-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA OPEN: Will Jan Jobs Crest Powell's High Bar?

- MNI US Payrolls Preview: A Potential Test Of Powell’s Higher Bar To A March Cut

- MNI Fed Review - Jan 2024: Powell Sets High Bar To March Cut

- MNI ECB INTERVIEW: Beware Temporary Inflation Dip- ECB's Kazaks

- MNI: BOE Holds Rates At 5.25% in 3-Way Split

- MNI US DATA: Continuing Claims Increase Supported By NSA Data

US

FED (MNI): Fed Review - Jan 2024: Powell Sets High Bar To March Cut: The January FOMC meeting formally put an end to the tightening bias which had persisted for 16 meetings, shifting to a more neutral stance as it held rates for the 5th time in 6 meetings.

- But those were unsurprising outcomes - our preview indicated that the main question for this meeting would be the degree to which the FOMC kept the door open to a rate cut as soon as March. MNI had expected the Committee to be wary of signaling a March cut, instead re-emphasizing a patient approach, with the 50% market-implied probability for a March reduction looking too high.

- In that regard, the main headline from the January FOMC was that Chair Powell appeared to come into the press conference deliberately intending to push back against expectations that the FOMC would make its first cut in March.

- Powell didn’t rule out a March cut – but he set a high bar, implying that it would require significant surprises in the “totality” of the data between now and then for them to ease.

NEWS

UK (MNI): BOE Holds Rates At 5.25% in 3-Way Split

The Bank of England left interest rates unchanged at 5.25% at its February meeting, though in a surprising three-way vote split that saw two Monetary Policy Committee members call for a rate hike and one for a cut.

ECB INTERVIEW (MNI): Beware Temporary Inflation Dip- ECB's Kazaks

The European Central Bank has to be careful not to cut rates too early in response to what may be a brief convergence of inflation towards its 2% medium-term target, Bank of Latvia governor Martins Kazaks told MNI on Thursday.

US (MNI): House-Passed Tax Bill Faces More Difficult Test In Senate

The USD$79 billion tax deal which sailed through the House, 357-70, yesterday faces a sterner test in the Senate amid questions over the actual cost of the bill, the tricky politics of an election year, and an exceptionally busy Senate schedule.

US (MNI): Biden Targets Union Vote In Detroit Amid Criticism Of Gaza Strategy

President Joe Biden will deliver remarks at a private campaign event in Detroit, Michigan today. Biden's appearance is intended to solidify the union vote in the wake of last week's endorsement from United Auto Workers boss Shaun Fain and head off discontent with amongst Michigan voters over Biden's unconditional support for Israel.

SECURITY (MNI): US Def Sec-'Multi-Tiered Response' To Be Delivered After Jordan Attack

US Secretary of Defense Lloyd Austin III speaking at a presser at the Pentagon. "his is a dangerous moment in the Middle East. [We] will take all necessary actions to defend the US, our interests and our people. We will respond where we choose, when we choose, and how we choose."

NATO (MNI): Hungarian Parl't To Reconvene Early; No Guarantee Of Sweden Ratification

The Hungarian National Assembly will convene on Monday 5 Feb, ahead of the scheduled date of 26 Feb, as opposition lawmakers seek to push forward the ratification of Sweden's NATO accession bid.

US TSYS 10Y Yield Sinks to 3.8% Ahead Jan Employment Report

- Tsys finished strong but off late morning highs Thursday, concerns over regional bank weakness helped push Treasury futures to the highest levels since late December '23 with TYH4 tapping 113-06.5 high (+28), well through initial resistance of 112-26.5 (Jan 12 high) focus on 113-12 (Dec 27 high and bull trigger). 10Y yield falls to 3.8147% low.

- Late morning rally appeared to be related to wider concerns over NY regional banks after New York Community Bancorp (purchaser of collapsed Signature Bank shares) fell over 40% yesterday and as much as 14% again today before paring losses to -11%. Meanwhile KBW Regional Banking Index is down -2.29% from -5.13% at midday.

- Knock-on effect saw projected rate cut chances above post-FOMC highs briefly Thursday, before moderating in the second half.

- Early support: Tsy futures extended highs after higher than expected Initial Jobless Claims (242k vs. 212k est) and Continuing Claims (1.898M vs. 1.839M est, prior down-revised slightly to 1.828M from 1.833M).

