-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Gains as Fitch Fires Warning Shot

Highlights:

- USD gains as Fitch fire warning shot on US sovereign

- Gilt curve extends post-CPI move as markets price in BoE terminal nearing 5.50%

- Secondary GDP, housing data in view

US TSYS: Bear Flattening As 2s10s Hits Lows Since Mid April

- Cash Tsys are currently close to lows across the curve, bear flattening as 2Y yields of ~4.42% push fresh highs since the early days of regional banking woes. Fitch placed the US on negative ratings watch as the deadline for an increase in the debt ceiling approaches. Whilst broadly in line with EU FI, Treasuries significantly outperform Gilts which see further post-CPI adjustment.

- 2YY +4.5bp at 4.421%, 5YY +3.5bp at 3.815%, 10YY +1.5bp at 3.757% and 30YY +0.2bp at 3.988%. 2s10s just off a low of -66.4bps touched a low since Apr 19 otherwise last seen since Mar 16.

- TYM3 trades 12 ticks lower at 113-01+ just slightly off lows of 113-00. Having cleared support at 113-04 (May 23 low), it stopped just shy of 112-30 (61.8% retrace of Mar 2-24 rally) after which lies 112-21 (Mar 13 low).

- Fedspeak: Barkin ('24 voter) at 0950ET, Collins (non-voter) at 1030ET.

- Data: GDP incl core PCE Q1 2nd release (0830ET), weekly initial claims (0830ET), Chicago Fed nat activity index Apr (0830ET), pending home sales Apr (1000ET), Kansas City mfg activity May (1100ET)

- Note/bond issuance: US Tsy $35B 7Y Note auction (91282CHF1) – 1300ET

- Bill issuance: US Tsy $35B 4W, $35B 8W bill auctions – 1130ET

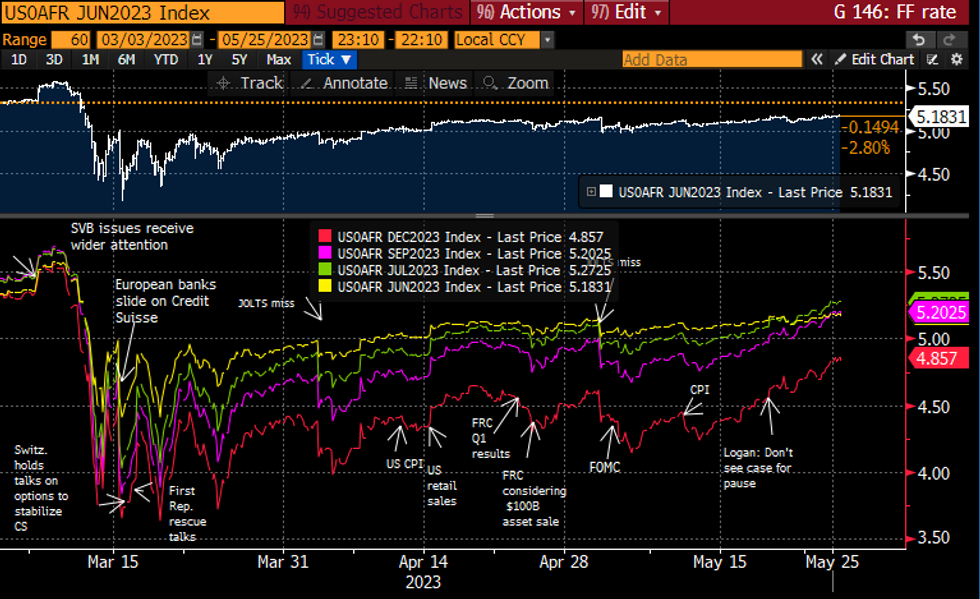

STIR FUTURES: Fed Rates Path Marginally Off New Post SVB Highs

- Fed Funds implied rates are slightly off fresh post-regional banking woe highs having reversed a dip after the FOMC minutes. Of note, the terminal effective sits around 5.27% with the July decision and with 42bp of cuts from the peak to year-end for less than one full 25bp cut priced from current levels.

- Cumulative change from 5.08% effective: +10bp Jun (-0.5bp), +19bp Jul (-1bp), +11.5bp Sep (unch), -4bp Nov (+1bp), -23bp Dec (+2bp), -41bp Jan (+3bp).

- Bostic (’24 voter) spoke late yesterday, possibly mildly more hawkish than recently by noting that the “best case” is the Fed won’t mull rate cuts until well into 2024. Continued data dependency isn’t particularly different to Monday saying he’s comfortable waiting a bit to see how things play out and that policy acts with a lag.

- Ahead, Barkin (’24 voter) and Collins (non-voter, with text). Barkin spoke Mon (won’t pre-judge June policy decision) and before that May 16 (willing to raise raises again if necessary) whilst Collins last spoke in March.

Source: Bloomberg

Source: Bloomberg

BOE VIEW CHANGES

- BNP: Add an extra hike in August to a terminal 5.00% rate (previously had expected final hike in June).

- Deutsche Bank: Expect 5.25% terminal rate (3x25bp hikes) from 4.75% previously. Expect first cut in May 2024 with 4.50% by end-2024 (from 3.75%) and 3.50% by end of cycle.

- NatWest Markets: Base case now for 2x25bp hikes to 5.00% in August with risk of 5.50% by November (previous terminal rate forecast was 4.50%). "More aggressive tightening in the near-term will tend to reinforce the policy ‘pivot’ theme, though any cutting cycle probably begins later than we previously expected (Q3 rather than Q2 2024)."

- Pantheon: Now expect June and August hikes to terminal 5.00% (previously had expected May to be the final hike). Push back first cut to May 2024 (from Feb) then quarterly 25bp cuts with Bank Rate at 4.25% by end-2024 (from 3.50%).

