67 Low Sep 25 and the bear trigger

- SUP 4: 3054.11 Low June 15

EUROSTOXX 50 bearish focus remains intact. The index suffered a sharp setback on Oct 15 extending the pullback from 3305.77, Oct 12 high. The move lower potentially reverses the recent Sep 25 - Oct 12 recovery. Attention is on 3147.28, Oct 2 low where a break would expose the key support handle at 3097.67, Sep 25 low. Clearance of this level would mark an important bearish break. The bull trigger is at 3305.77, Oct 12 high.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.