- Meanwhile Nonfarm Productivity higher than expected at 3.2% vs 2.5% est (prior down-revised to 4.9% from 5.2%) while Unit Labor Costs came in at 0.5% vs. 1.2% est (prior revised to -1.1% from -1.2%).

- Look ahead Friday Data Calendar: Jan Employ Report, UofM Inflation Expectations

OVERNIGHT DATA

US Payrolls Preview (MNI): A Potential Test Of Powell’s Higher Bar To A March Cut. Bloomberg consensus sees nonfarm payrolls rising 185k in January, primary dealers see a median 205k.

- All change from revisions: The establishment survey will be affected by annual benchmark revisions, new seasonal factors and updated estimates for the net birth/death model, whilst the household survey (e.g. unemployment rate) will be adjusted for new population controls.

- The unemployment rate is seen increasing a tenth to 3.8%, flattered by rounding, whilst average hourly earnings are seen moderating with some looking for a larger slowing in what would be increasingly dovish after latest data reveal continued strong productivity growth.

INTERVIEW (MNI): US Manufacturing Nearing Growth Phase, ISM Says

The U.S. manufacturing sector is gradually stabilizing and edging closer to a new phase of expansion as new orders posted their strongest reading since May 2022, Institute for Supply Management chair Timothy Fiore told MNI.

US DATA (MNI): Continuing Claims Increase Supported By NSA Data. Initial claims surprised higher at a seasonally adjusted 224k (cons 212k) in the week to Jan 27 after 215k (initial 214k), a second weekly increase off a 189k print marked one of the lowest readings on record.

- This range from 189-224k is a useful reminder to focus on the four-week average, which increased 5k to 208k but remains historically low (for comparison: 2019av 218k, 2019 single week low 197k).

- Initial claims increased a non-seasonally adjusted 11k on the week, driven by California (+5.6k) and NY (+4.3k) which appear slightly larger than the historical norm.

- Continuing claims were also stronger than expected, rising to 1898k (cons 1839k) in the week to Jan 20 after a slightly downward revised 1828k (initial 1833k). Recently, it has only been higher with the 1925k in mid-Nov.

- Note that the 134k increase in NSA continuing claims looks sharp compared to prior years, indicating perhaps some genuine softening in hiring activity.

US DATA (MNI): ISM Manufacturing Sees Surprise Orders and Prices Strength. ISM manufacturing beat expectations as it increased to 49.1 (cons 47.2) in Jan after a downward revised 47.1 (initial 47.4), its highest since Oct’22 but still having remained in contraction territory ever since.

- Prices paid notably stronger than expected at 52.9 (cons 46.9) after 45.2, the highest since 53.2 in Apr’23 (tallying with the earlier PMI selling prices) and before that Jul’22.

- There was also surprise strength in new orders at 52.5 (cons 48.2) after 47.0, its highest since May’22 and the strongest monthly increase since Oct’20.

- The new orders to inventories differential has been pointing to upside for manufacturing activity for some time, and again increased 3pts to 6.3 for its highest since Feb’22.

- Employment was as expected at 47.1 after a downward revised 47.5, with no significant implications for tomorrow’s payrolls report.

US DATA (MNI): Yet More Strength In Productivity Growth. Nonfarm productivity surprised higher in Q4 at 3.2% annualized (cons 2.5%) in preliminary data after Q3 was revised down from 5.2% to 4.9%.

- There have now been three extremely strong quarters of productivity growth, averaging 3.9% annualized since Q2 which has made it far easier for wage growth to be consistent with the 2% inflation target. The upshot is that unit labor costs only increased 0.5% annualized in Q4 (cons 1.2) after -1.1% in Q3, a significant helping hand in the return to 2% inflation.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 318.89 points (0.84%) at 38471.43

- S&P E-Mini Future up 50.25 points (1.03%) at 4921.25

- Nasdaq up 180.2 points (1.2%) at 15344.29

- US 10-Yr yield is down 5.3 bps at 3.8596%

- US Mar 10-Yr futures are up 18/32 at 112-28.5

- EURUSD up 0.0052 (0.48%) at 1.087

- USDJPY down 0.59 (-0.4%) at 146.33

- WTI Crude Oil (front-month) down $1.81 (-2.39%) at $74.03

- Gold is up $15.54 (0.76%) at $2055.10

- European bourses closing levels:

- EuroStoxx 50 down 9.8 points (-0.21%) at 4638.6

- FTSE 100 down 8.41 points (-0.11%) at 7622.16

- German DAX down 44.72 points (-0.26%) at 16859.04

- French CAC 40 down 68 points (-0.89%) at 7588.75

US TREASURY FUTURES CLOSE

- 3M10Y -4.228, -150.527 (L: -155.02 / H: -142.007)

- 2Y10Y -4.048, -33.892 (L: -34.731 / H: -27.633)

- 2Y30Y -5.879, -10.096 (L: -11.15 / H: -2.495)

- 5Y30Y -3.377, 29.951 (L: 28.47 / H: 33.767)

- Current futures levels:

- Mar 2-Yr futures up 1.5/32 at 102-28 (L: 102-24.5 / H: 103-00.125)

- Mar 5-Yr futures up 9.5/32 at 108-22 (L: 108-11.25 / H: 108-30)

- Mar 10-Yr futures up 17.5/32 at 112-28 (L: 112-09.5 / H: 113-06.5)

- Mar 30-Yr futures up 1-24/32 at 124-03 (L: 122-15 / H: 124-24)

- Mar Ultra futures up 2-19/32 at 131-26 (L: 129-16 / H: 132-19)

US 10Y FUTURE TECHS: (H4) Watching Resistance

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-20/112-26+ High Jan 31 / 12

- PRICE: 112-13+ @ 11:39 GMT Feb 1

- SUP 1: 111-20+/110-26 20-day EMA / Low Jan 19 and bear trigger

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

A bearish trend condition in Treasuries remains intact and recent gains appear to be a correction. However, the recovery does suggest scope for an extension near-term. Initial resistance is at 112-20+, yesterday’s intraday high. The key short-term resistance is 112-26+, the Jan 12 high. Clearance of this level would be a bullish development and expose 113-12, the Dec 27 high. Key support and the bear trigger lies at 110-26, the Jan 19 low.

SOFR FUTURES CLOSE

- Mar 24 -0.025 at 94.890

- Jun 24 -0.010 at 95.380

- Sep 24 steady00 at 95.815

- Dec 24 +0.010 at 96.185

- Red Pack (Mar 25-Dec 25) +0.030 to +0.065

- Green Pack (Mar 26-Dec 26) +0.080 to +0.090

- Blue Pack (Mar 27-Dec 27) +0.095 to +0.110

- Gold Pack (Mar 28-Dec 28) +0.115 to +0.125

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00643 to 5.32352 (-0.01295/wk)

- 3M -0.04275 to 5.27258 (-0.04485/wk)

- 6M -0.08118 to 5.08383 (-0.07357/wk)

- 12M -0.12439 to 4.70254 (-0.09644/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.874T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $691B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $679B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $75B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $221B

US FED REVERSE REPO OPERATION

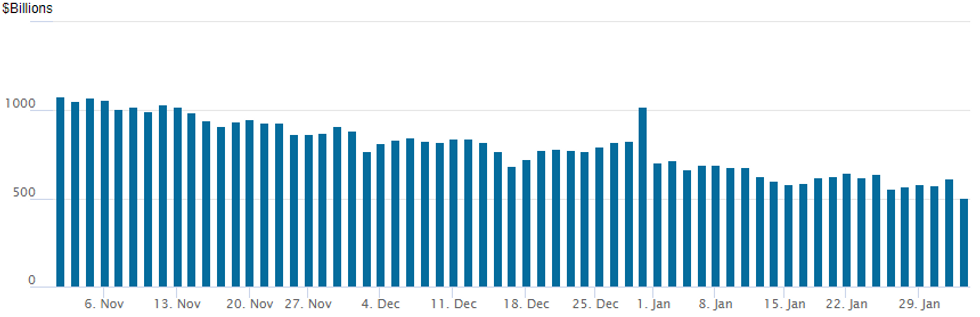

NY Federal Reserve/MNI

- RRP usage falls to the lowest level since mid-2021 today: $503.548B vs. $615.379B yesterday. Compares to prior low of $557.687B on Thursday, January 25.