- TD Securities: Now expect 2x25bp hikes in June and August to terminal 5.00% (with upside risks). "Expect that the MPC will keep Bank Rate at 5.00% until May next year, at which point it begins a series of 25bps rate cuts (the exact speed and timing will of course be a function of any idiosyncratic shocks at the time)." (Had previously expected first cut in February).

FOREX: Greenback Firmer for Fourth Session as Markets Adopt Cautious Approach

- Following a more tumultuous Wednesday session, GBP/USD is looking more stable, trading back to flat/minor positive territory to erase the ~30 pips losses suffered in Asia trade. Despite the more steady spot rate, the short-term outlook remains negative, with downtrendline resistance sitting just above at 1.2395, ahead of yesterday's highs at 1.2470. A break and close above here is required to steady the current bearish outlook.

- For a second successive session, NZD is the poorest performer in G10 - extending losses on the back of the unexpected declaration from the RBNZ that their tightening phase had concluded. This puts NZD/USD over 2.75% lower than pre-CB decision levels, and at the lowest level since November last year. Support undercuts at 0.6025, the 50% retracement for the October - February upleg.

- The greenback trades well, with markets adopting a more cautious footing after the warning over US' sovereign ratings from Fitch late yesterday. The USD Index is firmer for a fourth consecutive session, tipping the measure to a new multi-month high.

- Focus ahead turns to CB speak, with ECB's Villeroy, Centeno and de Cos on the docket as well as Fed's Barkin & Collins and BoE's Haskel. The data focus looks to weekly US jobless claims, secondary read for Q1 GDP and the pending home sales release for April.

GBP: Options Markets Remain Pessimistic Despite Spot Stabilisation

- Following a more tumultuous Wednesday session, GBP/USD is looking more stable, trading back to flat/minor positive territory to erase the ~30 pips losses suffered in Asia trade. Yesterday's price action saw the currency weaken while rate expectations marched higher (mimicking the inverse correlation noted in the wake of Truss' budget) - and despite the modest stabilisation in spot today, there remain underlying signs of fragility as markets continue to price in as much as 100bps of further tightening in 2023.

- Front-end risk reversals underscore the deteriorating outlook for GBP in options space, with 1m RR falling further in favour of puts - touching the lowest level since late March today. In sympathy, DTCC tracked trade has favoured downside protection, with over $2.5 in puts trading for every $1 in calls so far today - as put strikes layered between 1.22 and 1.2355 take particular focus.

- Downtrendline resistance sits just above at 1.2395, ahead of yesterday's highs at 1.2470. A break and close above here is required to steady the current bearish outlook.

FX OPTIONS: Expiries for May25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0765(E786mln)

- USD/JPY: Y138.10($838mln), Y138.50-55($611mln), Y139.50($764mln)

- USD/CAD: C$1.3600-05($808mln)

- USD/CNY: Cny7.0250($1.6bln), Cny7.0500($1.2bln), Cny7.1000($1.0bln)

EQUITIES: Eurostoxx Futures Remain Soft After Trading Lower Wednesday

- Eurostoxx 50 futures traded lower Wednesday and the contract remains soft - for now. The 50-day EMA, at 4266.20, has been pierced and this signals scope for weakness towards 4233.00, the May 4 low and a key short-term support. A break of this level would strengthen bearish conditions. On the upside the bull trigger is at 4409.50, the Nov 18 2021 high (cont) and a major resistance.

- S&P E-minis traded low yesterday and this resulted in a test of the 50-day EMA at 4124.40. A clear break of this average would highlight a stronger short-term reversal and open 4062.25, the May 4 low and a key support. Initial key resistance has been defined at 4227.25, the May 19 high. A reversal higher and a breach of this resistance would confirm a resumption of the uptrend that started on Mar 13

COMMODITIES: Gold Holds Close to Multi-Week Lows

- WTI futures traded higher yesterday and this resulted in a test of the 50-day EMA, which intersects at $74.41. Short-term gains are considered corrective, however, a clear breach of the 50-day EMA would highlight a stronger bullish theme and expose $76.74, the Apr 28 high. Trend signals still highlight a bear market. Support to watch lies at $69.39, the May 15 low. A break would be bearish.

- The bear cycle in Gold remains intact and price is trading closer to its recent lows. The yellow metal last week cleared support at $1975.3, the 50-day EMA and $1969.3, the Apr 19 low. This highlights a stronger bearish threat and opens $1934.3, the Mar 22 low and $1931.4, trendline support drawn from Nov 3 2022. Key resistance and the bull trigger is at $2063.0, May 4 high. Initial firm resistance is $2022.6, the May 12 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2023 | 0900/1100 |  | EU | ECB de Guindos Presents ECB Annual Report 2022 | |

| 25/05/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/05/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 25/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 25/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/05/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 25/05/2023 | 1230/0830 | *** |  | US | GDP |

| 25/05/2023 | 1350/0950 |  | US | Richmond Fed's Tom Barkin | |

| 25/05/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 25/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/05/2023 | 1430/1030 |  | US | Boston Fed's Susan Collins | |

| 25/05/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/05/2023 | 1630/1730 |  | UK | BOE Haskel Speech at Peterson Institute | |

| 25/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 26/05/2023 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 26/05/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 26/05/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 26/05/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 26/05/2023 | 0600/0800 | ** |  | SE | PPI |

| 26/05/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/05/2023 | 0740/0940 |  | EU | ECB Lane Panels Dubrovnik Econ Conference | |

| 26/05/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/05/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/05/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/05/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/05/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/05/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 26/05/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.