-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

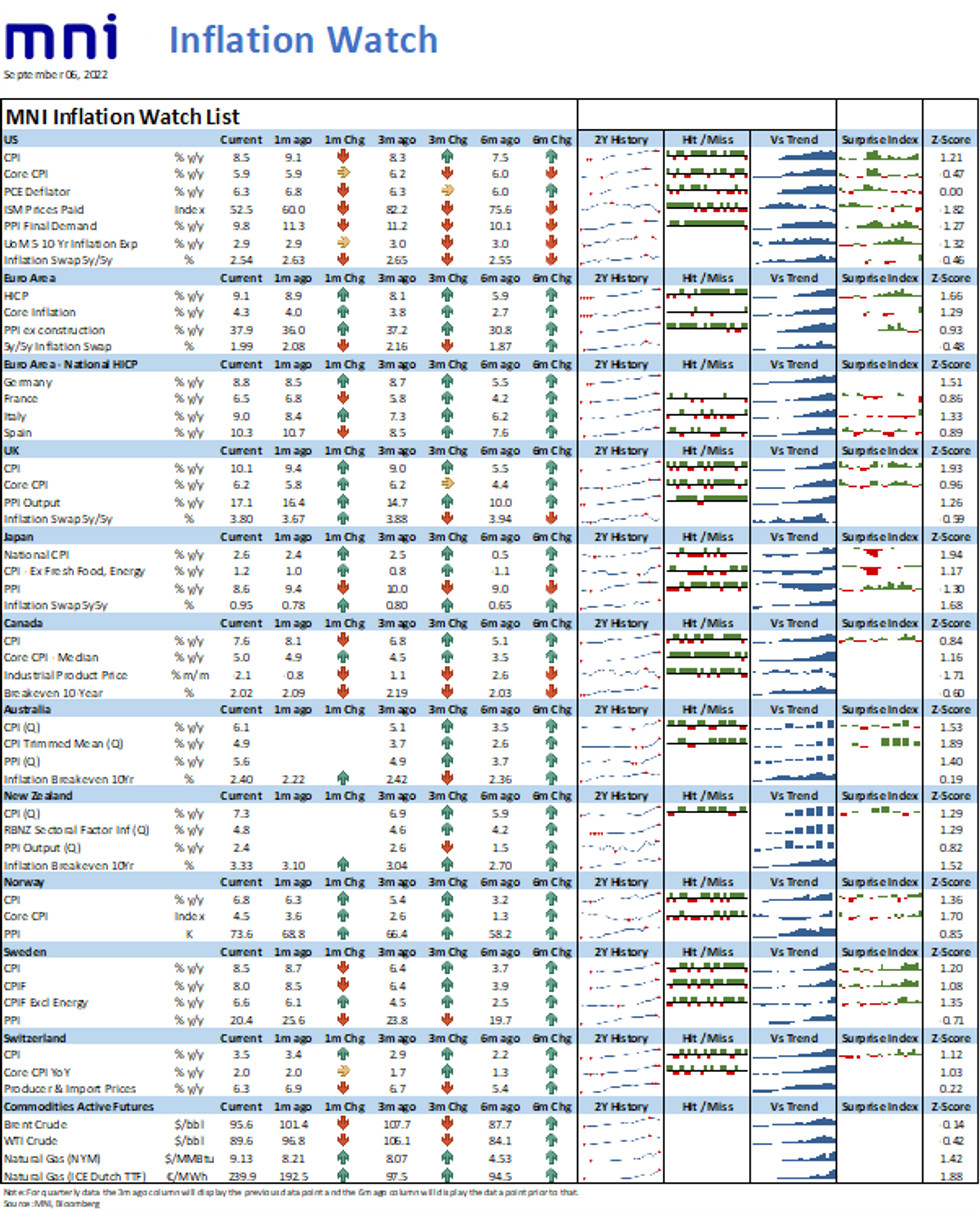

Free AccessMNI Monthly Macro Data Round Up

In the document below we review the major data releases of the past month, including the major releases from the US, Eurozone, UK, Germany, France, Italy and Spain.

*Note: All latest rates are for July, except for the Eurozone and Switzerland where August data has been published. Australia and New Zealand Inflation rates are for Q2.

PMI Data

PMIs Show Recession Risks Rising As Manufacturing Stalls

The August PMI releases underlined a continued slowdown across global manufacturing. The global JPM PMI slowed to 50.3 from 51.1,signalling that manufacturing activity all but stalled last month. A few signals that we see from the developed markets PMI data:

- Global growth is clearly slowing and risks of outright recession are rising. High inflation rates are cutting investment and consumer spending. Meanwhile, lingering supply constraints have been worsened by Chinese lockdowns and the Ukraine war.

- Weaker demand is translating into lower new orders and production.

- Europe remains weak but perhaps not as much as feared. German PMI managed to stabilise at a marginally contractive level, but only France experienced an uptick back into (modestly) expansionary territory. Both Italy and Spain recorded contractions and overall Eurozone PMI hit a fresh 26-month low.

- One of the sharpest downturns was recorded in the UK, with foreign demand plunging. The contraction appears lagged by one month compared to other major economies.

- Japan, the US and Australia recorded modest month/month reductions, though remaining in expansive territory.

Source: MNI / Bloomberg / JP Morgan / ISM

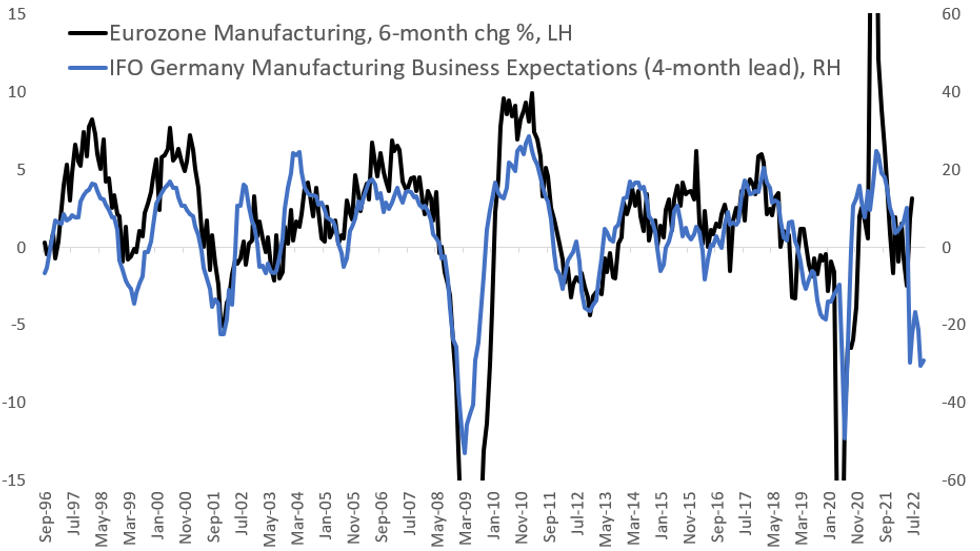

"Soft" Data Pointing To A Very Hard Manufacturing Recession

The German August IFO release provided another reminder that the "soft" data hasn't fully translated into weaker hard data in the Euro area just yet.

- The Eurozone industrial production index for the manufacturing industry actually picked up to a post-2017 high in June.

- However, the German IFO Manufacturing Expectations index has been firmly negative for the past six months (since February, the start of the Russia-Ukraine conflict).