- Meanwhile, the number of counterparties falls to 74 from 82 Wednesday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE: $1B Alexandria Real Estate 2Pt Issuance Kicks Off Feb Corp Supply

- Date $MM Issuer (Priced *, Launch #

- 2/1 $1B #Alexandria Real Estate $400M 12Y +140, $600M 30Y +150

- 2/1 $Benchmark Korean Development Bank (KDB) 3Y, 5Y investor calls

- 2/1 $Benchmark Republic of Benin 14Y investor calls

- 2/1 $500M Allied Universal Holdco 7NC3 investor calls

- --

- 1/31 No new US$ high grade supply Wednesday. Total $295.35B for Jan'24, highest since April 2020.

EGBs-GILTS CASH CLOSE: Gilts Outperform After Initial BoE Selloff

European core yields finished mostly lower and well off session highs Thursday, with Gilts closing as an outperformer on BoE decision day.

- Yields opened higher after the Fed's Powell came out on the hawkish side overnight, with European morning headlines centered around data: Eurozone flash inflation came in above the consensus coming into the week on both headline and core, but was largely in line with the national prints so had limited impact.

- The BoE skewed more hawkish than most market participants had expected though was broadly in line with MNI's view, with a vote split including 2 members favouring a hike (vs consensus for a unanimous vote to hold), and the tightening bias being ended (though this was expected).

- Gilt yields hit session highs after the decision but slightly dovish wording surrounding inflation projections helped limit weakness.

- Yields had already started leaning lower as the BoE wrapped up, but the fall gathered steam amid yet another set of dovish US labour market data and accelerated an hour before the European cash close as US bank stocks fell sharply for a 2nd day, triggering a safe haven rally.

- The German curve twist flattened, with the UK's bull flattening. Periphery spreads widened again on the risk-off move (as did swap spreads), led by Greece.

- Capping a busy week will be the US nonfarm payrolls report Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.9bps at 2.457%, 5-Yr is up 0.2bps at 2.053%, 10-Yr is down 1.7bps at 2.149%, and 30-Yr is down 3.4bps at 2.371%.

- UK: The 2-Yr yield is down 2.4bps at 4.234%, 5-Yr is down 4.7bps at 3.698%, 10-Yr is down 4.8bps at 3.746%, and 30-Yr is down 4.2bps at 4.414%.

- Italian BTP spread up 1.4bps at 157.6bps / Greek up 3.3bps at 108.2bps

FOREX Greenback Reverses South Amid Lower Yields and Higher Equities

- A mid-session decline for US yields amid a confluence of headlines on US regional bank concerns and geopolitical developments, prompted a notable turn lower for the greenback on Thursday. Despite the earlier extension of post-FOMC dollar strength, the USD index eventually slipped all the way into negative territory on the session and currently resides 0.25% lower ahead of the APAC crossover.

- Sensitivity to core rates continues to feed through to USDJPY volatility, with the pair briefly making a new post-Fed low at 145.90 on Thursday. A subsequent bid for equities and stabilisation in rates has seen the pair consolidate back around 146.30.

- Moving average studies have recently crossed and are in a bull-mode set-up for USDJPY, reinforcing the current bullish trend condition. Key short-term support remains much lower at 144.36, the Jan 12 low. A break would be required to signal a top.

- Elsewhere, EURUSD has risen 0.52% to 1.0875, with the late equity strength further boosting the pair to session highs. However, the Australian dollar has underperformed compared to G10 counterparts, rising only 0.10% against the dollar despite the broader greenback selloff.

- From a trend perspective, a bearish theme in AUDUSD continues to dominate and the latest pause appears to be a flag formation - a bearish continuation pattern. A resumption of weakness would open 0.6500, a Fibonacci retracement and the next objective.

- Currency markets appear to be consolidating ahead of another busy data docket on Friday, headlined by the release of US employment data for January. Bloomberg consensus sees nonfarm payrolls rising 185k in January, primary dealers see a median 205k. University of Michigan consumer sentiment and inflation expectations will round off the week’s data calendar.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2024 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 02/02/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 02/02/2024 | 1215/1215 |  | UK | BOE's Pill- MPR National Agency briefing | |

| 02/02/2024 | 1330/0830 | *** |  | US | Employment Report |

| 02/02/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 02/02/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.