- Those expectations point to a substantial drop in Eurozone manufacturing output in H2 2022 to a degree not seen on a sustained basis since just after the global financial crisis (see chart).

- Loosening supply chain bottlenecks (as noted by IFO) could help provide some welcome relief, but energy woes, poor prospects for trade / demand, and broad inflationary pressures suggest that the "soft" data may not be exaggerating the potential for manufacturing downside.

Source: IFO, Eurostat, MNI Calculations

Source: IFO, Eurostat, MNI Calculations

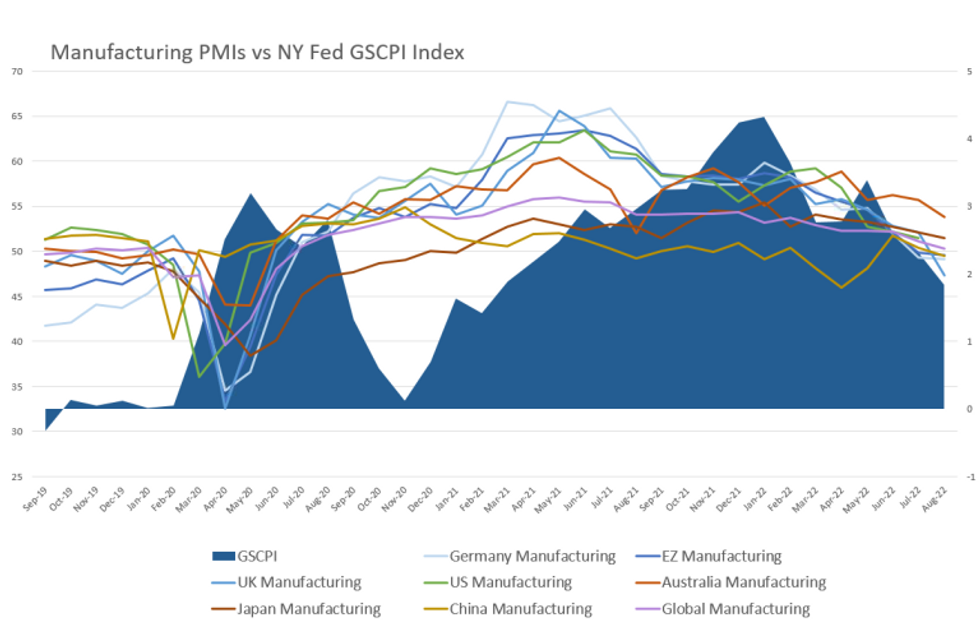

PMIs Add To Evidence That Supply Chain Pressures Are Easing

Supply chain pressures eased again globally in August, whilst inventories remain historically high as demand falters, according to the latest round of global manufacturing PMIs. Although indications of slowing demand highlights global recession risks, easing in supply-driven inflation will come as welcome news for central banks as it will relieve upside pressure on inflation.

- A slowdown in client demand has relieved pressure on manufacturing bottlenecks. Although production activity remained relatively buoyant in August, this reflected a reduction of backlogs last month as manufacturers worked through existing orders rather than new ones. So to an extent, elevated production readings masked waning final demand.

- A reduction in elevated inventory levels will translate into downwards price pressure going forward. Firms will find themselves forced to engage in lowering prices on existing inventory in order to move products.

- The easing trend in overall supply chain bottlenecks is set to continue. The NY Fed Global Supply Chain Index (which in part incorporates supply chain-related compoents from PMI surveys) has been easing since its December 2021 peak and while still elevated on a historic basis, remains set to continue this trajectory.

- Further Chinese lockdowns and sanctions on trade with Russia continue to pose risks to supply chains headed into year-end.

Source: MNI / Bloomberg / S&P Global / NY Fed

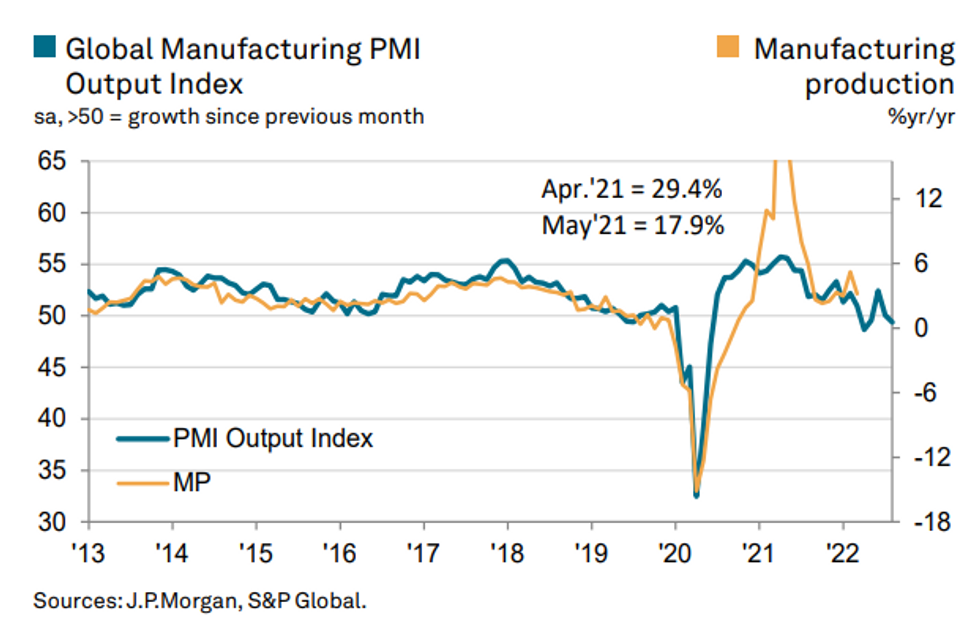

Weak Demand Weighs On Manufacturers, But Waning Prices May Bring Relief

Several themes emerge from August's Global PMI data - and point to a weak near-term outlook for manufacturers, but some light at the end of the tunnel if and when inflationary pressures ease.

- Firms are pricing in slow demand into the year end as global inflationary pressures chip at consumer spending. New orders saw a sharp fall due to waning demand across the Eurozone, UK, US and Japan, whilst remaining robust in Australia.

- This will continue to weigh on overall output. Eurozone manufacturing output is already falling at the fastest pace since mid-2020, adding to recessionary fears.

- Cooling inflationary pressures across the surveys imply that August CPI data could show prices growth slowing, after several countries posted another round of surprisingly hot prints in July. This effect appears more delayed for Australia, where output costs are yet to ease.

- Optimism is improving (albeit still low) in the Eurozone, though have fallen further in the UK. Improvements in the Eurozone were largely underpinned by slowing prices which were expected to bolster future consumer purchasing power. However, energy prices and gas scarcity as a result of the Ukraine war remain of key concern (particularly in the EU).

- Australian manufacturing remains robust with new orders and production continuing to grow, albeit at a softer pace. The August ISM US PMI out Thursday - which was met with a hawkish market reaction - highlighted an expansion in new orders. But in this regard, the ISM PMI wasn't in line with the S&P PMI, which recorded falling orders.

Source: JPM, S&P

Source: JPM, S&P

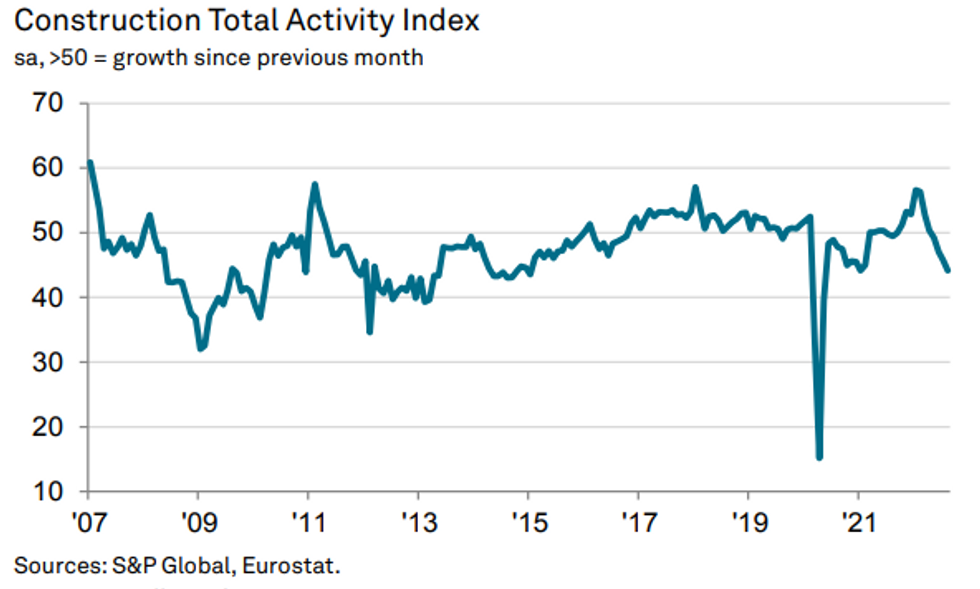

Construction PMIs Cement First Employment Contraction Since 2020

UK AUG CONSTRUCTION PMI 49.2 (FCST 48.1); JUL 48.9

EUROZONE AUG CONSTRUCTION PMI 44.2; JUL 45.7

GERMANY AUG CONSTRUCTION PMI 42.6; JUL 43.7

- August construction PMIs saw activity fall again across the Eurozone and UK, confirming weak economic outlooks and investing incentives. The backdrop of both high inflation and continued uncertainty driven by the war in Ukraine continues to cause construction demand to slump.

- The euro area recorded the steepest fall in new work since the onset of the pandemic, whilst the UK experienced the slowest new order growth since June 2020.

- Despite inflationary pressures being interpreted as slowing and beyond the recent peak, euro area confidence remains around mid-2020 levels. UK business confidence also remains well below average.

- A negative shift in employmentwas highlighted in the August construction PMIs. Jobs contracted in August in the euro area for the first time in two years and job shedding was the fastest since mid-2020. Job creation in the UK was the softest in 15 months. With the ECB keeping a keen eye on the health of the labour market heading into their Thursday meeting, employment reductions cropping up in other sectors could hint at weakening employment as rates increase going into the year-end.

Eurozone:

US DATA

MNI Inflation Insight: A Welcome Cooling But A Long Way To Go

- CPI inflation saw a welcome cooling in inflationary pressures as supply side disruption eases, but it is just one month of data with FOMC members looking for a sustained cooling in inflation. Monthly core inflation remains well above rates consistent with the 2% target and persistent rent components run hot.

- U.S. consumer prices stabilized in July as energy prices fell, leaving the yearly gain in the CPI at 8.5%, below market expectations for an 8.7% gain. Core inflation climbed 0.3% on the month and 5.9% on a year-over-year basis. Energy prices tumbled 4.6% last month while the owners' equivalent rent measure of housing costs surged 0.6%.

- Markets slashed odds of a third 75bp hike in Sept back to a coin toss between 50bp/75bp.

- Post-CPI Fedspeak pushed back on changes to rate path, being too early to declare victory. No clear formal changes from analyst rate calls for the Sept FOMC.

- Unrounded % M/M (SA): Headline -0.019%; Core: 0.313% (from 0.706%)

- Unrounded % Y/Y (NSA): Headline 8.525%; Core: 5.911% (from 5.917%)

- Underlining the narrative that July's reading was "soft", the M/M headline unrounded was negative, first time since May 2020. And the M/M core unrounded was the lowest since Sept 2021.

- Our Inflation Insight includes MNI analysis plus views from eighteen sell-side analysts. Full report here: https://marketnews.com/mni-us-inflation-insight-aug-22-a-welcome-cooling

U.Mich Inflation Expectations At Odds With Climbing Market Measures

- Continuing its recent run of revisions, U.Mich consumer inflation expectations were pushed lower in the final August reading.

- The long-term 5-10Y measure was confirmed to have held sideways at 2.9% (initially 3.0%) whilst the 1Y measure saw a larger than first thought slowdown from 5.2% to 4.8% (initially 5.0%).

- The release should add some support that surveyed measures of inflation expectations have stabilised/dipped but it comes against market-based measures seeing a notable drift higher since mid-July with both the 5Y breakeven and 5Y5Y measures up some 20-30bps from early July levels at 2.79% and 2.40% respectively, having previously fallen to pre-taper levels.

- Market reaction was however distorted by Powell's speech hitting at the same time.

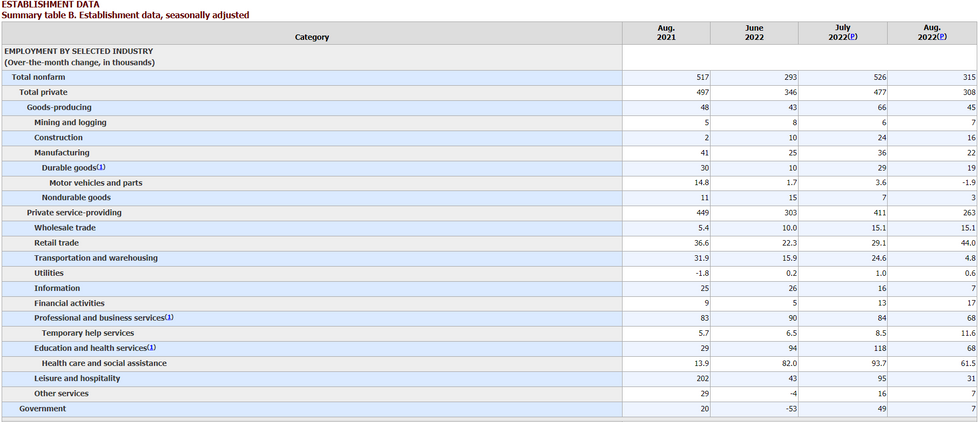

Payrolls Report A Necessary But Insufficient Step Toward 75bp In Sept

August's U.S. employment report doesn't significantly alter the near-term Fed hiking outlook.

- The August unemployment report probably soft enough to preclude a 75bp hike as a "done deal" at least until the August CPI data comes out on Sept 13, and that justifies the 3+bp drop in implied pricing for the meeting (now 64bp, vs just under 68bp pre-payrolls).

- But the report was also strong enough to push off any talk of a dovish "pivot". In other words, August employment was probably a necessary though in itself insufficient for another 75bp move.

- Looking past the 0.2pp rise in the unemployment rate, the soft earnings growth, and the weaker-than-expected headline payrolls gains (when downward revisions are taken into account), August's employment report was mostly a positive report card on the health of the labor market.

- The higher unemployment rate is easily explained by stronger labor force participation, especially given the strong Household survey employment gains (which in turn will come as comfort to those concerned that their recent weakness was pointing to a more significant slowdown than the Establishment survey numbers suggested).

- The Fed will probably ignore the wage growth slowdown; they are more focused on metrics with fewer compositional issues (median wage trackers, Employment Cost Index, etc).

From a broad economic perspective, the payrolls report looked healthy. Job gains were solid across the board in the Establishment Survey, with the major categories of businesses expanding payrolls except one (a 3k drop in durable goods manufacturing of motor vehicles and parts).

- And temporary help services (+11.6k) - historically a leading indicator of labor market health - continued to accelerate, albeit from fairly low levels.

- Higher unemployment / underemployment could be concerning to some on the FOMC, particularly given a sharp rise in unemployment for a variety of demographic categories (Black or African American +0.4%, Hispanic or Latino ethnicity +0.6%, High school graduates, no college +0.6%). And it might point to a labor market with fewer supply-side constraints, meaning less fear over inflation dynamics.

But looking at the bigger picture, this report shouldn't dissuade FOMC policymakers from pursuing the path they had envisaged.

- Incoming economic data still aren't pointing to an ongoing economic / labor market slowdown to the extent that the FOMC will be seriously concerned. NFPs are just one month of data, but might even bolster their belief that a "soft landing" is achievable. Absent a very weak August CPI number, any meaningful dovish "pivot" is likely to have to wait until after the September meeting.

Establishment Survey Payroll Changes By IndustrySource: BLS

Establishment Survey Payroll Changes By IndustrySource: BLS

Continued GDP vs GDI Recession Ambiguity

- Real GDP saw a slightly larger than expected upward revision in Q2, from -0.9% to -0.6% annualised (cons. -0.7%), led by stronger consumption (from 1% to 1.5%) which was only partly offset by a slightly larger than first thought drag from residential investment (-0.6pps).

- The main drivers are broadly the same as the advance release: GDP fell again in Q2 with a concerning pause in final domestic demand growth (-0.15pp contribution) as a large drag from the change in inventories was only partly offset by a boost from net exports [chart 1].

- However, newly released data for real gross domestic income (GDI) showed continued divergence to GDP, supporting FOMC members Bullard and Waller in pushing back against recession fears, rising +1.4% annualised in Q2 after +1.8% in Q1 [chart 2].

- Average the two measures and the economy slowed almost to a crawl though 1H22 (+0.2% annualised), but would still be in stark contrast to the technical recession indicated by GDP (-1.1% annualised).

Sluggish Consumption As Savings Rate At New Post-2009 Low

- Along with the surprisingly soft headline and core PCE inflation prints, real personal spending disappointed in July as it increased just 0.2% M/M (cons 0.4%) after 0.1% M/M.

- Continuing a string of subdued monthly prints, real spending has started Q3 on a soft note, increasing just 1% on a 3M/3M annualised basis following the 1.5% in Q2.

- Back in nominal terms, similarly sized disappointments for both income and spending meant relatively little change for the personal savings rate, although a tenth downward revision to 5.0% leaves it at a fresh low since Aug’09 as the pace in the reduction of savings begins to restrain growth.

EUROZONE DATA

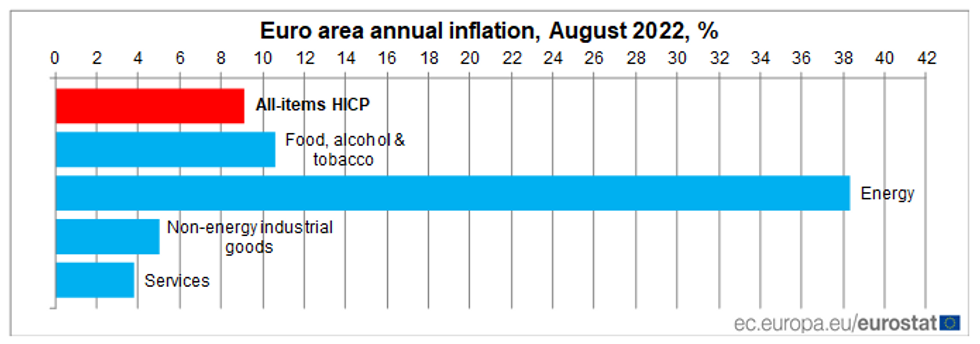

Eurozone Inflation at a fresh high 9.1%, ups pressure on ECB

EUROZONE AUG FLASH CPI +0.5% M/M (FCST +0.4%); JUL +0.1% M/M

EUROZONE AUG FLASH CPI +9.1% Y/Y (FCST +9.0%); JUL +8.9% Y/Y

EUROZONE AUG FLASH CORE CPI +0.5% M/M, +4.3% Y/Y (FCST +4.1%); JUL +4.0% Y/Y

- Following forecasts beats from Germany, Spain, France and Italy, the Eurozone aggregate August CPI rose 0.1pp higher than initially anticipated, accelerating from +8.9% y/y in July to +9.1% y/y in the August flash.

- The month-on-month uptick of +0.5% on both the headline and core figure implies another strong increase, despite headline prices almost stalling at +0.1% m/m in the previous month.

- The strongest rates were recorded again in Eastern European countries, with Estonia (+25.2% y/y), Lithuania (+21.1% y/y) and Latvia (+20.8% y/y) taking the lead. Economic reliance on trade with Russia will likely underpin this data.

- As such, the market is pricing around 66bp, as the probability of a 75bp hike at the September 8 meeting becomes significantly larger despite recessionary fears looming.

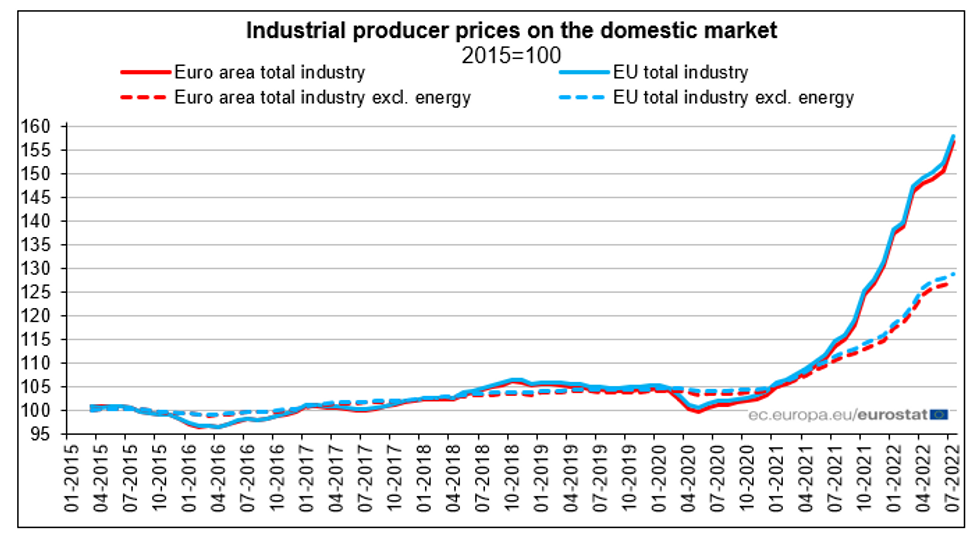

Core PPI Continues to Slow Despite Headline Spike

EUROZONE JUL PPI +4.0% M/M (FCST +3.7%); JUN +1.3%r M/M

EUROZONE JUL PPI +37.9% Y/Y (FCST +37.3); JUN +36.0%r Y/Y

- Eurozone factory-gate inflation jumped by +4.0% m/m in July, the fastest pace since +5.3% m/m in March at the onset of the Ukraine war.

- Diving into the detail of the report highlights optimistic improvements in core readings. Excluding energy, PPI grew by a substantially softer +0.6% m/m, and slowed in the annualised reading by 0.6pp to +15.1% y/y to a four-month low.

- Yesterday's manufacturing PMIs highlighted manufacturing input and output costs softening further. As demand slows and supply-chain pressures ease, PPI should come down further in upcoming months. This supports a slowdown in headline inflation going forward and will be welcome news for the ECB as CPI is yet to ease at +9.1% y/y.

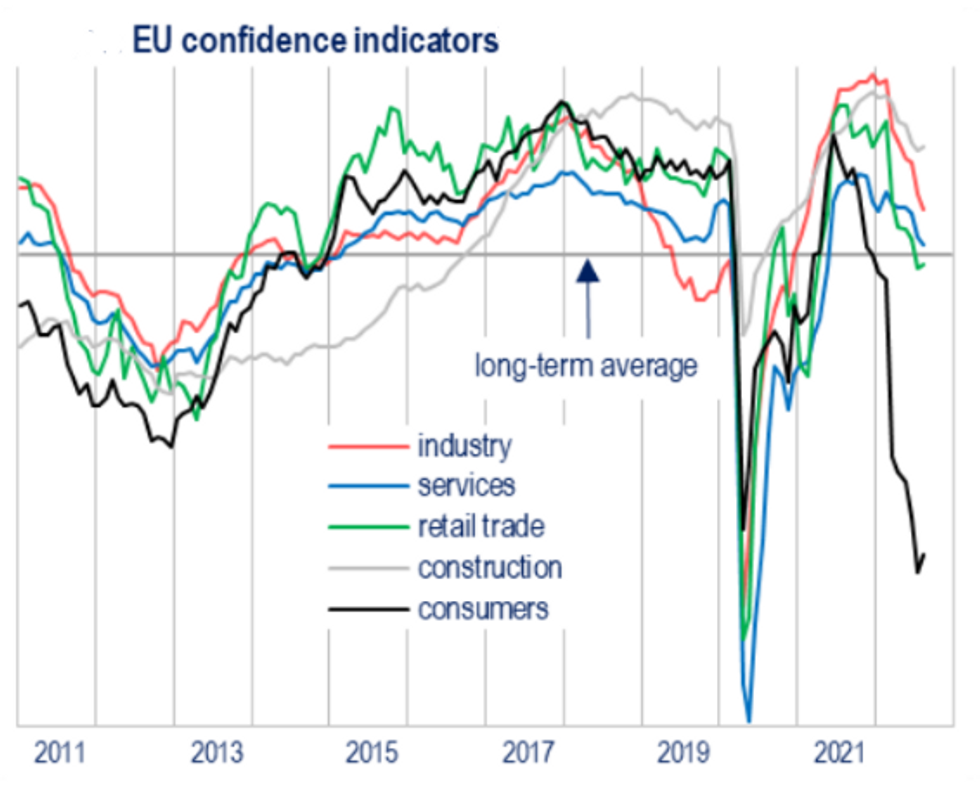

Economic Sentiment Dips Further, However Outlooks Improving in August

EUROZONE AUG ECONOMIC SENTIMENT INDEX 97.6 (FCST 98.0); JUL 98.9r

EUROZONE AUG INDUSTRIAL CONFIDENCE 1.2 (FCST 2.4); JUL 3.4r

EUROZONE AUG SERVICES CONFIDENCE 8.7 (FCST 8.8); JUL 10.4r

EUROZONE AUG CONSUMER CONFIDENCE -24.9 (FLASH CONFIRMED); JUL -27.0

- Sentiment indicators for the eurozone aggregate weakened further in August, all falling slightly lower than anticipated levels. However, fresh improvements in outlooks in the detail of the report are not to be discounted.

- Economic sentiment weakened by 1.3 points to 97.6, whilst industrial confidence saw the largest decline of 2.2 points to 1.2 and services by 1.7 points to 8.7. The largest declines in overall sentiment were recorded by the Netherlands (-4.8) and Germany (-2.5), whilst Spain saw a small improvement (+0.8).

- Consumer confidence was confirmed at -24.9, a modest improvement on the July record low as future expectations were better.

- Industry was the key driver of weakening confidence, dampening for the sixth consecutive month as demand faltered. Services confidence also saw a decline.

- For both sub-indices improvements were however seen in expectations, hinting at a shift towards more optimistic outlooks. Stabilisation was noted in the retail and construction sectors.

- Price expectations declined again in August, implying both consumers and industry anticipating inflation to be moving beyond the peak. This alongside the shift towards more optimistic sentiment regarding future economic conditions will be welcome news for the ECB, despite headline figures remaining downbeat.

Source: European Commission

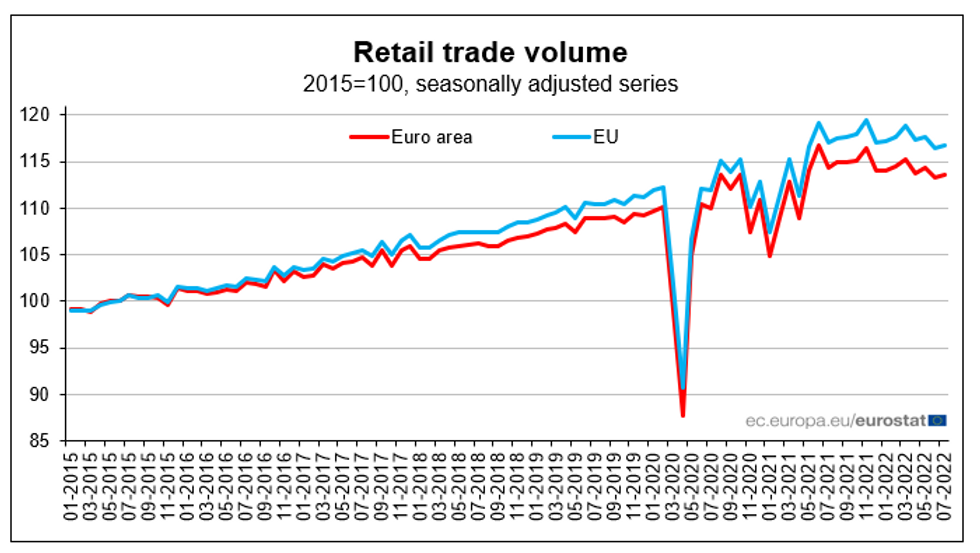

Retail Sales See Softer Growth

EUROZONE JUL RETAIL SALES +0.3% M/M (FCST +0.4% M/M); JUN -1.2% M/M

EUROZONE JUL RETAIL SALES -0.9% Y/Y (FCST -0.8%); JUN -3.7% Y/Y

- July Eurozone retail sales were softer than anticipated, seeing a minor +0.3% m/m improvement on June whilst contracting for the second consecutive month (albeit less severely) in the annualised print at -0.9% y/y (June saw -3.7% y/y).

- Non-food products accounted for the bulk of downwards pressure in July vs June, implying a slowdown in consumer spending as consumers grappled with inflation at 8.9% in July (9.1% in Aug).

- Retail sales volumes still remain above pre-pandemic levels. Euro area consumer confidence saw a small improvement from historic lows in August, however remains deeply pessimistic implying little improvement in spending.

- The August services PMI was downgraded to 49.8 in the final print, which alongside a contractive manufacturing PMI suggests a contraction across the sector and a higher probability of a Q3 GDP contraction for the bloc.

UK DATA

UK CPI In Double Digit Surprise As Food Costs Soar

Inflation continued to outpace expectations in July, with the consumer price index (CPI) rising 10.1% year-on-year to a fresh 40-year high, up from 9.4% in June. The rate exceeded analysts consensus forecasts of an increase of 9.8% y/y and was above the Bank of England's outlook for July.

- According to Grant Fitzner, the ONS's chief economist, a wide range of price rises drove inflation up again this month. "Food prices rose notably, particularly bakery products, dairy, meat and vegetables, which was also reflected in higher takeaway prices," he said.

- The retail price index (RPI), the measure used for rises in many benefits and services, rose 12.3% year-on-year, the highest annual increase since March 1981.

- The higher-than-expected July CPI reading set an extremely bearish tone, with short-end instruments badly underperforming as central bank hike expectations ratcheted up.

More priced for the UK than the ECB or the Fed

- The implied rate for the September MPC meeting continue to move to new highs with 69bp now priced in - this is more than the 67bp priced for this week's ECB meeting and also more than the 64bp priced in for the FOMC meeting in a fortnight. Also by year-end markets now price 193bp of hikes for the BOE, against 175bp for the ECB and 135bp for the Fed. There is no part of the curve over the next 12 months where markets expect less from the BOE than either of these peers.

- This is despite a lack of communication since the last MPC meeting.

MNI INTERVIEW: UK Cost-Of-Living Slams Consumer Sentiment- Gfk

- Following on the heels of another inflation surprise earlier in the week, UK consumer confidence has plumbed new depths with the GfK series sliding to -44 in August vs -42 consensus.

- UK retail sales data for July only narrowly missed expectations although continued to show a drop in spending (Inc Auto Fuel -3.4% Y/Y)

Financial events begin to feel like they are moving "beyond the control" of most people, Joe Staton, Client Strategy Director at GfK told MNI Thursday after the GfK Consumer Confidence Index slumped to -44 in August, its lowest level since records began almost half a century ago.

- ”That reflects the acute concern concerns of consumers as the cost-of-living soars. A sense of exasperation about the UK’s economy is the biggest driver of these findings," Staton said, pointing out that all sub-indexes are falling.

- "These findings point to a sense of capitulation, of financial events moving far beyond the control of ordinary people," he added.

MEDIA GLOOM

According to Staton, the daily dose of dire news on rising prices across the media has certainly weighed on sentiment as "headline after headline shows inflation eroding household buying power and the strain on the personal finances of many in the UK is alarming."

But on a close reading of both the data and the wider news agenda, Staton believes there is little to feel optimistic about. "Just making ends meet has become a nightmare. The crisis of confidence will only worsen as autumn rolls in and the colder months of winter then arrive,” he said.

Underlying the Gfk survey data are increased expectations for even higher inflation ahead. In August 2021, 31% of respondents saw rapidly rising prices a year ahead, with that number now at 53% -- a troubling takeaway for the Bank of England as it monitors expectations across the economy.

Stresses Intensifying On Economic Lynch Pin #1

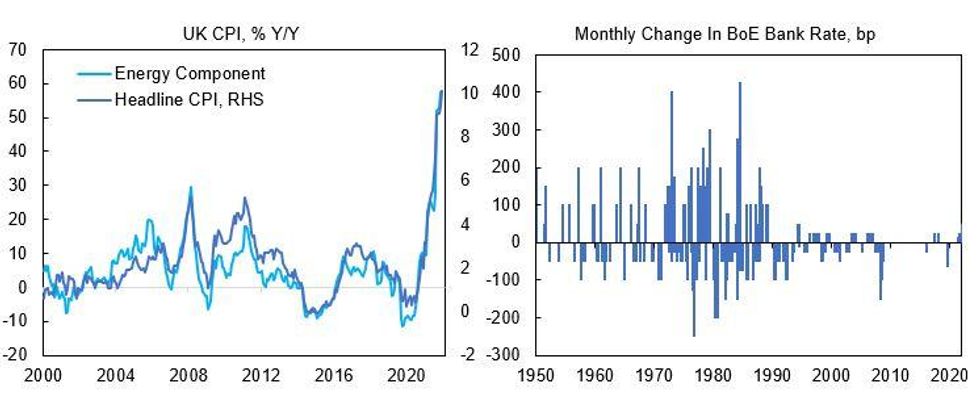

Data published this morning show UK inflation breaching into double-digit territory for the first time in around 40-years. Evidence is starting to mount that inflation is eroding incomes and purchasing power, which is particularly problematic for the UK's consumption-orientated economy and poses a dilemma for the Bank of England. We gathered together some charts which are indicative of how these processes are playing out.

- Inflation itself shows no signs of slowing down, despite the BoE recently upping the ante and delivering its first 50bp hike in over 25-years.

- The separate energy component of the CPI basket has continued to push higher, reaching 57.8% Y/Y in July. While fuel use has a relatively small weighting in the basket, the large surge in prices is having an outsized impact on headline inflation. Higher energy prices also have indirect impacts on prices of goods and services through transport costs and material input prices (e.g. plastics).

- It is widely expected that the average annual energy bill for UK households will push above £4,000 next year from closer to £1,000 before the energy price shock. This would impact lower income earners the hardest, who have also stockpiled the least amount of savings during the pandemic and have a high propensity to consume out of income. With the government still in the middle of a leadership election, and with stiff resistance in some sections of the Conservative party to either a windfall tax on energy companies, or energy bill support measures for households, any official intervention is likely to fall short of the mark. As such, the hit to purchasing power will be a heavy drag on economic activity in the coming quarters.

- The BoE's approach to reining in inflation has been relatively timid so far with bank rate adjustments more reminiscent of the 'great moderation' period, rather than the high inflation period of the 1970s and 1980s, which the current inflation readings more closely resemble. The BoE will need to make a judgement call on whether economic headwinds will be sufficient to override the supply-side shock. If not, the central bank could find itself upping the ante again with further 50bp+ rate hikes going into an economic downturn.

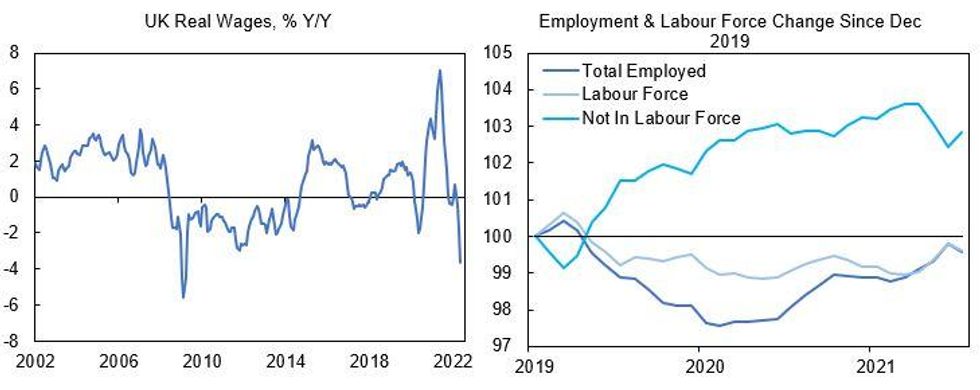

While UK wages have started to respond to the higher cost of living, the magnitude of second-round effects has been limited thus far.

- In the first chart below we have deflated average weekly wages by the UK CPI and transformed to a Y/Y series. Real wage growth has collapsed and is returning to 2009 levels.

- Continued job gains are eroding space capacity, although the growing population of inactive workers (outside of the labour force) has been the main factor behind the tightening labor market. Indeed, while the economically active population has increased by 0.76% since December 2019, employment has contributed -0.27pp (total employment is still below pre-pandemic levels) while the stock of workers outside of the labour force has contributed 1.03pp.

- Even with the labour market still tightening, concerns about the economic outlook are being well-telegraphed (not least by the BoE's own particularly gloomy assessment at the August MPC meeting) and could work against wage negotiations when job security starts to trump maintaining purchasing power.

- A persistent squeeze on real incomes, heading into another surge in household energy bills, would require spending down savings or liquidating assets in order to maintain consumption, otherwise household spending would need to adjust lower.

With incomes falling, the last resort for maintaining household spending are savings and borrowing.

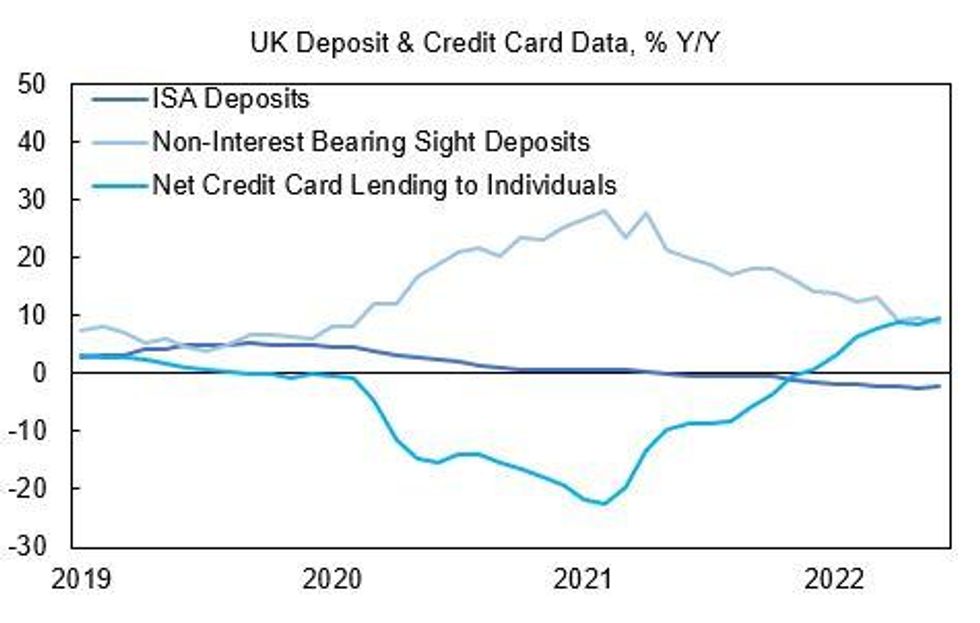

- In the chart below we look at the Y/Y growth in ISA deposits and non-interest bearing sight deposits, with the former being a tax-free savings vehicle and a proxy for long-term saving, while the latter serves as a proxy for liquid cash balances.

- It is clear from the chart that UK households are now drawing down from long-term savings, while growth in cash balances held on sight deposit have fallen sharply.

- At the same time, credit card lending has been picking up, albeit having contracted during the pandemic. '

- The trends are still relatively embryonic at this stage, but could accelerate if inflation continues to push higher and wages struggle to catch up.

- BoE research has shown that savings accumulated during the pandemic have largely accrued to the highest income earners, with lower income earners not managing to significantly stockpile liquid balances. Although we have not seen any evidential data, it is likely that lower income earners will be the first to draw down cash balances and would be more likely to fully deplete savings to support purchasing power. Again, given the inverse relationship between income level and propensity to consume out of income, the draw down in savings is an ominous sign for household spending in the coming quarters.

GERMAN DATA

Headline Inflation Bounces Back to May High, Downside Surprise to Month-on-Month

GERMANY AUG FLASH CPI +0.3% M/M (FCST +0.4%); JUL +0.9% M/M

GERMANY AUG FLASH CPI +7.9% Y/Y (FCST +7.8%); JUL +7.5% Y/Y

GERMANY AUG FLASH HICP +0.4% M/M (FCST +0.4%); JUL +0.8% M/M

GERMANY AUG FLASH HICP +8.8% Y/Y (FCST +8.8%); JUL +8.5% Y/Y

- German CPI accelerated to +7.9% y/y in the flash August data, in line with MNI's forecast of +7.94% y/y. On the month, a slowdown to +0.3% m/m was recorded.

- The harmonised print saw another uptick in August, with prices growing at +0.4% m/m and +8.8% y/y as anticipated. This was a 0.3pp jump from +8.5% y/y in July.

- Energy prices continue to account for the bulk of German inflation (+35.6% y/y in August), followed by food (+16.6% y/y- up 1.8pp), whilst good prices continue to accelerate due to persistent supply chain issues and broad-based inflationary pressures. The effects of the 9-euro ticket and fuel discounts suggest that the implied inflation rate is likely to have been higher.

- Whilst the German headline data saw prices continue to expand, Spanish HICP slowed 0.4pp in the August flash to an elevated 10.3% y/y according to this morning's data, with the month-on-month inflation rate all but stalling at +0.1% as fuel and energy prices fell. The continued 0.3pp uptick in the core print however confirms that broad-based inflation is yet to ease.

- As price pressures continue to intensify and core inflation sees no relief, the chance of a 75bp hike from the ECB are increasing going into the September meeting.

Source: MNI / Bloomberg

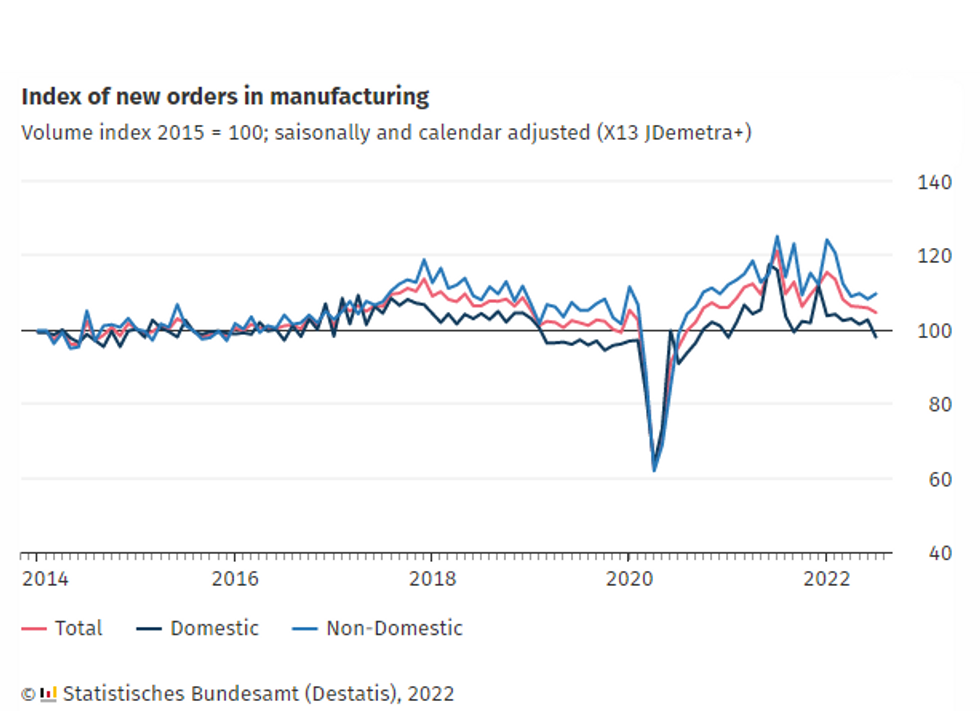

Factory Orders Lower Again As Recession Fears Grow

GERMANY JUL FACTORY ORDERS -1.1% M/M (FCST -0.7%); JUN -0.3%r M/M

GERMANY JUL FACTORY ORDERS -13.6% Y/Y (FCST -13.4%); JUN -9.0% Y/Y

- German factory orders contracted for the firth consecutive month in July, at a stronger rate than in June and than expectations. As the largest eurozone economy, this data underscores fears of a looming recession for Q3 and Q4 ahead of the ECB's Thursday meeting.

- This data suggests downside risk ahead of tomorrow's July industrial production figures, which should contract in both headline numbers.

- The German Statistics office notes that 2021 had been a bumper year in manufacturing, and this contraction carries less weight. The key downwards pressure came from consumer goods orders (down 16.9%) largely due to the drop in demand for pandemic-related pharmaceuticals. Capital goods orders contracted by 0.2% m/m, implying investment levels are falling as economic outlooks remain bleak.

- New orders again outpaced turnover as shortages of intermediate products remain acute, worsened by the war in Ukraine.

FRANCE DATA

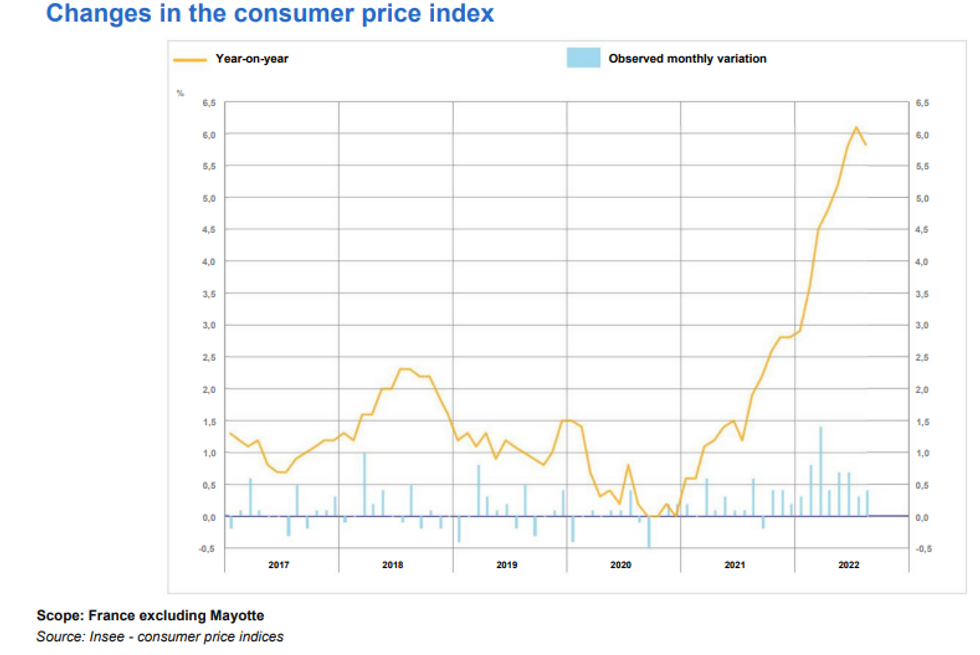

Headline inflation lower, but core may edge higher

FRANCE AUG HICP +0.4% M/M (FCST +0.6%); JUL +0.3% M/M

FRANCE AUG HICP +6.5% Y/Y (FCST +6.7%); JUL +6.8% Y/Y

- Both month-on-month and annualised HICP prints were 0.2pp milder than expected in the August flash estimate. HICP increased by +0.4% m/m (vs +0.3% in July) and by +6.5% y/y (vs +6.7 in July). The national CPI figures mirrored this trajectory.

- The slowing of inflation was largely due to decreased energy prices. Service price inflation progressed at the same rate as last month, whilst manufactured goods and food price inflation continued to accelerate.

- As such, the core inflation (due with the final release) will likely see another small uptick.

- Factory gate inflation saw little relief in July, accelerating by +1.6% m/m, a 0.3pp uptick and holding steady close to highs at +27.2% y/y.

- Final GDP for Q2 was confirmed at +0.5% q/q and +4.2% y/y.

- The report also detailed a substantial slump in consumer spending in July, whereby spending contracted by -0.8% m/m and -4.3% y/y, 0.6pp and 0.4pp worse than the consensus expectations.

- Despite the continued decline in consumer spending and waning demand, the persistent acceleration in underlying inflation will likely trump in importance for the ECB ahead of the September meeting, underlining the need for further tightening.

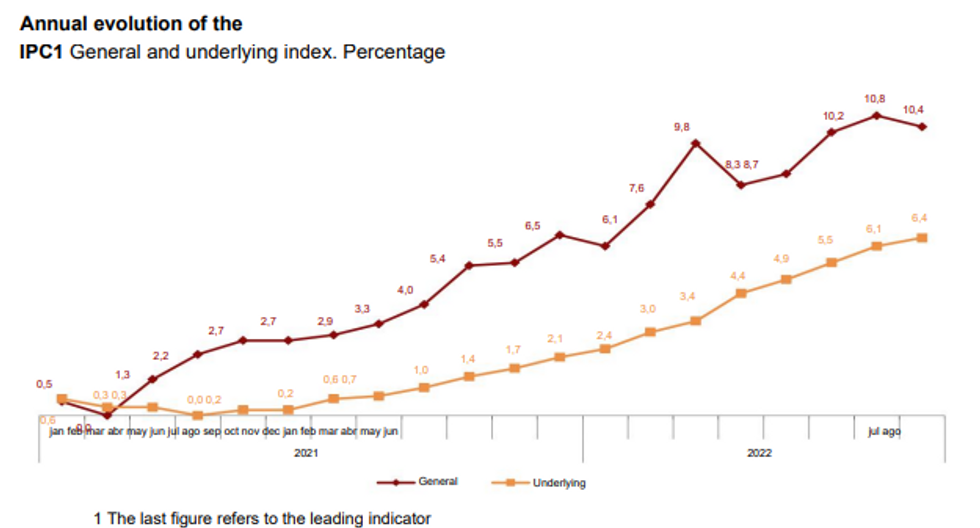

SPANISH DATA

Inflation Slows to +10.3% in August Flash, Core Continues to Accelerate

SPAIN AUG FLASH HICP +0.1% M/M (FCST +0.1%); JUL -0.6% M/M

SPAIN AUG FLASH HICP +10.3% Y/Y (FCST +10.3%); JUL +10.7% Y/Y

- Spanish flash headline HICP was in line with market expectations in the August release, slowing by 0.4pp to +10.3% y/y. The month-on-month inflation rate all but stalled at +0.1% m/m, following the -0.6% m/m deflation seen in July.

- The national CPI reading saw similar moves, also softening by 0.4pp in the annualised print, bringing it 0.3pp lower than anticipated at +10.4% y/y.

- The key driver of softer price growth this month was due to the fall in fuel prices. Electricity, food, hospitality and tourism continued to see prices increase.

- As such, core inflation is seen 0.3pp higher at +6.4% y/y in the August flash, a 1993 high.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.